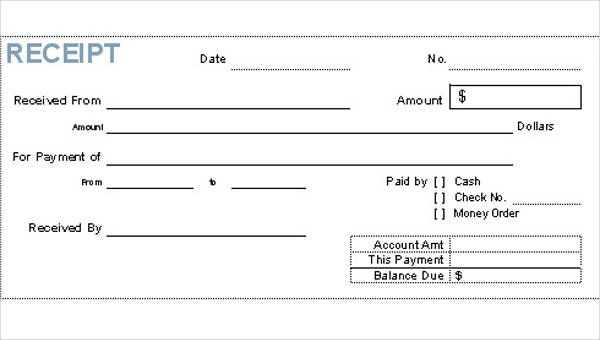

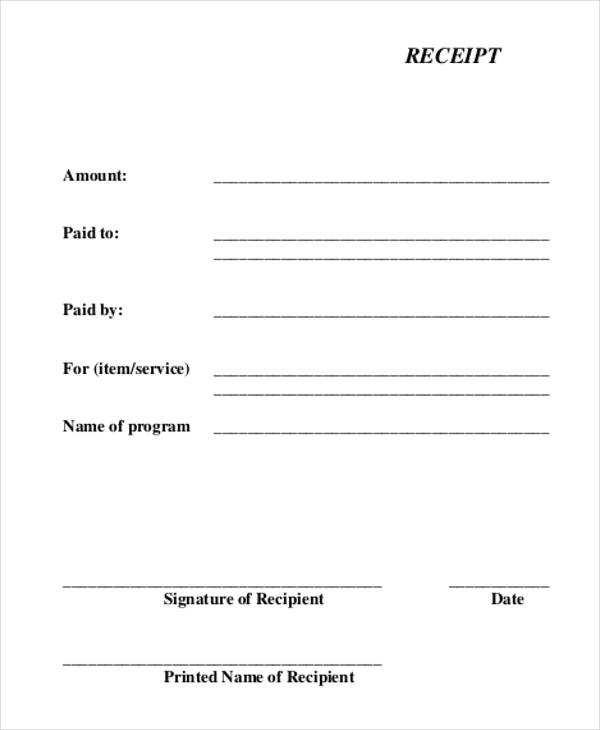

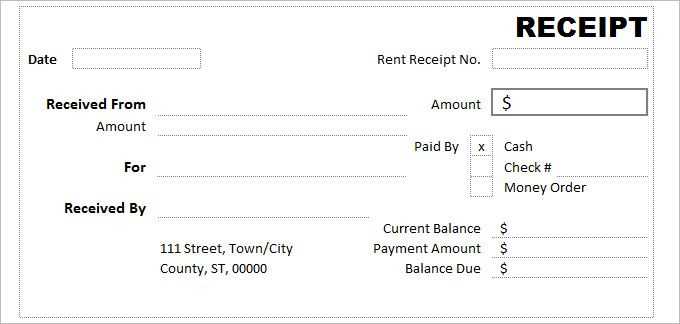

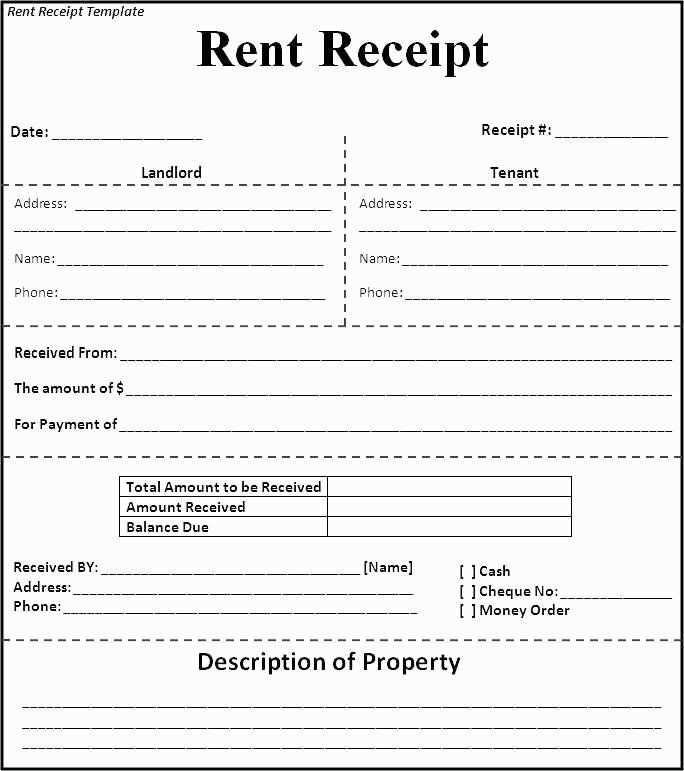

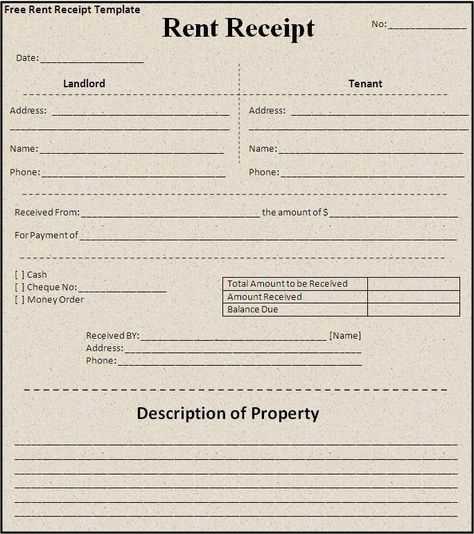

A well-structured receipt template includes key information for both the seller and the customer. Make sure to include the date of the transaction, the seller’s name or business name, the items purchased, and their respective prices. A clear breakdown helps avoid confusion and provides clarity for both parties.

Ensure the template has a space for tax rates or any applicable fees. This helps in maintaining transparency and prevents disputes. Include the total amount, and if relevant, any discounts or promotions applied. Keep the font readable and sections logically organized to ensure the receipt is easy to follow.

Remember to provide a section for payment methods. Whether the payment was made by cash, credit card, or other means, specifying this on the receipt confirms the mode of payment used. This is especially useful for tracking purposes and for future reference.

Choosing the Correct Format for Date and Time

For consistency, use the ISO 8601 format for dates and times. This format ensures that the date is easily understood across different regions. The preferred structure is YYYY-MM-DD for dates and HH:MM:SS for time.

When displaying time, always specify whether it’s in 12-hour or 24-hour format. The 24-hour system reduces ambiguity and is commonly used in professional contexts. For example, 14:30 is clearer than 2:30 PM in international settings.

If your receipt needs to accommodate multiple regions, consider using localized formats. In the United States, the format MM/DD/YYYY is common, while in Europe, DD/MM/YYYY is standard. Be mindful of these differences to avoid confusion.

Always separate date and time with a space or the letter T (e.g., 2023-08-15T14:30:00). This improves readability and helps ensure the proper separation of data elements.

In cases where you need to include time zone information, specify it clearly using UTC offsets. For example, 2023-08-15T14:30:00+02:00 denotes the date and time in a specific time zone.

Including Tax Information: What to Add

Include the applicable tax rate for the transaction. Clearly list the percentage, as well as the total tax amount calculated from the subtotal. This helps to ensure transparency and compliance with local regulations.

Next, specify the tax type, such as VAT, sales tax, or excise duty. Labeling the tax type prevents confusion for both the customer and the business.

- Tax rate (e.g., 10%, 15%)

- Tax type (e.g., VAT, sales tax)

- Total tax amount

Make sure the tax is broken down clearly, especially when multiple items are involved. If there are different tax rates for separate items, list them individually next to each product or service on the receipt.

Finally, include your tax identification number (TIN) or VAT number if required by local tax authorities. This adds credibility to the receipt and is often legally required for businesses to issue receipts with tax information.

Designing a Clear Breakdown of Products/Services

Keep the breakdown concise and structured to ensure clarity. Each product or service should have its own line with a brief description, quantity, unit price, and total cost. Avoid clutter and group related items together.

| Product/Service | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| Item 1 | Brief product description | 1 | $10.00 | $10.00 |

| Service A | Service description | 2 | $15.00 | $30.00 |

| Item 2 | Another product description | 1 | $25.00 | $25.00 |

Provide subtotals and taxes clearly, and separate each section for easy reading. This helps the customer track each cost individually and understand the final amount with minimal confusion.

Be consistent with formatting. Ensure fonts are legible and the table layout remains clean. Limit the use of bold or italics to key areas like item totals or headings to avoid overwhelming the reader.

How to Handle Discounts and Additional Charges

Clearly separate discounts and additional charges in the receipt. Use distinct line items to avoid confusion. Display the original price, the discount, and the final price after the discount separately. This ensures transparency and clarity for the customer.

Applying Discounts

To apply a discount, subtract the discount amount from the total price. Show the percentage or fixed amount of the discount clearly next to the item or total price. Indicate whether the discount applies to a single item or the entire purchase. This helps customers verify the discount they received.

Handling Additional Charges

For additional charges, list them separately, specifying the reason for the extra cost. Common charges include delivery fees, service fees, or handling charges. Ensure these are added after applying any discounts. Be transparent about these charges to prevent misunderstandings.

Adding Legal Notices and Return Policies

Ensure that your receipt includes the necessary legal notices and return policies to protect both your business and customers. Clearly state any terms related to refunds, exchanges, and warranty claims. This transparency can prevent disputes and misunderstandings.

Include a Refund Policy

Be specific about the conditions for returns. Mention the timeframe (e.g., 30 days from purchase) and the requirements for a valid return, such as the condition of the product or the presence of the receipt. Clearly state whether refunds will be issued as store credit or back to the original payment method.

Warranty Information

If your product is covered by a warranty, briefly outline the terms. Include the duration of the warranty and the types of damages or defects it covers. This can help customers understand their rights and the level of protection they receive.

Don’t forget to mention any specific legal obligations you may have under consumer protection laws in your country or region. This can vary, so check your local regulations to ensure compliance.