Use this simple IOU receipt template to keep track of money lent or borrowed. This template will help you document the amount owed, the borrower’s details, and the terms of repayment, ensuring both parties have a clear record. It’s easy to fill out and provides the necessary details to avoid confusion later.

Begin with the borrower’s name and date of the transaction at the top of the receipt. Then, list the amount borrowed, followed by the payment terms, such as the date by which the debt must be settled. You may also include a field for any interest if applicable. Make sure to include a clear signature area for both parties to sign, confirming the agreement.

Having a standardized receipt like this can be helpful for both personal and business transactions, creating a straightforward record of any loan or debt agreement. Adjust the template as necessary to suit your specific needs, but always ensure that both parties agree to the terms before signing.

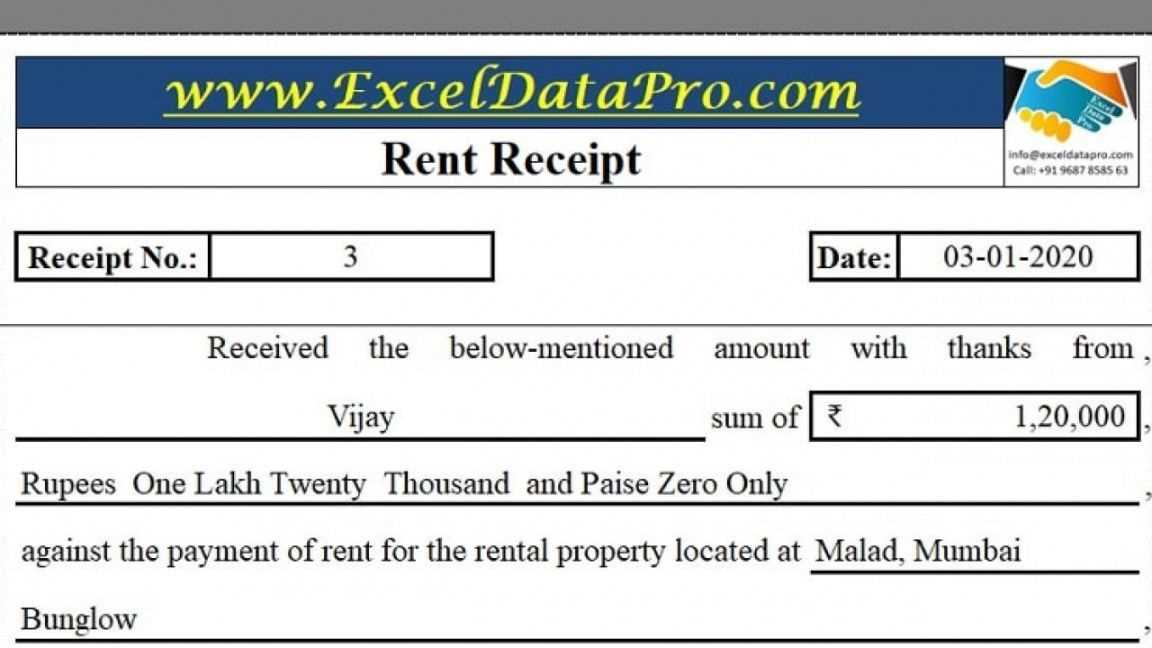

Simple IOU Receipt Template

To create a straightforward IOU receipt, focus on including the following key elements for clarity and ease of understanding:

- Date: Specify the exact date when the IOU was issued.

- Amount: Clearly state the amount owed in words and numbers.

- Borrower’s Information: Include the full name and contact details of the person who owes the money.

- Lender’s Information: Provide the full name and contact details of the person receiving the payment.

- Purpose of Loan: Briefly describe the reason for the loan or transaction.

- Repayment Terms: Include the repayment schedule, whether it’s a lump sum or installment plan.

- Signature: Both parties should sign the document to acknowledge the agreement.

- Witness (optional): Include a space for a witness if applicable.

This template should be straightforward and functional. Avoid unnecessary details, focusing on the most crucial information needed for both parties to have a clear understanding of the transaction.

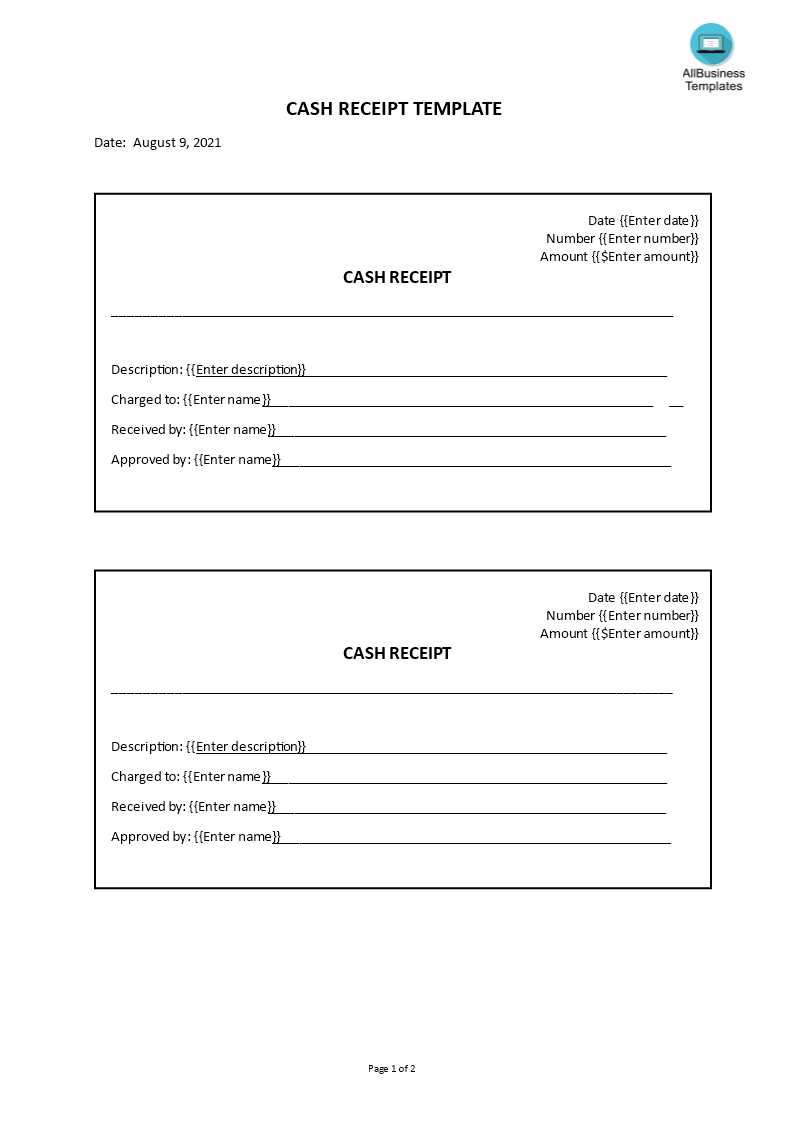

How to Create a Clear IOU Receipt with Basic Information

To create a straightforward IOU receipt, include these key details: the borrower’s name, the lender’s name, the amount owed, the date of the transaction, and any terms of repayment. Ensure that each section is clear and easy to read to avoid any confusion later.

Step 1: Include Borrower and Lender Information

Begin with the full names of both parties involved. This helps clearly identify who is borrowing and who is lending. Including contact details can be useful but is optional.

Step 2: Specify the Amount and Payment Terms

Write the exact amount owed in both words and numbers for clarity. If applicable, mention the due date for repayment and any specific terms, such as interest or installment details. Keep the language simple to prevent misinterpretation.

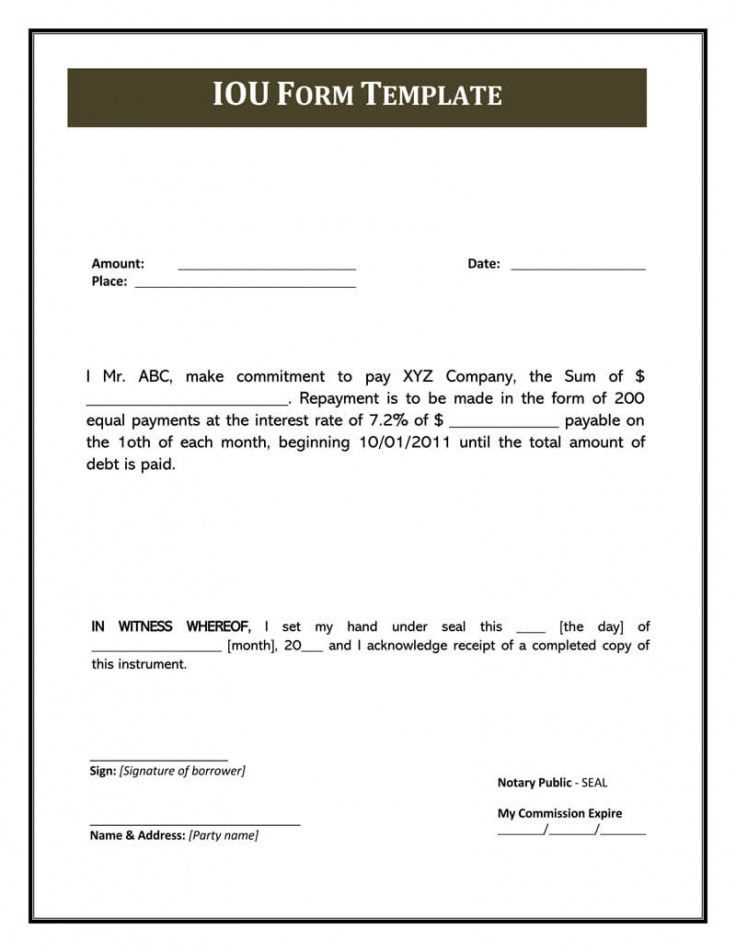

Incorporating Legal Language into Your IOU Template

To ensure your IOU template holds up in a legal context, include specific phrases that clearly define the terms of the agreement. Start by stating the exact amount owed, along with the currency and any applicable interest rate if relevant. You should also specify the due date for repayment and outline any penalties for late payment.

Incorporate language that clarifies both parties’ obligations. For example, use phrases like “The undersigned borrower agrees to repay the sum of [amount] to the lender on or before [due date].” Be explicit about whether the payment is to be made in full or if installments are permitted, and include the frequency of payments if necessary.

Include a clause that acknowledges the validity of the IOU. A simple phrase such as “This document represents a legally binding agreement between the borrower and lender” can affirm its enforceability. You should also make it clear that any alterations to the IOU must be made in writing and signed by both parties.

For added protection, consider adding a dispute resolution clause. This section should specify how any disagreements regarding the IOU will be handled, such as through mediation or arbitration, and outline the jurisdiction for legal proceedings.

Lastly, have both parties sign and date the document. The signature section is crucial in making the IOU legally binding, ensuring both parties are aware of and agree to the terms.

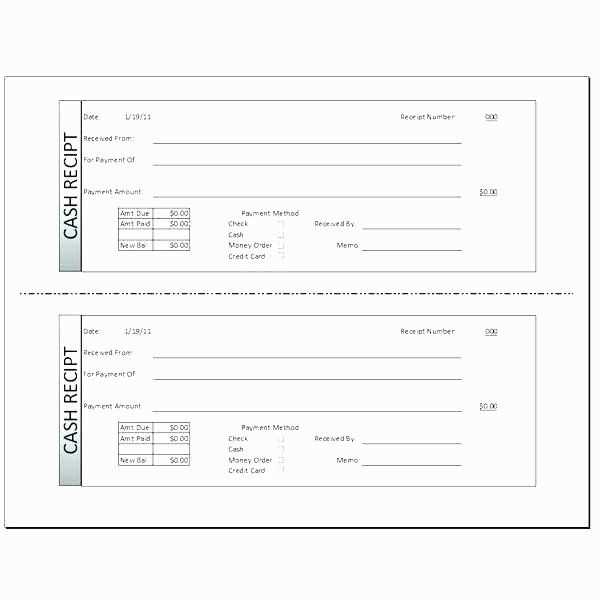

Adding Customizable Elements for Different Loan Types

To tailor an IOU receipt template for various loan types, begin by incorporating customizable fields that reflect the specifics of each loan. For personal loans, include sections for the borrower’s name, loan amount, interest rate, and payment schedule. Add an optional field for collateral if applicable.

Adjusting Payment Terms

For installment loans, integrate a breakdown of the loan’s repayment schedule. Include the number of installments, due dates, and amounts. Allow flexibility for varying payment frequencies (weekly, bi-weekly, monthly) based on the borrower’s agreement.

Adding Interest and Fees

Include a dynamic section for interest rates and any additional fees that may apply. Some loan types, like payday loans, may require a separate field for daily or weekly interest. Make this section adjustable, so users can input interest formulas or flat rates depending on the loan type.