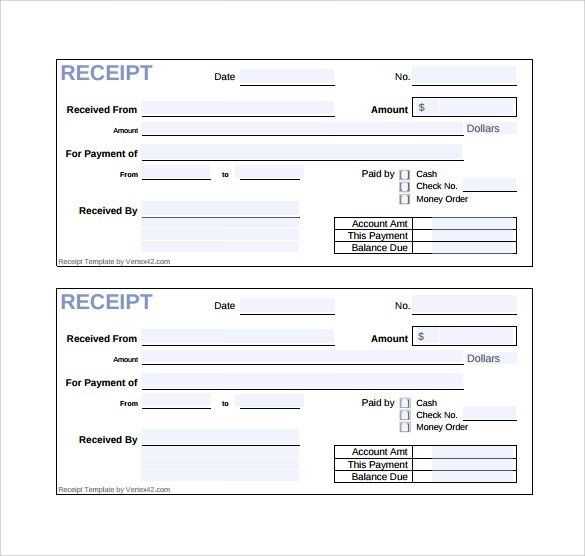

To create a clear and professional receipt for money received, it’s vital to include all the key details. Start with the name of the payer, the exact amount received, and the method of payment. Specify whether the payment is for a product, service, or loan to avoid any confusion. Ensure to add the date and location of the transaction for reference purposes.

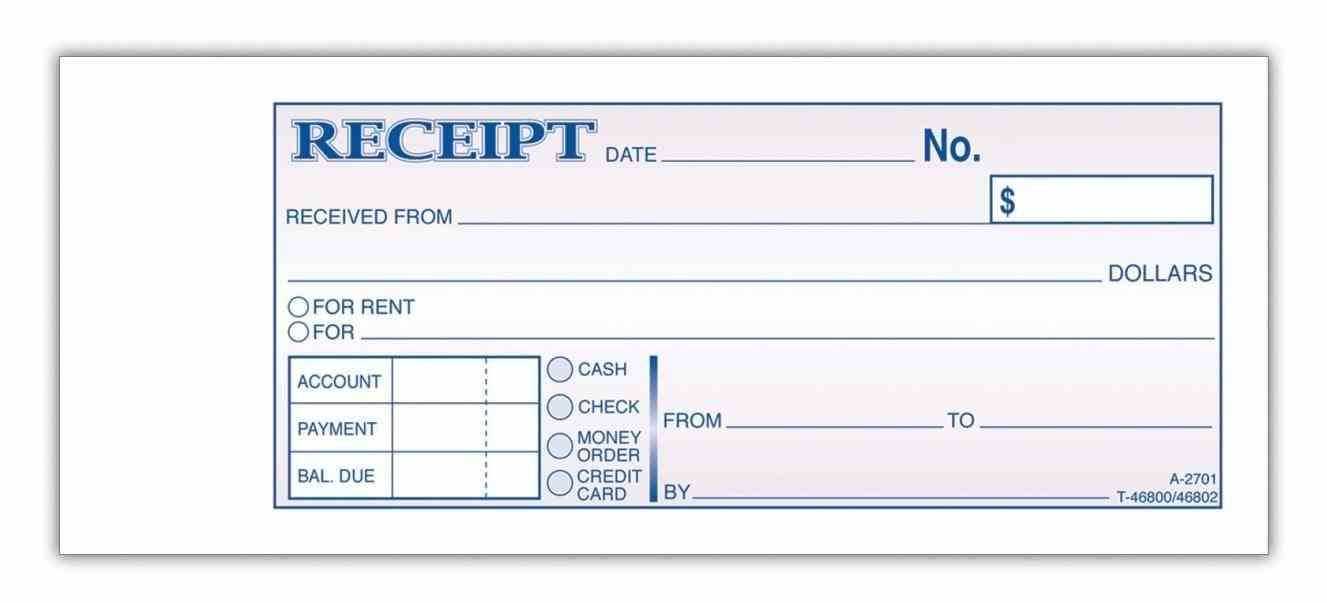

A good receipt template should also have space for the receipt number to keep records organized. This will help both parties track payments and avoid potential disputes. Be sure to use a unique, sequential number for each receipt issued.

For added clarity, include contact details for both parties involved in the transaction. This makes it easier for both the payer and the payee to follow up if needed. Lastly, sign the receipt or include a digital signature to validate the transaction. By covering all these points, you ensure that the receipt serves its purpose as both a record and a proof of payment.

Here’s the corrected version:

Ensure all relevant details are clearly stated in the receipt. Start with the full name of the payer, followed by their contact information. Specify the exact amount received and include the currency used. Include a brief description of the transaction, highlighting the purpose or service provided. Don’t forget to mention the date and method of payment, whether it’s cash, check, or electronic transfer. Always provide a unique receipt number for easy reference. Finally, ensure the recipient’s signature or acknowledgment is visible at the bottom for validation.

Receipt for Money Received Template

To create an effective receipt for money received, focus on including the key elements: the payer’s details, the amount received, the purpose of the transaction, and the date of payment.

- Payer’s Information: Clearly list the name of the person or entity who made the payment. If applicable, include contact details such as email or phone number.

- Amount Received: Write the exact amount received, specifying the currency (e.g., USD, EUR). You can also include the payment method (cash, check, bank transfer) for clarity.

- Purpose of Payment: Provide a brief description of what the payment was for, such as “rent payment,” “loan repayment,” or “purchase of goods.”

- Date of Payment: Include the exact date when the money was received. This helps in tracking transactions and maintaining an accurate record.

- Signature: While not mandatory, adding a signature (or an electronic equivalent) can help validate the receipt.

Ensure that the information is clear and legible, avoiding unnecessary complexity. This template can be customized based on the nature of the transaction, but these basics will cover most needs.

Include the date and time of the transaction at the top of the receipt. This provides a clear reference for both parties. Record the name of the person or business making the payment and the recipient’s name or business name. Clearly state the amount of money received, both in numbers and words, to avoid confusion.

List the purpose of the payment–whether it’s for goods, services, or a donation. If applicable, include an invoice number or any reference number related to the transaction. Provide payment method details, such as cash, credit card, or bank transfer, to clarify how the transaction occurred.

Make sure to include a space for the signature of the person who received the payment. This validates the transaction. For transparency, add your contact information, including phone number or email address, so the payer can reach you if necessary.

Finally, ensure the receipt is clear and legible, with all necessary information presented in a straightforward, easy-to-read format. Keep a copy for your records and provide one to the payer for their reference.

1. Receipt Title

Clearly label the document as a “Receipt” to avoid confusion. This helps both parties easily identify the nature of the document at a glance.

2. Date of Transaction

Include the exact date when the payment was made. This ensures clarity and can help track financial records over time.

3. Payee and Payer Details

List the names of both the individual or business receiving the payment (payee) and the one making it (payer). If applicable, include addresses or other relevant contact information.

4. Transaction Amount

Clearly state the amount of money received, including both the total sum and the currency used. If there were multiple payments or partial transactions, break these down accordingly.

5. Payment Method

Indicate how the payment was made–whether by cash, check, credit card, or online payment method. This provides transparency and helps track different payment channels.

6. Transaction Description

Provide a brief description of the goods or services for which the payment was made. This allows both parties to reference what the payment was for if needed later.

7. Receipt Number

Assign a unique receipt number for easy identification and future reference. This also simplifies record-keeping and aids in tracking for both personal and tax purposes.

8. Signature or Authorization

In some cases, it’s helpful to include a section for the payee or an authorized person to sign the receipt, verifying the transaction. This adds an extra layer of legitimacy.

9. Taxes and Additional Charges

If applicable, list any taxes, discounts, or extra charges that were added to the payment. This clarifies the final amount paid and any adjustments made during the transaction.

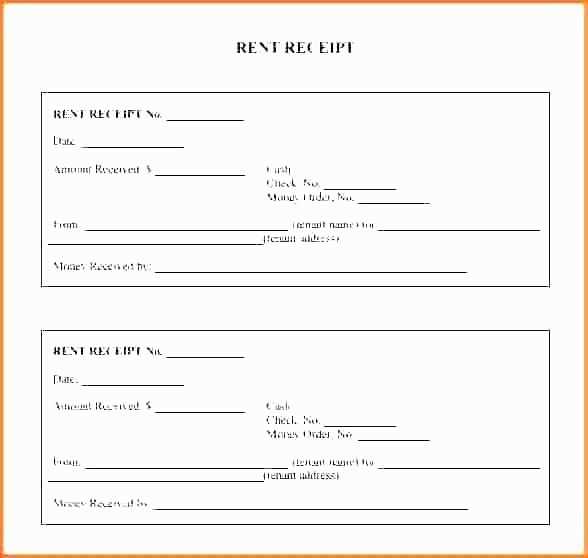

For recurring payments, include a section to specify the payment frequency, start date, and next payment due. This clarifies the ongoing nature of the transaction and ensures proper tracking of the payment schedule.

If the transaction is a partial payment, break down the amount received and the remaining balance. Add details such as installment dates or any agreed-upon terms for clearing the balance. This provides a clear understanding for both parties involved.

In the case of refunds or returns, include the original transaction details along with the refunded amount. Mention the reason for the refund to avoid confusion and maintain a record of the transaction flow.

For deposits or advance payments, highlight the deposit amount and specify the balance due after the payment. This helps prevent misunderstandings, particularly for services or items not yet delivered.

For transactions involving multiple items or services, list each item or service with its individual cost. This enables clear tracking of individual payments and makes it easier to verify the total amount received.

Receipt for Money Received Template

To create a clear and organized receipt for money received, include the following key details:

| Field | Description |

|---|---|

| Date | Record the exact date when the payment was received. |

| Receipt Number | Assign a unique number to each receipt for easy tracking and reference. |

| Payee | Include the name of the individual or organization receiving the payment. |

| Payer | Specify the person or business making the payment. |

| Amount | List the exact amount of money received in both numbers and words. |

| Payment Method | Detail how the payment was made, such as by cash, check, or bank transfer. |

| Purpose | State the reason for the payment, whether it’s for goods, services, or another purpose. |

By using this structure, you ensure that all necessary details are captured, making the receipt clear and professional. It helps both the payer and payee track financial transactions accurately.