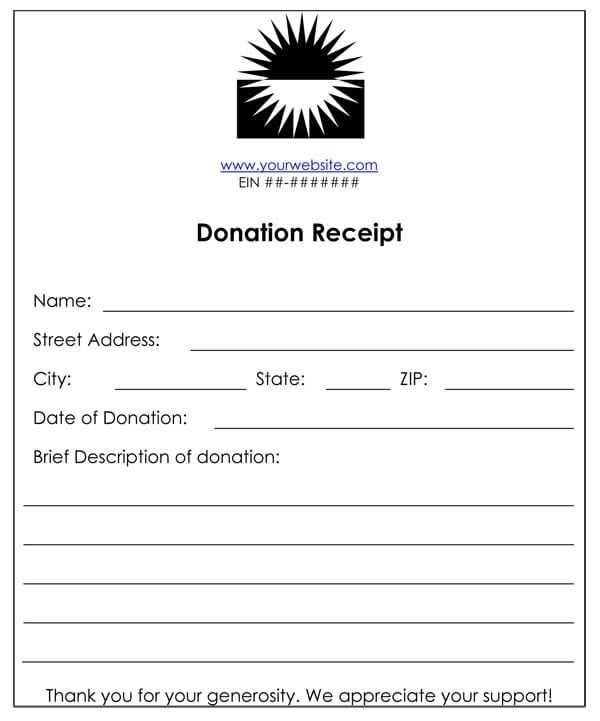

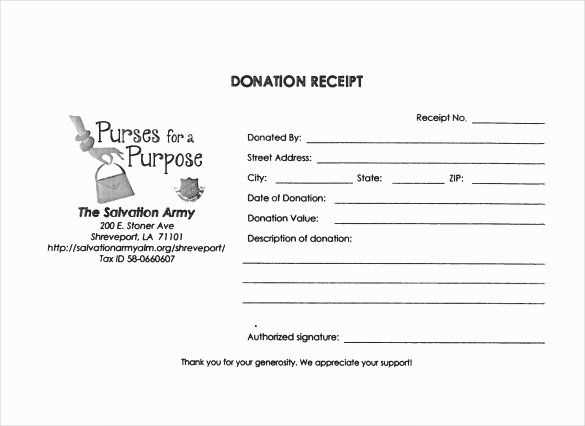

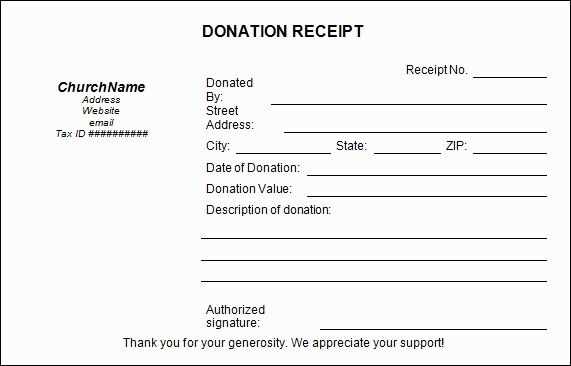

Creating a clear and professional church donation receipt is simple with the right template. A well-designed receipt ensures transparency, builds trust with donors, and provides them with the necessary documentation for tax deductions. The template should include key information such as the donor’s name, donation amount, date, and a statement confirming that no goods or services were provided in exchange for the donation.

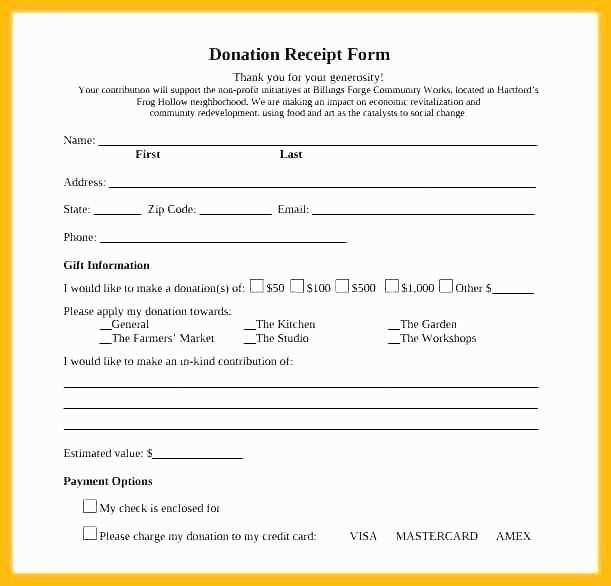

Consider using a customizable template to suit your church’s specific needs. The sheet should have spaces for details like the donation method (cash, check, online, etc.) and the church’s tax-exempt status number. If your church frequently receives donations, it’s helpful to store the information digitally, which makes the process of issuing receipts faster and more organized.

When crafting your donation receipt sheet, include a thank you note at the bottom. Donors will appreciate the personal touch and feel more connected to your mission. Clear formatting, with easy-to-fill-in fields, will ensure each receipt is accurate and professional.

Here are the revised lines without repetitions:

Ensure that every church donation receipt is clear, accurate, and tailored to meet your congregation’s needs. A well-organized receipt template can streamline your accounting and donor communication.

Key Points for a Donation Receipt

- Include the name and address of the church.

- State the donation amount and specify whether it is a cash or non-cash contribution.

- List the date of the donation.

- Clarify if any goods or services were provided in exchange for the donation.

- Provide a thank-you message for the donor’s generosity.

Template Recommendations

- Format the receipt in a professional and easy-to-read layout.

- Ensure all necessary tax information is included, if applicable.

- Always issue receipts promptly after receiving a donation.

By following these recommendations, you’ll provide your donors with clear, tax-compliant records and foster ongoing support for your church.

- Church Donation Receipt Template Sheet

Creating a Church Donation Receipt Template Sheet helps streamline the process of acknowledging contributions and ensuring tax compliance. It’s important to include certain key elements to make sure the receipts are both legally valid and clear for donors.

Key Elements to Include

Each donation receipt should feature the name and address of the church or organization, along with the date of the donation. Clearly indicate the amount donated, whether it’s a cash gift or non-cash donation (such as goods or services). If the donation is non-cash, provide a description of the item(s) donated. It is also important to specify that the donor did not receive any goods or services in return for the contribution, unless something minimal was provided (like a thank you note). For non-cash donations, include an estimated value if applicable, but it’s typically the donor’s responsibility to value these items.

Additional Information to Consider

Including a donation receipt number can help track donations, especially for larger churches. The receipt should also mention that the church is a registered tax-exempt organization, including its tax-exempt ID number, to clarify its status. It’s also a good idea to have a section for the donor’s contact information (name, address, email) so that they can be easily reached for future communications or updates.

Lastly, ensuring that the format is easy to read and understand will enhance the donor’s experience. An organized template should be ready for use every time a donation is made, so the process remains smooth and transparent for both the church and the donor.

Begin by including key details that confirm the donor’s gift. This includes the church’s name, address, and contact information, along with the donor’s name and the date of the donation. Clearly state the donation amount, and specify whether it was a one-time gift or recurring. If applicable, include the method of donation (e.g., cash, check, online transfer). Provide a brief note about any goods or services exchanged, such as event tickets or gifts, if relevant.

Organizing the Information

Organize the template into sections for clarity. Place the church’s contact details at the top, followed by a section for the donor’s information. Below that, list the donation specifics in a clean and readable format. Separate the sections with clear headings to guide the reader. Use bullet points or tables to break down the information, especially for larger donations with multiple components. Make sure everything is easy to find and understand.

Adding a Personal Touch

Consider adding a personal thank-you note at the bottom of the receipt. A simple line expressing gratitude for the donor’s generosity creates a positive impression and reinforces the relationship. Customize this message for different donation amounts or occasions to make it feel more personal and relevant.

To ensure clarity and transparency, a church donation acknowledgment must include certain details. These elements ensure donors know their contributions are recognized and provide all necessary information for tax purposes.

1. Donor Information

- Donor’s full name

- Mailing address

- Contact details (optional but helpful for further communications)

2. Donation Details

- Date of the donation

- Amount or description of the donation (cash, goods, or services)

- Any goods or services provided in exchange (if applicable)

3. Church Information

- Church name

- Address

- Tax-exempt status (e.g., 501(c)(3) in the U.S.)

4. Acknowledgment of No Goods or Services Provided

- Clearly state whether any goods or services were received in exchange for the donation.

- If no goods or services were provided, include a statement to this effect to make the acknowledgment valid for tax deduction purposes.

5. Donation Purpose (if applicable)

- Specify if the donation is earmarked for a particular project or fund, such as building renovations, mission trips, or general operating expenses.

Including all these details will ensure your acknowledgment is both meaningful and compliant with legal standards for charitable donations.

Got it! If you have any specific questions about the 30 hp motors or need advice on repair and maintenance, feel free to ask!

Use clear and consistent formatting in your church donation receipt template. Include the donor’s name, donation amount, and date of contribution in the body. Ensure each receipt has a unique receipt number for easy tracking.

The template should include a statement of the church’s tax-exempt status and clarify whether the donation is tax-deductible. Provide a section for a description of any goods or services received by the donor, if applicable.

Make sure to leave space for the church’s name, address, and contact details, as well as the signature of the authorized person who processed the donation. This adds legitimacy and accountability to the receipt.

| Field | Example |

|---|---|

| Donor Name | John Doe |

| Donation Amount | $50 |

| Date | February 12, 2025 |

| Receipt Number | 001234 |

| Tax Deductible | Yes |

| Goods/Services | None |

Offer the receipt in both printed and digital formats for convenience. A consistent, easy-to-read template makes managing donations smooth for both the donor and your church’s accounting team.