A food donation receipt template helps document donations made to charitable organizations. It’s important to include specific details for tax deductions and record-keeping. The template should clearly identify the donor, the recipient organization, and the food items donated, including quantities and condition. This ensures transparency for both parties and provides the necessary information for accurate reporting.

The receipt should include the date of donation, the name of the donor, and the address of the donor. A description of the items donated is crucial, listing each food type and its approximate value. While non-perishable food donations are typically easier to assess, perishable items might require an estimated value based on common market prices.

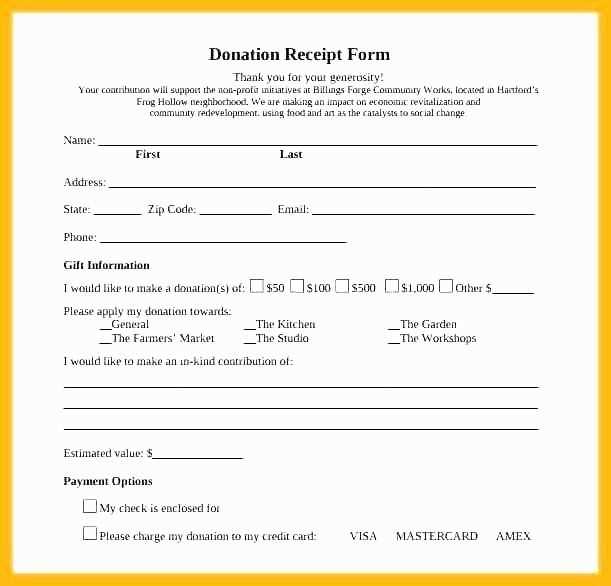

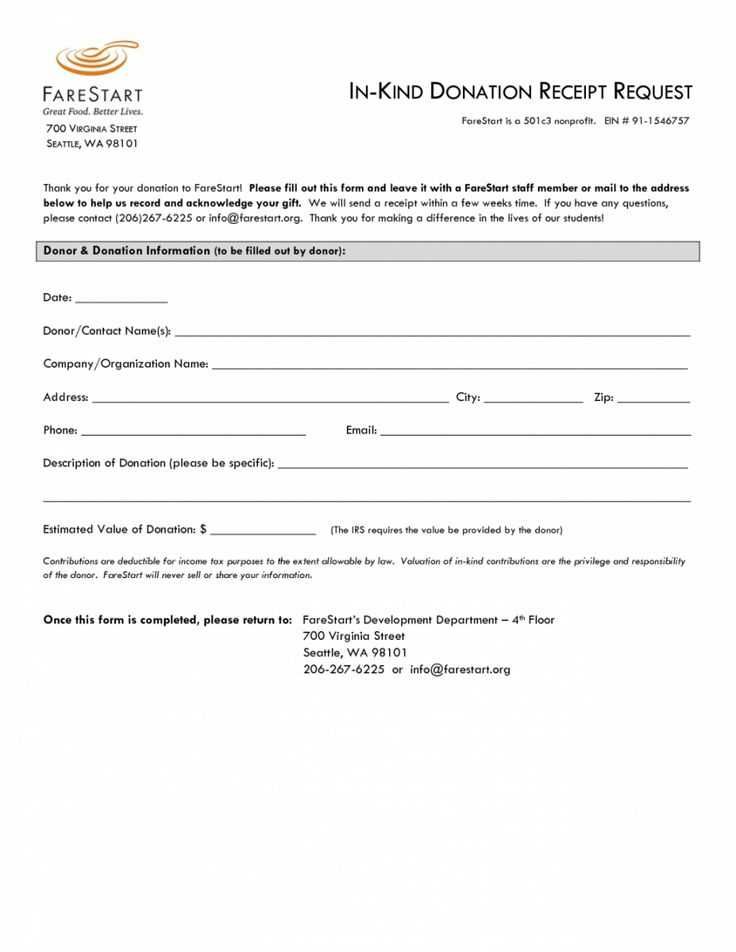

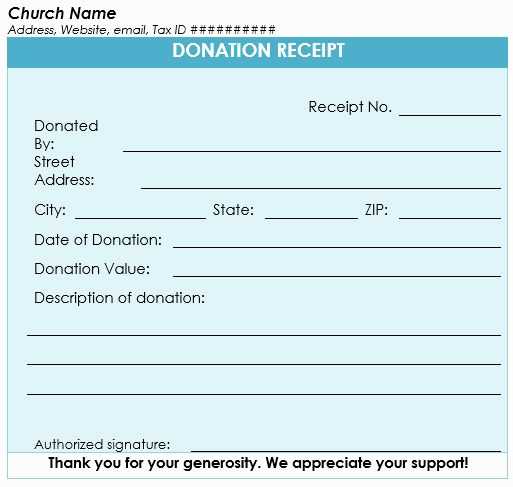

To create a simple and effective food donation receipt template, use a clear structure. Start with the charity’s name, address, and contact details. Then, include a donation summary, followed by the donor’s contact details. End with a statement confirming that no goods or services were provided in exchange for the donation, as this is required for tax deduction purposes.

Here are the corrected lines:

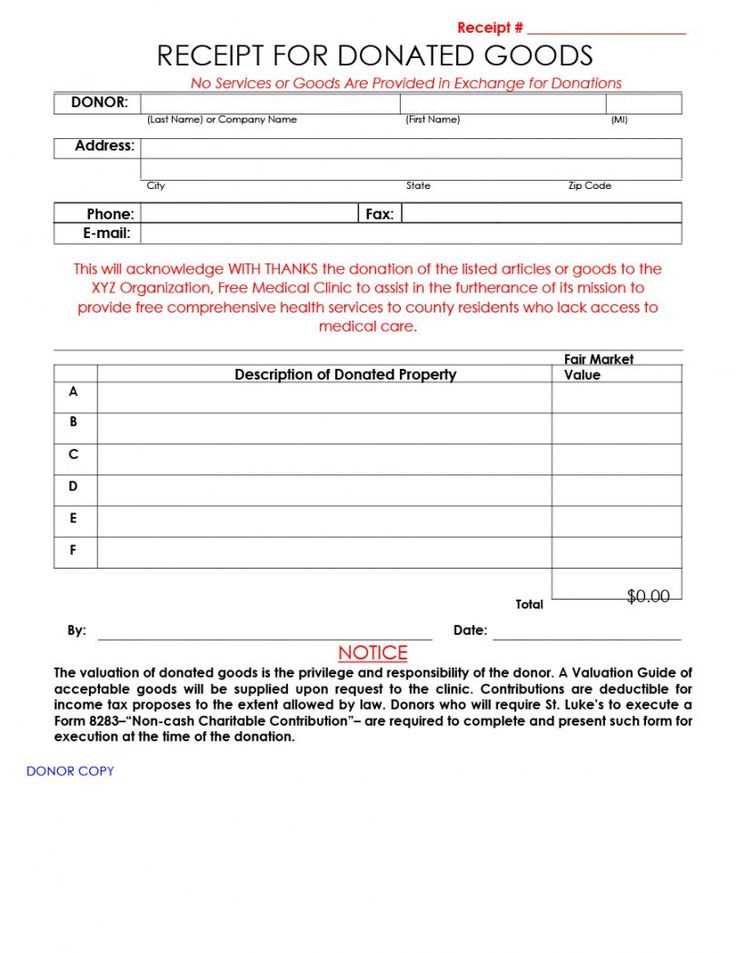

Ensure that each item is listed separately with a clear description and the corresponding value or weight donated. This makes the receipt more transparent and useful for both the donor and the recipient organization.

Donor Information

Clearly display the donor’s name, address, and contact details. This helps ensure the receipt is properly attributed and can be verified if necessary.

Donation Details

Provide detailed information on the donated goods, including quantity, type, and condition. This helps to avoid any ambiguity in the transaction and ensures accurate record-keeping for tax purposes.

Finally, include a signature line for the recipient organization’s authorized representative. This confirms the receipt of the donation and adds an official touch to the document.

Food Donation Receipt Template

Creating a food donation receipt is straightforward but requires accurate details to ensure both the donor and the recipient have the necessary documentation. Here’s a template that can be easily adapted for different food donation scenarios.

Required Information

- Donor’s Name: Full name of the individual or organization making the donation.

- Recipient Organization’s Name: The name of the charity or nonprofit organization receiving the donation.

- Donation Date: The exact date the food was donated.

- Description of Donated Food: A clear list of the food items donated (e.g., canned goods, fresh produce, frozen meals, etc.).

- Estimated Value of Donation: An estimated value of the food based on its fair market price.

- Signature: Signature of the authorized person from the recipient organization.

- Contact Information: Phone number or email address of the organization or the contact person.

Sample Template

Food Donation Receipt Donor's Name: _________________________ Recipient Organization: ______________________ Donation Date: ____________________________ Description of Food Donated: - Canned Beans (10 cans) - Fresh Apples (5 lbs) - Frozen Chicken Breasts (2 packs) Estimated Value of Donation: $50.00 Signature of Authorized Representative: ______________________ Contact Information: _______________________

This template ensures clarity and consistency in acknowledging food donations. Customize the list of items and estimated value based on your specific donation details. A well-documented receipt benefits both the donor for tax purposes and the organization for record-keeping.

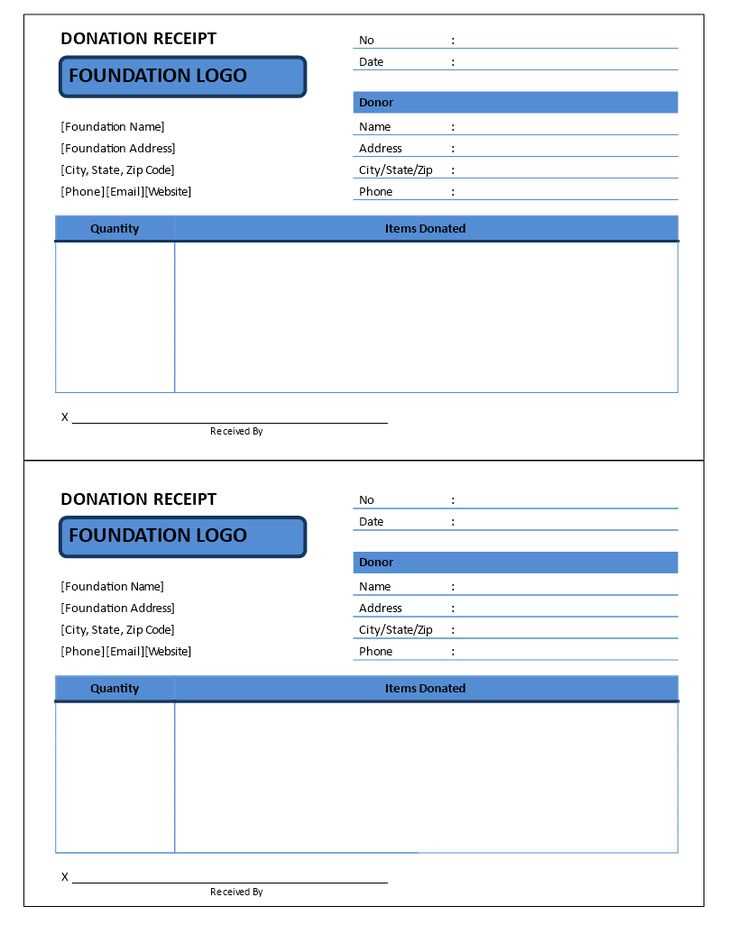

Include the name and logo of your organization at the top of the receipt. This adds a professional touch and helps the donor easily identify the source of the receipt.

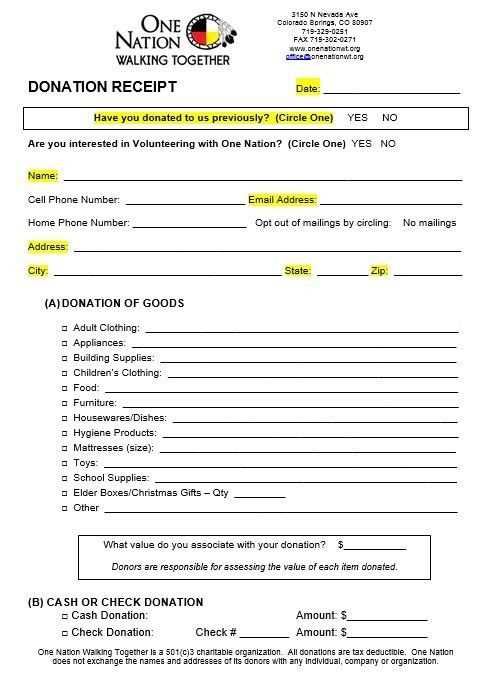

List Donated Items with Specifics

Detail each food item donated, including quantity and description. For instance, “10 cans of soup” or “5 bags of rice.” This transparency ensures the donor knows exactly what they contributed and helps with their record-keeping.

Include Legal and Tax Information

Provide a statement confirming that no goods or services were provided in exchange for the donation. This is necessary for the donor’s tax deductions. Additionally, include your tax-exempt status number, if applicable.

Lastly, don’t forget to thank the donor for their support and reinforce the impact their contribution has on your cause.

Make sure to include the donor’s full name and address. This will help both parties keep clear records and ensure the donation is correctly attributed for tax reporting purposes.

Clearly state the date of the donation. This detail is necessary to determine the tax year in which the contribution occurred.

Provide a description of the donated food items. Include the type of food donated, such as canned goods, fresh produce, or packaged items. Be as specific as possible.

Include the quantity of food donated. This can be measured by weight, number of boxes, or individual items depending on the type of donation.

If applicable, assign a reasonable value to the donation. This could be based on the fair market value of the items, which can be estimated by checking local values for similar goods.

If the donor received anything in exchange for the donation, such as a token or acknowledgment, this must be noted. Tax laws require that only the portion of the donation that exceeds the value of any received benefit is eligible for a tax deduction.

Include your organization’s name, address, and tax-exempt status. This confirms the legitimacy of the donation and the eligibility for a tax deduction.

Finally, make sure to include a statement that no goods or services were provided in exchange for the donation, or specify what was given, if anything.

Ensure receipts are issued immediately after a donation is received. This helps maintain accurate records and provides timely acknowledgment to donors. Whether the donation is in-kind or monetary, receipts should contain key details such as the donor’s name, date of donation, a description of the food, and an estimated value if applicable. For in-kind donations, ensure you mention that the value of the donation is an estimate by the donor and not the nonprofit’s valuation.

Distributing Receipts

Distribute receipts via email or print them on-site, depending on donor preference. Offering both options ensures convenience. If printed, ensure the receipt is legible and neatly formatted. For digital receipts, store them in a secure system and provide easy access for donors in case they need to retrieve their receipts for tax purposes. Make sure the digital system complies with data protection regulations.

Storing Receipts

Store both physical and digital receipts in an organized manner. Digital receipts should be stored in a cloud-based system with proper backups, ensuring they are easy to retrieve if needed. For physical receipts, maintain a filing system that sorts receipts by donation date and donor name. This allows quick access during audits or donor follow-up.

To create a food donation receipt, include all the necessary details to comply with legal standards and provide clarity for both parties. Below is a simple guide on how to structure it effectively:

Key Components of a Food Donation Receipt

The following elements should be present in every food donation receipt:

| Field | Description |

|---|---|

| Donor Name | Include the full name or organization name of the person donating food. |

| Donation Date | Provide the exact date when the donation was made. |

| Description of Items | List the items donated, including quantity and type of food. If possible, provide an estimate of value for tax purposes. |

| Recipient Name | Include the organization receiving the donation, including the address and contact details. |

| Signature | Ensure the donor and the recipient organization representative sign the document to validate it. |

| Tax Information | If the donation is tax-deductible, provide necessary details or instructions for claiming the deduction. |

Formatting Tips

Keep the format simple and clear. Use legible fonts and a clean layout. Ensure the donor’s name and the donation details are easy to read. This receipt can be either physical or digital, but make sure both parties receive a copy for their records.