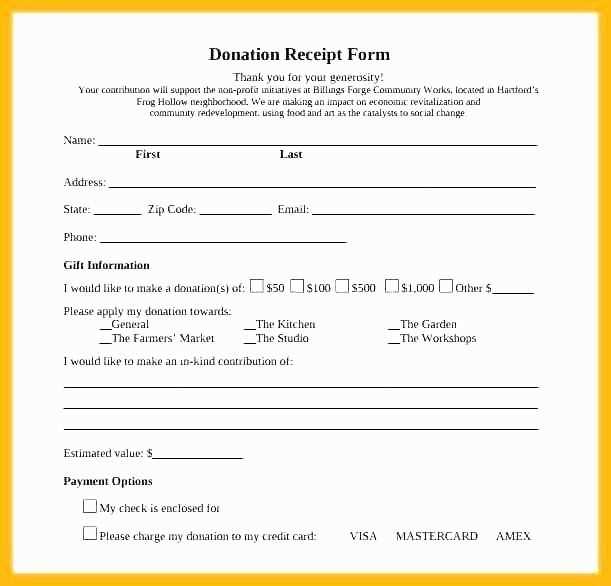

For a non-profit organization, issuing an in-kind donation receipt is an important step in ensuring transparency and maintaining trust with donors. A well-structured receipt serves as proof for the donor and provides necessary documentation for tax deductions. This template can help you organize and formalize donations effectively.

Start with the donor’s name and address clearly displayed at the top of the receipt. This establishes the donor’s identity for record-keeping and tax purposes. Include the date of the donation and a brief description of the items donated, including their condition. If possible, provide an estimated value of the items donated, though the donor is responsible for determining the fair market value.

Make sure to specify that the organization did not provide any goods or services in exchange for the donation, as this affects the donor’s eligibility for tax deductions. A clear statement like “No goods or services were provided in exchange for this donation” is necessary to avoid any confusion.

Lastly, include the signature of an authorized representative from your organization along with their title. This ensures the legitimacy of the receipt and offers the donor confidence that the donation was properly recorded.

Corrected Lines:

Ensure you include the donor’s full name and contact information. This helps maintain transparency and proves that the donation was acknowledged by your organization.

Clearly describe the donated items. Be specific about the type and quantity of goods received to avoid confusion and ensure proper record-keeping.

Indicate the date of the donation. This is crucial for tax reporting and helps both the donor and your nonprofit stay organized.

Include a statement clarifying that no goods or services were exchanged for the donation. This is important for tax deduction purposes.

Make sure to sign the receipt. An authorized representative from your nonprofit must sign the document to verify its authenticity.

- Non-Profit In-Kind Donation Receipt Template

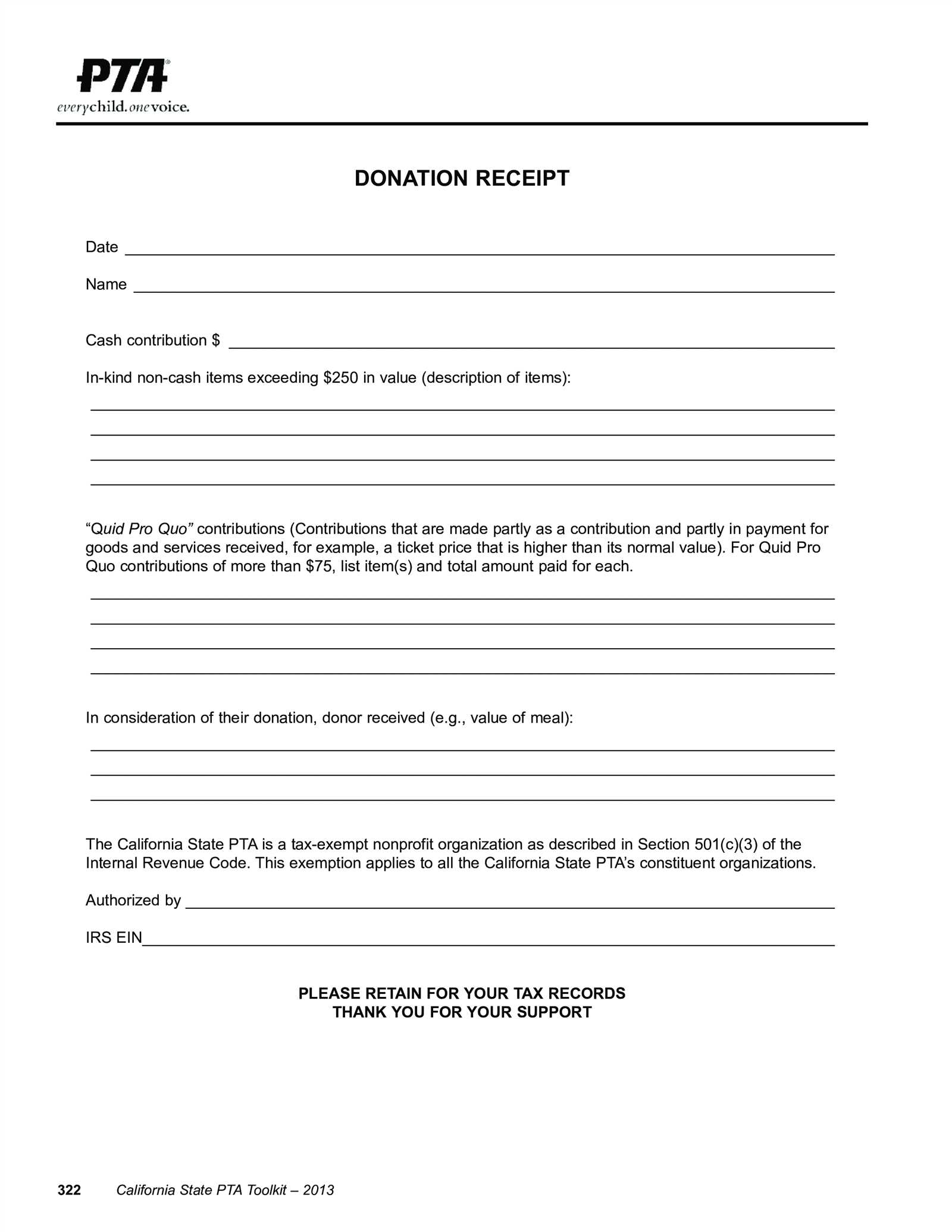

Create a simple, clear, and accurate receipt for in-kind donations with the following template. This receipt will help your non-profit organization acknowledge donations properly for tax purposes.

Template Components:

1. Donor Information: Include the donor’s name, address, and contact details. Make sure this section is clearly identifiable to avoid confusion when reviewing donations.

2. Donation Details: Describe the items donated, including quantity, quality, and condition. Be as specific as possible to avoid misunderstandings. For example, if you receive clothing, note the types, sizes, and conditions (e.g., “5 new jackets, size medium, excellent condition”).

3. Date of Donation: The receipt should mention the exact date the donation was made. This helps with record-keeping and ensures the donation is processed in the correct fiscal year.

4. Estimated Value: Provide a space for the donor to note the estimated value of the items donated. You can also add a disclaimer that your non-profit does not appraise the value of in-kind donations, which ensures that the donor understands that they are responsible for valuing their donation.

5. Non-Profit Information: Include the name of your organization, address, and contact details. This reassures donors that the receipt is legitimate and helps them easily contact your organization if needed.

6. Tax-Exempt Status: Include a statement confirming your tax-exempt status under IRS 501(c)(3) or other relevant laws. This is critical for donors to claim their charitable deductions on tax returns.

7. Signature: A space for a representative from your non-profit to sign. This adds a layer of authenticity to the receipt and shows your organization’s acknowledgment of the donation.

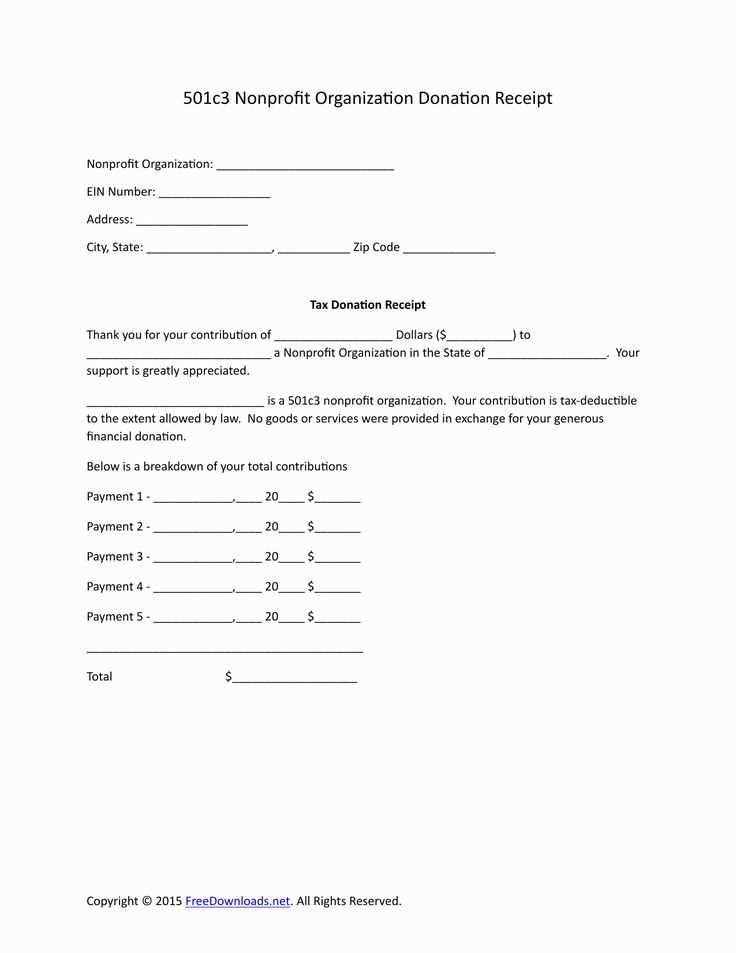

Example Template:

Donor Name: ______________________

Address: _________________________

Contact: _________________________

Donation Details: ______________________ (Include descriptions of the donated items)

Date of Donation: ______________________

Estimated Value of Donation: ______________________

Organization Name: ______________________

Tax-Exempt Status: 501(c)(3) – EIN __________________

Authorized Signature: ______________________

Having this template in place ensures a smooth donation process for both your organization and the donor, while also maintaining necessary documentation for tax reporting and compliance. Customize it to suit your specific needs and the types of in-kind donations you typically receive.

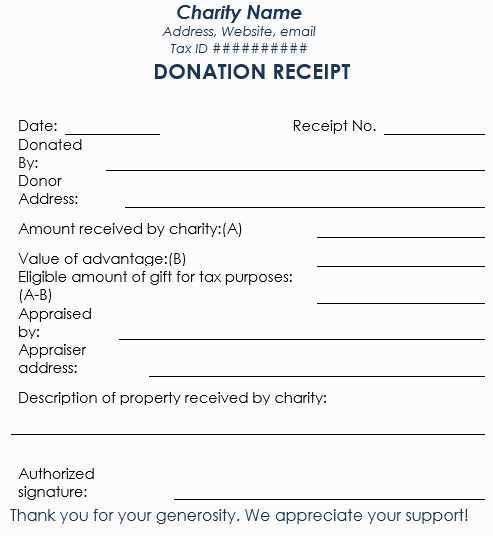

To ensure your donation receipt complies with legal requirements, include the following information:

1. Donor Information

Clearly state the donor’s name and address. This is essential for tax purposes, and helps both the donor and your organization maintain proper records. Make sure the information is accurate and up to date.

2. Organization Details

Include the name of your organization, address, and tax-exempt status (e.g., IRS 501(c)(3) designation). This verifies your nonprofit status and provides the donor with necessary documentation for tax deductions.

3. Description of Donated Goods or Services

List the donated items or services in detail, specifying their condition. If the donation is a non-cash gift, such as goods, avoid placing a value on the items. Instead, state that the donor is responsible for determining the value for tax purposes.

4. Date of Donation

Document the exact date when the donation was made. This date is significant for tax reporting and determines the applicable year for deductions.

5. Statement of No Goods or Services Provided

If no goods or services were provided in exchange for the donation, include a statement confirming this. For partial donations where goods or services were exchanged, note the value of what was provided to the donor.

6. Signature and Title

The receipt should be signed by an authorized individual from your organization, such as the executive director or finance officer. Include their title for reference.

Ensure that your donation receipts are clear, specific, and compliant with both federal and state laws. Providing these details not only protects your nonprofit but also supports your donors in receiving the maximum tax benefits available.

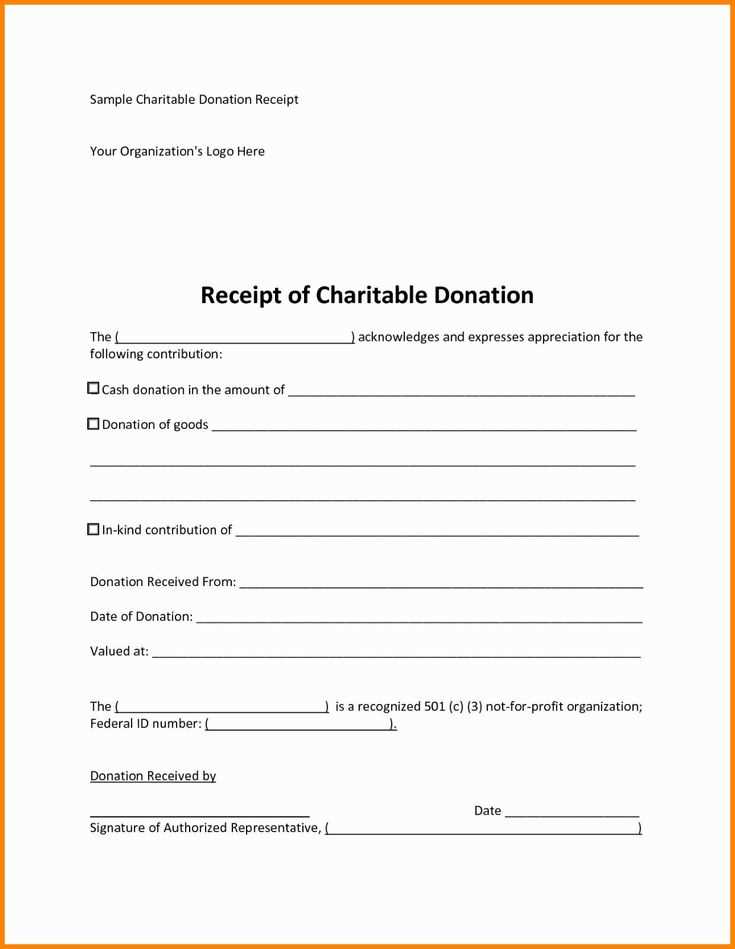

When issuing a donation receipt, make sure to include the following details for transparency and compliance:

| Item | Description |

|---|---|

| Donor’s Name | List the full name of the donor or the name of the organization making the donation. |

| Date of Donation | Include the exact date on which the donation was made. |

| Description of Donated Items | Provide a brief description of the donated items or services. For in-kind donations, this will be a detailed list. |

| Value of Donation | If applicable, indicate the fair market value of the donation. Nonprofits can use the donor’s estimate or provide guidance on valuation. |

| Nonprofit’s Name and Contact Information | Include the official name, address, and phone number or email of the nonprofit organization. |

| Tax-Exempt Status | State the nonprofit’s tax-exempt status, along with the IRS designation, such as 501(c)(3) in the U.S. |

| Statement of No Goods or Services | For tax-deductible donations, include a statement confirming whether any goods or services were provided in exchange for the donation. |

| Signature | Sign the receipt, typically by an authorized representative of the nonprofit. |

By including all these elements, you ensure that your receipt is accurate, transparent, and complies with tax regulations. This helps donors keep proper records for their potential tax deductions and builds trust with your nonprofit organization.

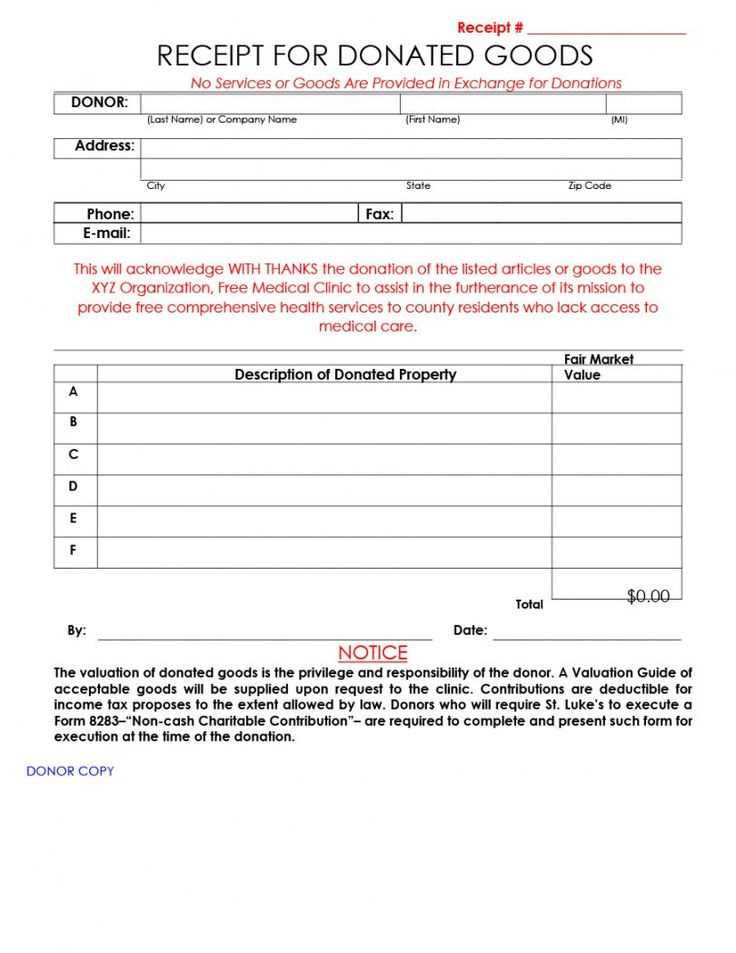

For tax purposes, the value of donations needs to be calculated accurately to ensure compliance and potential deductions. Here’s how to handle the valuation process:

- Determine the Fair Market Value (FMV): This is the price a willing buyer would pay a willing seller for the donated item, with neither being under any compulsion to buy or sell. It’s not what the donor paid for the item or its replacement cost, but rather what someone else would pay for it on the open market.

- For Goods: If the donation involves items like clothing, electronics, or furniture, you should refer to the current selling price for similar used goods. Websites like Goodwill or Salvation Army may offer pricing guides based on typical donation values.

- For Vehicles: If the donated item is a vehicle, the FMV can be determined using online tools like Kelley Blue Book or NADA Guides. These resources provide estimates based on the make, model, year, mileage, and condition of the vehicle.

- For Appreciated Assets: If the donation is an appreciated asset (like stocks or real estate), use the value on the date of the donation. For securities, the fair market value is typically the average of the high and low prices on the donation date.

- Document the Donation: Always provide the donor with a detailed receipt that includes the description of the items donated, the FMV, and a statement that no goods or services were exchanged in return for the donation. This documentation is key for tax filing and must be kept for your records.

Valuing donations correctly is key to ensuring both the donor and your nonprofit are fully compliant with tax regulations while making the most out of these contributions.

Non-Profit In-Kind Donation Receipt Template

Clearly document the in-kind donation with a concise and accurate receipt. Include the donor’s name, address, and the donation details. Mention the items or services donated along with their fair market value. If you can’t assign a value, note that it is the donor’s responsibility to determine it.

Key Information to Include

The receipt should list the date of the donation and a description of the items or services given. If there are multiple items, group them logically. Avoid vague descriptions; be specific (e.g., “5 boxes of books” instead of “assorted items”). Include a statement that no goods or services were provided in exchange for the donation unless applicable.

Formatting Tips

Ensure the template is easy to read with clearly defined sections. Keep the layout professional and organized. Use bullet points or numbered lists for multiple items. Provide space for the donor’s signature, especially if required for tax purposes. Double-check all the details to avoid discrepancies that might cause confusion later.