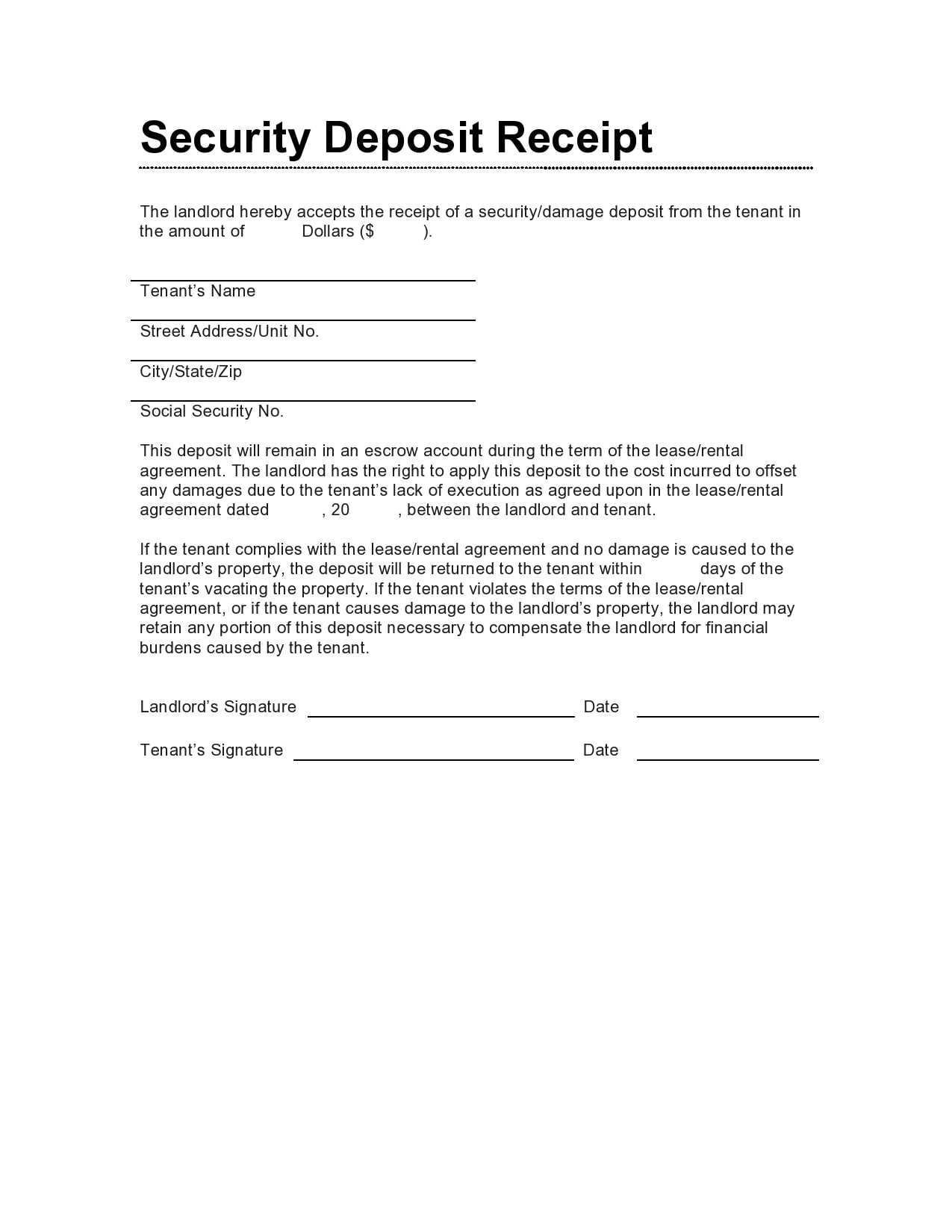

To create a clear and legally binding receipt for a security deposit, use a template that includes all necessary details. A well-structured receipt will help both parties–tenant and landlord–maintain transparency and avoid misunderstandings in the future.

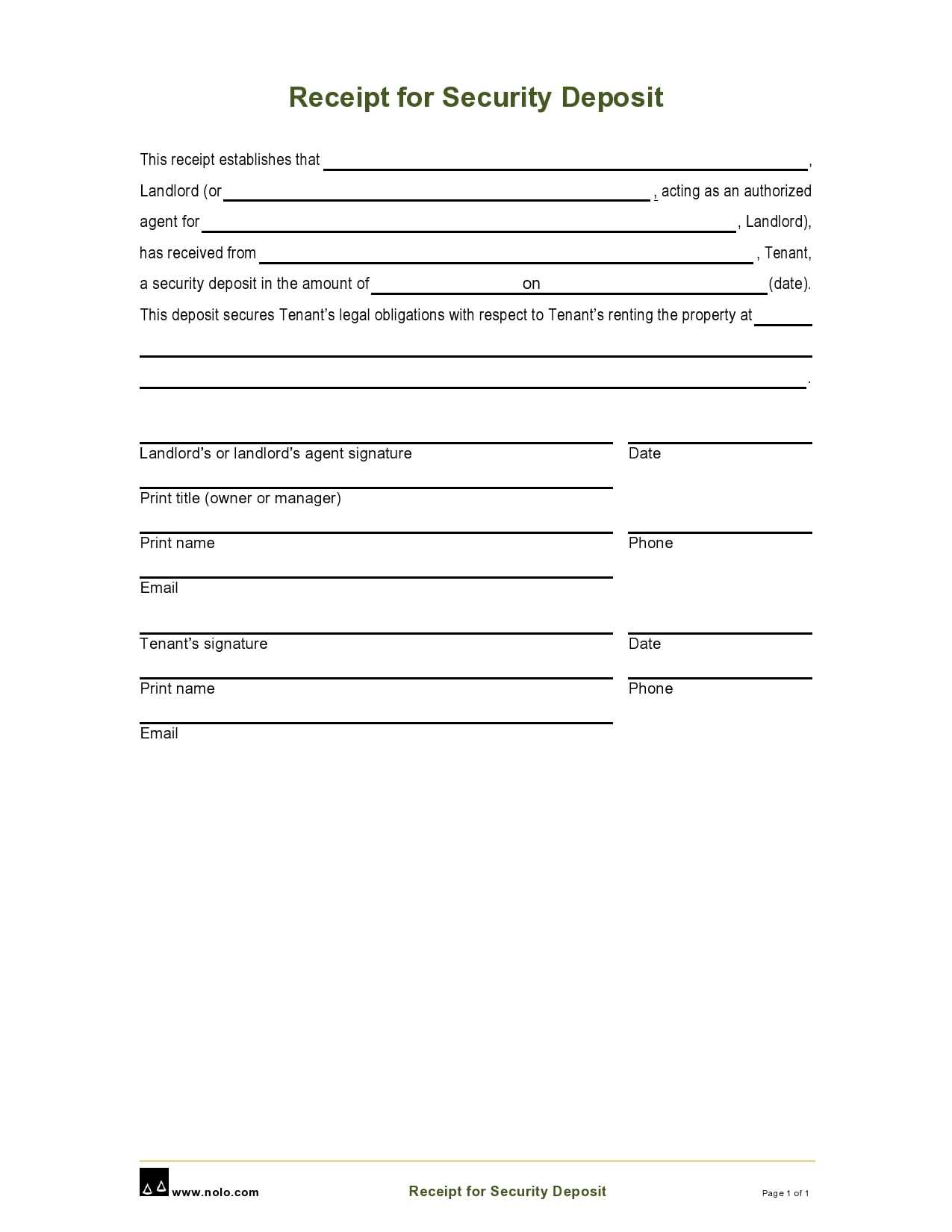

Ensure the receipt clearly states the amount of the deposit, the date it was paid, and the purpose for which it is being held. It’s crucial to include both the tenant’s and landlord’s details to identify the parties involved. Provide a section that outlines the conditions under which the deposit may be returned or withheld, based on the agreement’s terms.

Finally, sign and date the receipt to validate the transaction. Having both parties acknowledge the deposit’s terms provides protection should any disputes arise later on. A straightforward and well-documented receipt can streamline the process for both tenant and landlord, avoiding complications down the line.

Here is the revised version:

Clearly outline the details of the security deposit in the receipt. Include the full name of the tenant, the property address, the deposit amount, and the date of payment. Make sure to mention the condition of the property at the time of payment, noting any items or areas that were inspected.

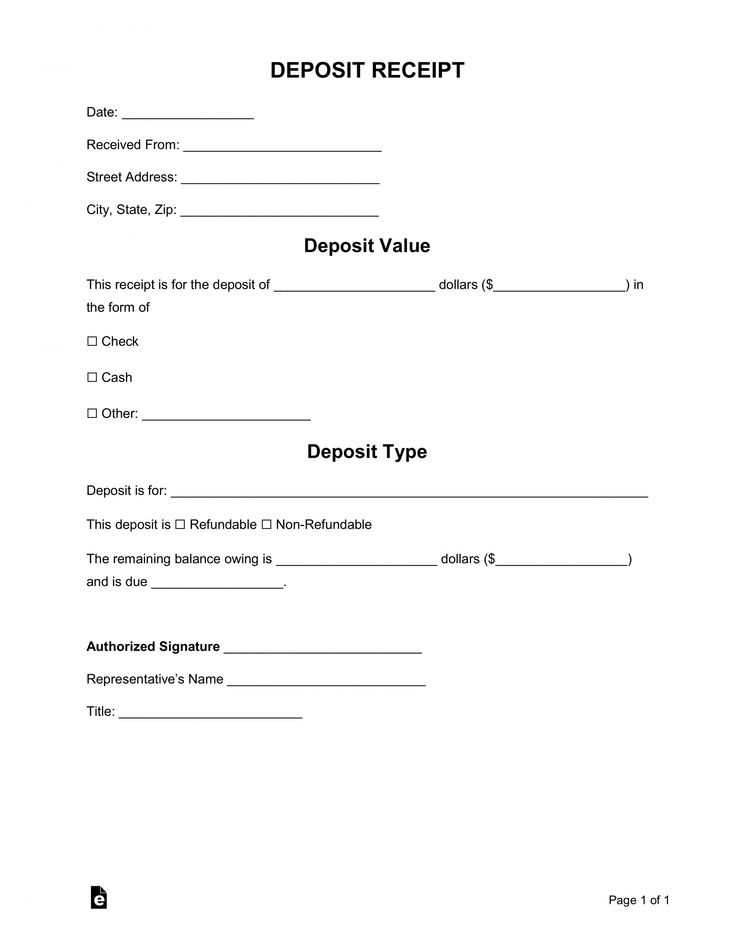

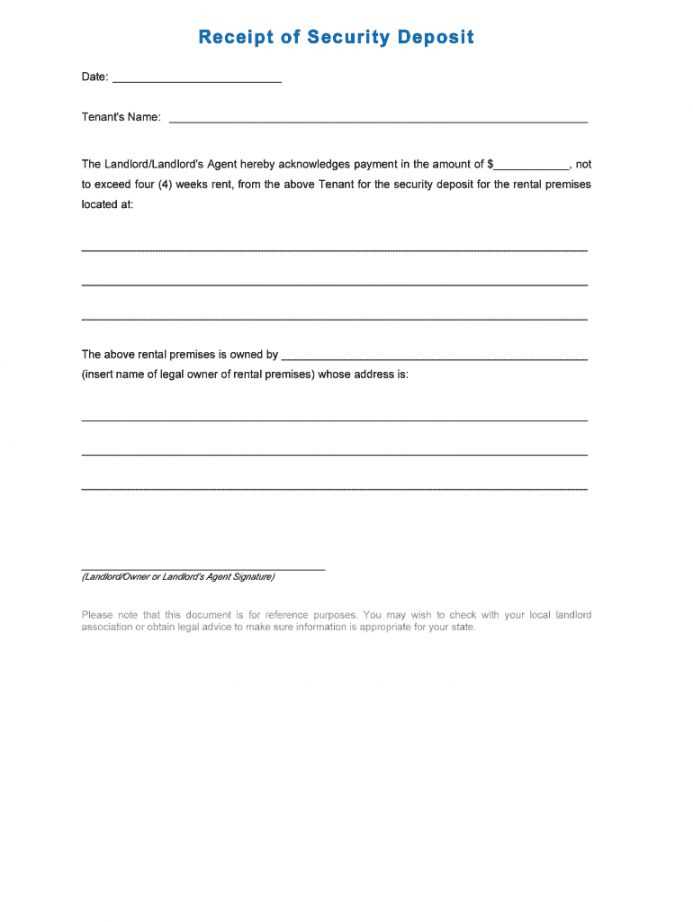

Security Deposit Receipt Template

The receipt should have the following structure:

| Field | Description |

|---|---|

| Tenant’s Name | Full name of the tenant paying the security deposit |

| Property Address | Address of the rental property |

| Amount of Deposit | The total security deposit paid |

| Date of Payment | The date the deposit was paid |

| Condition of Property | Notes on the condition of the property at the time of deposit |

Additional Recommendations

Make sure the receipt is signed by both the tenant and the landlord, confirming the accuracy of the details. Keep a copy of the receipt for your records, and provide the tenant with a copy as well. This will help avoid misunderstandings in the future.

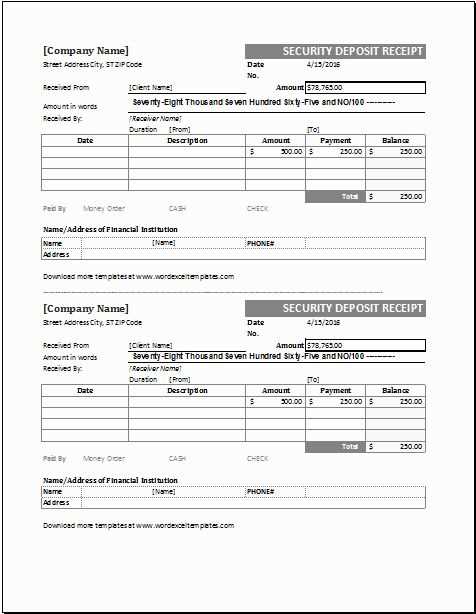

- Receipt of Security Deposit Template

When creating a receipt for a security deposit, it’s crucial to include specific information that ensures clarity for both the tenant and the landlord. Start with the full name and address of the person or entity receiving the deposit. Add the tenant’s name and the rental address where the deposit is being applied. This establishes the context of the agreement.

Key Details to Include

Specify the amount of the security deposit paid, the date of the transaction, and the method of payment used (e.g., cash, check, bank transfer). This helps in tracking the payment and serves as proof for both parties.

It’s also necessary to mention the purpose of the deposit, often for property damage or unpaid rent. Clarify whether any portion of the deposit will be non-refundable, and if applicable, provide terms for its return at the end of the lease agreement.

Additional Considerations

In some cases, you may need to include a statement about the conditions under which deductions can be made from the deposit. If applicable, outline how and when the tenant will be informed of any deductions after inspection. This transparency builds trust and ensures both parties understand their responsibilities.

Clearly state the names of the landlord and tenant, along with the rental property address. Indicate the exact amount of the security deposit, including the payment method (cash, check, or transfer) and the date it was received.

Specify Terms for Deposit Return

Describe any conditions for withholding or returning the deposit. If applicable, mention interest on the deposit. Clarify any possible deductions for damages, unpaid rent, or cleaning costs, and explain the process for returning the deposit, including timelines for the return after the lease ends.

Include Signatures for Agreement

Provide a space for both the landlord and tenant to sign, confirming the details of the deposit and acknowledging the terms. This ensures both parties understand and agree to the conditions and serves as proof of the transaction.

Clearly outlining the terms of a security deposit ensures both parties have a mutual understanding of expectations. Include these critical elements in the documentation:

- Deposit Amount: Specify the exact sum of the security deposit, ensuring both parties acknowledge the agreed-upon amount.

- Deposit Purpose: State the reason for the deposit, such as covering potential damages or unpaid rent.

- Conditions for Refund: Outline the specific conditions under which the deposit will be returned, including the timeframe for return after lease termination.

- Handling of Deductions: Define acceptable deductions from the deposit, such as for damage repairs or outstanding rent. Include any processes for notification and documentation of such deductions.

- Account Details: Include the bank account information, if applicable, for deposit return or clarify the method of repayment.

- Initial Inspection Report: Attach or reference a detailed report of the property’s condition at the start of the lease to avoid disputes over damages.

- Interest on Deposit: If the deposit is subject to interest, clearly indicate the rate and how it will be handled at the time of refund.

- Signatures: Ensure both parties sign the document to confirm agreement on all terms, making the contract legally binding.

Additional Tips for Clarity

- Clear Language: Avoid ambiguous terms and ensure that every clause is easy to understand.

- Legal Compliance: Verify that the document adheres to local regulations regarding security deposits, including limits on amounts and refund timelines.

Always double-check the details before issuing a deposit receipt. One common mistake is neglecting to include all necessary information, such as the exact amount, payment date, and the terms associated with the deposit. Ensure that the tenant or payer’s name is correct, and that the receipt clearly states whether the deposit is refundable or non-refundable.

Omitting Deposit Terms

Another mistake is failing to outline the conditions under which the deposit will be returned or withheld. A vague receipt can lead to misunderstandings. Clearly state if the deposit will be refunded after a certain period or if it will be used to cover damages or unpaid rent. Specify the time frame for returning the deposit after the lease ends or service completion.

Incorrect Date or Amount

Always verify that both the amount and the date on the receipt are accurate. An incorrect date can cause confusion about the timing of the deposit, and an incorrect amount may lead to disputes later. Make sure the number reflects the exact payment received and that there are no discrepancies.

Lastly, ensure that the receipt is signed by the appropriate parties. Whether it’s a landlord, property manager, or business owner, the signature confirms the receipt of the deposit and serves as proof of the transaction.

Receipt of Security Deposit

Always include a clear statement in the receipt to confirm the amount received and the purpose of the deposit. Specify whether the deposit is refundable, the conditions under which it may be returned, and the timeframe for doing so. This ensures both parties understand their rights and responsibilities.

Key Elements to Include

Make sure to include the following details in your receipt:

- Tenant’s name and contact information

- Landlord’s name and contact information

- Exact amount received

- Date of receipt

- Property address

- Purpose of the deposit (e.g., security deposit for rental property)

- Conditions for refunding the deposit

- Signature of the landlord or authorized person

Formatting Tips

For clarity, list the information in a clean and organized format. A numbered or bulleted list helps break down key points, making it easier for both parties to refer back to when needed.