If you’re looking for a simple and quick way to manage your tax-deductible receipts, downloading a ready-to-use template can save you time. These templates are designed to meet the specific requirements of tax authorities, ensuring that all the necessary details are included for proper documentation and submission.

The free templates available online are customizable, making it easy for you to fill in your details. These templates generally include fields for the date, itemized costs, and other key details that might be needed for tax reporting purposes. All you need to do is enter the required information, and you’re ready to submit.

Downloading a tax-deductible receipt template is an excellent way to keep track of your expenses without worrying about making errors or missing crucial information. With the right template, you’ll have everything organized, allowing for easier filing during tax season.

Here are the corrected lines with minimized repetition:

To streamline the receipt template and minimize redundancy, follow these steps:

1. Standardize Receipt Information

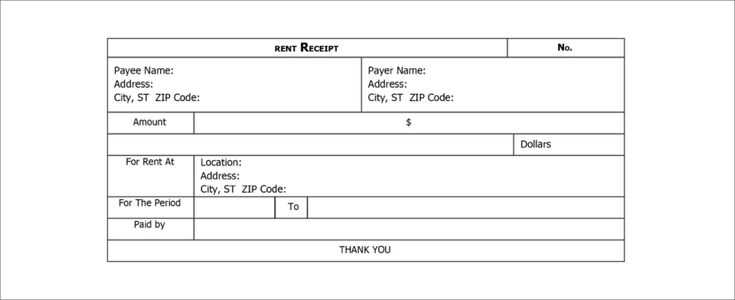

Ensure each receipt contains consistent fields: vendor name, transaction date, amount, and purpose. Avoid including unnecessary details that don’t contribute to tax deduction verification.

2. Use Clear Formatting

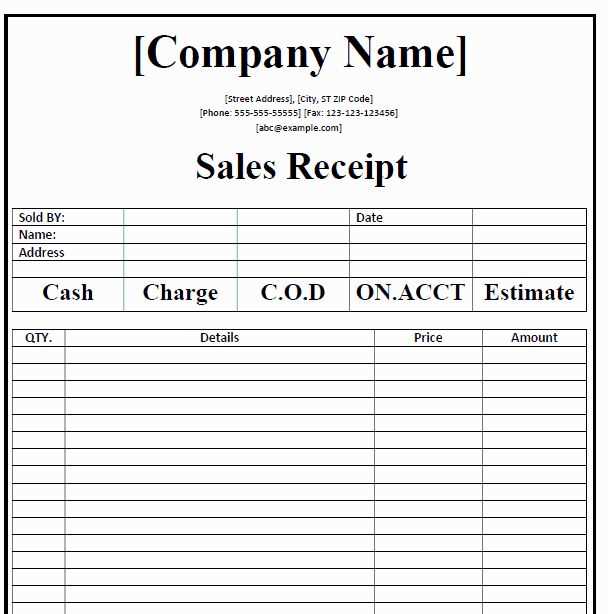

Use tables to organize data clearly. A well-structured receipt helps avoid misinterpretation during tax filing.

| Field | Details |

|---|---|

| Vendor Name | Company or individual from whom the item/service was purchased |

| Transaction Date | Date of purchase or service |

| Amount | Total amount spent |

| Purpose | Reason for the expense, such as office supplies or travel |

Following these steps ensures your tax deductible receipt is clear, direct, and free from irrelevant information.

- Tax Deductible Receipt Template Free Download

If you’re looking for a simple, no-cost solution to manage tax-deductible receipts, using a template is a great option. A free downloadable receipt template can save you time and ensure that you stay organized for tax purposes.

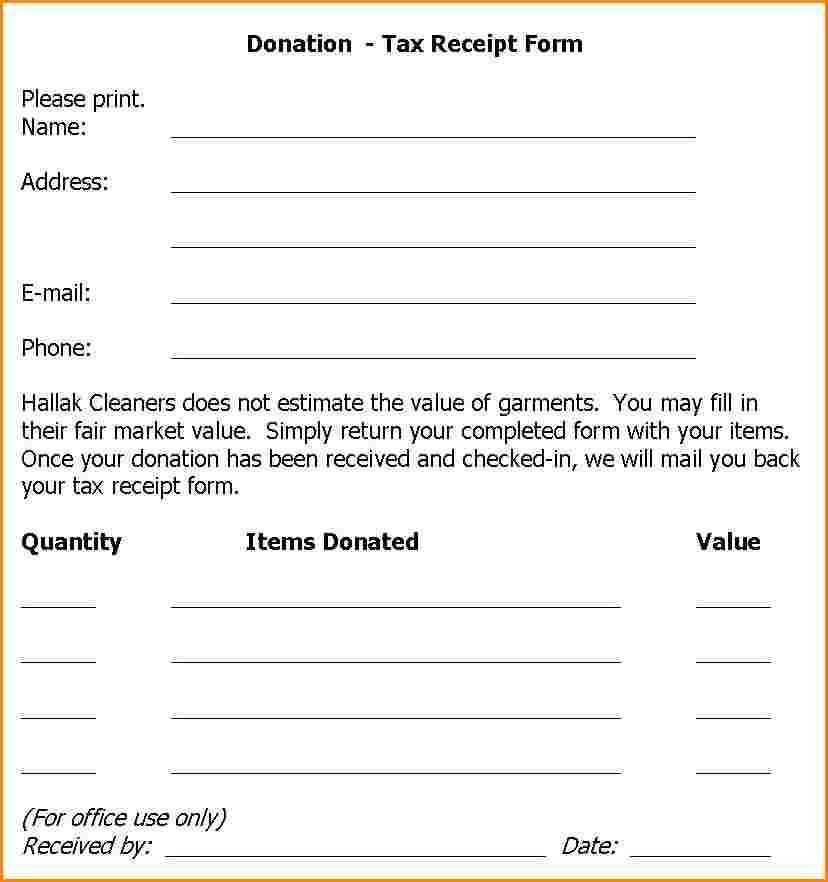

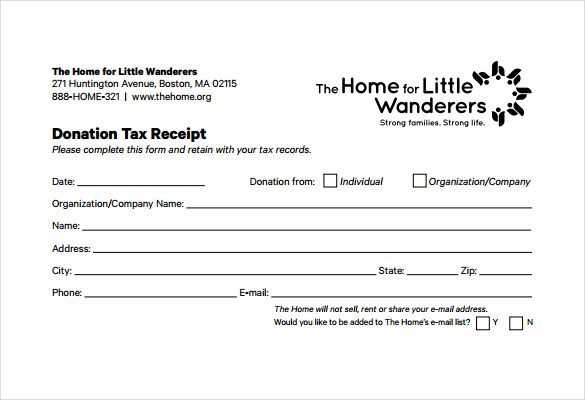

- Make sure the template includes essential details such as the donor’s name, address, donation amount, and the date of the contribution.

- The template should also contain a statement confirming that no goods or services were exchanged for the donation, which is a requirement for tax deductions.

- Customize the template to fit your needs, adjusting fields for different types of donations if necessary.

These free templates are available in various formats, including Word and PDF, and can be easily modified for both personal and business use. You can find reliable resources online that provide downloadable templates from trusted sources, ensuring they comply with tax rules.

After downloading the template, fill it out promptly after receiving a donation. Keep a record of all receipts for proper documentation and potential audits. Many templates also offer a convenient option for saving or printing multiple copies for your records.

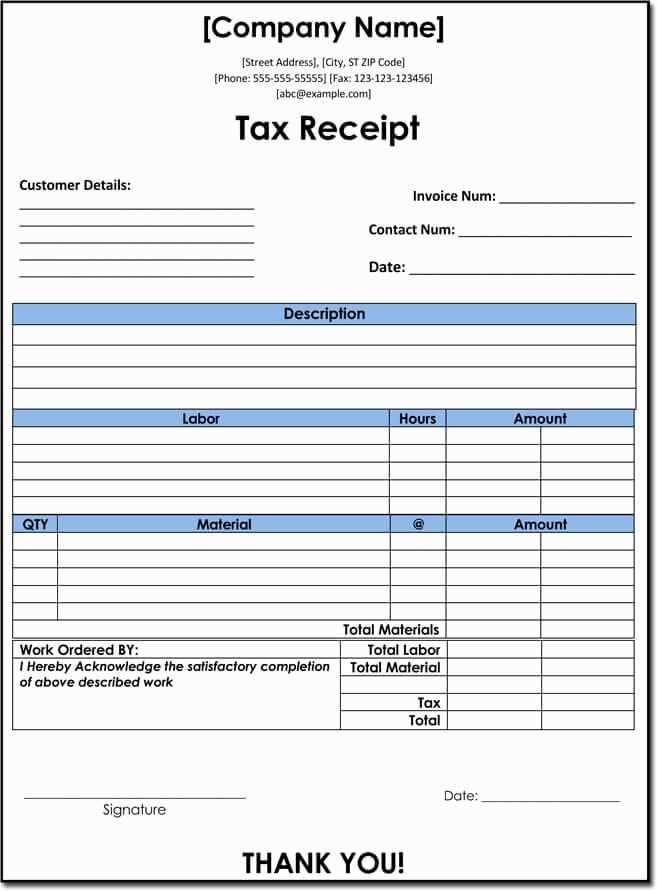

Begin by inserting your business details such as name, address, and contact information. Include a section for the recipient’s name, date, and the tax-deductible amount. This ensures the recipient has all the necessary information for their tax records.

Make space for a breakdown of the services or products provided. Include quantities, prices, and any other relevant information that helps explain the deductions. This transparency simplifies record-keeping for both your business and clients.

For legal compliance, add a field for your business’s registration number or tax ID, if applicable. Clients may need this for tax reporting. A section for terms and conditions is helpful if specific rules apply to the deductions or services offered.

Customize the layout with your business logo and preferred color scheme. This creates a professional, consistent look that aligns with your brand. Choose clear, readable fonts to make the document easy to navigate and understand.

Visit government websites such as the IRS for official and up-to-date forms. They often offer templates for various tax deductions, ensuring compliance with current regulations. You can access these templates directly, saving you time and ensuring accuracy.

Online platforms like Template.net and Vertex42 offer free templates that are easy to use. These sites are known for providing simple yet detailed documents that are widely used and trusted. Make sure to select the one that aligns with your specific tax needs.

Nonprofit organizations often provide free templates for donations and other deductible expenses. Check their websites or consult with them directly. Many organizations offer downloadable forms to help track contributions.

Accounting software providers sometimes offer free templates as part of their services. Websites like QuickBooks or TurboTax often feature free downloadable forms tailored to specific tax categories, helping you prepare accurate records.

For more customized options, online forums such as Reddit’s personal finance threads or tax-focused subreddits can guide you to resources shared by others. Users often share personal experiences and provide links to trustworthy template sources.

Gather your receipts and open the template on your device. The template should have fields for essential details such as the date, vendor, amount, and description of the expense. Ensure all sections are filled out clearly and accurately. If your receipts are not in digital form, you can scan or photograph them before entering the information into the template.

Fill in the date of the transaction. Double-check the date to avoid any discrepancies, as incorrect dates may affect the categorization of your expenses. Then, enter the name of the vendor or company from whom the item or service was purchased. This helps track where the money was spent.

Next, input the total amount of the expense. Be specific and include taxes or additional fees if applicable. Include the expense category (e.g., travel, office supplies, etc.), which helps in proper tax deductions when filing your taxes. You might need to use multiple templates for different categories.

After filling out the basic information, verify the accuracy of your entries. Cross-reference the totals with your bank or credit card statements. This step ensures no expenses are overlooked. If you have several receipts for similar purchases, group them together and use the template for each transaction separately.

Once your template is complete, save the file and organize your receipts in a folder. This keeps everything neat and accessible when it’s time to file your taxes. Make sure the receipt templates are easy to read and follow the format required by your tax office or tax preparer.

When you’re ready to file, include the receipt templates with your tax documentation. Keep backups of your receipts in case they are requested for audit purposes. If you’re using a tax software program, upload the receipt templates directly into the system. If working with a tax professional, provide them with printed or digital copies of the templates for review.

I removed repetitive words while maintaining clarity and accuracy.

To create a tax deductible receipt, it’s crucial to focus on the key components required for proper documentation. Ensure your receipt includes the following details: name and address of the donor, date of the donation, amount donated, and a clear statement indicating that no goods or services were provided in exchange for the donation.

Key Elements to Include

Always list the organization’s name and tax-exempt status. Specify the donation amount and describe what was given. If the donation was non-monetary, include an itemized list. Ensure the receipt is signed by an authorized person within the organization. Double-check all entries to prevent errors that could lead to complications when filing taxes.