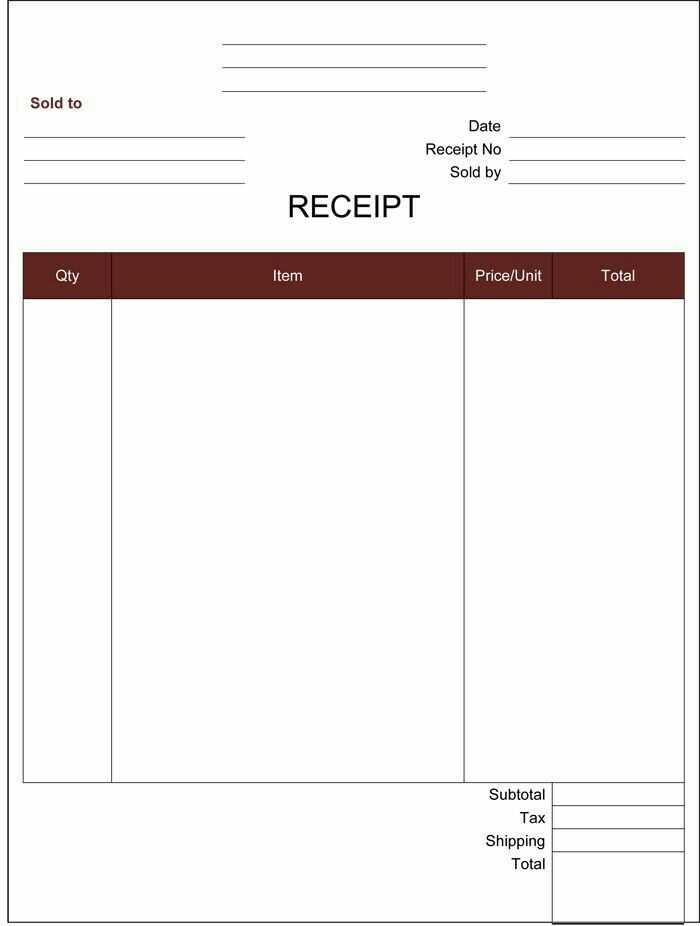

For smooth transaction processing, make sure your vendor receipt template is straightforward and clear. Begin by listing all the essential details: the vendor name, transaction date, itemized list of products or services, and the total cost. This creates a reliable record for both parties involved.

Clarity is key. Keep the format simple but thorough. Include specific terms such as payment method, invoice number, and any applicable taxes. This helps avoid confusion and makes the document easier to reference when needed.

Accuracy matters when detailing quantities, prices, and total amounts. Double-check your figures before finalizing the document to avoid discrepancies later. Use a consistent layout to enhance readability, and always ensure that the receipt includes a contact number or email for any follow-up inquiries.

Vendor Receipt Template

A vendor receipt template should include all necessary information that accurately reflects the transaction between the vendor and the buyer. This ensures clarity for both parties and provides a reliable record of the purchase. Below are key components that should appear in a vendor receipt template:

Key Elements

| Element | Description |

|---|---|

| Vendor Name and Address | Include the full name of the vendor and their business address for easy identification. |

| Receipt Date | The date the transaction took place, confirming the timing of the purchase. |

| Itemized List of Products/Services | List each product or service sold with clear descriptions, quantities, and prices. |

| Total Amount | Show the total amount paid, including taxes and any additional charges. |

| Payment Method | Specify how the payment was made, such as credit card, cash, or check. |

| Vendor’s Contact Information | Include phone numbers or email addresses to allow for follow-up questions. |

Additional Details

It’s helpful to include a receipt number for reference, which can assist with returns or customer service inquiries. If applicable, you may also want to add warranty details or terms of service for the products or services provided. Keep the design simple yet professional, ensuring that all the necessary details are easy to find.

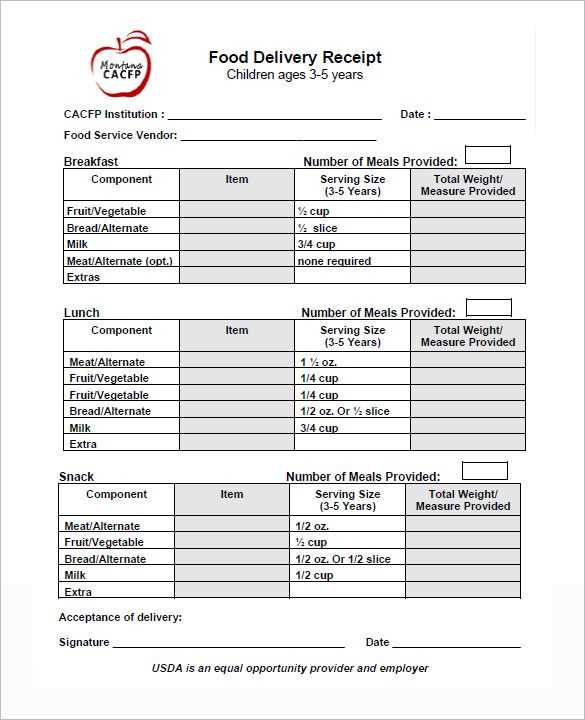

How to Customize Template Fields for Specific Transactions

Adjust template fields based on transaction type for better accuracy and clarity. Begin by identifying the transaction category, such as purchase, return, or service, and modify the template fields accordingly.

1. Define Transaction Categories

- Determine the types of transactions you handle, such as cash, credit, or refund.

- Each category will require specific fields like payment method, tax applied, or discount details.

2. Add Relevant Fields

- For a purchase transaction, include product details, quantity, unit price, and applicable taxes.

- For returns, add the reason for the return and restocking fee (if applicable).

- For services, fields like service description, duration, and labor cost may be relevant.

By making these adjustments, your template will reflect the nature of each transaction while ensuring that all required information is captured. Keep in mind that customization should focus on improving the clarity of your records, avoiding unnecessary complexity.

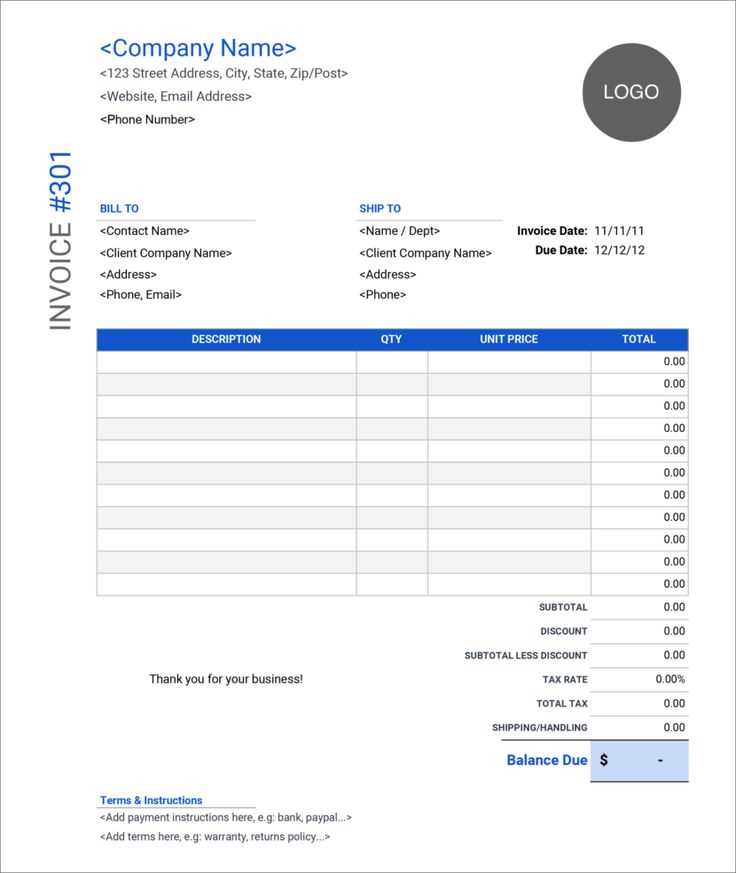

Steps for Including Payment Terms and Delivery Details

Specify Payment Terms: Clearly outline the payment method and timeline. Indicate whether payments are due immediately, within a set number of days, or upon receipt of goods. If you offer credit terms, specify the duration and any interest charges for late payments.

State Accepted Payment Methods: List the methods you accept, such as bank transfers, credit cards, checks, or digital wallets. This helps prevent confusion and ensures customers know how to complete the transaction.

Define Delivery Terms: Provide clear details on the delivery process, including who is responsible for shipping costs, estimated delivery dates, and any delivery charges. If applicable, state whether delivery is free or if shipping costs vary based on location.

Include Shipping Instructions: Specify any special shipping requirements, such as handling fragile items, packaging details, or preferred couriers. This can help ensure smooth logistics and reduce any potential issues.

State Return or Exchange Policies: If applicable, mention your policy on returns or exchanges. Clearly define the conditions under which returns are accepted and the process for initiating an exchange.

Highlight International Delivery Conditions: If offering international shipping, outline any additional fees, customs requirements, or restrictions. This will help set expectations for international customers.

Ensuring Legal Compliance and Tax Information in Your Template

Include the necessary legal disclaimers and tax details in your vendor receipt template to ensure compliance with local regulations. Clearly state your business’s tax identification number (TIN) and any other required information like VAT numbers, if applicable. This is especially important for businesses that operate internationally or in multiple states.

Tax Breakdown and Rates

Provide a transparent breakdown of the taxes applied to the transaction. Include the tax rate, total tax amount, and any exemptions or discounts. This allows both the vendor and customer to clearly understand how tax is calculated. Always ensure that the rates are up-to-date according to the current tax laws.

Legal Terms and Conditions

Incorporate a section for any legal terms related to the transaction. This can include refund policies, delivery terms, and dispute resolution procedures. Having these terms on the receipt ensures that both parties are aware of their rights and obligations in case of issues.