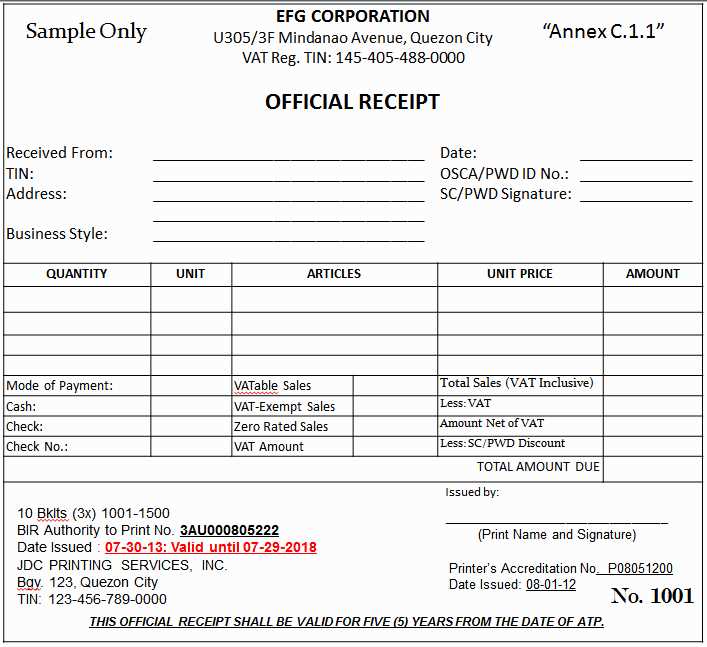

Creating an official receipt in the Philippines involves a clear and straightforward approach. By following the proper template, businesses can ensure they meet legal requirements while maintaining professionalism. An official receipt serves as proof of transaction and should contain specific information to comply with the Bureau of Internal Revenue (BIR) regulations.

Start with including the business name, followed by the official receipt number. This is crucial for record-keeping and tracking purposes. Make sure the date of transaction is clearly stated, as well as the description of the goods or services provided. The amount paid should be written clearly, with taxes, if applicable, separated from the total.

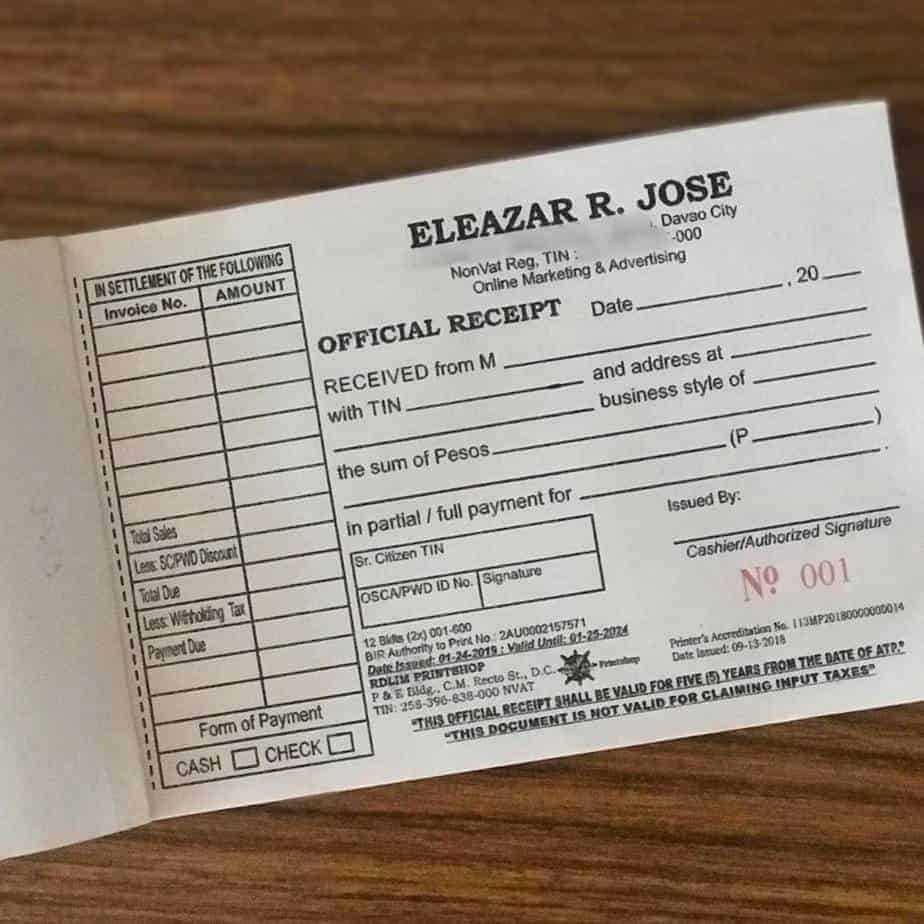

Ensure that the BIR accreditation number is included to validate that the receipt is authorized by the tax authority. This should be displayed prominently to avoid any confusion during audits or when verifying the authenticity of the transaction.

Lastly, a signature or authorized representative is required on the receipt to confirm its legitimacy. Always double-check the template for these key elements to ensure full compliance with legal requirements in the Philippines.

Here is the revised version with no repeated words:

For a clean, professional official receipt template, include the following components:

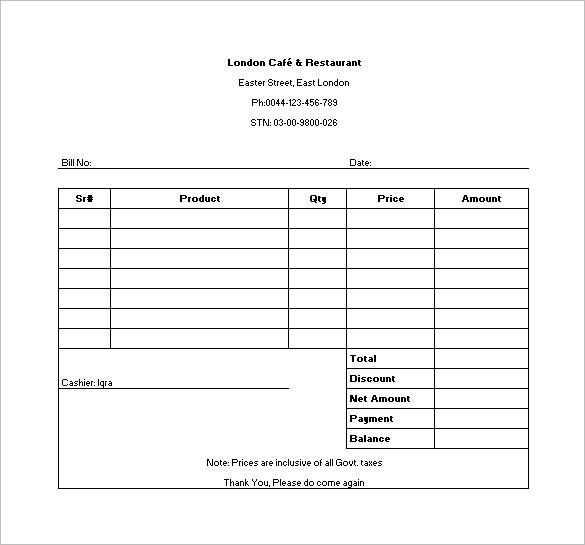

Header: The company name should be prominent at the top, followed by the address, phone number, and email. Include the word “Official Receipt” clearly for quick identification.

Receipt Number: Assign a unique number to each receipt for tracking purposes.

Transaction Details: List the date, items purchased, quantities, and prices. Ensure clarity and accuracy for each transaction.

Tax Information: Include the applicable tax rate and the amount charged. Display the total including tax at the bottom of the list of items.

Payment Information: State the payment method (cash, credit card, etc.), along with the total paid and any change given.

Footer: Add any legal or business disclaimers, including business registration details. A signature line or digital signature can also be included.

This layout ensures every essential piece of information is included in a user-friendly manner. Keep the format consistent for easy future reference.

Sample Official Receipt Template Philippines

To create a legally compliant receipt template in the Philippines, ensure it includes all the required details mandated by the Bureau of Internal Revenue (BIR). Begin with the header that displays the title “Official Receipt” clearly. Include the name, address, and TIN (Taxpayer Identification Number) of the business issuing the receipt. This is crucial for tax reporting purposes.

Next, include the date of transaction, a unique receipt number, and a description of the goods or services provided. You must list the amount charged, along with the applicable VAT (if any) and the total amount paid. If there are multiple items, provide a breakdown for transparency. For businesses subject to VAT, include the VAT breakdown as well.

Ensure that the payment method (cash, check, bank transfer, etc.) is recorded clearly on the receipt. For auditing purposes, the receipt should also have space for the signature of the issuer or an authorized representative, which helps validate the transaction.

If you are looking to download or customize a free template for your official receipts, there are many online resources available. Websites like the BIR’s official portal or third-party document creation platforms offer free templates. Customize these templates by inputting your company’s details and adjusting the layout to match your needs. You can also find some options that include built-in formulas to calculate VAT and totals automatically.