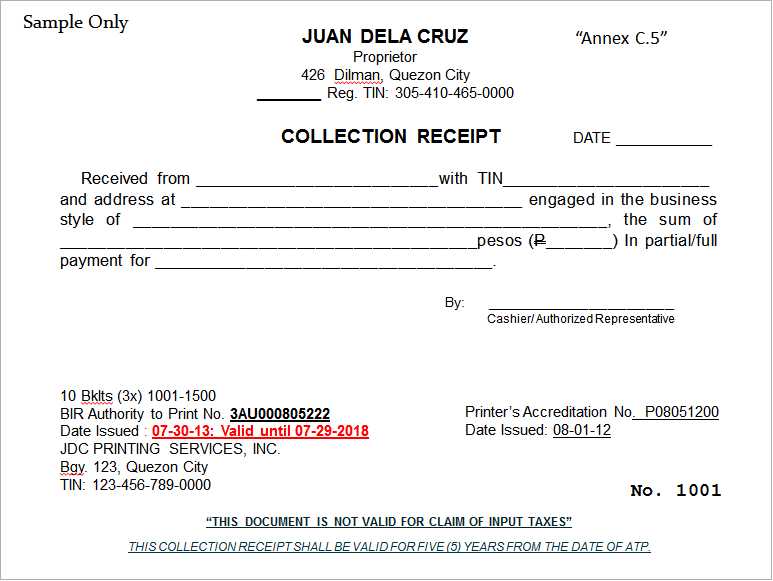

For businesses in the Philippines, creating an official receipt template is a straightforward yet necessary task. Start by including key information such as the name of your business, address, contact details, and the taxpayer identification number (TIN). These elements are crucial for tax compliance and to ensure transparency in financial transactions.

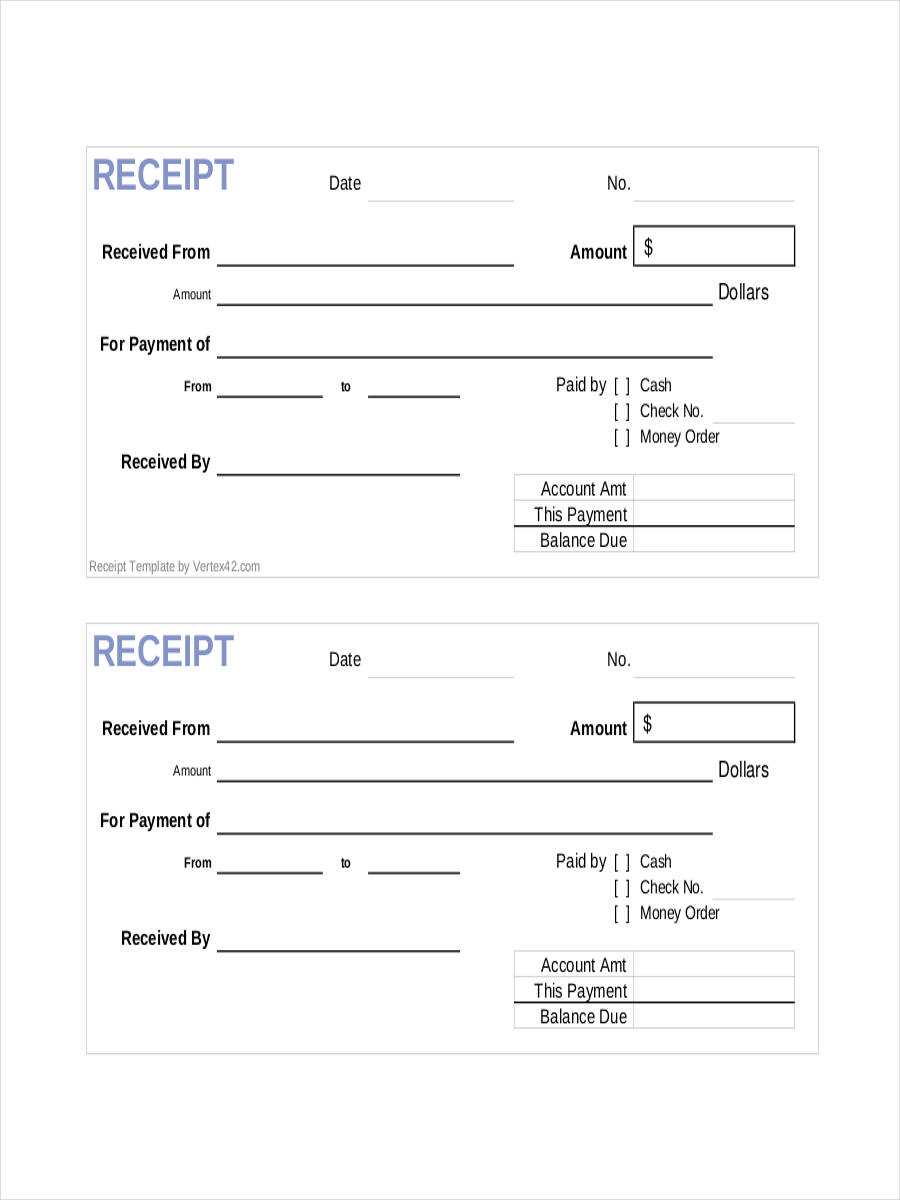

Next, include a unique receipt number for tracking purposes. This number should follow a sequential order to maintain an organized system. It’s also recommended to add the date of the transaction, the amount paid, and the description of goods or services provided. Clear and concise descriptions help customers understand what they are being charged for.

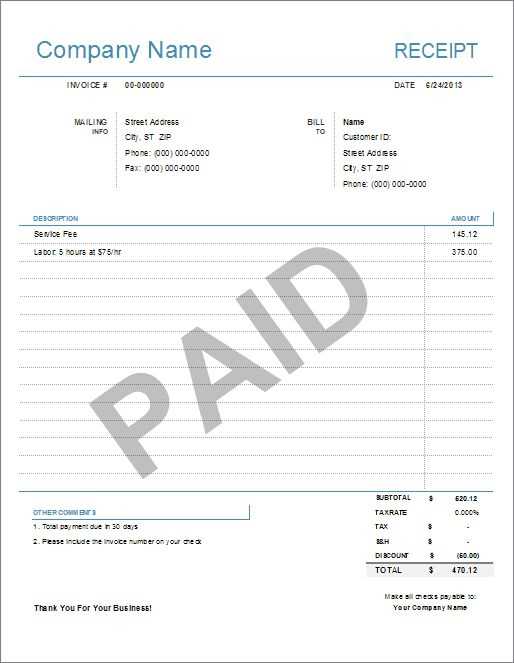

Don’t forget to include the payment method used, whether cash, card, or online transfer. This helps clarify the mode of payment for both you and your customer. For additional clarity, break down the total cost, listing individual charges, taxes, and discounts, if applicable.

Lastly, always provide a space for the authorized signature or stamp, as this adds legitimacy to the receipt. Regularly updating your receipt template ensures it remains compliant with any changes in Philippine business regulations.

Here is the corrected version:

To create an official receipt in the Philippines, make sure it follows the proper structure. Include the name of your business, the date of the transaction, and a breakdown of the goods or services provided. Each item should list the price and, if applicable, taxes. Make sure to add a unique receipt number to avoid confusion and for record-keeping purposes. If the transaction involves VAT, state the total price and VAT amount separately.

Receipt Template Format

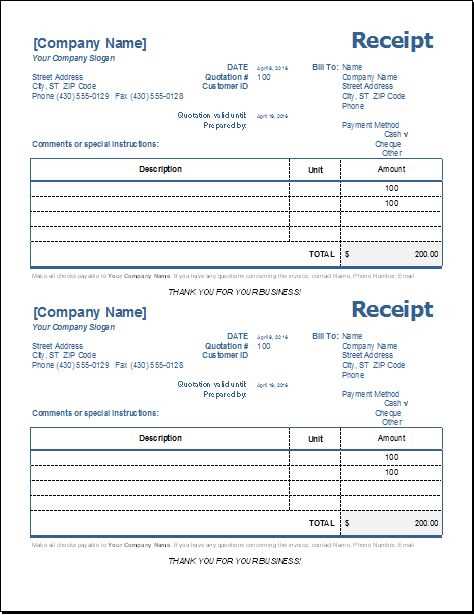

The receipt should include the following key sections:

- Business Name – Clearly displayed at the top of the receipt.

- Transaction Date – The exact date of purchase or service provision.

- Receipt Number – A unique identifier for each receipt.

- Itemized List – Each product or service with its corresponding price.

- Tax Details – Specify the VAT or other applicable taxes, if any.

Additional Requirements

Ensure that the receipt is printed with clear fonts. The document should be legible and free of errors. Some businesses may also include their business permit number and other relevant details required by the Bureau of Internal Revenue (BIR).

Official Receipt Philippines Template Guide

For creating a proper official receipt in the Philippines, it’s vital to include all required components. A standard receipt must contain the name of the business, the address, and the tax identification number (TIN). Additionally, the receipt should clearly state the transaction date, the amount paid, and a detailed description of the items or services rendered.

Understanding the Key Elements of an Official Receipt

The following elements are mandatory in an official receipt template:

- Business Name and Address: The legal name and address of the business issuing the receipt.

- Taxpayer Identification Number (TIN): Required for businesses registered with the Bureau of Internal Revenue (BIR).

- Receipt Number: Each receipt must have a unique number to prevent duplication.

- Date of Transaction: Always include the exact date when the transaction took place.

- Amount Paid: Clearly state the amount the customer paid, along with the applicable tax if relevant.

- Item or Service Description: Describe what was purchased or what service was rendered in detail.

How to Properly Format a Receipt Template

To format your receipt template, start by choosing a layout that organizes information logically. Place the business name and TIN at the top for easy identification. Follow with the transaction date, amount, and receipt number in a clear, readable font. Use a consistent structure for all receipts to avoid confusion and maintain professionalism.

For electronic receipts, ensure all the same details are included and that the design is user-friendly for digital users. Using a template tool or software can help streamline the process and ensure compliance with legal requirements.

Lastly, always double-check your template for accuracy before issuing a receipt. Errors can lead to discrepancies that could affect tax filings or customer relations.

Common Mistakes to Avoid When Creating a Receipt

Avoid omitting mandatory details such as the TIN or receipt number. These are critical for legal purposes. Don’t use vague descriptions for the items or services provided, as this can cause confusion and make the receipt invalid. Also, ensure the date is accurate–misdated receipts can lead to disputes.

Consistency is key. Using a different format for each receipt or altering the layout can cause confusion. Stick to a professional template and avoid cluttered designs that detract from the essential information.