To claim a tax deduction for your charitable donation, ensure you provide a proper letter with an itemized receipt. This document should clearly detail the donation, including the amount, description of goods or services, and confirmation that no goods or services were received in exchange for the donation. A well-written letter simplifies your tax filing process and ensures the donation is acknowledged for tax purposes.

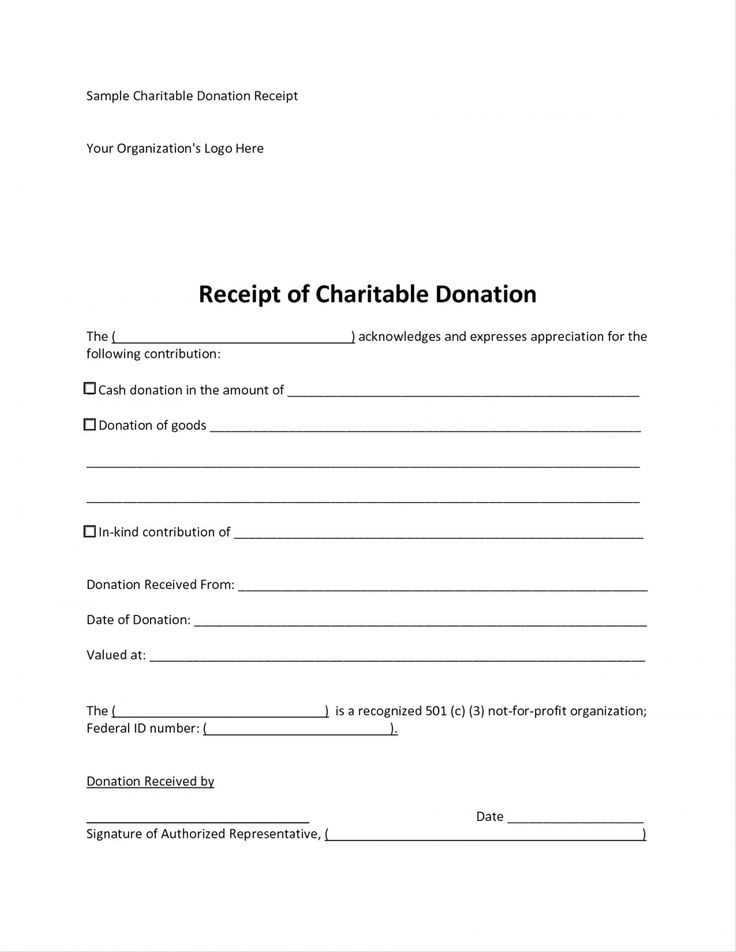

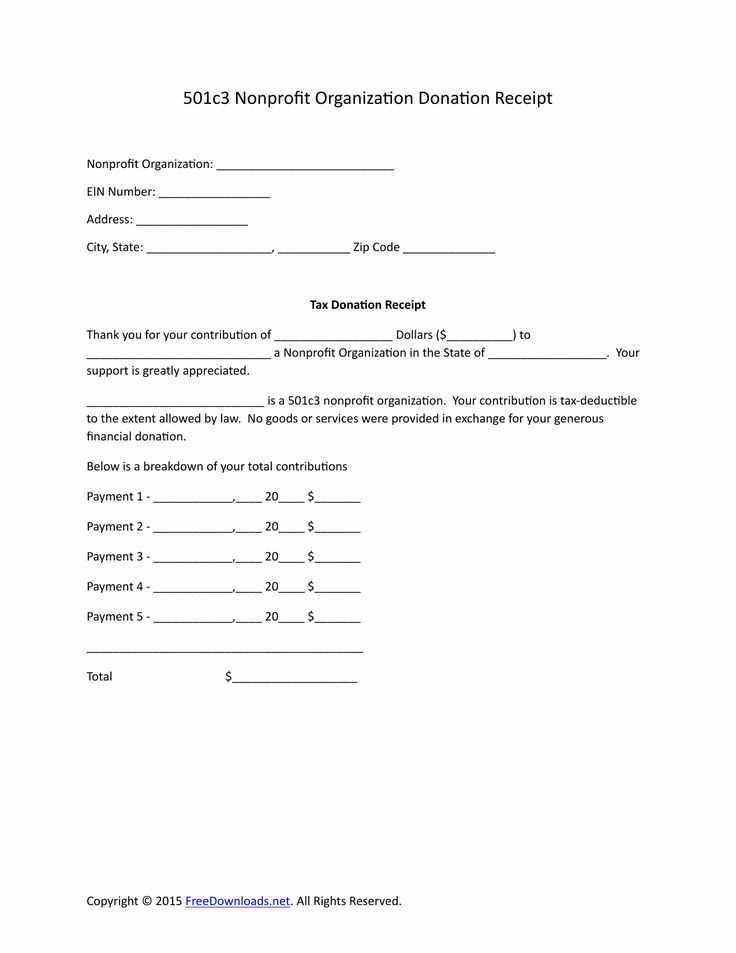

Donation Letter Template should include the name of the charity, its address, and a brief description of the donation, along with the date. Make sure to state that the donation is tax-deductible and include a statement verifying that no goods or services were provided in return. Additionally, include the charity’s tax-exempt status, such as its 501(c)(3) status in the United States.

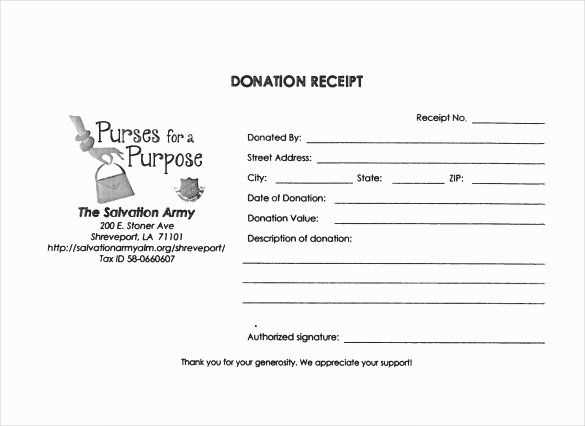

Receipt Information is just as important. Be sure that it is signed by an authorized representative of the charity. The receipt should also indicate the fair market value of donated goods, especially if non-cash items are involved. The clearer and more detailed your records, the easier it will be for both you and the IRS during tax season.

Here are the corrected lines:

Ensure your donation letter includes all necessary details for tax deduction purposes. Below are the main components to focus on:

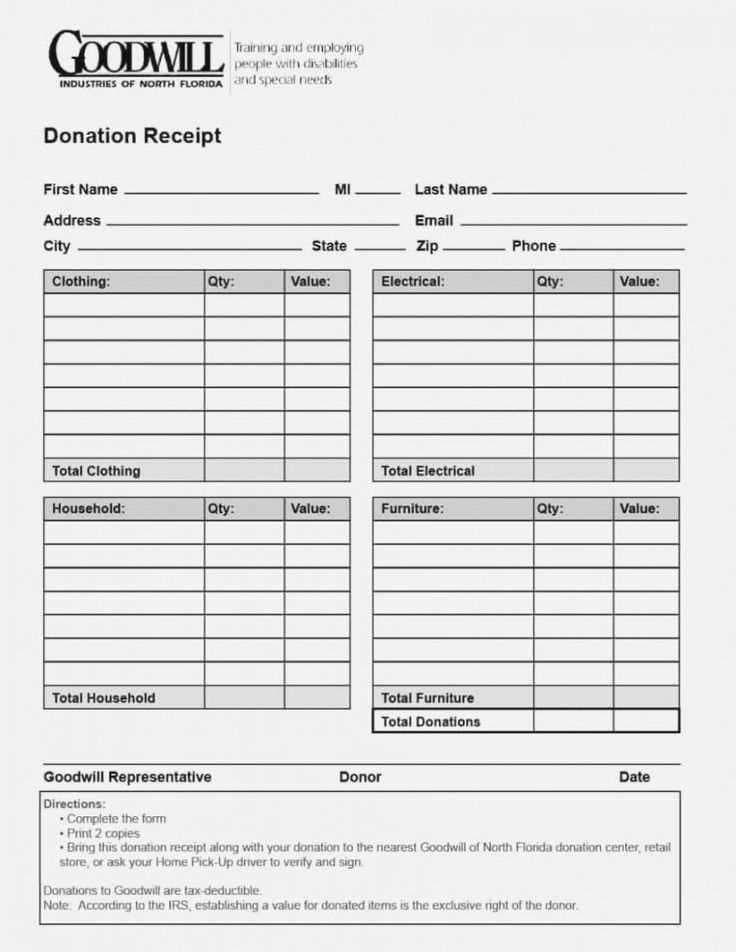

- Donor Information: Clearly state the name, address, and contact details of the donor. This helps in identifying the donor during the tax filing process.

- Charity Information: Include the charity’s name, address, and its tax-exempt status (IRS 501(c)(3) status, for example). Ensure this information is accurate and current.

- Donation Description: Provide a specific description of the donated items or money. For non-cash donations, include details about the condition and the estimated value of the items, if applicable.

- Donation Value: State the fair market value of the donation. For cash donations, this would simply be the amount given. For goods, list the approximate market value at the time of donation.

- Date of Donation: Clearly list the date the donation was made to establish the period for tax purposes.

Receipt Acknowledgment

For tax purposes, include a statement acknowledging that no goods or services were provided in exchange for the donation, unless that is not the case. This will affect the deductible amount for the donor.

- If the donor received something in return (like a gift or service), specify the fair market value of the goods or services received, so the donor knows how much of the donation is deductible.

- Provide a clear statement confirming the tax-deductible status of the donation to reassure the donor.

Final Details

Ensure the letter is signed by a representative of the charity, and include a contact number or email in case the donor has any further questions. Keep a copy for the charity’s records and ensure the donor receives the receipt in a timely manner.

- Tax Write-Off Donation Letter Template with Receipt

When drafting a donation letter for tax write-off purposes, include the donor’s full name, address, and the donation’s value. A receipt is necessary for the donor to claim the deduction on their taxes. Clearly state the date of the donation and a description of the donated items or amount. Below is an example template to follow:

Donation Letter Template

[Organization’s Name]

[Organization’s Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

[Date]

[Donor’s Name]

[Donor’s Address]

[City, State, ZIP Code]

Dear [Donor’s Name],

We are writing to acknowledge your generous donation to [Organization’s Name]. We greatly appreciate your support in helping us further our mission.

Details of the donation:

- Donation Date: [Date of Donation]

- Description of Donation: [Item description or monetary donation]

- Estimated Value: [Value of the donation]

This donation is tax-deductible under the Internal Revenue Code Section 170, and no goods or services were exchanged in return for your contribution.

Thank you again for your generosity. If you have any questions, please don’t hesitate to contact us.

Sincerely,

[Signature]

[Name of Authorized Representative]

[Title]

[Organization’s Name]

Receipt for Tax Purposes

This receipt is provided for the purpose of claiming a charitable donation deduction on your taxes. Please retain this for your records.

Ensure your donation letter clearly outlines the details necessary for tax deductions. Start by stating the donor’s name, address, and the date of the contribution. Follow this with a description of the donation, including the amount (or value if it’s an in-kind gift). Mention whether the donation was cash or goods, as this distinction affects the deduction amount.

Include a statement confirming that no goods or services were provided in exchange for the donation. If anything was given in return, note its value to determine the deductible portion of the donation. For in-kind donations, describe the items and their condition to establish a fair market value.

Conclude with a formal expression of gratitude, reinforcing that the contribution is tax-deductible. Finally, ensure that the letter is signed by an authorized individual within the organization to authenticate the donation receipt.

A receipt for tax purposes must include key details to ensure its validity. Clearly state the name of the organization or entity receiving the donation, along with their tax-exempt status or charity registration number. Specify the date of the donation, along with the amount or value of the donation, and indicate if it was cash or in-kind. If applicable, mention any goods or services provided in exchange for the donation, along with their fair market value. Lastly, include a statement confirming that no goods or services were received if the donation was entirely monetary. This ensures compliance and helps donors claim deductions accurately.

One of the most frequent mistakes is failing to include a clear description of the donation. Specify what was given–whether it’s money, goods, or services–along with an accurate value. This avoids any ambiguity and helps the recipient claim the correct deduction.

Omitting Required Tax Information

Always include necessary details such as the donor’s name, donation amount, and date of donation. Also, mention that no goods or services were received in exchange for the donation if applicable. Without this information, the letter may not meet IRS requirements for tax deductions.

Inaccurate Valuation of Donated Items

When donating non-cash items, providing an inflated value can cause trouble. Be sure to reference fair market value. Use reliable sources like guides from charitable organizations to back up the valuation. An overstatement can result in issues with the IRS.

Another mistake is not providing a receipt or acknowledgment for donations exceeding a certain amount. The donor must have written proof for contributions over $250. Ensure your letter serves as an official receipt with all required details.

Tax Write-Off Donation Letter Template with Receipt

When preparing a donation letter for tax write-off purposes, make sure to include the following elements to ensure it meets IRS standards. A well-structured letter should contain the donor’s name, the organization’s details, the donation amount, and a statement confirming whether any goods or services were exchanged. Below is a simple example of how to format the letter:

| Donor Information | John Doe, 123 Elm St, Springfield, IL 62701 |

|---|---|

| Recipient Organization | XYZ Charity, 456 Maple Ave, Springfield, IL 62701 |

| Donation Amount | $500 |

| Goods or Services Received | None |

| Date of Donation | February 10, 2025 |

| Statement | This letter confirms your donation of $500. No goods or services were exchanged for this contribution. |

Ensure that the donation letter clearly states that no goods or services were exchanged for the contribution, if applicable. This allows the donor to claim the full donation amount on their taxes. If something was received in return, such as tickets or a gift, the value of that item should be subtracted from the total donation for accurate tax purposes.