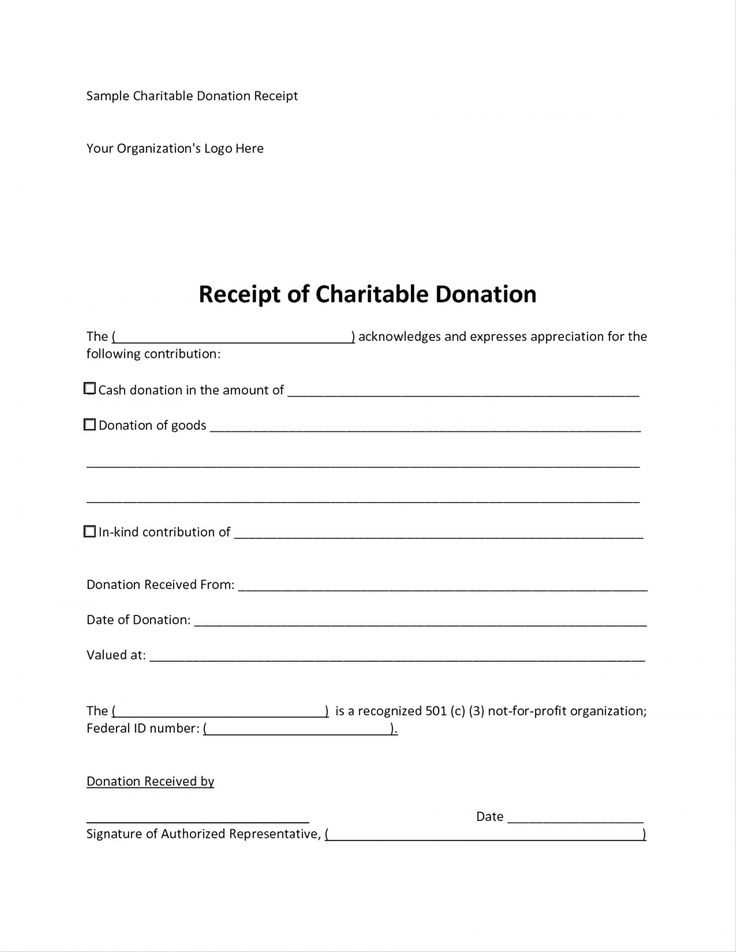

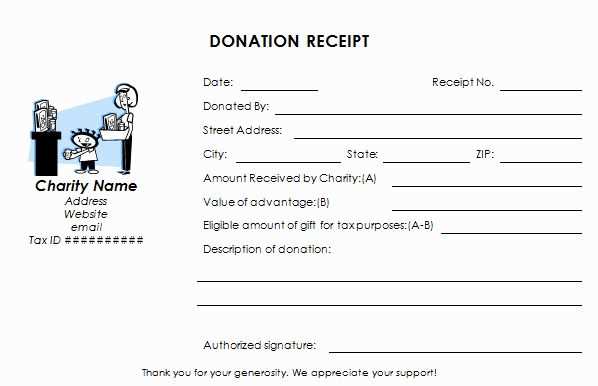

Use this template to create tax receipts for charitable donations with ease and accuracy. It’s designed to include all the necessary information your donor needs for tax reporting. By maintaining consistent records, both you and your donors can ensure proper documentation for tax purposes.

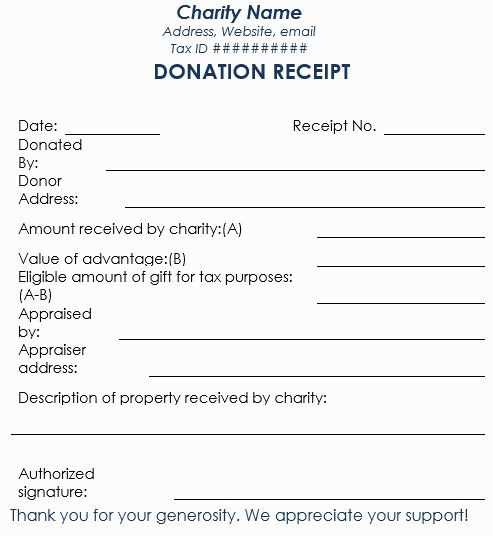

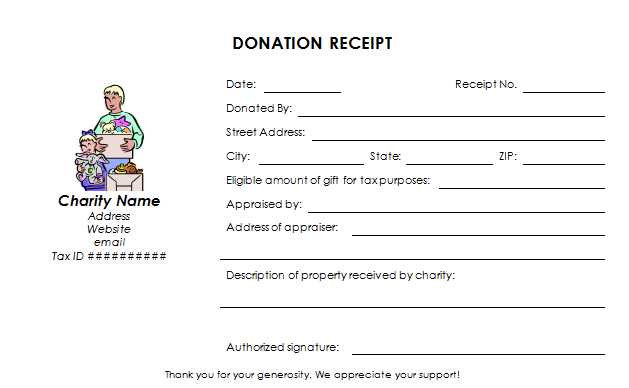

Start with donor details – Include the donor’s name, address, and the date of the donation. Ensure that the address matches the one used for tax filing to avoid any discrepancies.

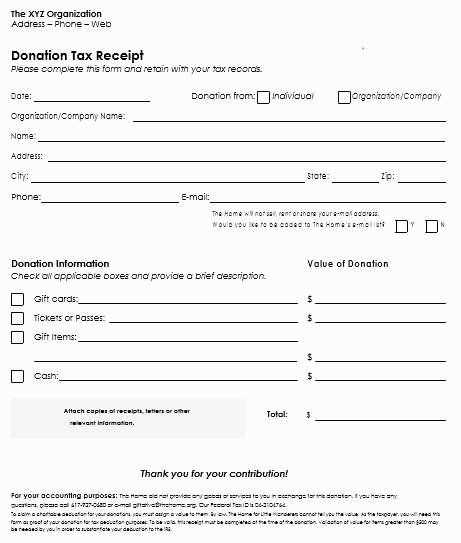

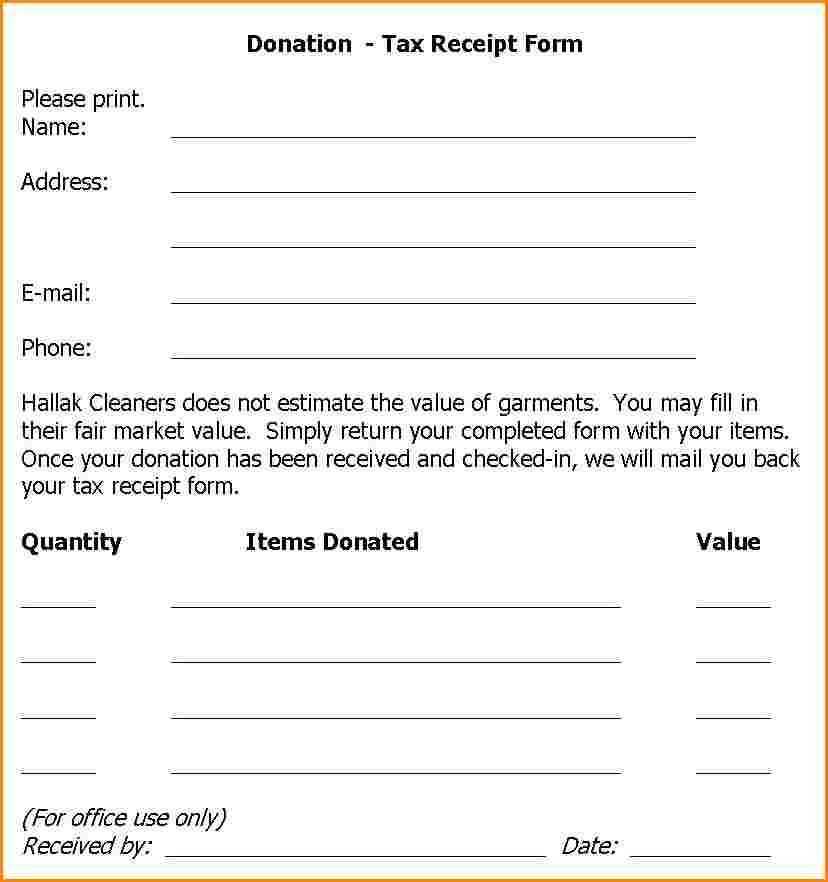

Donation amount – Clearly state the amount donated, whether in cash or goods. If the donation involves goods, specify their value based on fair market estimates.

Organization details – Make sure to provide your organization’s name, address, and tax identification number. This information is necessary to validate the donation for the donor’s tax records.

Official statement – Add a brief confirmation that no goods or services were provided in exchange for the donation. This is a requirement for tax deduction purposes.

Double-check all fields for accuracy before issuing the receipt. A properly filled-out tax receipt helps streamline the donation process and keeps your organization compliant with tax laws.

Here’s the revised version with fewer repetitions:

Ensure that the tax receipt includes the donation amount, donor’s name, and the organization’s details clearly. Provide a breakdown of the donation type, whether it’s monetary or in-kind. Avoid repeating the donor’s name unnecessarily and simplify the language to maintain clarity.

Donation Type Clarification

State explicitly if the contribution is cash or a non-cash donation. For non-cash donations, include a brief description of the items. This helps avoid redundancy and makes the receipt more readable for both the donor and the recipient organization.

Tax-Exempt Status

Make sure to include a statement confirming the organization’s tax-exempt status. This information reassures the donor that the donation qualifies for tax deductions, keeping the content straightforward without unnecessary phrasing.

Tax Receipts for Donations: A Practical Guide

How to Format a Donation Tax Receipt

Steps to Create a Template for Donation Receipts

What Information to Include in the Receipt

Legal Aspects of Issuing Tax Receipts

Customizing Receipts for Different Types of Donations

How to Distribute Receipts to Donors

Begin by structuring the receipt with clear and consistent sections. Start with the donor’s name, the organization’s name, and the donation date. This forms the foundation. Follow this with a brief description of the donation type–whether monetary or in-kind–along with its value. For in-kind donations, include a description of the item(s) and their fair market value.

Steps to Create a Template for Donation Receipts

Use a simple layout to ensure all necessary fields are easily visible. Key sections include:

- Donor’s full name and address

- Amount donated or description of in-kind donation

- Donation date

- Organization’s contact information

- Statement of tax-exempt status or non-profit status

- Signature of the person issuing the receipt

Ensure the format complies with local tax regulations. You can create a template using a word processor or a spreadsheet application.

Legal Aspects of Issuing Tax Receipts

Tax receipts must include accurate and truthful information. Organizations should verify that they are registered as a charity or tax-exempt entity before issuing receipts. Ensure the value of donations, especially in-kind, is evaluated fairly and correctly. Issuing false information could result in penalties or tax liabilities. Retain records of issued receipts in case of audits or verification requests.

Customizing your receipts based on donation types and amounts helps ensure clarity and maintains compliance. For large donations, detailed descriptions and even an acknowledgment letter may be required. For smaller, regular contributions, a simple receipt may suffice.

Distribute receipts promptly, either through email or physical mail, based on the donor’s preference. For transparency, send receipts within a reasonable time frame, typically within 30 days of receiving a donation. This ensures donors have the necessary documentation to claim deductions on their taxes.