A well-crafted receipt is a key document for any transaction, ensuring clear communication between buyer and seller. A written receipt template simplifies the process, providing a clear structure to follow. By using a template, you save time and reduce the risk of errors that can arise from writing receipts manually each time.

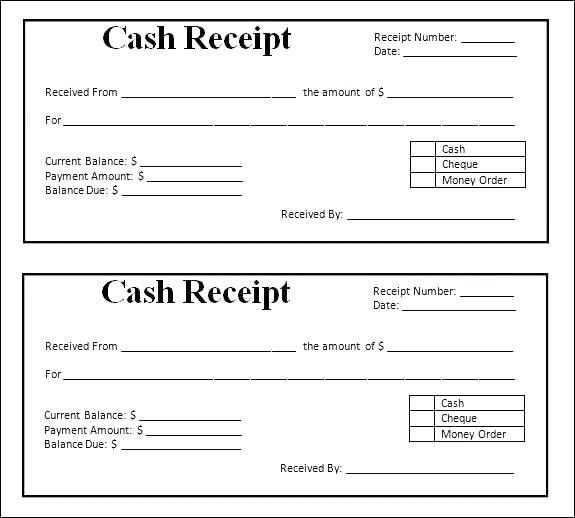

Make sure your receipt includes the basic elements such as the date of the transaction, the items or services purchased, their prices, and the total amount paid. Also, include payment details like method of payment, transaction reference number, and the name of the person or company issuing the receipt.

For a professional touch, it’s important to use a clean, easy-to-read format. Ensure that your template is customizable to suit different types of transactions. A simple, structured design will make the receipt clear and reduce confusion for both parties involved.

Here are the corrected lines:

Start by ensuring all receipt details are clearly listed. This includes the date, seller’s contact information, and the description of the product or service. Make sure the total amount is clearly visible, and any applicable taxes are separately stated.

| Item | Price |

|---|---|

| Product Name | $50.00 |

| Tax (5%) | $2.50 |

| Total | $52.50 |

Make sure all information is correctly aligned, with no spelling mistakes. Avoid abbreviations and keep language simple and clear. Always double-check for consistency in formatting across the document.

- Template for Written Receipt

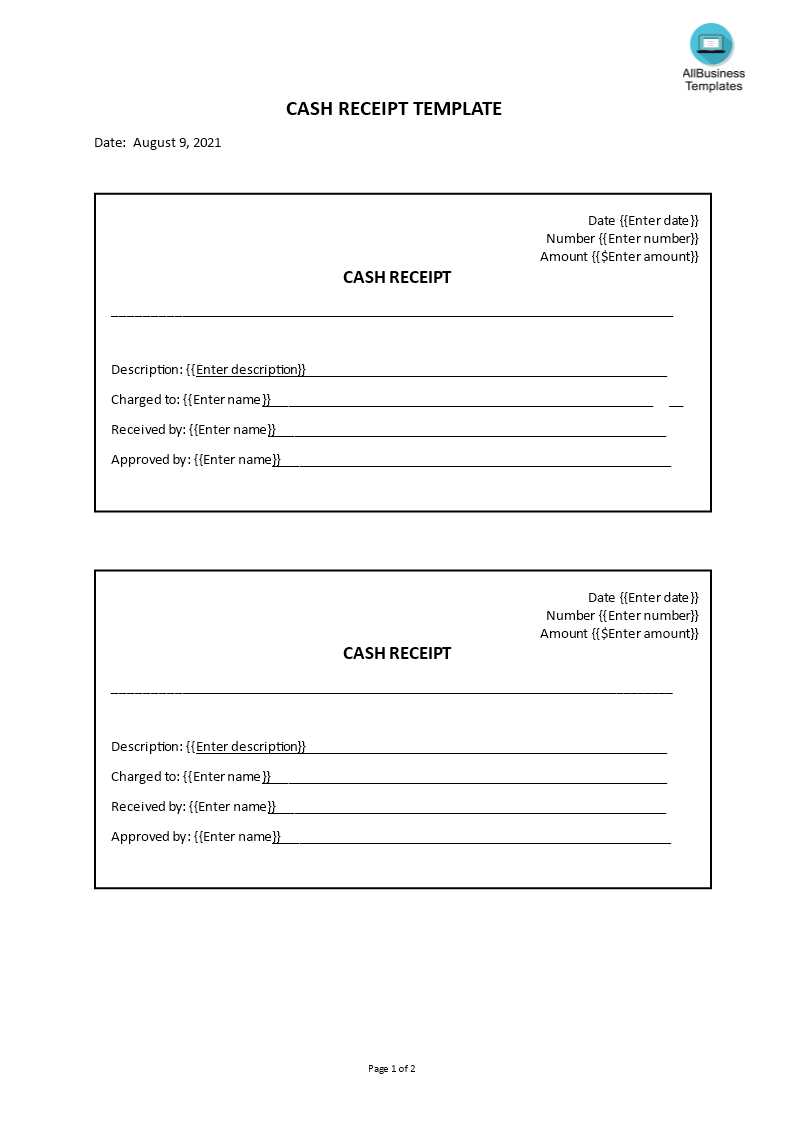

To create a clear and professional written receipt, follow this simple template. Ensure that all required details are present for both the buyer and the seller.

Receipt Date: Include the exact date of the transaction to avoid confusion later.

Transaction Number: A unique identifier for tracking purposes, if applicable.

Seller’s Information: List the name, address, and contact details of the seller for transparency and accountability.

Buyer’s Information: Include the buyer’s full name and contact details, ensuring clarity on who made the purchase.

Description of Goods or Services: Be specific. Include quantity, item names, and any other important characteristics.

Total Amount: Clearly mention the amount paid. Specify whether the price includes taxes, shipping, or other charges.

Payment Method: State the method of payment used (e.g., cash, credit card, check, etc.) to verify the transaction.

Signature: Both the buyer and seller should sign the receipt to acknowledge the transaction.

Additional Information: If necessary, add any warranty or return policies, delivery details, or other relevant terms.

To create a clear and useful receipt, make sure to include the following details:

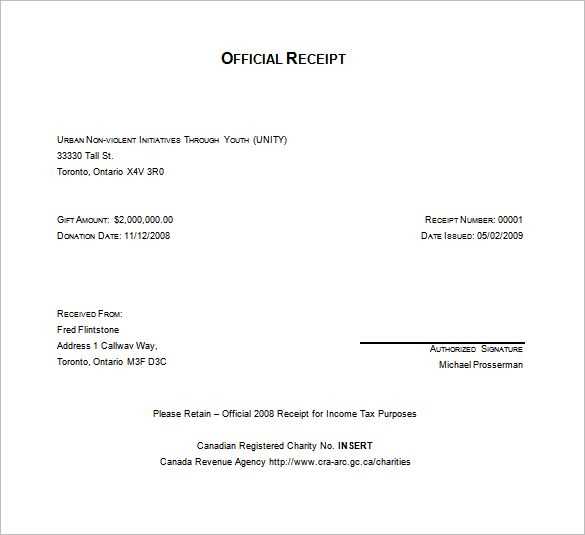

- Business Information: Include the business name, address, and contact details. This ensures the recipient knows where the transaction occurred.

- Receipt Number: Assign a unique number to each receipt for easy tracking and record-keeping.

- Transaction Date and Time: List the exact date and time of the transaction to provide a clear record.

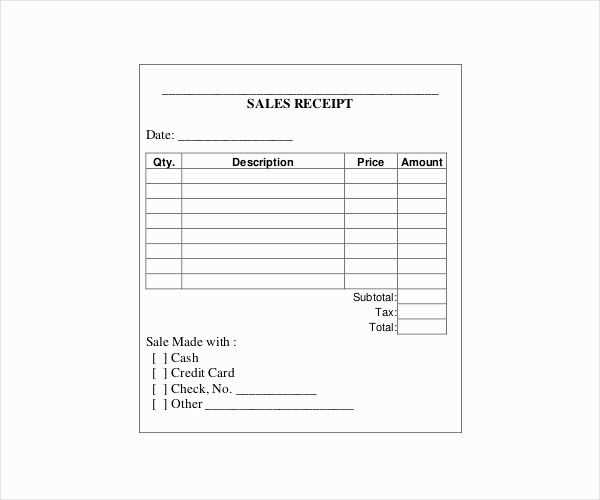

- Itemized List of Products or Services: Detail each item or service purchased, along with quantities and individual prices.

- Total Amount: Clearly show the total cost of the transaction, including taxes and any discounts applied.

- Payment Method: Specify how the payment was made, whether by credit card, cash, or another method.

Optional Information

- Customer Information: If needed, add the customer’s name or contact details for personalized receipts.

- Refund or Return Policy: Including a brief note on the return policy can help clarify customer expectations.

Use a format that aligns with the intended purpose of the receipt. For simple transactions, a basic text document or PDF is usually sufficient. If you require more detailed information, such as tax data or company branding, consider using a template with structured fields like tables. PDFs are widely recognized for their compatibility and security, ensuring that the layout remains unchanged when shared.

For businesses managing large volumes of receipts, opt for formats that integrate easily with accounting software. CSV or Excel files allow for easy data extraction and can streamline record-keeping. Avoid overly complex file types unless necessary for specific workflows.

Consider accessibility for both your team and your clients. Standard document types like PDF or Word are easily accessible on most devices, while more complex formats might require specialized software to open, leading to potential issues.

Accuracy is key–ensure every detail, from the transaction amount to the date, is correct. Even small errors can create confusion. Double-check the spelling of names, addresses, and items purchased.

Missing Information

Leaving out important details such as the business name, transaction number, or payment method can cause problems down the line. Always include clear identifiers for both the buyer and seller.

Unclear Formatting

A messy layout can make it hard to read key information. Organize details in a logical order: business name, date, items, amount, and payment method. Avoid cluttering the receipt with unnecessary text or graphics.

Lastly, avoid using vague descriptions of the goods or services. Be specific about what was purchased to prevent future disputes or confusion.

To create a simple written receipt template, focus on including key details such as the date, itemized list of purchases, and payment method. Keep the layout clear, ensuring each element is easy to locate and understand.

Template Structure

- Header: Include the title “Receipt” at the top for immediate identification.

- Date: Clearly mention the date the transaction occurred.

- Item List: List each purchased item with its price. Include a subtotal for clarity.

- Payment Method: Specify how the payment was made (e.g., credit card, cash).

- Total Amount: Calculate the total cost at the end.

- Signature: Optional but can be included for added verification.

Best Practices

- Ensure the font is legible and the layout is simple.

- Provide enough space between sections for readability.

- If applicable, include any tax details in a separate line.

- Be consistent in the format, especially for numbers and currency symbols.