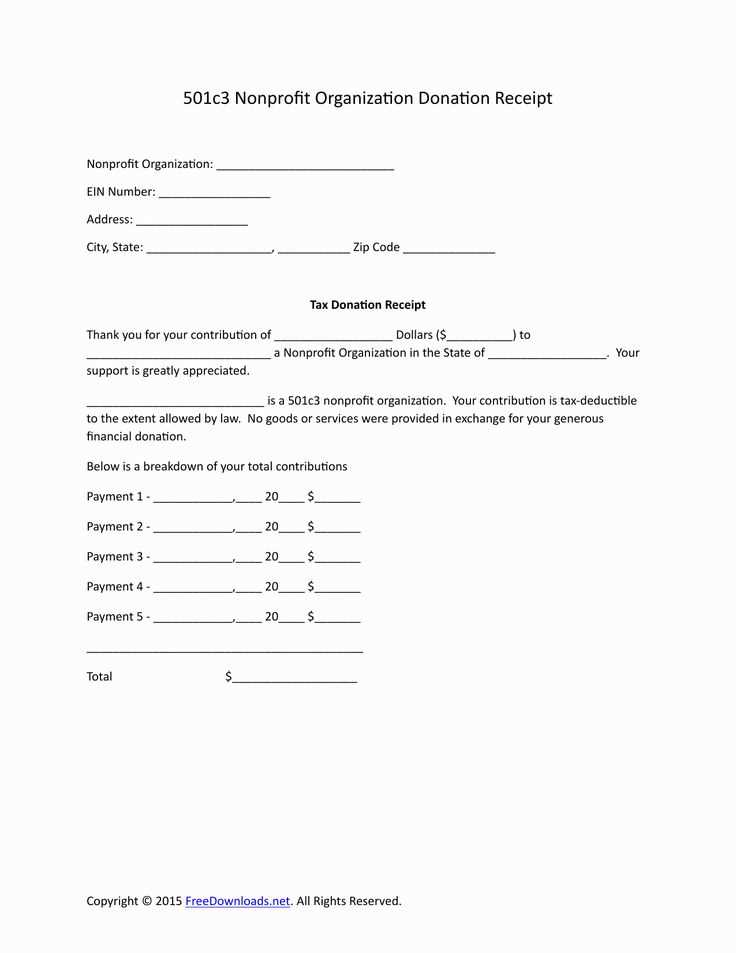

For accurate record-keeping, a 501c3 donation receipt template in Word format is highly recommended. This template simplifies the process of documenting charitable contributions, ensuring that both donors and organizations comply with IRS requirements. Customizable fields in the template make it easy to include details like donor name, contribution amount, date, and organization details.

The receipt serves as official proof of donation, necessary for donors to claim tax deductions. A well-designed template should also provide a section for the organization’s EIN (Employer Identification Number) to avoid confusion during tax filing. Make sure to include a brief statement confirming the donation was made with no goods or services exchanged in return.

With this 501c3 donation receipt template, organizations can maintain organized donation records, streamline the donation acknowledgment process, and ensure transparency in all charitable activities. Simply adjust the pre-set format to fit your needs and stay compliant with legal and financial standards.

Here’s the revised version:

For a 501c3 donation receipt, make sure to include these key elements: donor information, donation details, the nonprofit’s name, and the IRS tax-exempt status. Start with the donor’s name and address to ensure they can verify the donation. Clearly state the date of donation and the amount donated. If the donation includes non-cash items, describe them accurately, including their fair market value.

Basic Structure

The receipt should specify if any goods or services were exchanged in return for the donation. This is necessary to comply with IRS regulations. Include a statement that no goods or services were provided if that’s the case, or list the value of any items given in return. Ensure the nonprofit’s tax-exempt status is visible by including the IRS-approved language for 501c3 organizations.

Formatting Tips

Keep the layout clear and straightforward, with sections for donor details, donation information, and a statement regarding any exchanges. Use a simple, professional font and avoid clutter. Don’t forget to include a thank-you note at the bottom to acknowledge the donor’s generosity and support.

501c3 Donation Receipt Template in Word

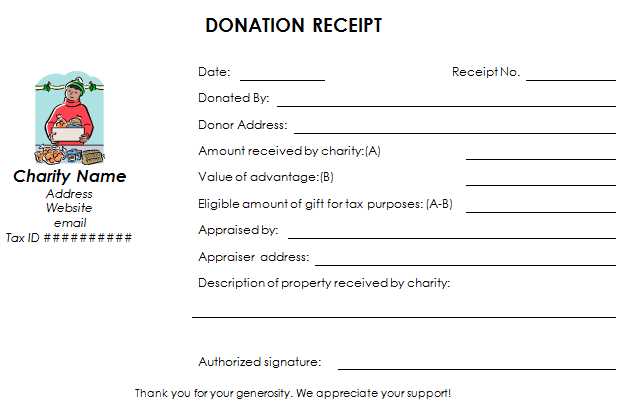

To create a 501(c)(3) donation receipt template in Word, begin with a simple layout that includes key details for the donor’s tax deduction purposes. The template should contain the organization’s name, address, and EIN (Employer Identification Number). Be sure to include a statement confirming the organization’s 501(c)(3) tax-exempt status. Specify the donation date, description of the items or cash amount donated, and the fair market value of donated goods, if applicable.

For monetary donations, clearly indicate the total amount contributed. If goods are donated, describe each item with its condition, quantity, and estimated value. If no goods or services were provided in exchange for the donation, include a statement like “No goods or services were provided in return for this gift.” For donations where goods or services were provided, indicate their value, helping the donor assess the amount eligible for tax deduction.

Consider adding a thank-you note or message at the end to acknowledge the donor’s generosity. Save the template in Word format to allow for easy customization for each donor’s specific contribution details. Keep the template simple and straightforward to ensure compliance with IRS guidelines for charitable donations.

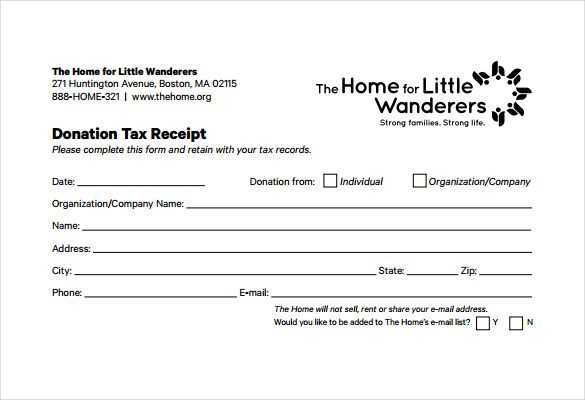

To customize a 501c3 donation receipt in Word, open a blank document and start by adding the organization’s name, address, and contact details at the top of the page. This should be prominently displayed, as it’s the first point of reference for donors. Use bold text or a larger font for the organization’s name to make it stand out.

- Next, include the donor’s name and address. This helps verify the donation details and ensures accuracy for tax purposes.

- Clearly state the date of the donation. This can be added in a separate line or as part of the donation details section.

- Specify the donation amount. If it’s a monetary donation, write the exact dollar value. For non-cash donations, provide a description and estimated value.

- Include a statement that no goods or services were provided in exchange for the donation, if applicable. This is a key tax requirement for 501c3 receipts.

Make sure to provide space for a signature line, which can be added at the bottom. This signature will serve as the acknowledgment of the donation.

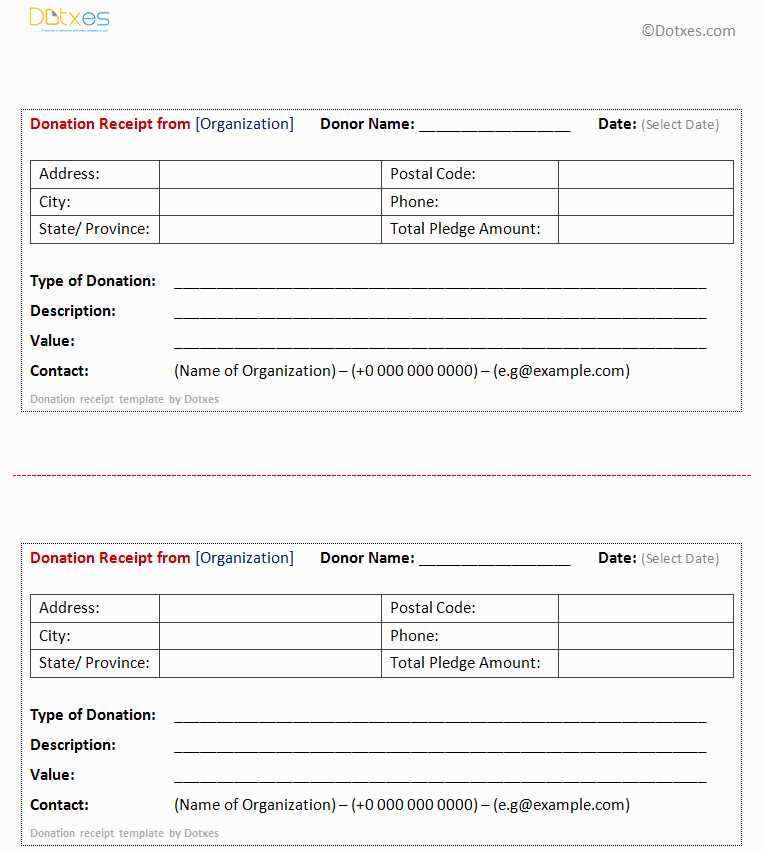

- Use tables to organize information clearly and professionally. Tables make it easy to align text and ensure the document looks clean and structured.

- Choose simple fonts like Arial or Times New Roman for readability, and keep the text size consistent for a polished appearance.

- Finally, save the template as a Word document and update it as needed for future donations.

To ensure compliance with IRS guidelines, a 501c3 donation receipt must include several key elements. These details help the donor claim a tax deduction and confirm the donation’s legitimacy.

| Element | Description |

|---|---|

| Donor’s Name | The receipt should clearly list the full name of the donor to validate the donation. |

| Organization’s Name and Address | The receipt must include the legal name and address of the 501c3 organization. This is critical for verification and audit purposes. |

| Date of Donation | The date when the donation was made should be explicitly stated, ensuring it falls within the correct tax year. |

| Amount or Description of Donation | For monetary donations, the exact amount must be recorded. For non-cash donations, a description of the item(s) given must be listed. |

| Statement of No Goods or Services Provided | If the donor did not receive anything in return for their donation, the receipt must include a statement confirming that no goods or services were provided. If something was received, the value of those goods or services should be included. |

| Tax-Exempt Status | The receipt must affirm that the organization is a qualified 501c3 charity, typically through the inclusion of the tax-exempt status number. |

Each of these elements ensures transparency and provides both the donor and the charity with the necessary documentation for tax purposes.

Always ensure that the donor’s full name, address, and contact details are correctly listed. Incorrect or missing information could create complications for both tax reporting and communication.

Don’t forget to specify the donation amount clearly, whether it’s a monetary gift or the value of goods/services donated. For non-cash donations, an itemized list with estimated values is necessary to avoid confusion.

Include a unique receipt number for each transaction. This helps keep your records organized and enables easy tracking of donations for both your organization and the donor.

Clearly state the donation date. This is important for tax purposes, especially when donations are made at the end of the year. An accurate date will prevent any discrepancies with the donor’s tax filings.

Make sure to include a thank-you message for the donor, acknowledging their contribution. This shows appreciation and strengthens your relationship with supporters while maintaining a positive image for your nonprofit.

Avoid using vague or outdated templates. Customizing the receipt to fit the specific details of each donation ensures that all necessary information is included and up-to-date.

501c3 Donation Receipt Template

Creating a clear and professional donation receipt for a 501(c)(3) organization is vital for both legal compliance and donor relations. A well-structured template ensures all necessary details are provided without confusion.

Key Information to Include

The donation receipt must include the following components:

- Organization Name: Clearly list the nonprofit’s legal name as registered with the IRS.

- Donor’s Name: Include the full name of the donor as it appears on their tax documents.

- Date of Donation: Specify the date the donation was received.

- Donation Amount: Include the exact amount of the donation or a description of the donated goods, if applicable.

- Tax Status Statement: A statement confirming the organization’s 501(c)(3) status, such as “This organization is a 501(c)(3) nonprofit entity.”

Additional Recommendations

For more detailed records, include any notes regarding whether the donation was monetary or in-kind, and whether any goods or services were provided in exchange. It is advisable to provide donors with receipts shortly after donations are made to ensure they are able to claim any tax deductions without delays.