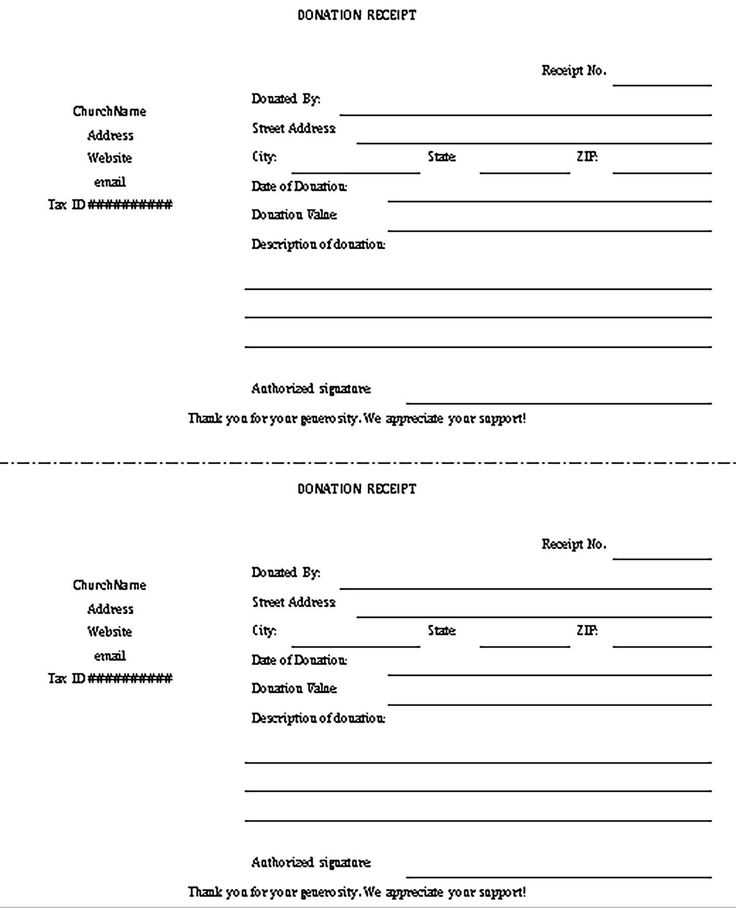

Provide a clear and concise receipt to donors. A donation receipt should include the nonprofit’s name, address, and tax identification number, as well as the donor’s name and the amount donated. Be sure to specify the date of the donation and whether the contribution was in cash, goods, or services.

Ensure that the receipt includes a statement confirming the donation is tax-deductible. For example, you can include the phrase: “This donation is tax-deductible to the extent allowed by law.” It’s also helpful to note any goods or services provided in exchange for the donation, including their fair market value.

It’s advisable to send the receipt promptly after receiving a donation, either electronically or by mail. Always keep accurate records to support any claims of charitable donations during tax filing.

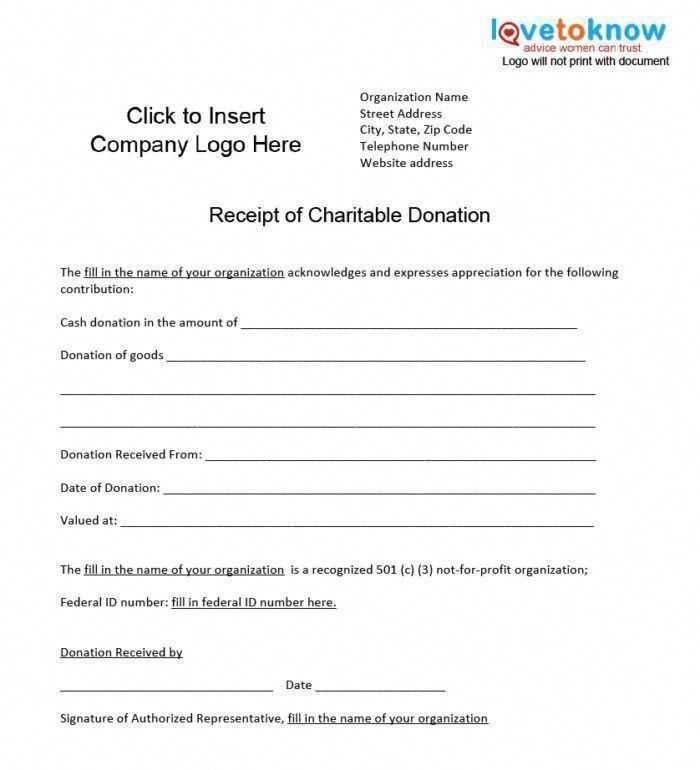

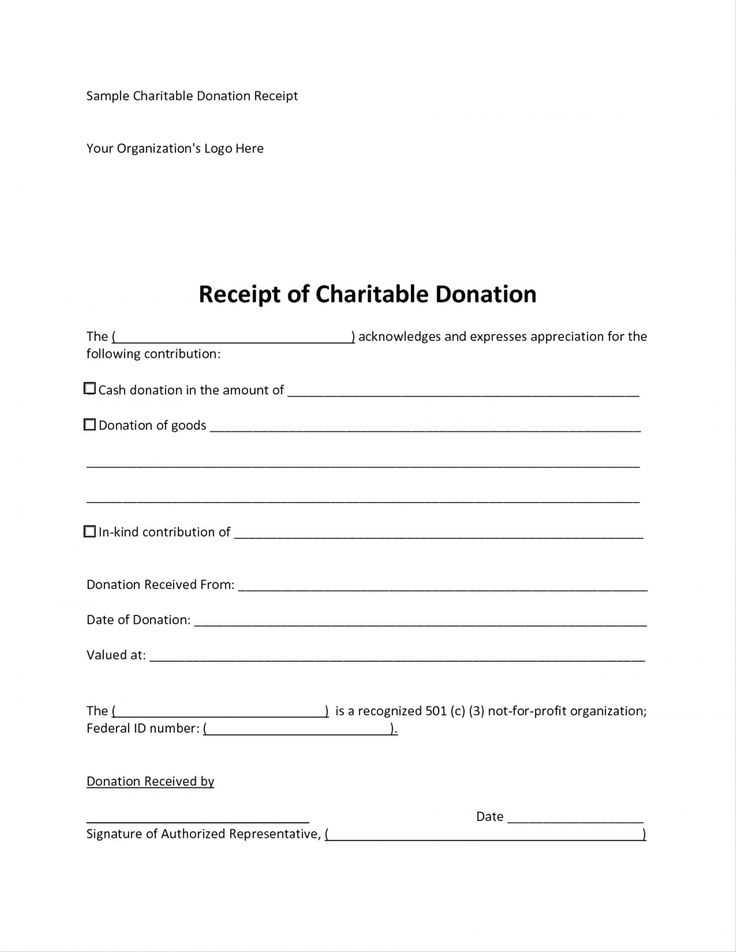

Template for Receipt of Donation to Nonprofit

Provide clear and concise details when issuing a donation receipt to ensure transparency and accountability. A donation receipt serves as proof for donors to claim deductions on their taxes, so make sure it includes all necessary elements.

Key Information to Include

- Organization Name: Ensure the full legal name of the nonprofit is clearly stated.

- Donation Amount: Specify the exact amount donated. If the donation is non-monetary, provide a description and estimate of the value.

- Date of Donation: Include the date the donation was received.

- Donor’s Information: Include the donor’s name and address. If applicable, also include contact information such as email or phone number.

- Purpose of Donation: Briefly explain the purpose of the donation, if specific to a program or project.

- Tax-Exempt Status: State the organization’s tax-exempt status and include the EIN (Employer Identification Number) to allow the donor to claim tax deductions.

Donation Receipt Format Example

- Organization Name: [Your Nonprofit’s Name]

- Receipt Number: [Unique Receipt Number]

- Donor’s Name: [Donor’s Full Name]

- Donation Amount: $[Amount] or [Description of Non-Monetary Donation]

- Date of Donation: [Date]

- Purpose of Donation: [Specific Program or Project]

- Tax-Exempt Status: [EIN Number]

By including these details, you provide clarity for the donor and maintain a professional and legally sound receipt system for your nonprofit.

Structuring a Clear Acknowledgment of Donations

Begin with a personalized greeting that recognizes the donor’s specific contribution. Address the donor by name to create a sense of personal connection. Clearly specify the amount or value of the donation, ensuring transparency and clarity.

Details of the Donation

Clearly outline the purpose for which the donation will be used. If applicable, mention any specific programs or projects the donation supports. This gives the donor confidence that their contribution will make a tangible impact.

Expressing Gratitude

Thank the donor sincerely, emphasizing their importance to the organization’s mission. Acknowledge the impact of their donation, and express how it will directly benefit the community or cause. A warm, genuine tone will enhance the feeling of appreciation.

End with a final note of appreciation and an invitation for further engagement or involvement, whether through future donations, events, or volunteer opportunities. Keep the message positive and open for continued connection.

Customizing the Receipt to Reflect Your Nonprofit’s Branding

Include your nonprofit’s logo at the top of the receipt. This immediately creates a visual connection with your organization and makes the receipt easily recognizable. Ensure the logo is clear and appropriately sized to maintain a professional appearance.

Font and Color Consistency

Match the fonts and colors used on your receipt with your nonprofit’s branding guidelines. Stick to the same typography and color palette used in your marketing materials. This consistency reinforces your nonprofit’s identity and helps build trust with donors.

Personalized Thank You Message

Incorporate a heartfelt thank you message that aligns with your nonprofit’s mission. Personalize the content to reflect the donor’s impact, reinforcing the purpose of their contribution. This adds a personal touch and strengthens the relationship with your supporters.

Legal and Tax Information Required for Donation Receipts

Include the nonprofit’s legal name, address, and tax-exempt status on every donation receipt. This confirms the legitimacy of the organization and reassures donors that their contribution qualifies for tax deductions. Be sure to specify the type of donation–whether cash or non-cash–and include its value. For non-cash donations, a brief description of the item is necessary, but not the valuation.

Specific Legal Details

The receipt must state that no goods or services were provided in exchange for the donation, unless such goods or services were provided. If something was exchanged, indicate the fair market value of that item and clarify how much of the donation is tax-deductible. If the value of goods or services exceeds a certain threshold, this information becomes particularly relevant for both donor and nonprofit.

Tax Information

Ensure the receipt includes the nonprofit’s tax identification number (TIN) or Employer Identification Number (EIN). This helps the donor verify that their gift is eligible for tax deduction purposes. The IRS requires receipts for donations over a certain amount, so nonprofits should remain diligent in providing accurate documentation to avoid complications for both the organization and its supporters.