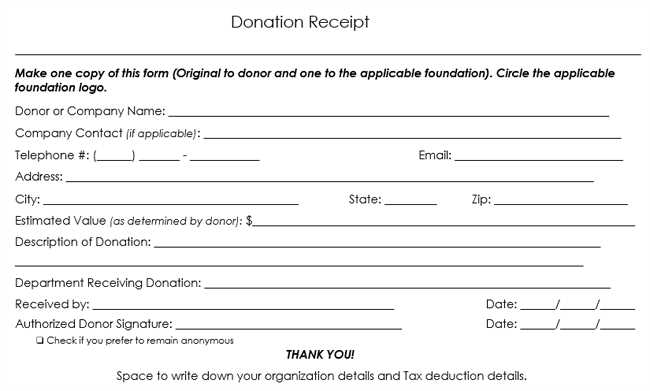

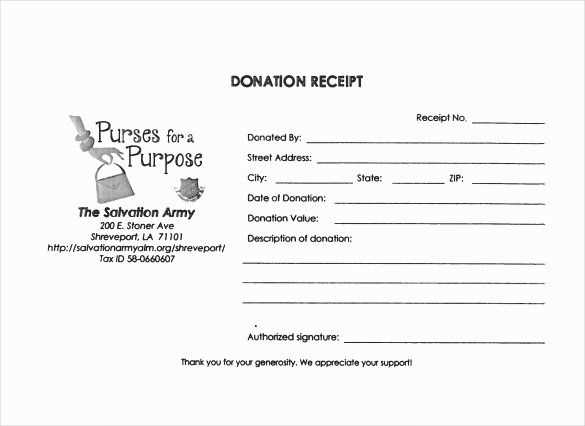

To ensure proper documentation of your furniture donation, using a furniture donation receipt template helps both you and the recipient. The template should include specific details such as the donor’s name, address, date of donation, and a description of the items donated. This information serves as proof of the donation for tax purposes or record-keeping.

Make sure the template includes the fair market value of the donated items, if possible. This allows the donor to accurately claim a deduction on their taxes. A well-organized template should also include a statement confirming that no goods or services were exchanged for the donation, ensuring that it remains a charitable contribution.

Additionally, ensure the template is clear and simple to fill out. A straightforward format not only makes the process easier but also helps avoid confusion in the future. A solid donation receipt should be kept by both the donor and the organization for reference.

Here’s the corrected version:

To create a clear and professional furniture donation receipt, start by including the donor’s full name, address, and contact details. Next, list the items donated with brief descriptions. Specify the condition of each item, such as “gently used” or “like new.” Include the date of the donation and a statement confirming that no goods or services were exchanged for the donation. Conclude with the organization’s name, tax-exempt status, and a signature line for verification. Ensure the format is neat, organized, and easy to read for both parties involved.

- Furniture Donation Receipt Template

When creating a furniture donation receipt, include these key components to ensure clarity and proper record-keeping:

1. Donor Information

Clearly list the donor’s full name, address, and contact details. This information is necessary for tracking donations and providing any follow-up communication or tax-related correspondence.

2. Donation Details

Detail each item donated. Be specific about the furniture, including a brief description and its condition. For example: “Wooden dining table – Good condition” or “Couch – Worn but usable.” This provides transparency for both the donor and the receiving organization.

3. Estimated Value (Optional)

If the donor provides an estimated value for the items, include this in the receipt. Otherwise, mention that no value was assigned. While the organization is not required to assess value, the donor might use this information for tax deduction purposes.

4. Receiving Organization Information

Include the name, address, and contact details of the organization receiving the donation. This provides legitimacy to the receipt and confirms that the donation was made to a recognized charity.

5. Signature

A representative from the receiving organization should sign the receipt. This confirms that the items were received as described. Include a date next to the signature for clarity.

Here’s a simple layout to follow:

Donor Information: Name: [Full Name] Address: [Full Address] Contact: [Phone/Email] Donation Details: Date of Donation: [Date] Items Donated: - [Item 1: Description and Condition] - [Item 2: Description and Condition] Estimated Value: [Optional, if provided] Receiving Organization: Name: [Organization Name] Address: [Organization Address] Contact: [Phone/Email] Signature of Representative: [Signature]

This template helps organize the necessary details for both tax purposes and organizational records. Keep a copy for your own records and provide one to the donor as proof of their charitable contribution.

To ensure that your donation receipt meets legal requirements, include the following key components:

1. Donor Information

List the full name of the donor and their address. This allows you to track donations and provide necessary documentation for tax purposes.

2. Description of the Donated Items

Clearly describe the items donated, including their condition. Avoid assigning a monetary value to the items unless they have been professionally appraised.

3. Date of Donation

State the exact date the donation was made. This ensures the receipt corresponds with the tax year and provides clarity for both the donor and the charity.

4. Acknowledgment of No Goods or Services Received

If the donor did not receive anything in return for their donation, state this explicitly. If there were goods or services provided, the receipt should include a description and estimated value of those items.

5. Charity Information

Include the charity’s name, address, and tax identification number (TIN) or EIN. This identifies the organization and ensures the donation is valid for tax deductions.

6. Signature

Include a space for the charity’s representative to sign, acknowledging receipt of the donation.

By following these guidelines, you ensure that both the donor and the charity comply with IRS requirements and that donations are properly documented for tax purposes.

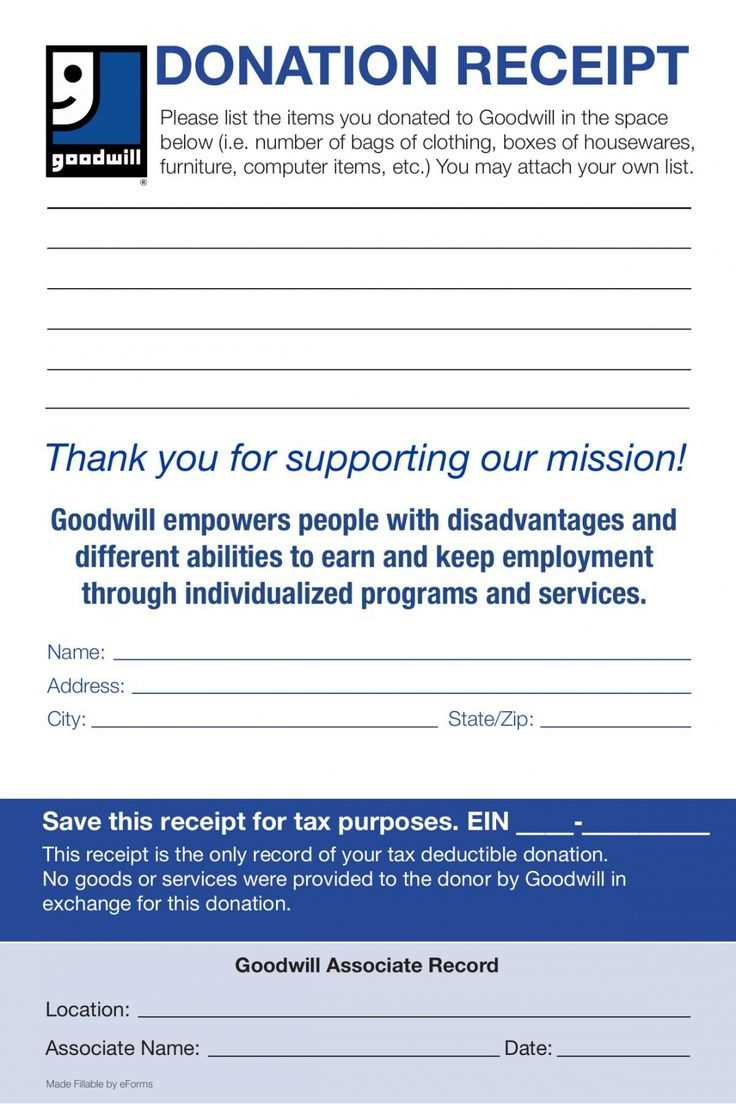

Include the following key details in a furniture donation receipt:

- Donor’s Full Name: Clearly list the full name of the donor for identification purposes.

- Donation Date: Record the exact date the donation took place.

- Description of Donated Items: Provide a detailed list of donated furniture, including quantities, materials, and condition (e.g., “wooden dining table, 6 chairs, slightly worn”).

- Estimated Value: If available, include the estimated market value of each item. This helps donors claim tax deductions, but the donor should assess the value themselves.

- Statement of No Goods or Services Provided: Clearly state that the donor did not receive any goods or services in exchange for the donation.

- Tax Identification Number (TIN): Include your organization’s TIN for the donor’s tax purposes.

- Thank You Note: A brief note expressing gratitude for the donor’s contribution.

- Authorized Signature: Ensure that a representative from the organization signs the receipt to authenticate it.

These elements help ensure the donation receipt is complete and useful for both the donor and the organization.

Always double-check the donor’s information. Incorrect names or addresses can cause confusion, leading to issues with tax deductions. Ensure that all details are accurate and up-to-date.

Incorrect or Missing Description of Donated Items

Clearly describe the items received. This includes quantity, condition, and specific details that distinguish them. Without this, the donor may struggle to prove the value of their contribution for tax purposes.

Failure to Include the Date of Donation

Every receipt must include the exact date the donation was made. A missing date can lead to complications when donors file their taxes, as the timing of their donation is important.

Don’t forget the organization’s details. The receipt should feature the name, address, and tax-exempt status of the receiving organization. Missing this information can undermine the validity of the receipt.

Keep a record of donated item values. While you can’t assign a specific value to non-cash donations, you can provide an estimate. Failing to include this can leave the donor uncertain about the value for tax reporting.

Lastly, avoid vague language. Ensure your receipt is clear, concise, and provides all necessary legal information. Ambiguous wording can create problems for both parties down the line.

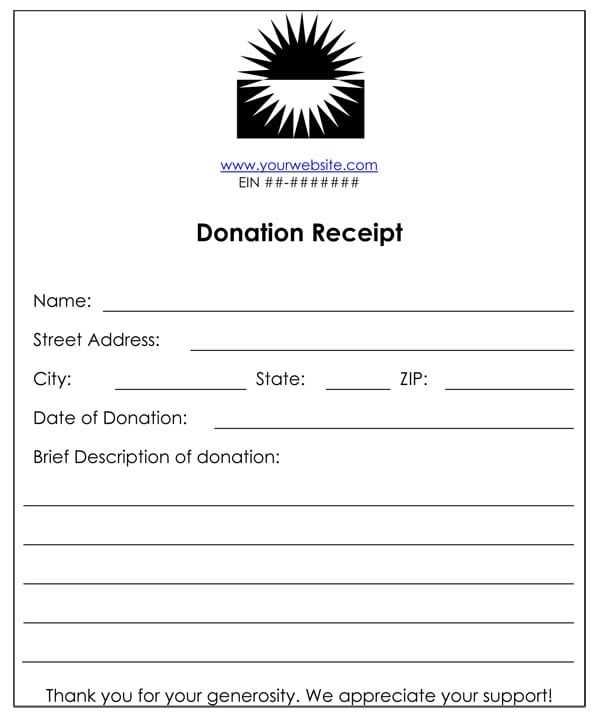

Furniture Donation Receipt Template

To ensure a clear and concise record of your donation, it’s important to include specific details on the receipt. A well-structured document should list the donor’s name, the donated items, and their approximate value. These elements ensure both clarity for the donor and compliance with tax regulations. Here’s a simple structure to follow:

Receipt Structure

| Donor Name | Item Description | Estimated Value | Donation Date |

|---|---|---|---|

| [Donor’s Full Name] | [Detailed Item List] | [Estimated Value of Items] | [Donation Date] |

Each donation receipt should include the name of the charity or organization receiving the donation. Be sure to clarify the type of donation as well, whether it’s a set of tables, chairs, or other home furnishings. This helps maintain transparency and simplifies the documentation process. Keep in mind that providing a breakdown of items is a good practice.

Tax Considerations

Including the estimated value of each donated item ensures that the donor can claim an appropriate deduction for tax purposes. While it’s not required to assign a precise value, an approximation based on market value is helpful. If possible, suggest that donors seek a professional appraiser for high-value donations.