For a quick and clear record of a transaction, use a money receipt template. It ensures both parties have a written proof of the payment made. The template should include key details like the date, amount, method of payment, and the names of the payer and receiver. Make sure to tailor it to suit the specifics of each transaction.

Include a receipt number for tracking purposes. This helps organize records, especially when dealing with multiple transactions. The payment method (e.g., cash, cheque, bank transfer) should be clearly stated for clarity. Also, add a description of the goods or services involved to avoid confusion later.

A well-designed receipt template saves time and minimizes errors. It provides both parties with an easy-to-reference document for future use. Customizing the template according to your needs will keep all important details in one place.

Here is the corrected version:

Ensure the receipt includes the full name of the payer and recipient. Include the exact amount paid, currency, and method of payment. Specify the reason for the payment, the date of the transaction, and the receipt number for tracking. Make the document clear by using readable fonts and logical formatting. This will help avoid confusion for both parties involved.

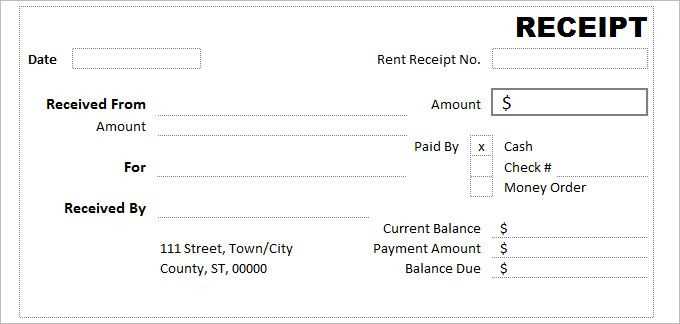

- Template for Money Receipt

A money receipt template should include key details like the payer’s name, the amount paid, and the date of the transaction. Ensure that it contains both the reason for the payment and the payment method, such as cash or cheque. This will help clarify the purpose of the receipt and prevent confusion later. The template should also offer space for the receipt number for tracking purposes.

Make sure the payer and payee’s contact details are visible, in case further clarification is required. A money receipt template should include the phrase “Received with thanks” or similar language to signify the completion of the transaction. It’s crucial to indicate whether the payment is partial or full. Additionally, the template must have a signature field for both the payer and the payee to acknowledge the transaction.

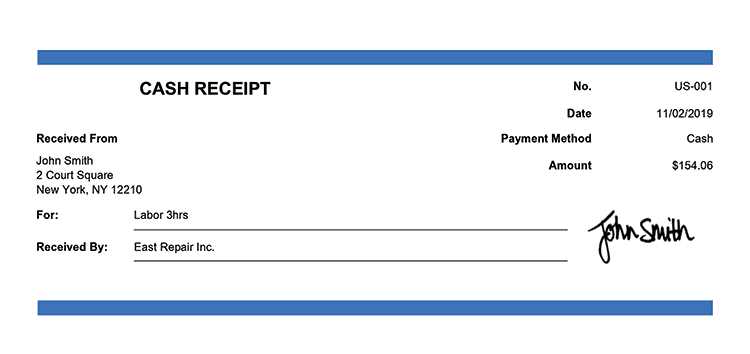

Here is a simple example of a money receipt template:

Receipt No: ________ Date: ___________ Received from: __________ Amount: ___________ In words: ____________ For: ____________________ Payment Method: __________ Paid By: ___________ Signature of Payer: ____________ Signature of Payee: ____________

Begin by setting up a header section for your receipt. Include the name of your business or individual name, contact information, and logo, if applicable. Ensure this information is easily visible at the top of the receipt.

1. Add Receipt Number and Date

Include a unique receipt number for tracking purposes, followed by the date of the transaction. This helps both parties keep accurate records.

2. List Purchased Items or Services

Clearly describe the items or services sold, along with their respective prices. If applicable, include quantities and item codes for reference. Use a table format for neatness and clarity.

Example:

- Item: Product Name

- Price: $XX.XX

- Quantity: X

3. Display Total Amount

Sum up the total cost of the transaction, including taxes or any additional fees. Clearly label this amount as the total.

4. Payment Method

Specify the payment method used, whether cash, credit card, or another method. This adds clarity and provides an official record.

5. Include Additional Notes or Terms

If necessary, add any refund policies or special terms related to the purchase.

Finally, leave space for the buyer’s and seller’s signatures, if required. This marks the completion of the transaction.

To create a clear and accurate receipt, include the following key elements:

- Date of Transaction: Record the exact date of the transaction to establish a clear timeline.

- Transaction Amount: Specify the total amount paid, including any applicable taxes or discounts.

- Payment Method: Indicate how the payment was made (e.g., cash, card, or bank transfer).

- Seller and Buyer Information: Include the name and contact details of both parties involved in the transaction.

- Unique Transaction ID: Add a reference or invoice number to help track the transaction.

- Itemized List: Provide a detailed breakdown of the items or services purchased.

- Signature (Optional): If necessary, include a space for the buyer’s or seller’s signature to confirm the agreement.

Ensure all required details are included in the receipt. Missing information, such as the payer’s name, payment date, or the total amount, can lead to confusion and disputes. Double-check the accuracy of each field before finalizing the document.

Always specify the payment method. Whether it’s cash, credit, or bank transfer, clarifying how the payment was made prevents any misunderstandings later. Failure to do this may raise questions about the legitimacy of the transaction.

Avoid vague descriptions of goods or services. Be specific about what was purchased and provide a clear breakdown of the costs. This transparency helps in case the receipt needs to be referenced or used for returns.

Do not forget to include your business contact information. This allows customers to easily reach you for inquiries or issues related to the transaction. Make sure your contact details are up to date.

Avoid issuing receipts with incorrect dates. An incorrect date can create confusion regarding the timing of the transaction. Ensure the date matches the actual day of payment.

Do not omit the signature of the issuer, if necessary. Some jurisdictions require that receipts be signed by the issuing party to make them legally binding. Verify the requirements in your location to avoid issues later.

Ensure the receipt is readable and free from errors. A receipt filled with typos or unclear handwriting can undermine its credibility. Take extra care to keep it neat and legible.

| Mistake | Consequences | Recommendation |

|---|---|---|

| Missing details | Confusion, disputes | Include all required fields (payer name, payment method, amount, etc.) |

| Vague descriptions | Misunderstanding of goods/services | Provide clear, detailed item descriptions |

| Incorrect date | Timing issues, disputes | Double-check the transaction date |

| No contact information | Inaccessibility for customer queries | Include accurate and up-to-date contact details |

| Unreadable format | Loss of credibility | Ensure legibility with clear writing and formatting |

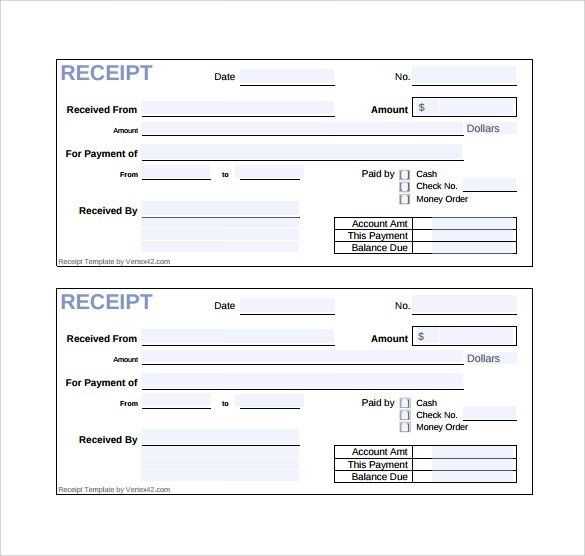

Money Receipt Template

Ensure your receipt includes the following key components:

- Receipt Title: Clearly label the document as “Money Receipt” at the top to avoid confusion.

- Date and Time: Include the exact date and time of the transaction to provide a reference point.

- Payee and Payer Information: List the full names or business names of both the payee and the payer. This adds clarity to the transaction details.

- Amount Paid: Specify the exact amount in both numerical and written form to eliminate ambiguity.

- Payment Method: Identify the method of payment (cash, cheque, bank transfer, etc.).

- Transaction Purpose: Briefly mention the reason for the payment. This will provide context for future reference.

- Signature: Both parties should sign to confirm the validity of the transaction.

These elements make the receipt clear and functional for both the payer and the payee.