Organizing daily cash receipts is a straightforward yet powerful method to track daily financial activity. A well-structured template will help you manage cash flow, maintain accuracy, and streamline your accounting processes. It allows you to monitor incoming payments, categorize them, and keep an eye on discrepancies or errors. Use the template to enter the transaction date, payer information, payment amount, and any related notes for easy reference.

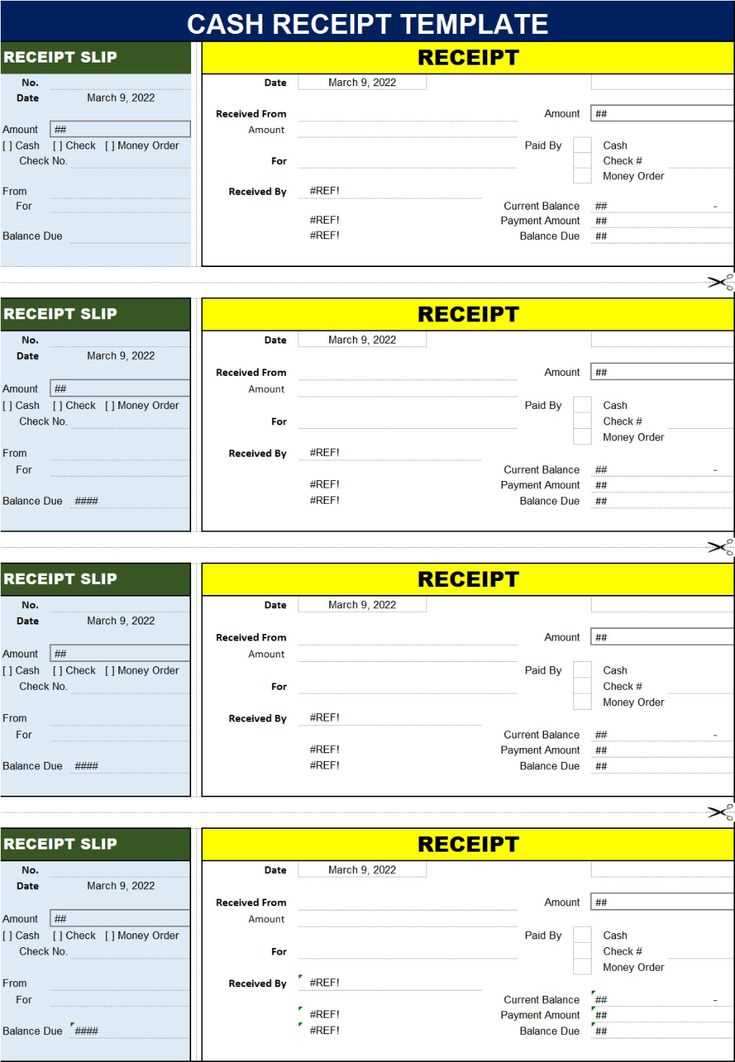

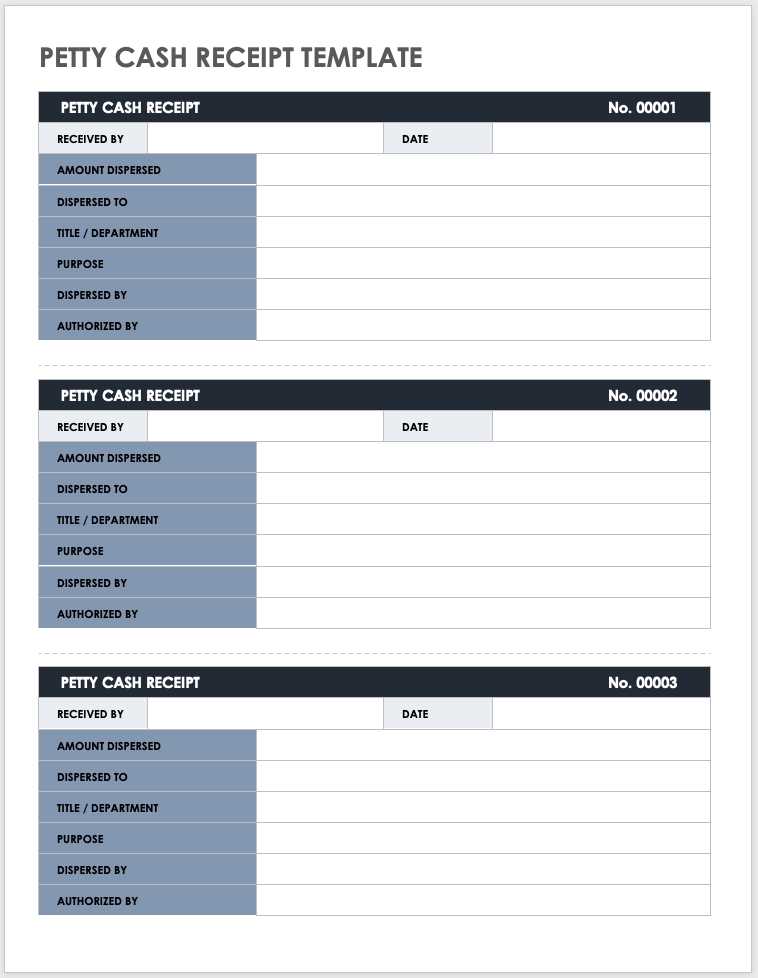

The template should include sections for each critical detail: payment type (cash, check, or electronic), source (customer name or transaction ID), and the total amount received. It’s also helpful to include a column for any adjustments, such as discounts or fees, to ensure accurate recording. By setting up clear categories for each transaction, you’ll easily identify trends in payment types and recognize when a payment is overdue.

At the end of the day, the template provides a quick snapshot of the day’s cash flow, allowing you to reconcile your records. Make sure to review the data regularly, and cross-check the recorded receipts against your bank deposits or cash registers. This method simplifies end-of-day summaries and ensures your accounting stays up to date without missing key details.

Here are the revised lines with minimized repetition:

Focus on clarity and precision when entering daily receipts. Instead of repeating details, structure the template to capture necessary data in distinct fields. For example, instead of writing the same transaction multiple times, group similar entries together in one row with an itemized breakdown in a sub-column. Use drop-down lists for frequent entries, such as payment methods or client names, to reduce manual input and eliminate redundancy.

Keep the template layout clean and straightforward. Consider limiting the use of repetitive calculations by applying formulae that automatically update totals based on the entered data. This not only simplifies the process but also reduces errors.

Regularly review and update the template to ensure it remains aligned with evolving reporting needs. Periodic adjustments will prevent unnecessary complexity and ensure that the template remains user-friendly and practical for daily use.

- Daily Summary Cash Receipts Template

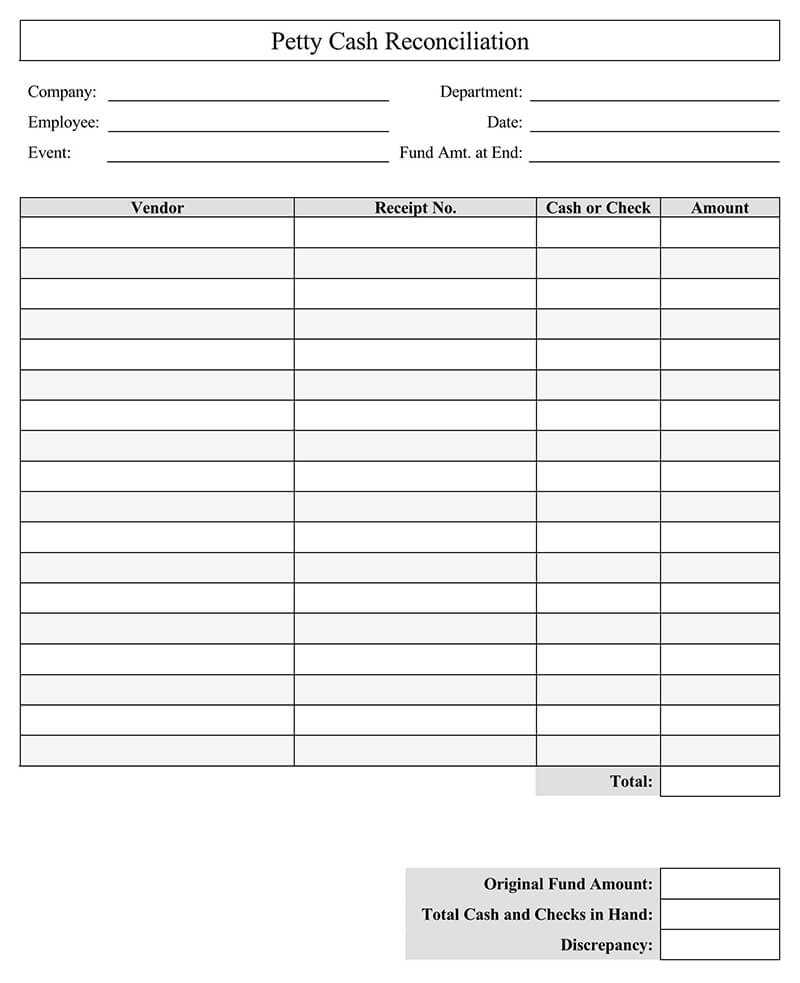

For accurate tracking, create a daily summary cash receipts template that captures all relevant transaction details. Start with columns for the receipt number, date, payer information, and payment method. Each transaction entry should include the amount received, the corresponding account, and a brief description of the payment type (e.g., cash, check, or credit). Use separate rows for different payment types, ensuring each entry is easy to identify.

Incorporate totals at the bottom of the template, summing up the day’s receipts by payment method. Include a separate field for the cash total and ensure there is a “grand total” field at the end for verification. This helps ensure your records align with actual cash on hand.

Consider using color coding or bold fonts for totals to make them stand out. This adds clarity when reviewing the day’s data and saves time when reconciling. A well-organized template helps avoid mistakes and ensures transparency in cash management practices.

Begin by defining the core categories you need for tracking. Create columns for Date, Description, Amount, Payment Method, and Receipt Number. These categories cover the basic information for each transaction.

Set up your spreadsheet software or accounting tool with these headings. If you’re using Excel, Google Sheets, or a similar program, make sure to adjust the column widths to fit the data comfortably. This will make your template more user-friendly.

To make the template more efficient, use dropdown lists for payment methods (e.g., Cash, Credit Card, Bank Transfer). This simplifies data entry and minimizes errors.

Consider adding conditional formatting to highlight entries that exceed a specific amount. For example, any receipt above $100 could be highlighted in yellow. This helps you quickly identify larger transactions.

If you plan to analyze your receipts, add a column for categories like “Office Supplies” or “Travel.” This can help you track expenses by type. You could also add a running total at the bottom to see your accumulated receipts throughout the month.

Lastly, save your template in a location that is easy to access and update regularly. Consider using cloud storage to ensure you can access it from anywhere and have a backup in case of device failure.

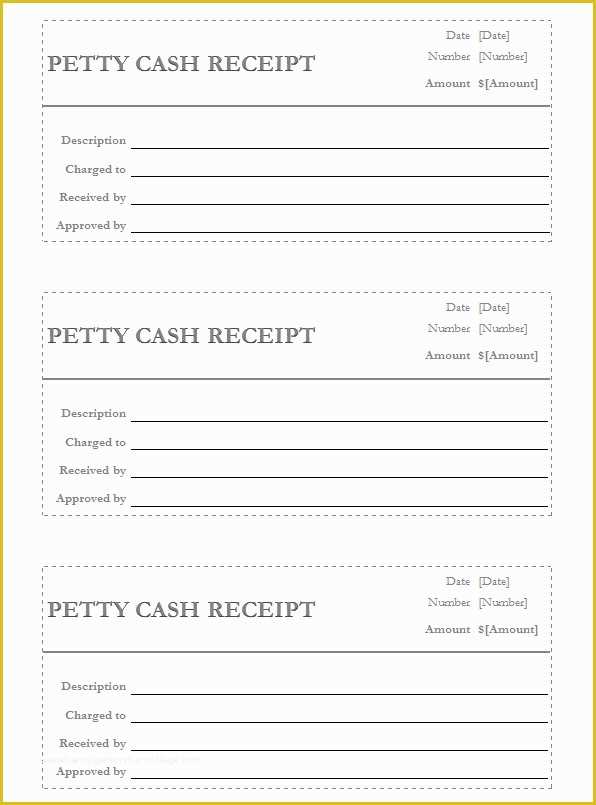

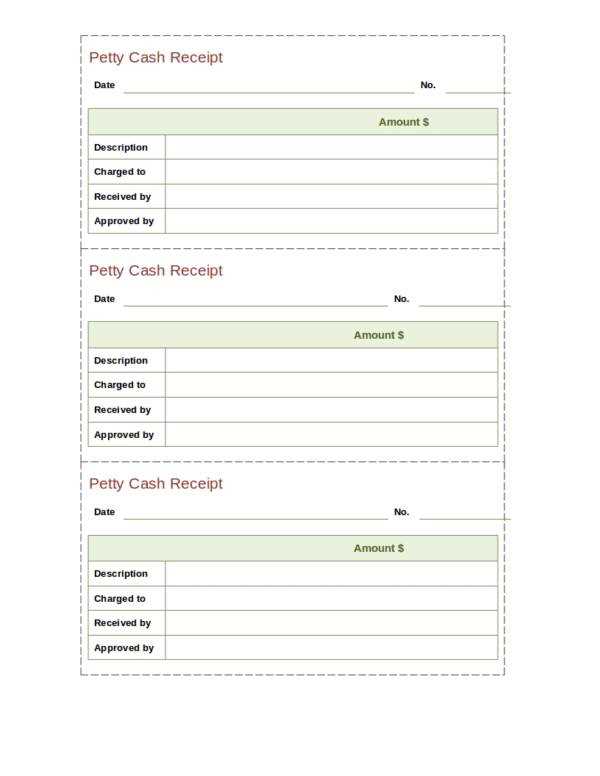

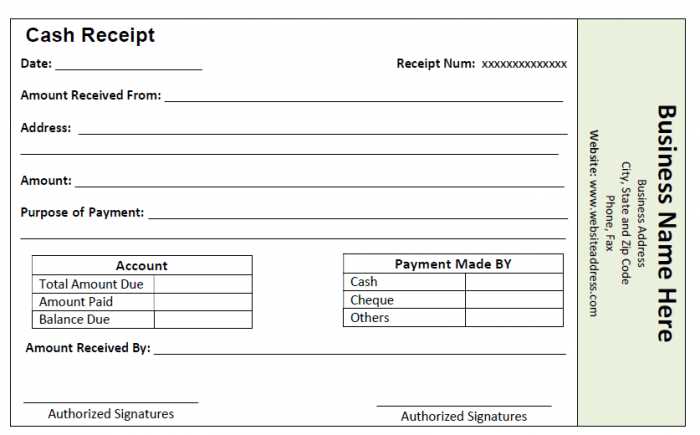

A cash receipts form should clearly document each transaction for accurate financial tracking. The following details are necessary:

Date and Time

Record the exact date and time of the transaction. This helps with proper time management and provides a reference for audits or inquiries.

Receipt Number

Assign a unique receipt number to each transaction. This serves as a reference to track and cross-check the transaction history efficiently.

Payment Method

Note the method of payment–whether cash, check, credit card, or other forms. This ensures transparency in how funds are received and is crucial for reconciling bank accounts.

Amount Received

Clearly state the exact amount received. Break this down if multiple items are involved, to ensure clarity in how the total amount is composed.

Source of Payment

Identify the payer’s name and contact details, especially in case refunds or clarifications are needed later. Include the customer’s account number if applicable.

Description of the Transaction

Provide a brief description of the transaction or services provided. This helps explain the context of the payment and prevents confusion during financial reviews.

Authorized Signature

Ensure that the form includes a space for the signature of the person receiving the cash, validating the transaction.

Balance Due

If the payment is part of a larger transaction, indicate any remaining balance due to ensure clarity on outstanding amounts.

Including these key elements ensures that the cash receipts form remains clear, accurate, and easy to reference. Proper documentation is crucial for financial accountability and audit trails.

Keep the template updated daily. Consistency in reporting ensures accuracy and transparency in your cash receipts. Enter each transaction as soon as it occurs to avoid delays or errors.

Organize Entries by Categories

Group similar transactions together. For instance, categorize receipts by payment type (cash, credit, checks) or department. This streamlines the reconciliation process and makes it easier to identify discrepancies.

Use Clear and Precise Descriptions

When adding descriptions to receipts, be specific about the source or purpose of the payment. Avoid vague labels such as “miscellaneous” and provide as much detail as possible to avoid confusion later.

- For cash payments, note the specific reason (e.g., “Customer payment for invoice #123”).

- For checks, include check numbers or customer names for quick reference.

By doing this, anyone reviewing the records can quickly understand the nature of each transaction without having to ask for clarification.

Regularly Cross-Check with Bank Statements

Match the amounts in the template with your bank account or payment processor records. This ensures that all received payments have been recorded and helps catch any missed transactions.

- Set a routine schedule for monthly reconciliation to avoid last-minute errors.

- Double-check entries that seem inconsistent or unusual to ensure all data is accurately reported.

Cross-checking regularly reduces the likelihood of discrepancies and streamlines the auditing process.

Utilize the Template’s Calculations

If your template includes automatic calculations, ensure these functions are working properly. This will help reduce manual errors and save time when tallying the totals at the end of the reporting period.

Maintain Backup Records

Keep backup documentation, such as receipts or invoices, for every recorded transaction. These records are crucial for verification during audits and help resolve any questions about the entries in the report.

Organizing your daily summary cash receipts is a practical step in maintaining financial clarity. Set up a template that includes key columns to track each transaction efficiently.

| Date | Description | Amount Received | Payment Method | Notes |

|---|---|---|---|---|

| 2025-02-12 | Customer Payment | $250.00 | Credit Card | Payment for invoice #1234 |

| 2025-02-12 | Cash Sale | $150.00 | Cash | Retail Sale |

| 2025-02-12 | Online Payment | $300.00 | PayPal | Online order #5678 |

Make sure to update the table daily with all cash inflows. This will help with balancing the cash flow and identifying any discrepancies in a timely manner. Ensure that the payment methods are clearly labeled to avoid confusion and track the payments accurately.