A donation receipt for 501(c)(3) organizations must include specific details to ensure compliance with IRS regulations and provide donors with the documentation needed for tax purposes. The receipt should clearly state that the organization is a 501(c)(3) tax-exempt entity, include the date of the donation, and outline the type and value of the contribution. If the donation includes goods or services, you must disclose whether any goods or services were provided in exchange for the gift.

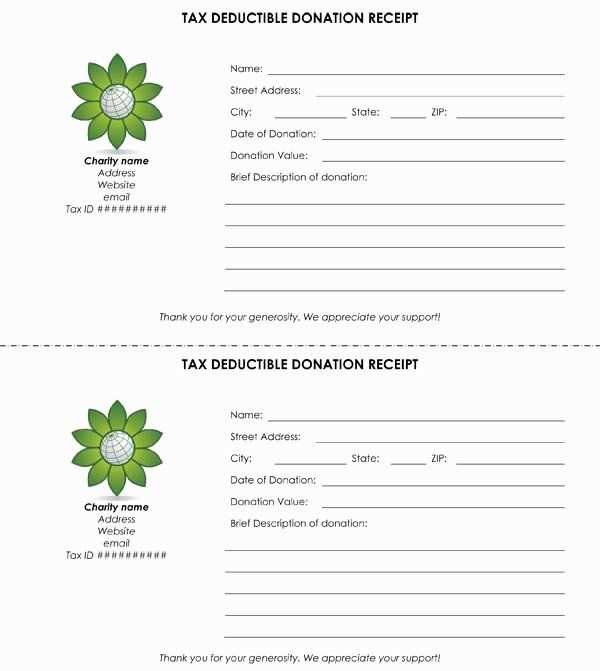

To create a valid receipt, start by listing the name and address of the donor, the organization’s name and tax ID number, and the date of the donation. If the donation is monetary, specify the amount. If the donation is non-cash (such as property or goods), include a description and estimated value of the items donated. If no goods or services were exchanged, the receipt should state this explicitly, as it’s necessary for the donor’s tax deduction claim.

For accurate reporting, always include a clear statement about whether the donor received any benefits in return for their donation. If you provided any tangible items, a fair market value must be provided. This helps avoid issues during an audit and ensures transparency between the organization and its donors.

By following these steps, you create a straightforward and compliant donation receipt template that meets IRS requirements and provides donors with the correct documentation for their tax filings.

Here’s an improved version:

To ensure your 501(c)(3) donation receipts meet IRS requirements, include these key components:

Donor Information

Start with the donor’s full name and address. This helps confirm who made the donation. If possible, also include the donor’s contact details, like email or phone number, for easier communication in the future.

Donation Details

Clearly state the donation amount, whether cash or non-cash items. For non-cash donations, describe the items in detail, including condition. If the value of the donation was appraised, include a brief note about that.

Include the date of the donation and a statement that the organization did not provide any goods or services in exchange for the donation. This is critical for tax purposes. If any goods or services were given, their estimated value must also be mentioned.

Conclude with the organization’s contact information and a signature from a representative. Keep the language simple, but ensure every detail is clear and accurate.

- Donation Receipt Template for 501(c)(3) Organizations

Start your donation receipt with your organization’s legal name and the IRS-assigned EIN (Employer Identification Number). This establishes your nonprofit status and ensures compliance.

Include the donor’s full name and address. This information is required for the donor’s tax records and provides clarity for both parties.

Clearly state the date of the donation. This ensures the donation aligns with the correct tax year for both the donor and your organization.

For monetary donations, specify the exact amount contributed. For non-cash gifts, provide a description of the items and their estimated value. If possible, use a reasonable method to appraise the value of in-kind donations.

If goods or services were received in exchange for the donation, include a statement with a description and the estimated value of those items. This helps both parties calculate the deductible portion of the donation.

Include a tax-deductibility statement confirming that the donation is tax-deductible and that the donor cannot deduct the value of any goods or services they received.

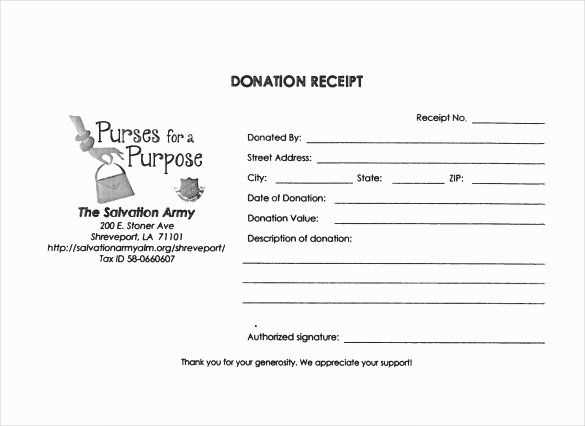

End with the signature of an authorized representative from your organization. This adds legitimacy to the receipt and ensures its validity for tax purposes.

A 501(c)(3) organization’s donation acknowledgment must contain specific elements to meet IRS guidelines and maintain transparency with donors. Here are the key components to include:

- Organization’s Name – Clearly state the official name of your organization, as registered with the IRS.

- Donor’s Name – Include the name of the individual or entity making the donation.

- Donation Amount – Specify the exact monetary value of the contribution. If it’s a non-cash donation, describe the items donated and estimate their fair market value.

- Donation Date – Note the date on which the donation was received.

- Statement of No Goods or Services Provided – If applicable, include a statement confirming that no goods or services were provided in exchange for the donation. If something was provided, describe the item(s) and provide their fair market value.

- Tax-Exempt Status – Include a statement that confirms the organization is a 501(c)(3) tax-exempt entity, often along with the organization’s tax-exempt number.

- Language Regarding Goods or Services – If the donor received something in return for the gift, state the value of the goods/services provided and differentiate it from the tax-deductible portion of the donation.

Ensure these elements are clear and present in each acknowledgment letter to comply with IRS requirements and build trust with your supporters.

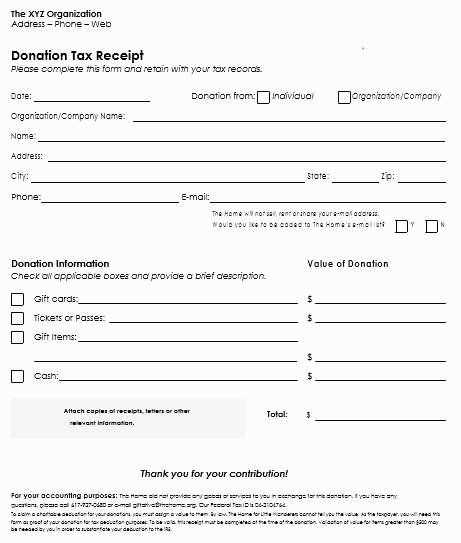

Ensure the receipt includes the following key elements to comply with IRS requirements:

- Organization’s Name, Address, and Tax-Exempt Status: Clearly state the 501(c)(3) organization’s name, address, and its tax-exempt status. Include the IRS tax-exempt number if available.

- Date of Donation: Specify the exact date of the donation, as this is essential for tax records.

- Donor’s Name: Include the name of the donor. If it’s a joint donation, list both names.

- Donation Amount or Description of Items: For cash donations, state the exact amount. For non-cash donations, provide a detailed description of the items, but do not assign a value to them–this is the donor’s responsibility.

- Statement of Goods or Services Provided: If the donation includes goods or services (e.g., tickets to an event), mention the value of these goods or services. This is crucial as it helps the donor distinguish between the charitable donation and the cost of the benefits received.

- Confirmation of No Goods or Services: If no goods or services were provided, include a statement confirming this to meet IRS standards.

- Signature of an Authorized Representative: Ensure the receipt is signed by an authorized representative of the nonprofit organization. This adds legitimacy and ensures the donor’s records are accurate.

Sample Donation Receipt Format:

- Organization’s Name and Tax-Exempt Number

- Donor’s Name

- Donation Date

- Amount/Description of Donation

- Statement on Goods or Services

- Signature of Authorized Representative

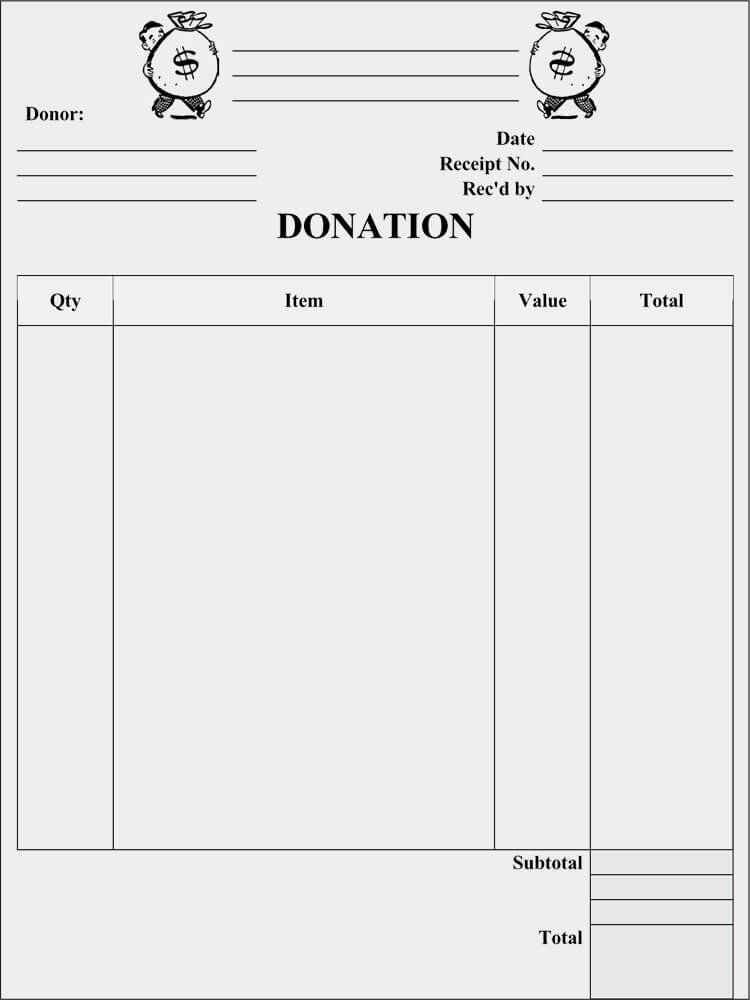

When donors offer non-cash gifts, you must acknowledge them appropriately in your donation receipt. These items can range from goods to services or even appreciated assets like real estate or stocks. The first step is to determine the fair market value (FMV) of the gift. This will help both you and the donor understand the tax implications of the donation.

To facilitate the process, make sure to include the following details in the receipt:

| Element | Description |

|---|---|

| Donor’s Name | The full name of the donor providing the non-cash gift. |

| Description of the Gift | A clear description of the item or service, including model numbers, quantities, or other relevant identifiers. |

| Fair Market Value | The appraised or estimated value of the non-cash gift at the time of donation. If necessary, include the basis for this valuation. |

| Statement of No Goods or Services Provided | A statement confirming no goods or services were given in exchange for the donation, or a description of any services if applicable. |

If the gift requires an appraisal, advise the donor to obtain one. Gifts valued over $5,000 typically need a qualified appraisal for tax deduction purposes. Be aware that you are not responsible for determining the value but must ensure it is reported accurately.

Finally, always thank the donor for their generosity. Acknowledge their contribution and encourage them to reach out if they need additional documentation for tax filing.

Legal Requirements for Donation Acknowledgments in 501(c)(3) Organizations

501(c)(3) organizations must provide donors with written acknowledgment of their contributions to comply with IRS regulations. This acknowledgment is necessary for the donor to claim a tax deduction. The receipt must include specific details, such as the amount of the donation, a description of non-cash donations, and a statement that no goods or services were provided in exchange for the donation, if applicable.

If the donor receives goods or services in return for their donation, the organization must specify the value of those goods or services. The IRS requires this information to ensure that donors can deduct only the portion of the donation that exceeds the value of the goods or services received.

The acknowledgment must also include the name of the charity and the date of the donation. For donations over $250, the organization must provide a separate, written acknowledgment for each donation. Donors must retain these receipts in their records when filing their tax returns.

For non-cash donations valued at over $500, the donor is responsible for completing IRS Form 8283, and the organization should provide additional documentation to support the claim. Donations valued over $5,000 require a professional appraisal and further detailed records from the organization.

Organizations must ensure that they issue donation receipts promptly, especially for larger donations, to facilitate proper reporting and tax deductions by the donor.

Design your donation receipt template to match your nonprofit’s identity. Incorporate your logo and brand colors for a personalized touch. This enhances recognition and builds trust with donors. Keep your layout clean and easy to read, focusing on clarity and usability.

Include specific fields to capture important information: donor’s name, donation amount, date, and your organization’s tax-exempt status. A receipt that displays this data in an organized way helps both the donor and your nonprofit stay on track for tax purposes.

For added convenience, consider adding a brief thank you message or a note about how their contribution will be used. This reinforces the value of their donation and encourages ongoing support.

Don’t forget to customize the footer with your nonprofit’s contact information, including your EIN (Employer Identification Number) for IRS purposes. This ensures that donors have all the necessary details for their records and tax filings.

Lastly, make sure the receipt template is easy to generate and send. Automation tools can help save time, ensuring receipts are sent promptly and consistently without extra manual effort.

Distribute donation acknowledgments through reliable, secure channels. For physical receipts, mail them in tamper-proof envelopes, and ensure that they are sent via a trackable service. For electronic receipts, use encrypted email or a secure donation platform that provides automated, encrypted acknowledgment emails.

Distributing Physical Receipts

When sending paper acknowledgments, ensure that all donor information, such as addresses and donation amounts, is securely handled. Use locked cabinets for storing physical records, and limit access to authorized personnel only. For mass mailings, consider outsourcing to a secure fulfillment service that specializes in handling sensitive donor information.

Storing and Protecting Digital Records

Store digital donation records in a secure, encrypted cloud service with robust access controls. Avoid storing records on local machines or unprotected servers. Limit access to only those who need it, using multi-factor authentication and strong passwords. Regularly back up records and audit your storage practices to detect any potential security risks.

Whether distributing physical or digital acknowledgment letters, protecting donor privacy and information is crucial. Always follow data protection regulations and your nonprofit’s privacy policy when handling donation records.

Donation Receipt Template for 501c3

Use a clean and clear format when creating a donation receipt for your 501c3 organization. List the donor’s name, address, and the amount donated. Specify whether the donation was monetary or in-kind, including a description of any non-cash items. Make sure to state if any goods or services were provided in exchange for the donation, and include their value. Avoid vague language and ensure transparency. Include your organization’s name, address, and tax identification number. This provides legal clarity for both the donor and the organization.

Remember to date the receipt and keep accurate records of each donation for tax reporting purposes. If the donor requests a copy of the receipt, send it promptly. For organizations that handle large volumes of donations, consider automating this process to maintain efficiency and accuracy in record-keeping.