To print a legal cash receipt, start by selecting a template that meets your requirements. A legal receipt should include specific details, such as the date, amount, payer’s information, and the purpose of the transaction. It’s important that the format adheres to any local legal standards for documentation, ensuring all necessary fields are present for clarity and compliance.

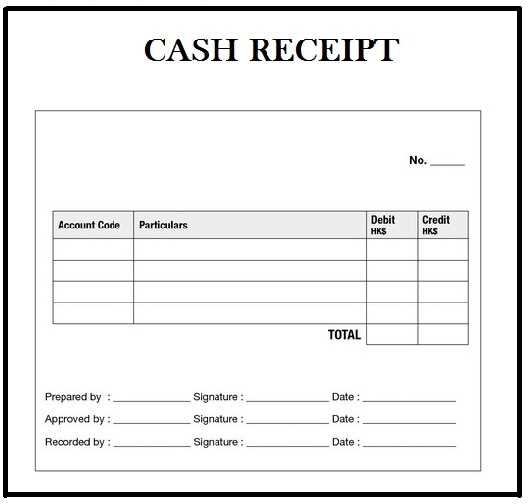

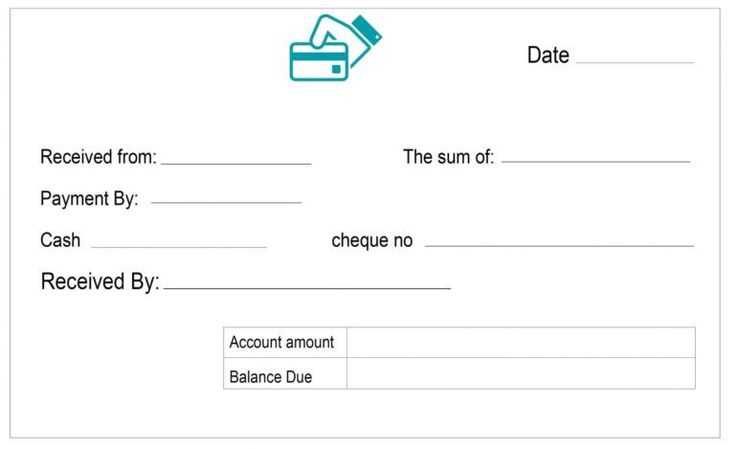

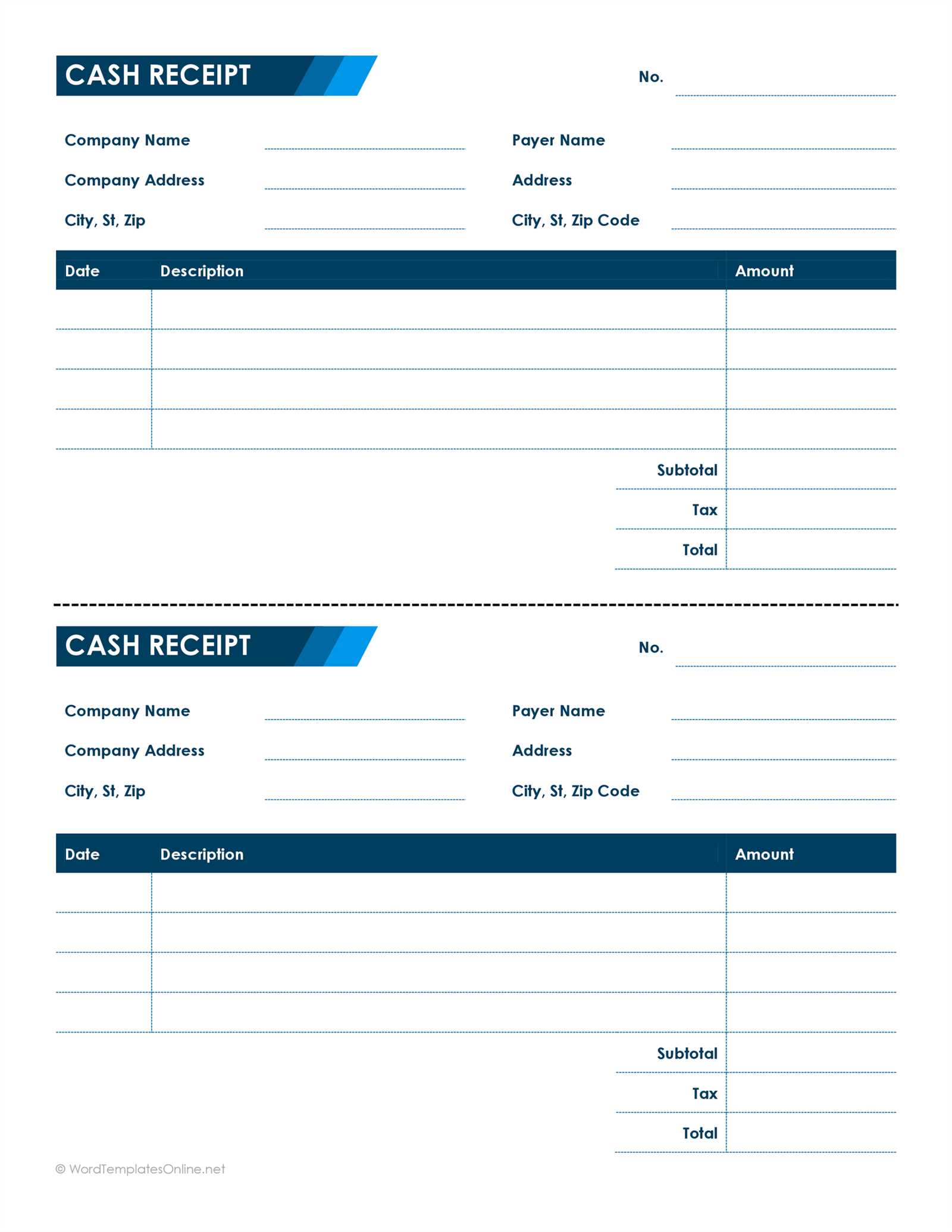

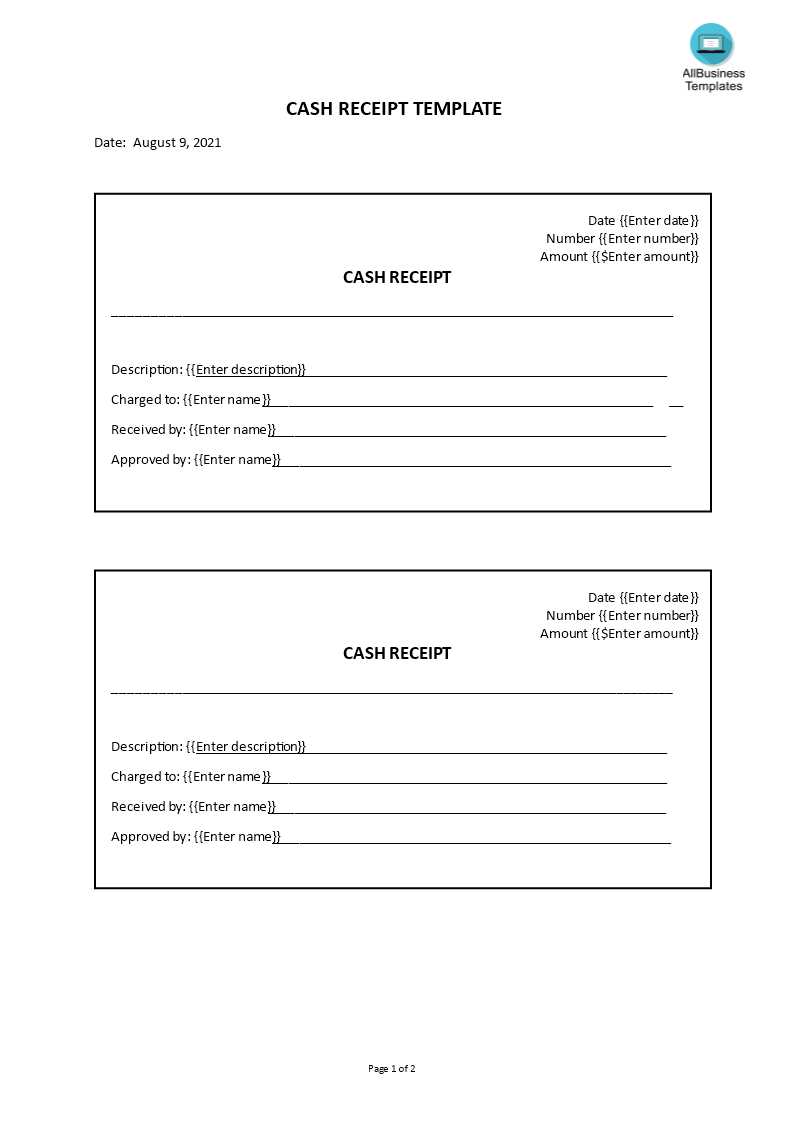

Choose a Template That Fits Your Needs – Numerous templates are available for immediate use, but make sure the one you choose has all the required fields. It’s advisable to look for a template that provides space for the payer’s name, address, and the payment method. You can also customize it based on your business requirements to avoid future confusion.

Ensure Accuracy in the Details – Before printing, double-check that the information filled in is correct. Mistakes in amounts or details can create legal issues down the line, especially if the receipt needs to be used for tax or accounting purposes. Pay particular attention to the transaction amount, both in numbers and words, as well as the payment method used.

Print Your Receipt – Once you’ve confirmed all the details, proceed to print. It’s best to print the receipt on high-quality paper, especially if it will be stored for long periods. For businesses with frequent transactions, using a receipt book with carbon copies may be a good option to keep a record of all issued receipts.

Here are the revised lines with reduced repetition:

Adjust the structure of your receipt template to ensure clarity. Include the date, payer’s name, amount received, and transaction details without redundancy. This will create a clean format that is easy to read.

- Clearly state the payer’s full name, avoiding unnecessary labels.

- Use simple descriptions for the payment purpose, focusing only on the most relevant details.

- Consolidate any repetitive sections such as payment methods, and highlight key information once.

Shorten sections that describe similar data multiple times. This helps reduce confusion and keeps the document concise. For example, if the payment method is listed more than once, remove the repetition and list it only once in the payment section.

Ensure the total amount is clear and appears in one place, without being repeated unnecessarily across multiple sections.

- Need to Print a Legal Cash Receipt Template

To create a legally valid cash receipt template, ensure it includes key details: the date of transaction, payer’s name, amount paid, method of payment, and the signature of the person receiving the payment. It is crucial that all these elements are clearly listed to avoid any disputes or confusion later on.

Required Details

Start with the date and payment amount. Specify the currency if it differs from local standards. Clearly write the payer’s name and address, as this identifies both parties involved. Add the transaction method (e.g., cash, check) and make a note of any reference number related to the transaction if applicable. The receipt should also indicate whether the payment is for a service or goods.

Legal Compliance

Verify that your template adheres to local regulations regarding receipts. For instance, some regions require tax identification numbers or specific wording on receipts. Double-check with a legal advisor or an accountant to confirm that all necessary legal elements are included.

To create a legal cash receipt template, focus on the basic components that guarantee clarity and accuracy. The first step is to include a header with the title “Cash Receipt.” This will help distinguish it from other financial documents. Then, add the date of the transaction to track when the payment was made.

Details of the Transaction

Include a section where the payer’s name, contact information, and any relevant identification number (e.g., invoice number, reference number) are listed. This section will help link the receipt to specific transactions for future reference.

Amount and Payment Information

Clearly state the amount paid in both numbers and words. The payment method (cash, check, card, etc.) should also be documented. This ensures transparency and avoids potential confusion over the payment type.

Lastly, leave space for signatures from both the payer and the recipient. This adds legal weight to the receipt and ensures both parties agree on the transaction details. Save the template in a widely accepted format, such as PDF, to ensure it can be easily printed or shared.

To create a legal cash receipt, include these specific components:

1. Receipt Number

Each cash receipt should have a unique number for easy tracking and reference. This helps in organizing and retrieving transaction records when needed.

2. Date of Payment

The exact date the payment is made should be clearly noted. This is crucial for record-keeping and legal purposes.

3. Amount Received

Indicate the total amount of cash received. It should be written both numerically and in words for clarity and to avoid errors.

4. Payer’s Name

Record the name of the person or business making the payment. This adds accountability and transparency to the transaction.

5. Payment Method

Specify if the payment is made in cash, check, or other forms. This will help distinguish between various types of receipts in the future.

6. Description of Goods or Services

Provide a brief but clear description of the goods or services for which the payment is made. This ensures both parties are aligned on what the payment covers.

7. Signature

Both the payer and the receiver should sign the receipt. This verifies the transaction and serves as proof of agreement.

8. Business Information

Include the name, address, and contact information of the business or individual receiving the payment. This is necessary for identification in case of disputes.

To create a legally valid receipt, it’s crucial to select a format that includes all the necessary information without being overly complex. A clear and concise layout helps both the issuer and the recipient understand the details of the transaction. Choose a simple, structured template that can easily be printed or saved digitally.

Key Elements for Your Receipt Template

Your receipt should contain the following key details:

| Element | Description |

|---|---|

| Date of Transaction | Indicate the date and time when the transaction took place. |

| Seller Information | Include the name, address, and contact details of the seller. |

| Buyer Information | Provide the buyer’s name and contact information, if applicable. |

| Itemized List of Products/Services | List the products or services with their corresponding prices and quantities. |

| Total Amount | Clearly state the total amount due, including taxes, fees, and discounts. |

| Payment Method | Specify how the payment was made (e.g., cash, credit card, online transfer). |

| Receipt Number | Include a unique identifier for the transaction. |

Format Options

Consider whether you need a paper receipt or a digital version. A paper receipt should be printed in a legible font and have enough space for all the relevant details. For digital receipts, choose a format like PDF or a simple email template that can be saved or printed easily. Both formats should be easy to read, professional-looking, and contain all legal requirements.

Adjust your receipt template to clearly match the type of transaction. For instance, when dealing with product sales, include fields for the item description, quantity, and price. If offering a service, add a section detailing the service type and duration. Keep the layout simple but clear for each transaction type.

For rentals, include additional fields for rental duration and return policy. For refunds, indicate the original transaction date and the reason for the refund. Customizing these sections ensures each receipt reflects the nature of the transaction.

| Transaction Type | Required Custom Fields |

|---|---|

| Product Sale | Item Description, Quantity, Price, Total |

| Service | Service Type, Duration, Rate |

| Rental | Rental Duration, Return Policy |

| Refund | Original Transaction Date, Refund Reason |

Keep your template adaptable to accommodate different transaction scenarios. Adjusting your template ensures clarity for both the customer and the business.

Always ensure that your receipt template includes all necessary details, such as the seller’s business name, address, and tax identification number. These elements provide legal clarity in case of disputes or audits.

Make sure your receipt template complies with local tax regulations. For example, include applicable sales tax rates and breakdowns if required by law in your jurisdiction.

Verify that the receipt contains accurate transaction data, such as the date, amount, and payment method. This will help avoid confusion and ensure that your records align with legal standards.

- Check if your country requires receipts for specific types of transactions, like large purchases or services rendered.

- Be cautious when using generic templates from online sources. They may not comply with all local regulations.

- Keep receipts for the legally required period. Some jurisdictions may mandate retaining transaction records for several years.

Consider adding terms and conditions on the receipt, especially for services, to protect both the seller and the buyer from potential legal issues.

Ensure your template is correctly formatted for printing by adjusting the margins and page size in your print settings. Double-check the layout to avoid any text or elements getting cut off during printing. Choose high-quality paper for durability and legibility, especially for legal purposes.

Print your template using a reliable printer that offers clear, legible results. Avoid using low-resolution printers, as they may produce unclear or blurry text, which could make the receipt difficult to read or use as proof of transaction.

Once printed, distribute the receipt directly to the intended party. If you are handing it over in person, ensure it’s signed and dated if required by your local regulations. For remote distribution, consider scanning and emailing the printed receipt in a PDF format for digital records.

To avoid confusion, clearly label your template with necessary details, such as the business name, transaction date, and total amount. Providing a physical or digital copy to both the payer and the payee is a good practice for transparency.

Creating a Legal Cash Receipt Template

To create a simple and clear legal cash receipt template, focus on the following structure:

Key Elements

- Receipt Number: Assign a unique number to track each transaction.

- Date: Include the exact date of the transaction.

- Received From: Specify the name of the payer.

- Amount: Clearly state the amount received in both words and numbers.

- Payment Method: Note whether the payment was made by cash, check, or another method.

- Signature: Provide a space for both the payer’s and receiver’s signatures.

Design Tips

- Keep the layout simple and professional. Avoid clutter.

- Ensure the font is easy to read, using standard sizes for clarity.

- Use consistent spacing between sections to improve readability.

Once your template is ready, you can print it and use it for all cash transactions. It helps keep records organized and legally compliant.