For quick and simple record-keeping of cash transactions, a Microsoft free cash receipt template is a great choice. This template allows you to efficiently document payments and receipts, helping you stay organized with minimal effort. By using this template, you can avoid mistakes in manually tracking cash flow, saving valuable time for more important tasks.

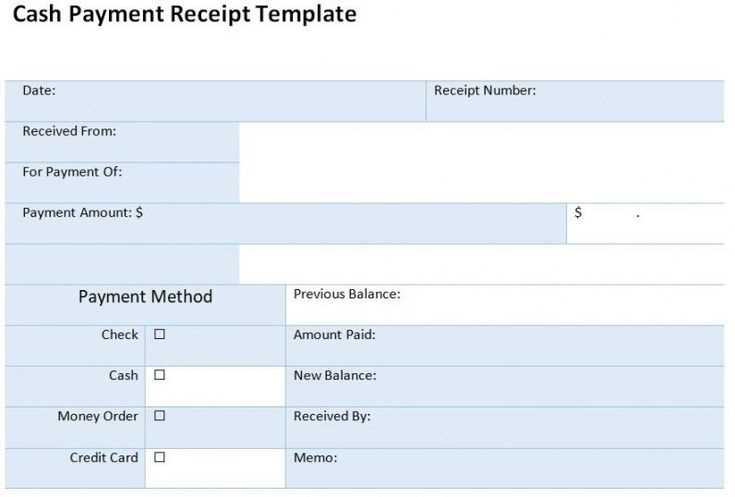

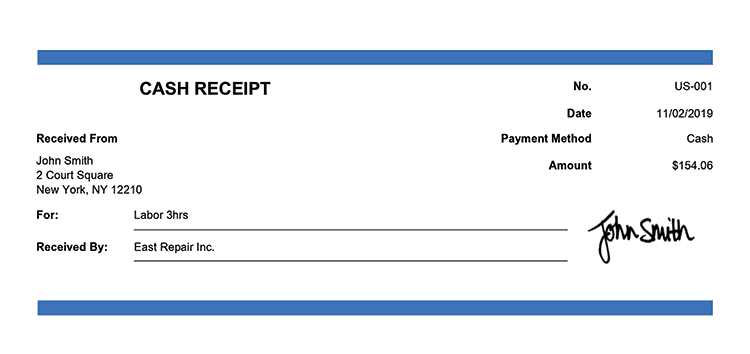

Each cash receipt includes key fields such as the payer’s name, transaction date, amount received, and purpose of payment. This clear structure ensures that you have all the necessary details in one place. Additionally, you can customize the template to fit your specific needs, whether you’re handling personal payments or managing business transactions.

The user-friendly interface of Microsoft tools makes it easy to fill out and print the template when needed. You can also store the digital version for future reference, ensuring quick access whenever you need to review or verify a transaction. Using a free cash receipt template offers both convenience and accuracy, which is important when keeping financial records tidy and transparent.

Microsoft Free Cash Receipt Template

The Microsoft free cash receipt template provides a straightforward solution for documenting cash transactions. It’s a simple yet practical tool for businesses that handle cash payments and want a clear record of each transaction. With this template, you can quickly generate receipts that capture all necessary details like payment amount, date, payer information, and a description of the transaction.

Key Features of the Template

This template includes predefined fields such as the date of payment, payer’s name, and transaction amount. It also allows you to customize additional fields to suit your specific needs, such as the purpose of the payment or a reference number. The design ensures that the receipt is clear and easy to understand, reducing the chances of errors or confusion.

How to Use the Template

Simply open the template in Excel, enter the relevant details for each cash transaction, and print or save the document as needed. The template is user-friendly and doesn’t require advanced technical skills. Adjust the columns or rows as necessary to accommodate additional details specific to your business operations.

Customizing the Template for Your Business Needs

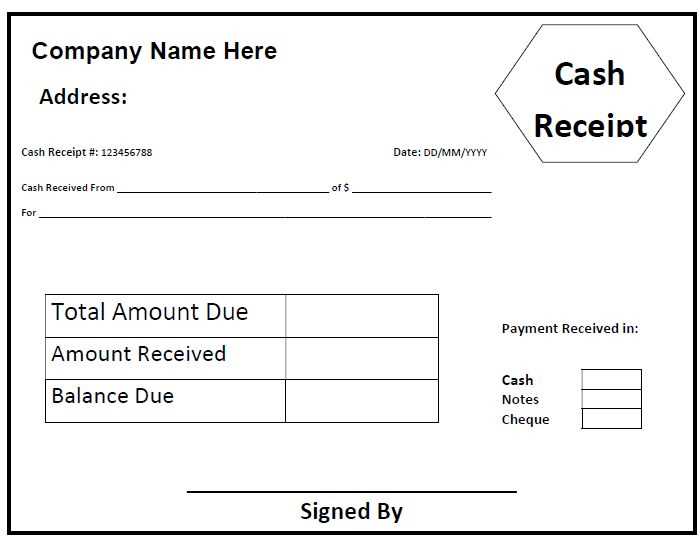

Adjust the template fields to match your company’s specific requirements. Replace generic text with your business details such as your company name, address, and contact information. This personalization ensures your receipts reflect your branding accurately.

Modify the item description section to fit your product or service offerings. Create a list of typical services or products you offer, and consider using dropdown menus or checkboxes for quick entry during transactions. This can speed up your billing process and reduce errors.

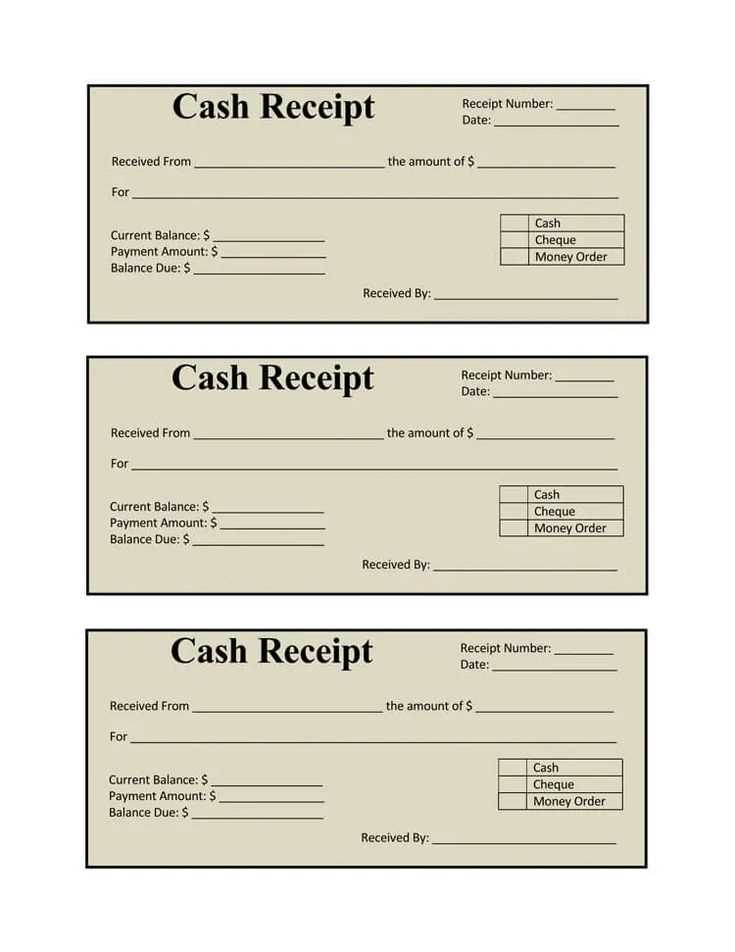

Add or remove fields based on your business type. For example, if you operate in retail, include fields for product codes, quantities, or discounts. For service businesses, you may want to focus more on labor hours and hourly rates.

Incorporate tax rates relevant to your business’s location. Update these settings periodically to ensure accuracy when processing receipts. A fixed tax rate section can prevent mistakes in pricing and increase transparency with your clients.

If your business offers multiple payment options, ensure the template accommodates all of them. Add areas for payment method details such as credit card numbers, online transaction IDs, or cash amounts received. This will keep records clear and organized.

Consider including a customized thank-you note at the bottom of the receipt. A brief message showing appreciation for your customers’ business can enhance their experience and potentially encourage repeat purchases.

Integrating Payment Methods and Tax Information

When setting up a free cash receipt template, make sure payment methods are clearly specified. Use simple checkboxes or dropdown menus to allow the selection of payment types such as cash, credit card, or bank transfer. This ensures clarity and prevents confusion when recording transactions.

Payment method integration should reflect your business’s common practices. For example, include fields for card numbers or transaction IDs for card payments, and account details for bank transfers. It’s important to maintain consistency in these entries to avoid errors in financial records.

Tax information is another critical component. Include a section where the applicable tax rates and amounts can be easily inputted based on the payment method and geographical location. Ensure that the template calculates the tax automatically once the payment amount is entered. This will reduce manual errors and streamline the process.

Additionally, offer an option to adjust tax rates based on product categories or services provided. For example, taxable goods could be differentiated from exempt items within the receipt template. Ensure these adjustments align with local tax laws to guarantee accuracy.

Lastly, make sure the receipt template is capable of capturing relevant tax identification numbers for businesses that are registered for tax purposes. This adds legitimacy and helps with tax filing.

Saving and Exporting the Receipts for Record Keeping

To keep your records organized, save receipts in a format that suits your needs, such as PDF or Excel. This allows you to quickly access and manage them when required.

- Save Receipts Immediately: After generating a receipt, click the ‘Save’ option to store it directly on your device. Ensure the file is named clearly, including the date and transaction details.

- Export to Excel or PDF: If using a template with export functionality, select the appropriate file format. PDF works well for printing or sharing, while Excel is ideal for detailed record-keeping and analysis.

- Organize Files: Create folders for each month or year to streamline access. Label each folder with a specific name for easy identification, such as ‘Receipts_January_2025’.

- Backup Your Files: Store copies of your saved receipts in a secure cloud service or external storage device to prevent data loss. Regularly backup your files to maintain a reliable record-keeping system.

Exported receipts can be attached to financial reports, helping you maintain accurate and easily accessible records for audits or tax purposes.