If you’re looking to streamline your payment process, using receipt templates can save both time and effort. Template.net offers a variety of free receipt payment templates that are easy to customize and use. These templates provide a professional format, ensuring your transactions are documented clearly for both your business and your customers.

With several design options available, you can choose a template that fits your brand’s style and the specific needs of your business. Whether you’re issuing receipts for retail sales, services rendered, or other types of payments, these templates allow you to capture all necessary details, from payment method to transaction date.

Don’t spend valuable time creating receipts from scratch. Take advantage of Template.net’s free receipt payment templates to improve your invoicing process. By using these templates, you ensure accuracy in your financial records while maintaining a professional image with your clients.

How to Use Free Receipt Payment Templates from Template.net

Accessing and using free receipt payment templates from Template.net is straightforward and saves you time. Here’s how to get started:

- Visit the Template.net website and navigate to the “Business” section.

- Search for “receipt payment templates” or use the filter options to narrow down the results based on your needs (e.g., format, style).

- Browse through the available templates and select the one that fits your business or personal requirements.

- Click on the template you want to use, and download it in your preferred format (Word, Excel, PDF, etc.).

- Open the downloaded template in the corresponding application, such as Microsoft Word or Excel, to make edits.

- Fill in the necessary details, such as the payer’s name, the payment amount, and the date.

- Customize any other fields as needed, such as payment method or receipt number.

- Once the receipt is ready, save it and print it for physical distribution or send it digitally to your client.

By using these templates, you can quickly create professional receipts without the need for designing one from scratch, keeping your workflow smooth and efficient.

Choosing the Right Receipt Template for Your Business

Pick a receipt template that aligns with your business needs and brand identity. For a small retail shop, go for a simple, clean layout that includes product details, pricing, and payment methods. If you run a service-based business, select a template that provides space for the service description, hourly rate, and total charges.

Look for templates that allow easy customization. You may need to add your company logo, change font styles, or adjust the color scheme to fit your branding. A receipt should reflect your business personality while maintaining clarity and professionalism.

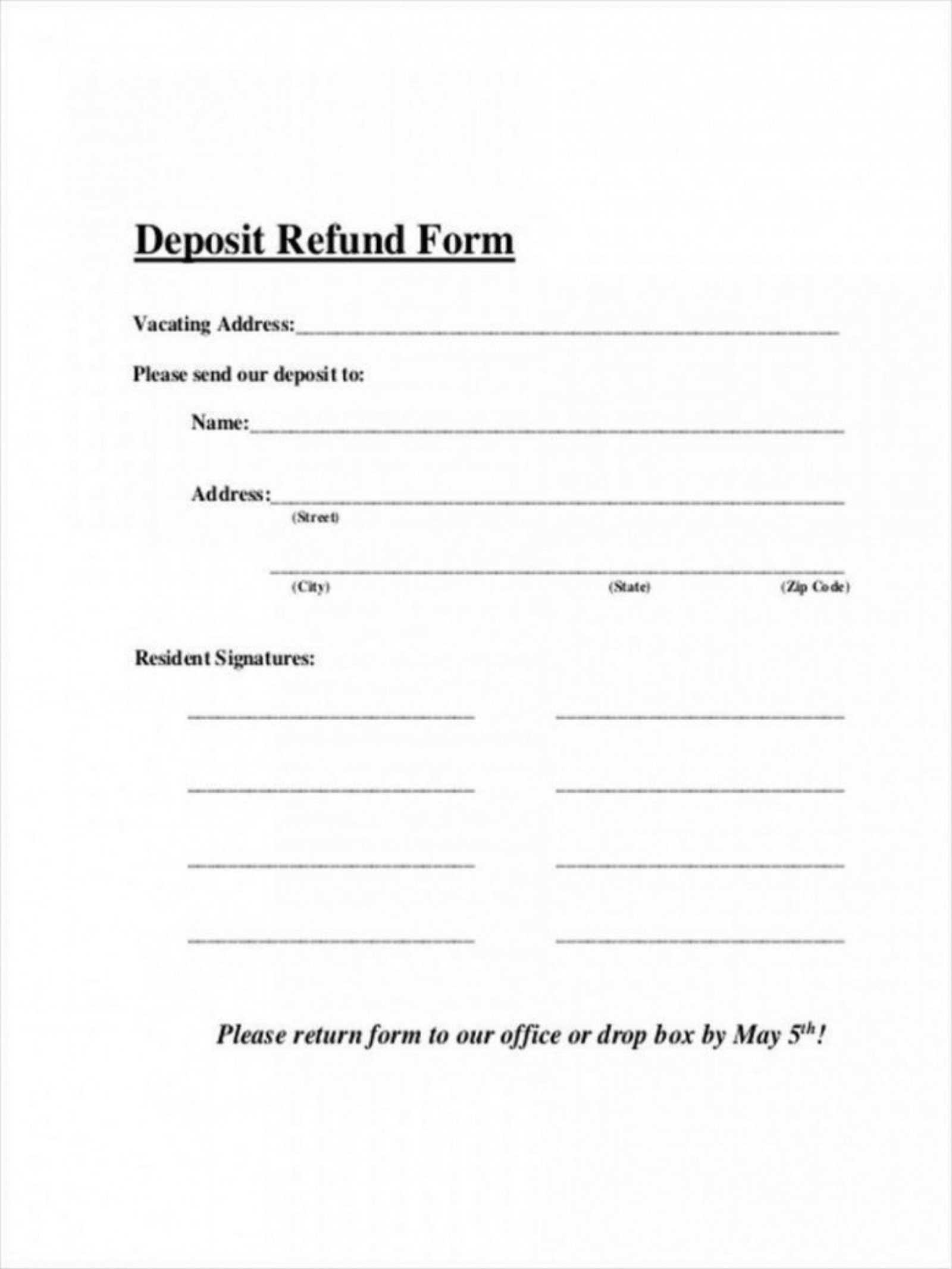

Ensure the template includes all required legal and financial information. Include a section for tax details, payment methods, and unique invoice numbers for easy tracking. This is especially important for businesses that need to comply with local regulations or keep detailed records for accounting purposes.

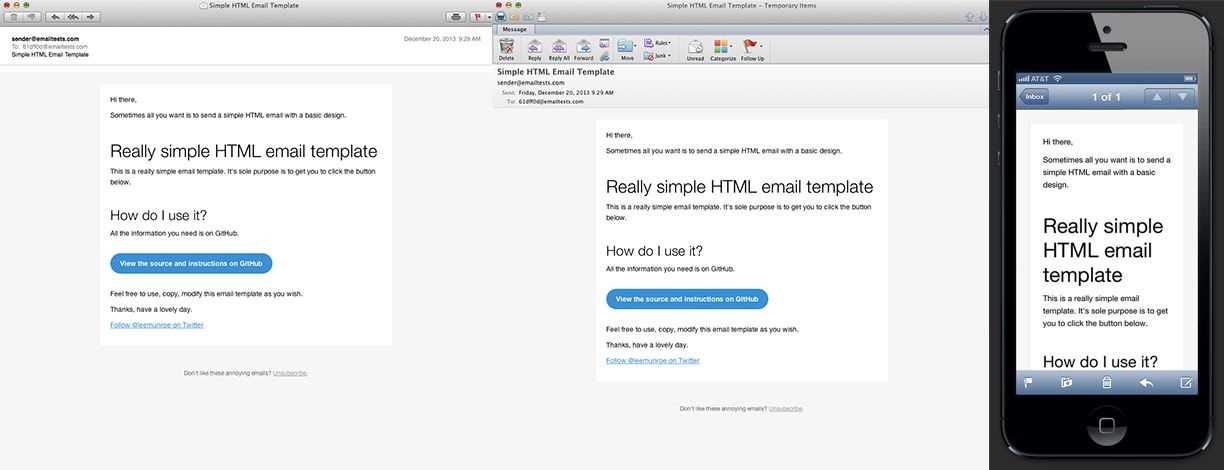

If you plan to use receipts for both online and offline transactions, choose a template that works in both formats. A versatile receipt that can be printed or sent electronically will streamline your operations and improve customer experience.

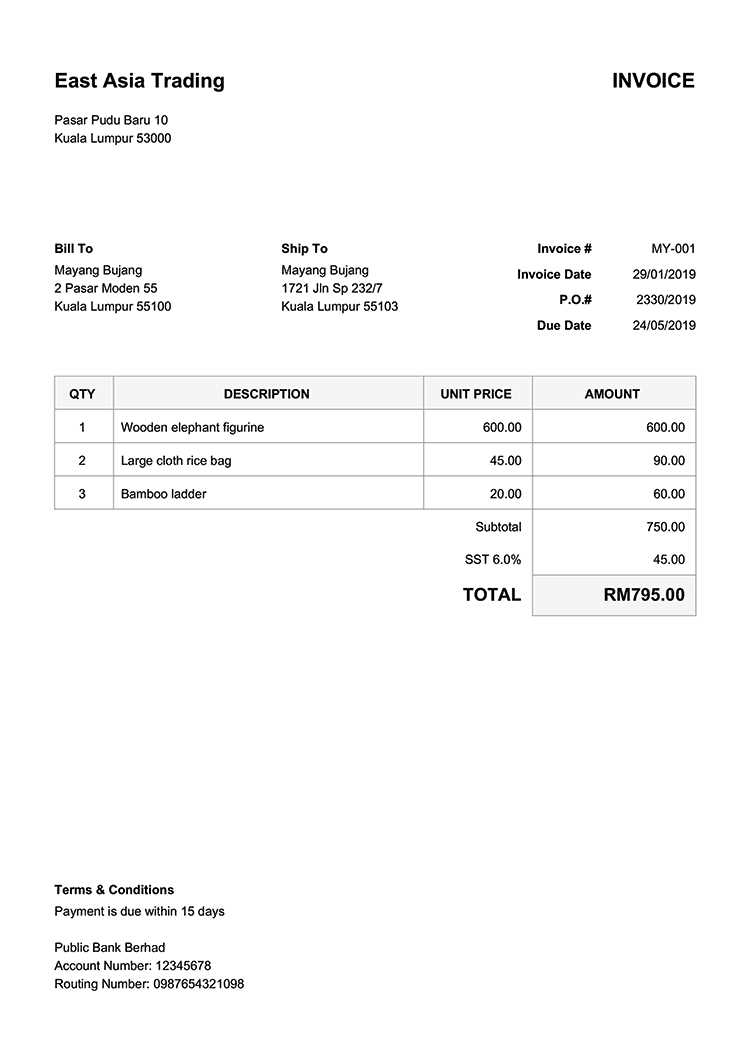

Consider templates that offer both a detailed breakdown and a summary of the payment. A clear itemized receipt helps build trust with customers by showing transparency in pricing, while a concise summary makes the receipt easy to read and store.

Finally, test the template in real-world scenarios before fully committing to it. Make sure it looks good on different devices, prints correctly, and includes all the necessary information without clutter. This will save you time and effort in the long run.

Customizing Your Receipt Template for Accurate Documentation

Adjust your receipt template to reflect your specific business details. Start by adding your company name, address, phone number, and email. This information helps your customers contact you easily and ensures transparency. Also, include your logo for a professional touch and easy brand recognition.

Ensure the receipt template contains the date of the transaction and a unique receipt number. This adds an organized record for both you and your customer. Use a clear and consistent format for the transaction details, including product descriptions, quantities, and unit prices. This will prevent confusion and ensure accuracy in future reference.

Incorporate tax calculations if applicable. Specify the tax rate and amount separately from the total to provide a breakdown of the charges. This level of detail aids in tax reporting and assures customers that all charges are legitimate.

Lastly, tailor the footer of your receipt. Include return policies or payment terms where relevant. This small addition keeps customers informed and reduces disputes over payments or refunds. Adjust each section based on your unique business model for clear and reliable documentation.

Saving and Managing Your Digital Receipts Effectively

Organize your digital receipts by using clear folder structures on your computer or cloud storage. Create folders for different categories, such as business expenses, personal purchases, or taxes, so you can quickly find them later. Always name your files in a way that makes sense to you, using dates or keywords that help you identify the receipt content without opening the file.

Using Receipt Management Apps

Take advantage of receipt management apps that automatically sort and store your receipts. Many apps integrate with your email, scanning paper receipts, and even categorizing them based on the vendor or amount. These apps often let you add notes or tags for easy searching. Make it a habit to upload receipts regularly to prevent backlog.

Backup and Security

Regularly back up your receipts to a secure location, such as an external hard drive or a trusted cloud service. This prevents the risk of losing valuable records due to accidental deletion or system failure. Also, consider encrypting sensitive financial information for added security.

Lastly, periodically review your stored receipts to ensure everything is organized and up-to-date. A well-maintained system will save you time and stress when you need to retrieve receipts for tax purposes or refunds.