A well-crafted donation receipt letter is vital for both the donor and the recipient organization. Providing a clear, professional template helps ensure that donors have the necessary documentation for tax purposes and acknowledges their generous support. Here’s how to structure a donation receipt letter for easy printing and distribution.

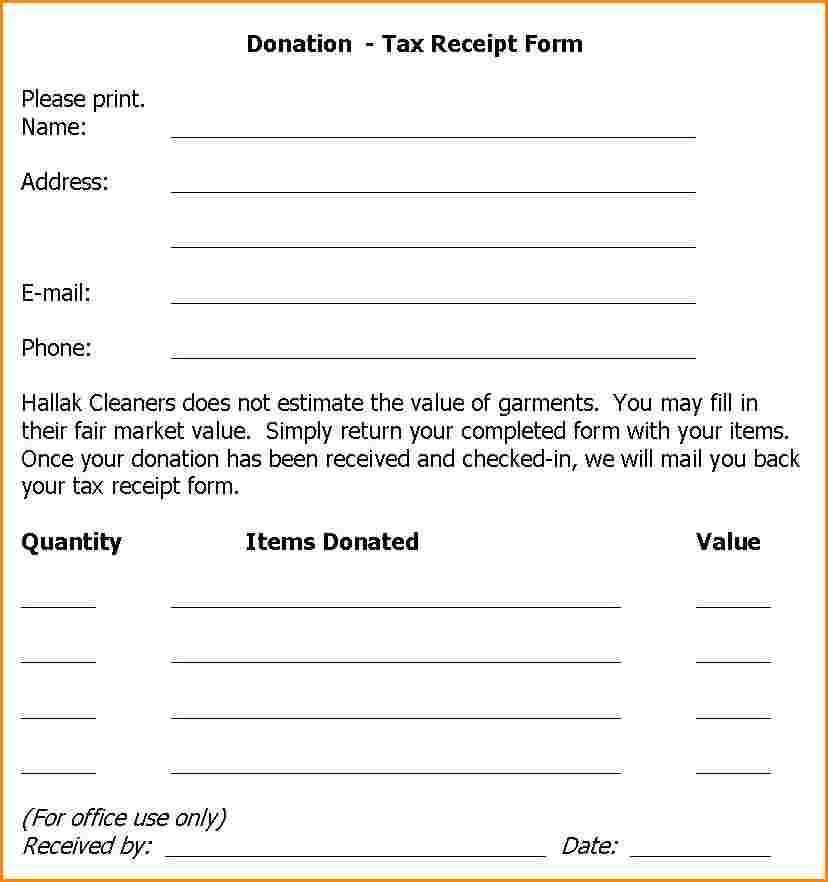

Start with a personalized greeting that includes the donor’s name. This shows appreciation and makes the letter feel more personal. Next, clearly state the donation amount, whether it’s monetary or in-kind. For in-kind donations, specify the items donated along with their fair market value. Ensure you’re accurate in documenting this information for transparency and proper record-keeping.

Conclude the letter with a thank you message. Reinforce the positive impact of their contribution on your cause and express sincere gratitude. This leaves the donor with a feeling of accomplishment and recognition. Additionally, if applicable, include a note on tax deductions for donations, as this can help encourage future giving.

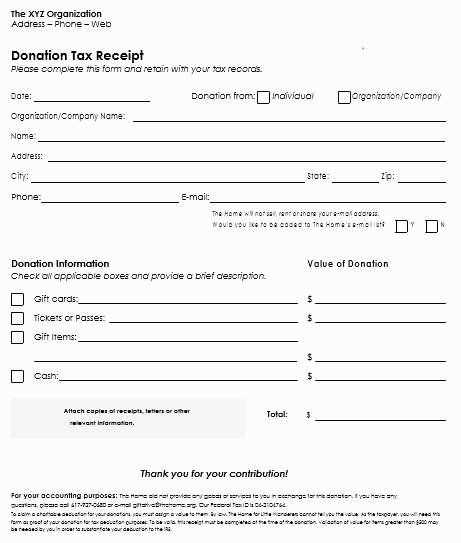

Printable Donation Receipt Letter Template

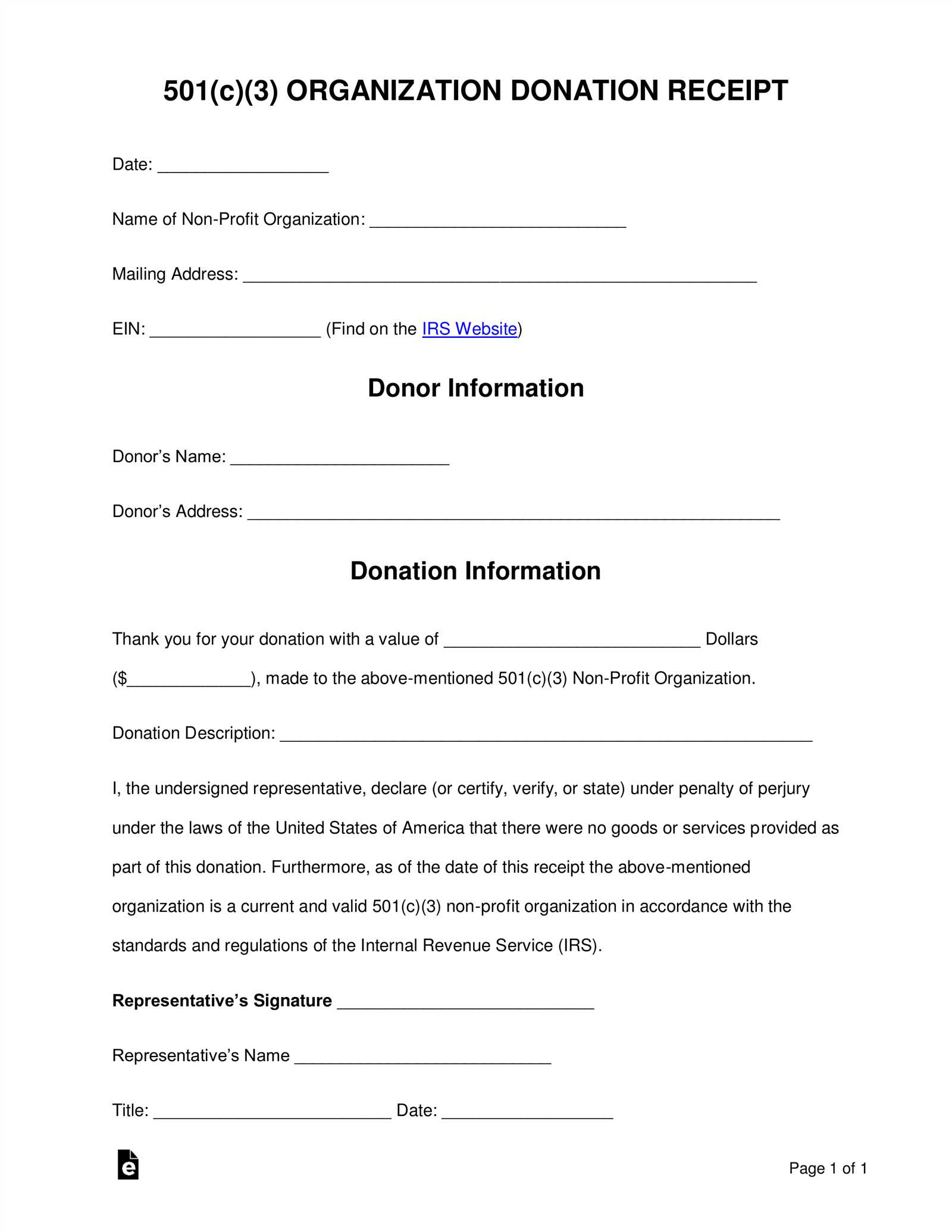

Creating a donation receipt letter is straightforward. Use the following key components in your template for clarity and compliance with tax regulations:

Key Elements to Include

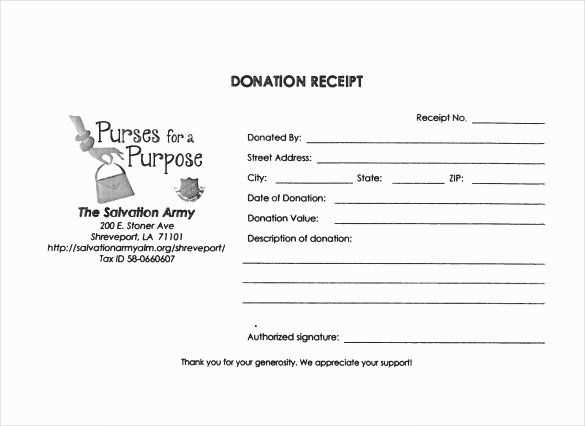

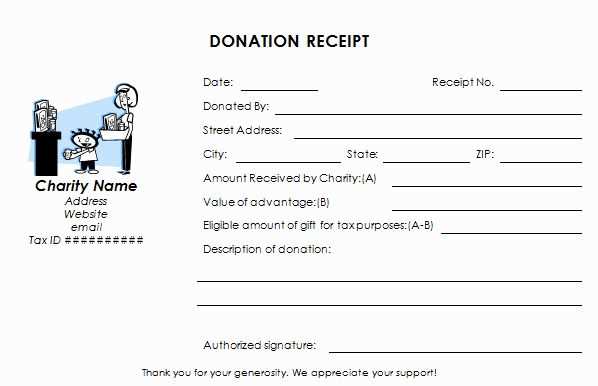

- Donor’s Name – Include the full name of the individual or organization making the donation.

- Donation Amount – Clearly state the monetary value of the donation or the fair market value of any goods or services donated.

- Date of Donation – Record the date when the donation was made.

- Organization Details – Mention the name, address, and contact details of your nonprofit organization.

- Tax-Exempt Status – Confirm that your organization is tax-exempt, including the EIN (Employer Identification Number) if applicable.

- Statement of No Goods or Services Provided – If no goods or services were provided in exchange for the donation, include this statement: “No goods or services were provided in exchange for this donation.”

- Signature – The signature of an authorized person within the organization, such as the executive director or treasurer, to validate the receipt.

Template Example

Here’s a simple format you can use:

[Organization Name] [Address] [City, State, ZIP Code] [Phone Number] [Email Address]Date: [Insert Date]Dear [Donor's Name],We gratefully acknowledge your generous donation of [Amount/Description of Goods] made on [Date].This letter serves as your official receipt for tax purposes. No goods or services were provided in exchange for your contribution.Thank you again for your support of our mission.Sincerely, [Authorized Signature] [Organization Name]

Adjust the wording according to your needs, but ensure that the necessary details are included for legal and tax purposes. This format helps both the donor and your organization stay organized and compliant.

Creating a Donation Receipt for Tax Purposes

To ensure your donation receipt is valid for tax deductions, include specific details. First, clearly state that the donation is tax-deductible. Mention the charity’s name, IRS status, and address. Record the donor’s name and address for verification.

Required Information

List the exact date of the donation and its value. If the donation includes physical goods, describe the items and estimate their fair market value. If a service or time was donated, state that it was not valued for tax purposes. Also, include a statement confirming no goods or services were provided in exchange for the donation, unless applicable.

Additional Tips

Print the receipt on your organization’s official letterhead to reinforce credibility. Sign and date the document to finalize it. If you are providing a receipt for a donation exceeding $250, remind the donor to retain it for their tax filing purposes. Keep a copy for your records.

Customizing Your Receipt for Different Donation Types

Adjust your donation receipt to reflect the type of contribution made. Whether it’s a monetary gift, goods, or services, each type requires specific details to ensure accuracy and transparency.

Monetary Donations

For cash or check donations, include the exact amount received, the date of the donation, and a statement confirming no goods or services were provided in exchange. If the donor made a recurring gift, specify the frequency and total annual donation amount, where applicable.

In-Kind Donations

When receiving goods or services, clearly describe the items and their estimated value. If possible, provide a detailed list of the donated items with descriptions and appraised values. Since in-kind donations don’t involve cash, it’s important to note that the donor is responsible for valuing their contribution.

Including Necessary Legal and Financial Information

Always include your organization’s legal name, address, and tax identification number (TIN) on the donation receipt. This is required to meet IRS regulations and to validate the receipt for tax purposes. Include a statement confirming that the donor did not receive any goods or services in exchange for their contribution, unless applicable, and clearly outline the amount of the donation.

If the donor received goods or services, the receipt should list these items and their estimated fair market value. This information ensures the donor can properly claim their charitable deduction. For non-cash donations, such as items or property, provide a description of the items and a statement that the donor is responsible for valuing the donation.

For example: “No goods or services were provided in exchange for this donation,” or if applicable, “Goods and services were provided, with a fair market value of $50.” This helps both the donor and the organization comply with tax rules and ensures transparency.

Include a clear statement on whether the donation is tax-deductible according to current tax laws, helping the donor understand how to use the receipt during tax filing.