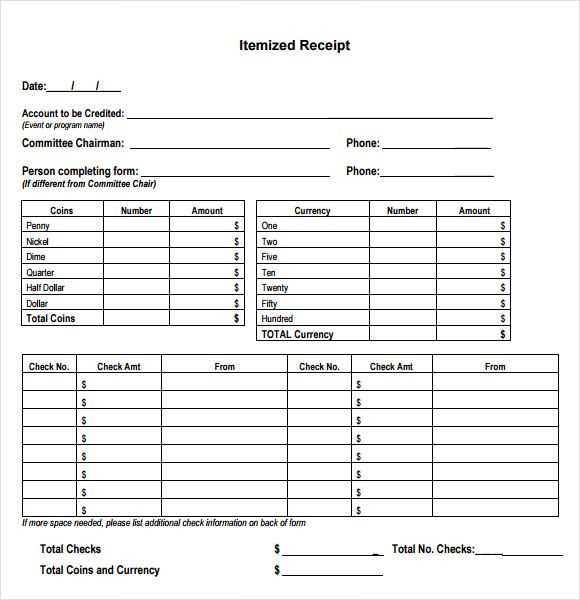

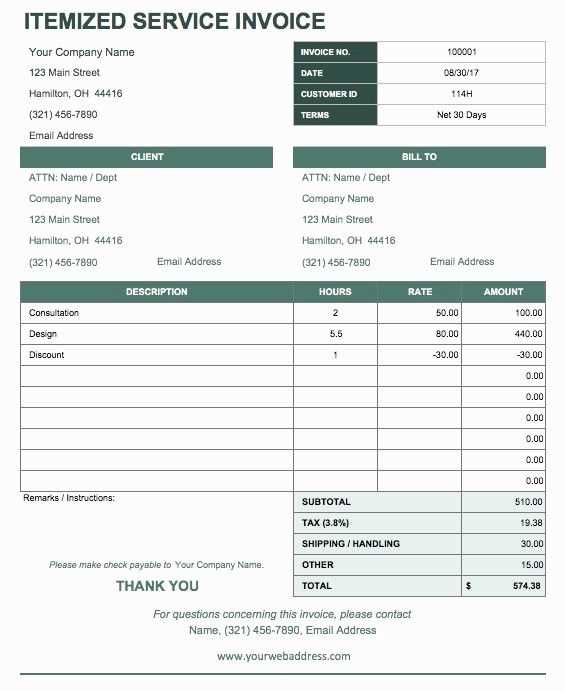

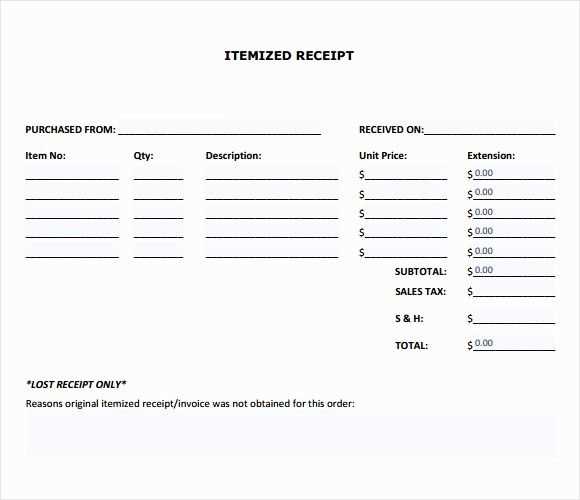

To make the most of your HSA (Health Savings Account), it’s important to have an organized system for tracking expenses. An itemized receipt is a critical part of this process. This template ensures you record all necessary details, such as the date, provider name, itemized services or products, and the total amount paid, which are required for reimbursement or tax reporting.

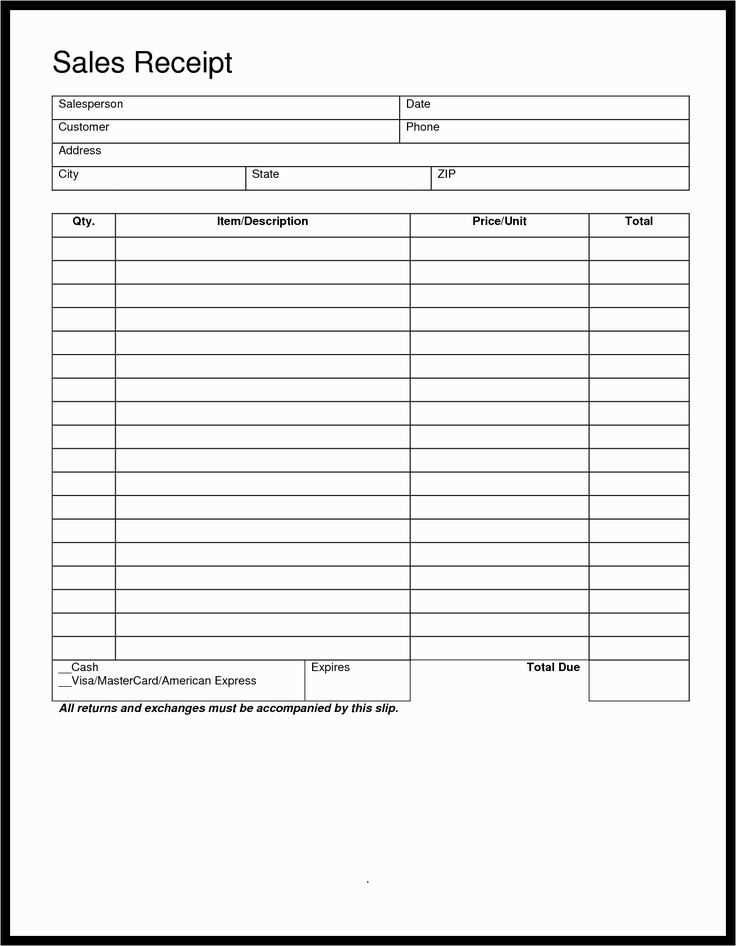

Using a clear and consistent template not only helps with HSA compliance but also makes it easier to submit claims. Each receipt should include a breakdown of the costs and a clear indication of what was purchased, whether it was for a medical service, prescription, or eligible over-the-counter item. Make sure to store these receipts securely for your records and possible audits.

Remember, having an itemized receipt can significantly reduce the risk of claim rejections or delays. If you are unsure about how to create or format an itemized receipt, there are numerous templates available online that you can customize. These templates help ensure you don’t miss any important details that might be needed during a claim submission.

Here’s the corrected version:

To create an HSA itemized receipt, include the following details:

- Date of Service: The specific date the service or item was purchased.

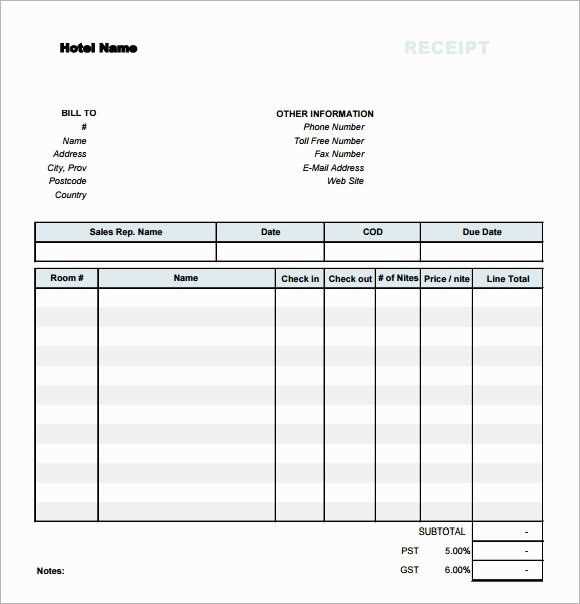

- Provider Information: Full name, address, and contact details of the service provider or seller.

- Description of Item/Service: A brief and clear description of the item or service received. Avoid ambiguous terms.

- Amount Paid: The exact amount paid, without any discounts or adjustments already applied.

- Payment Method: Specify the method used for payment, whether it was a credit card, debit card, or check.

- Medical Necessity: Clearly indicate if the expense is eligible under HSA guidelines. A note from the provider may be necessary.

Make sure the receipt is legible and includes all of these components. Incomplete or unclear receipts can lead to delays or rejection during HSA claims processing.

HSA Itemized Receipt Template Guide

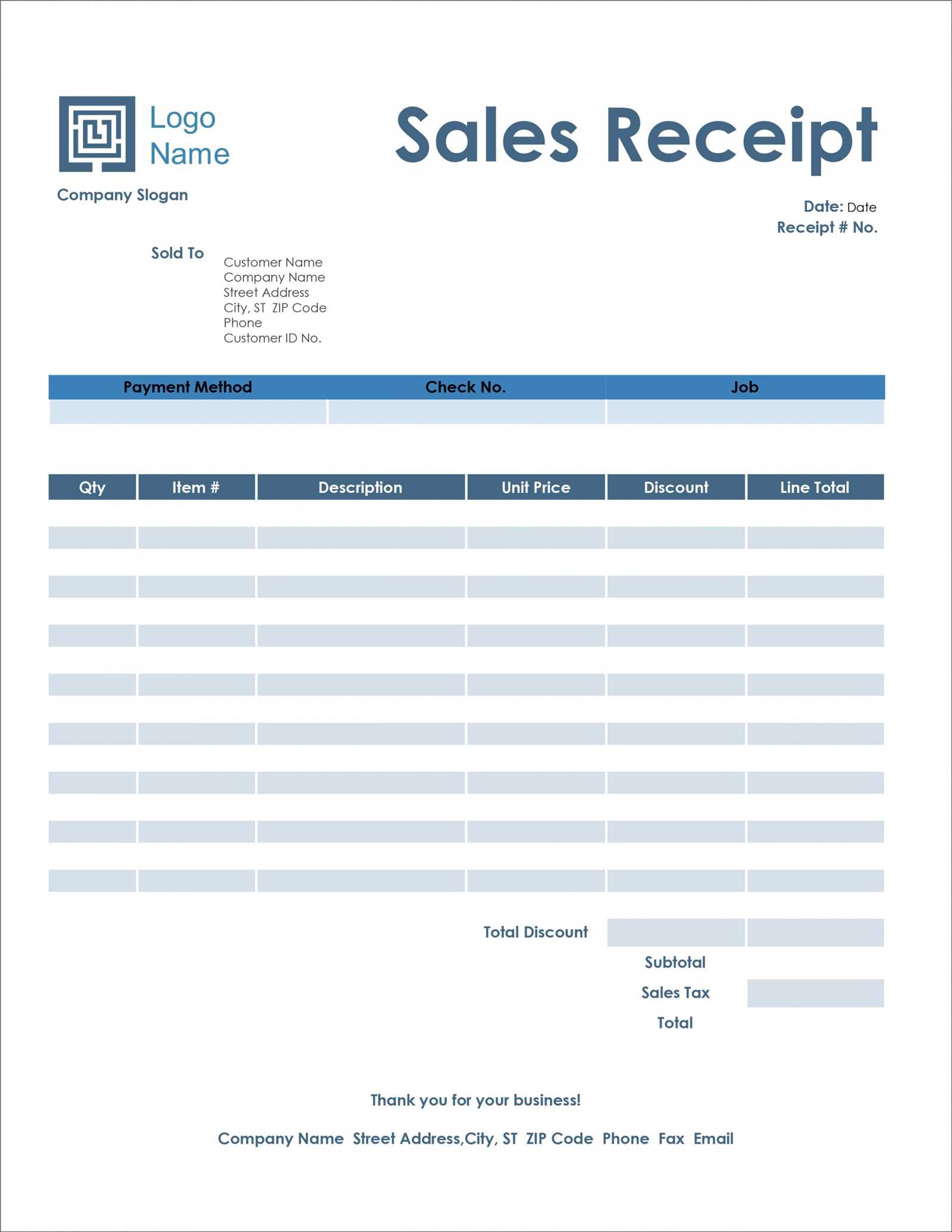

Creating a clear and accurate HSA itemized receipt is key to ensuring that your medical expenses are properly documented for reimbursement. Here’s how you can build one step by step:

Include the provider’s name, contact details, and service date. This ensures that the receipt clearly identifies where and when the expense occurred. List the itemized services or products with their corresponding costs. This breakdown provides transparency and verifies the exact amount being claimed. Include a brief description for each service to avoid confusion. For instance, instead of just saying “medical treatment,” describe it as “consultation for allergy testing.” Always note the payment method and ensure the total amount matches what was actually paid. Finally, make sure your receipt includes a statement confirming that the expense was not reimbursed by any other source, such as insurance.

When designing your template, focus on clarity and accuracy. Each section should be easy to read, and the necessary details should be easy to find. Consider using bold headings or simple columns to structure the information effectively.

Common mistakes people make include leaving out important details like the service provider’s contact information or listing services too vaguely. Another issue is failing to confirm whether the expense has been reimbursed by insurance. Double-check for accuracy in these areas to avoid delays or complications with claims.