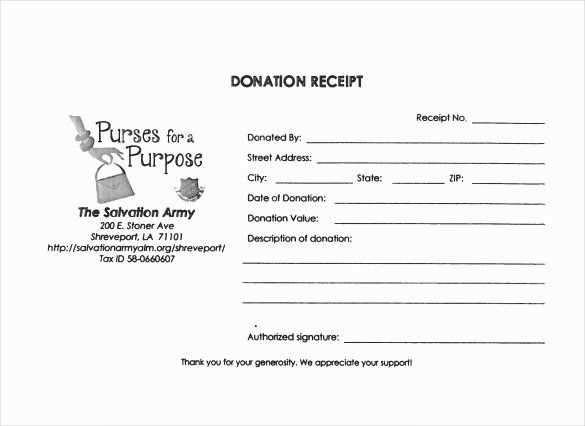

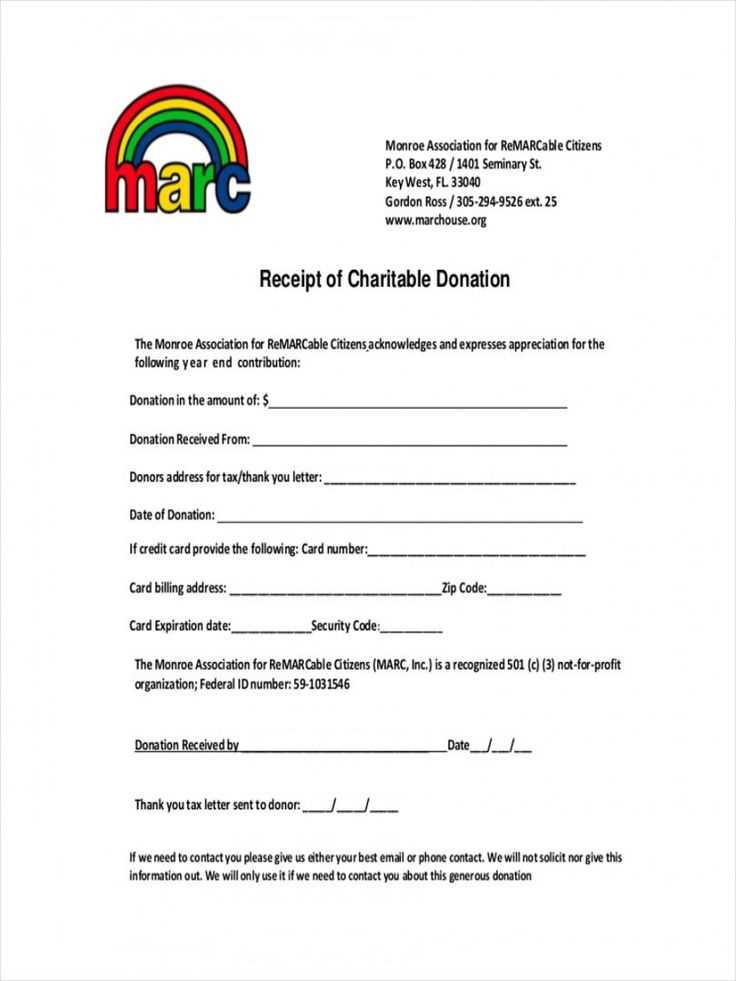

Creating a donation receipt can be a quick and straightforward task with the right template. A well-structured receipt provides both the donor and the charity with a clear record of the contribution, which is crucial for tax purposes and financial transparency. It should include basic information such as the donor’s name, the amount donated, and the date of the donation.

By using a free template, you can easily customize the details to fit your charity’s needs. The template should also allow for adjustments to include specific information like the donor’s contact details or any other relevant notes. For charities, offering a receipt ensures donors receive proper acknowledgment, reinforcing their decision to contribute.

In addition to simplifying your work, a standard receipt template helps maintain consistency across donations, making it easier to track contributions over time. Ensure that your receipt template is clear, concise, and professional to reflect the integrity of your organization.

Here’s a refined version minimizing word repetition while retaining their meaning:

For a donation receipt template, focus on clear, straightforward information. Include the donor’s name, the amount donated, and the date. Avoid unnecessary details to keep the receipt concise.

Key Elements to Include:

- Donor’s Name: Clearly state the donor’s full name.

- Donation Amount: Specify the exact monetary value or items donated.

- Date of Donation: Include the date when the donation was made.

- Organization Details: List the charity name, address, and tax ID if applicable.

Formatting Tips:

- Ensure the receipt is easy to read with adequate spacing.

- Keep font sizes consistent and avoid cluttering the page.

- Use bullet points to highlight key information.

By following these guidelines, you create a professional and clear donation receipt, reducing confusion and making it easier for both parties to keep accurate records.

Here’s a detailed HTML plan for the article “Charity Donation Receipt Template Free” with 3 distinct headings in English:

This section provides a practical guide on creating a charity donation receipt template for free. A simple, yet comprehensive template can save time and improve donor relations. Let’s explore the key components and how to structure the content effectively.

Key Information to Include in the Template

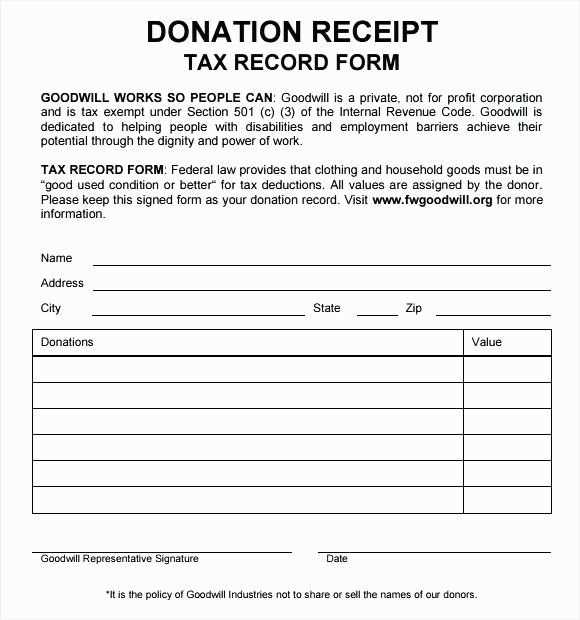

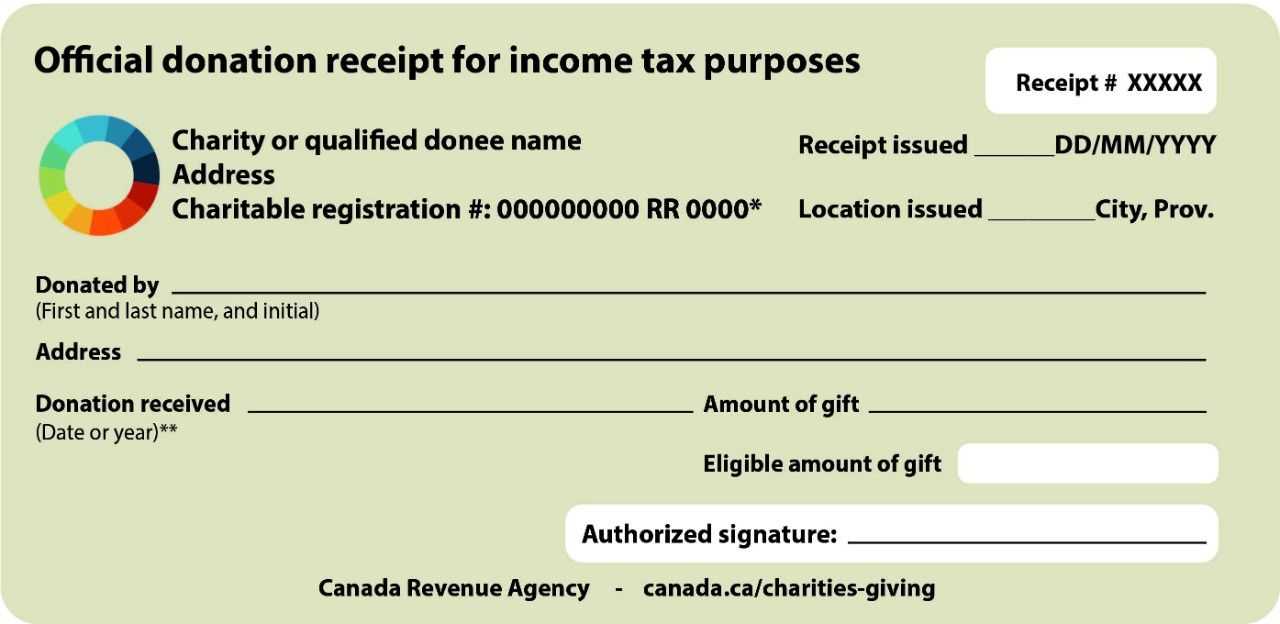

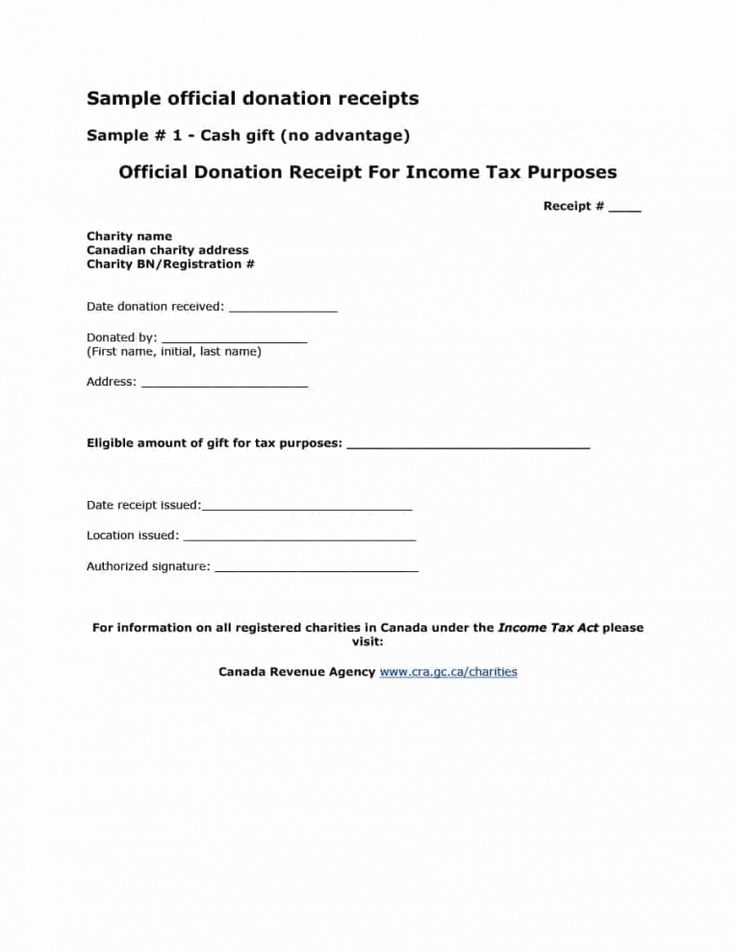

A charity donation receipt should include essential details that acknowledge the donor’s contribution while ensuring compliance with tax requirements. Below are the necessary elements:

| Element | Description |

|---|---|

| Donor Information | Name, address, and contact details of the donor. |

| Donation Date | The exact date the donation was made. |

| Donation Amount | Exact value of the donation, including monetary or itemized gifts. |

| Charity Information | Include the name of the charity, its address, and tax ID number. |

| Statement of No Goods or Services | A statement confirming the donor did not receive goods or services in exchange for the donation. |

Free Charity Donation Receipt Templates

You can access a variety of free templates online, which can be easily customized to meet your charity’s needs. Many websites provide downloadable templates in Word, PDF, and Excel formats. These templates typically come with all the necessary fields and comply with IRS requirements.

How to Customize and Use the Template

Customizing a donation receipt template is easy. Start by filling in the donor and charity information. Then, ensure the donation amount is correctly reflected, and add any additional notes or acknowledgements. Make sure the final receipt is clear and professional.

- How to Design a Custom Donation Receipt Template

Begin by deciding the structure of the receipt. Focus on clarity and simplicity. Include the donor’s name, donation amount, date, and the organization’s details. Make sure the template reflects the organization’s branding, like using its logo and colors to create a professional look.

Use clear headings to separate sections, such as “Donor Information,” “Donation Details,” and “Tax Information,” so that each part of the receipt is easy to find. Organize the donation amount in both figures and words for verification purposes. Include a statement about the non-refundable nature of the donation, if applicable.

Next, add a tax-deductibility statement, making sure it aligns with local tax laws. This is crucial for donors who need proof for their tax filings. You can also offer space for an acknowledgment of the donation, such as “Thank you for your generosity.”

Finally, ensure that the template can be easily customized. Create a version that allows you to quickly edit donor information and donation details. This makes it simpler to handle multiple receipts without additional effort. Use tools like Word or Excel to build a basic version, or employ a PDF template for more formal records.

Check out websites like Template.net, which offers a wide variety of free charity donation receipt templates. These are easy to download and customize to fit your specific needs. You can also visit platforms like Canva for ready-to-use templates, available without any cost once you create an account. The templates on these sites are simple and can be edited online, saving you time.

If you’re looking for more professional options, consider exploring Microsoft Office Templates for charity receipt samples. These templates are compatible with Microsoft Word or Excel, making them highly accessible and easy to use. The templates are clean, designed for nonprofit use, and completely free to download.

Another great option is Google Docs, where you can find numerous free donation receipt templates. Just search for “charity receipt template” in the Google Docs template gallery, and you’ll find a range of customizable templates ready for immediate use.

Additionally, nonprofit organizations like Charity Navigator or Nonprofit Hub sometimes offer templates or links to free resources, so it’s worth checking their websites for specific tools tailored to charitable giving.

Using these resources, you’ll be able to download and personalize a receipt template that meets both your aesthetic and functional requirements for charity donations.

To maximize your tax benefits, include specific details on your donation receipt. The IRS requires a clear description of the donated item or monetary amount, the charity’s name, and the date of the contribution. For non-cash donations, provide an estimated value of the items, either based on a fair market value or appraised amount if required.

Ensure the receipt states that no goods or services were provided in exchange for the donation. If any were, their value must be deducted from the total. This can be a simple statement such as: “No goods or services were exchanged for this donation.”

For monetary donations, include the exact amount donated, as well as the charity’s tax-exempt status. It’s also useful to note if your donation was a one-time gift or part of a recurring contribution plan.

Finally, remember to keep a copy of the receipt for your records and ensure it is signed by an authorized person from the charity. This documentation will be necessary for filing your tax returns and claiming deductions.

Provide clear itemization of the donation amount and date on your receipt. This ensures transparency and helps the donor verify their contribution. Include the full name of the charity, the donor’s name, and a concise description of the donated item or monetary value. Always state whether the donation is tax-deductible to comply with local regulations.

Donation Amount and Date

List the donation amount clearly and the exact date when the donation was made. If the donation involves goods, specify the fair market value of the items donated. This information is critical for both the charity and donor for accounting and tax purposes.

Tax-Deductibility Status

If the donation is tax-deductible, explicitly mention this in the receipt. Include the charity’s tax-exempt status number or the corresponding registration to support the donor’s claim during tax filing.