When keeping track of child care expenses, using a structured receipt template simplifies the process. The template allows you to capture accurate details for reimbursement or tax purposes, ensuring all necessary information is included. You should always list the date of service, the name of the child care provider, the services rendered, and the amount paid. These details are critical for record-keeping and verifying expenses with both employers and tax authorities.

Customize the template to fit your needs, whether for a single child or multiple children. Include any additional fees that may apply, such as late pick-up or extra activities. This helps maintain transparency and avoid confusion in future financial reviews. To make the process even smoother, consider adding a section for payment methods used, whether by cash, check, or credit card.

Using a standardized template for each expense ensures that all receipts are consistent and easy to understand. A well-organized receipt also makes it easier to track spending over time, helping you manage your budget and prepare for tax season. Make sure to keep a copy of each receipt and regularly update your records for accuracy.

Here is the corrected version:

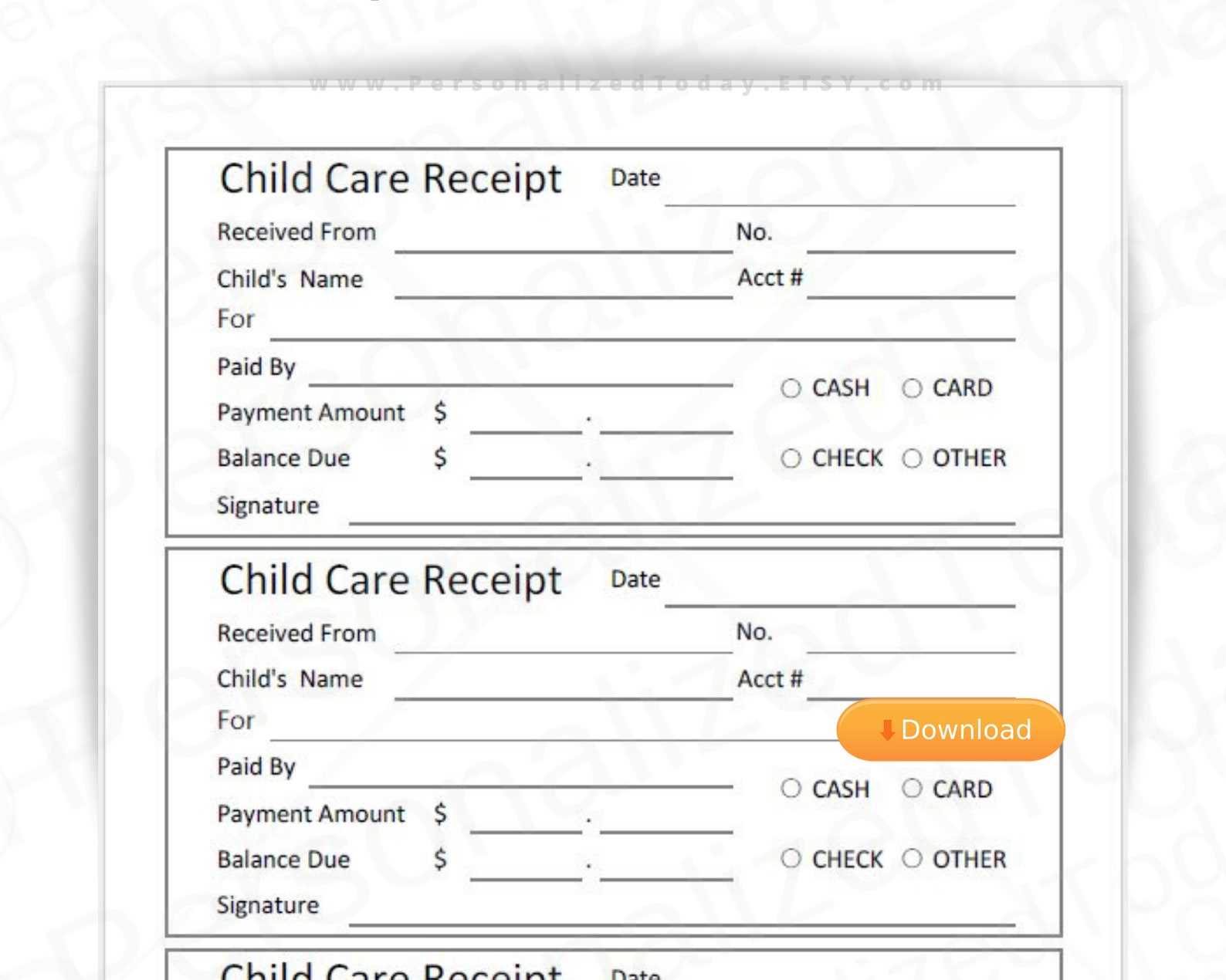

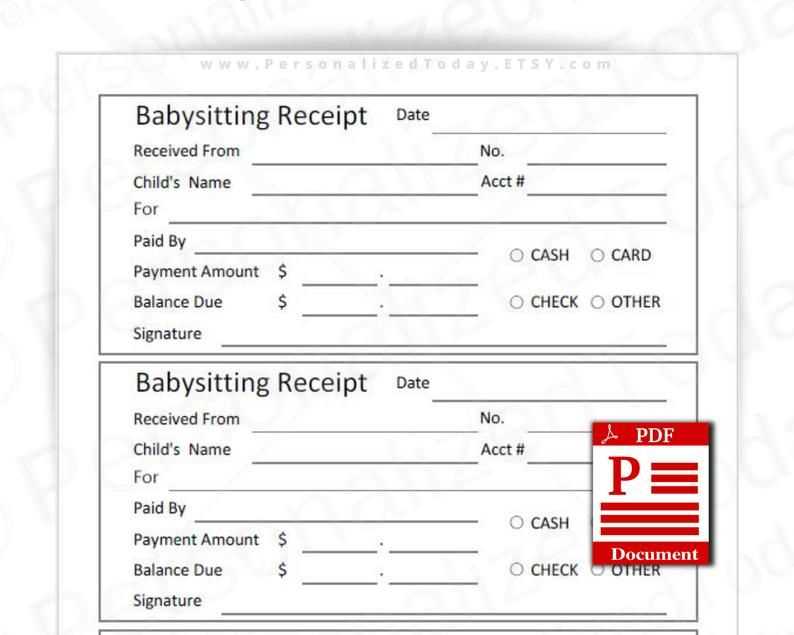

To ensure your child care expenses are well-documented, use a detailed receipt template that includes all necessary fields for tax purposes. Make sure the template captures the child’s name, the service provider’s details, the date(s) of service, and the amount paid. Include any applicable taxes or additional charges separately to maintain clarity. This will help avoid confusion and provide a clear breakdown of expenses.

Key Elements of a Child Care Receipt Template

1. Provider Information: Name, address, and contact details of the child care service provider.

2. Child’s Name: Include the child’s full name and, if applicable, their age or grade level for further clarity.

3. Dates and Hours of Service: Specify the exact dates and the hours worked to avoid ambiguity.

4. Payment Breakdown: List the total payment amount along with taxes, discounts, or additional charges for transparency.

Tips for Accuracy and Record-Keeping

Maintain a well-organized digital or physical file of these receipts. Consistency in naming conventions and categories will make it easier to track your expenses for both budgeting and tax reporting purposes.

Child Care Expense Receipt Template: A Practical Guide

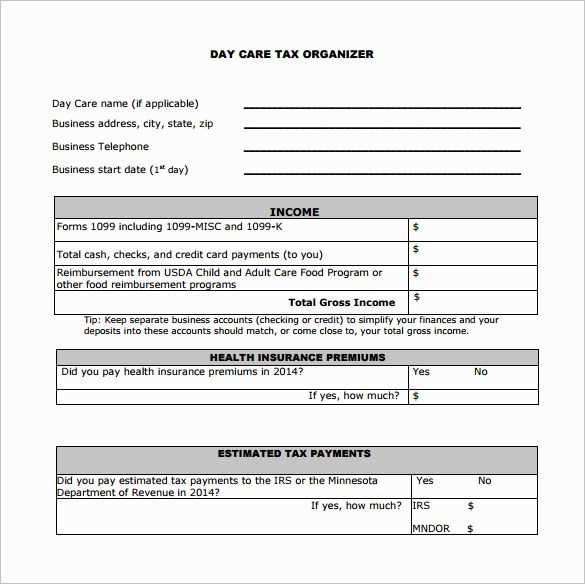

To create a child care expense receipt, make sure it includes the following key details for accuracy and compliance:

- Provider’s name and business information (address, phone number, email).

- Parent’s name and child’s details (name and age of the child).

- Service dates: Clearly indicate the start and end dates of the care period.

- Type of service provided (e.g., full-day care, part-time, after-school care).

- Total amount charged for the period, including breakdowns for hourly or daily rates if applicable.

- Payment method (cash, check, credit card, etc.) and any receipts or transaction IDs, if available.

- Signature of the provider for verification purposes.

Include these points on the template to ensure it serves as a valid document for tax purposes, reimbursement claims, or audits. Be clear with the service descriptions and amounts to avoid confusion or questions later. Make it easy to read and avoid excessive text or complicated formatting. Keep a copy for your records and update the template each time a new service is provided.

Include your business name, address, and contact details at the top of the receipt. This ensures easy identification of the service provider for tax purposes.

Clearly list the services provided, including the date of service, total hours worked, and the hourly rate. Add any applicable discounts or special offers, and calculate the subtotal.

Include a separate line for tax amounts. Make sure the tax rate and total tax are clearly indicated to avoid confusion during tax filing.

Clearly state the total amount due, both before and after tax. Ensure the breakdown is easy to follow and transparent.

Provide a unique receipt number for each transaction and include the payment method used (e.g., cash, check, credit card). This helps keep the record organized for future reference.

Ensure the layout is clean and well-organized. A professional, easy-to-read receipt will be helpful for both you and your clients when filing taxes.

Include the following details to ensure clarity and accuracy on a child care expense receipt:

- Provider’s Name and Contact Information: Include the full name, address, and phone number of the child care provider.

- Date(s) of Service: Clearly list the dates when the services were provided. This can be a range or individual days depending on the service.

- Child’s Name: Specify the child or children receiving care. This helps confirm the service provided is related to the correct individual.

- Amount Paid: State the total amount paid for the service. If payments were made in installments, list each separately.

- Service Description: A brief description of the services provided, such as daily care, after-school care, or special activities.

- Provider’s Tax ID Number or Social Security Number (SSN): This is needed for tax reporting purposes, ensuring that the expense can be verified for deductions.

- Payment Method: Indicate whether the payment was made in cash, by check, or via electronic transfer. This ensures there is a clear record of the transaction.

Tips for Adding Clarity

- Break Down Fees: If the cost is not flat, provide a breakdown (e.g., hourly rates, extra fees for special services).

- Include Payment Dates: Mention the exact date payments were received to prevent confusion during tax season.

Ensure you include all relevant details, such as the provider’s full name, address, and contact information. Omitting this data can lead to issues when parents need to claim tax deductions or apply for benefits. Double-check that the child care service’s name and registration details are correct on the receipt.

Accurately state the dates of service. Incorrect or incomplete date entries are a common mistake that can confuse both parents and tax authorities. Include the start and end dates for the specific service period, especially for recurring care sessions.

Clearly outline the total amount paid, breaking down the services provided if necessary. Avoid lumping multiple payments into one total without a breakdown, as it can lead to confusion for parents, especially when they are filing for reimbursements or deductions.

Be specific about the method of payment. If payment was made via check, credit card, or cash, include this detail on the receipt. This helps provide transparency and can resolve any future disputes regarding payment methods.

Don’t forget to add the tax ID or business registration number of the child care provider. This is particularly important for tax purposes and ensures the receipt is valid for any claims or verifications that may be required.

Avoid vague or unclear descriptions of services rendered. A receipt that simply states “child care services” without specifying hours or the type of service can be problematic. It’s important to include precise information about what was provided and the timeframes involved.

Ensure the receipt is signed, either digitally or physically, by the provider. A missing signature can make the document invalid or cause unnecessary confusion during audits or reimbursement processes.

Receipt Template for Child Care Expenses

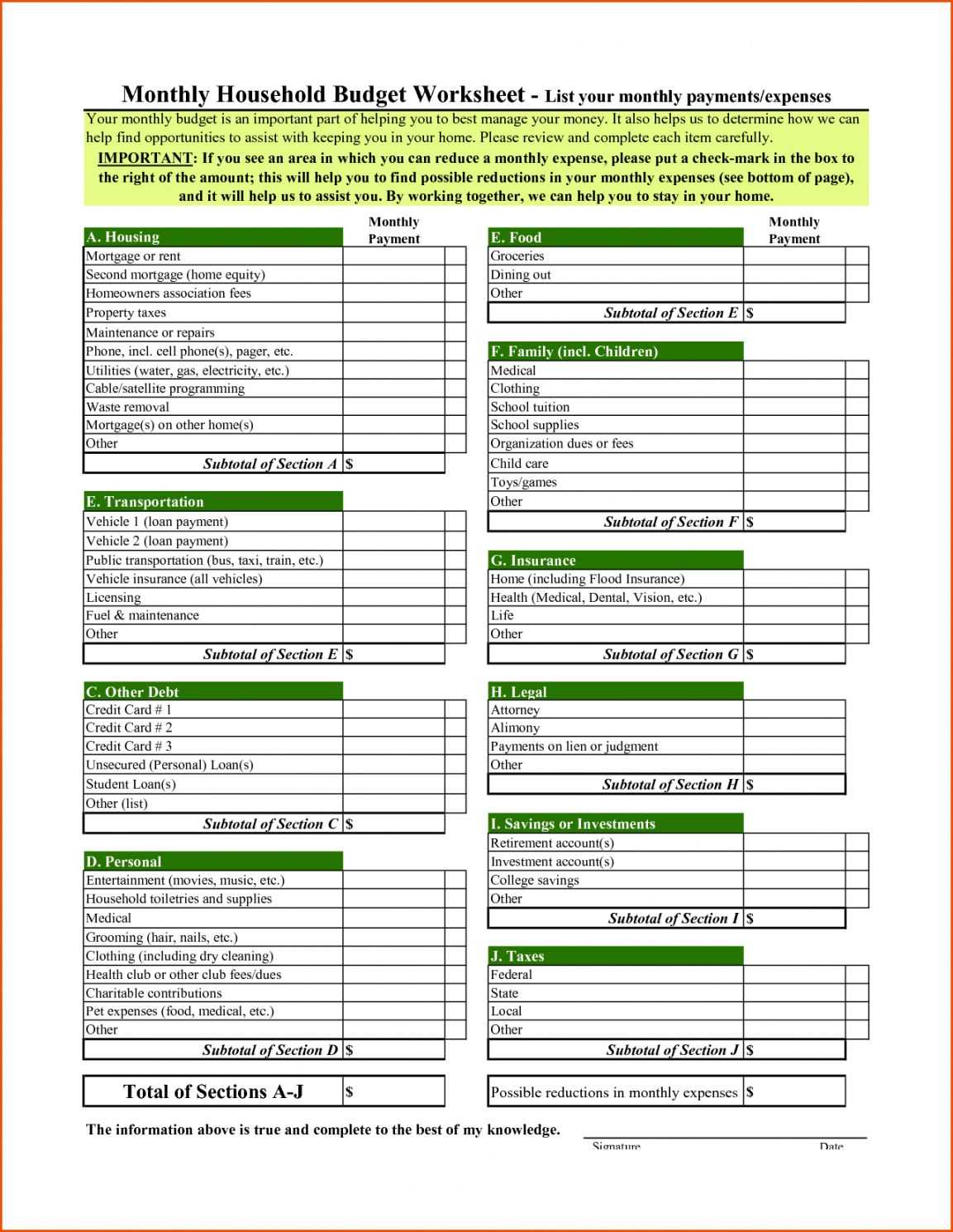

Ensure accuracy when filling out your receipt. Include specific details about the care provided, such as dates, hours worked, and total costs. Each item should be listed separately to avoid confusion. Additionally, make sure that the receipt includes the caregiver’s contact information, tax ID number (if applicable), and the name of the child receiving care.

Key Components of the Receipt

The following elements should always be included in the receipt for child care expenses:

| Component | Description |

|---|---|

| Caregiver’s Name | Full name of the person providing the service. |

| Caregiver’s Contact Info | Phone number or email address. |

| Child’s Name | Full name of the child receiving care. |

| Care Dates | Specific days or time periods when care was provided. |

| Care Hours | Number of hours per day or week the care was provided. |

| Total Payment | Total amount paid for services rendered. |

| Tax ID (if applicable) | Caregiver’s tax identification number for reporting purposes. |

Tips for Proper Record-Keeping

Make sure to retain copies of receipts for your records. It’s also helpful to track the total amount spent over time for budgeting purposes. If you’re applying for tax deductions, organizing receipts by month or year will simplify the process when you file.