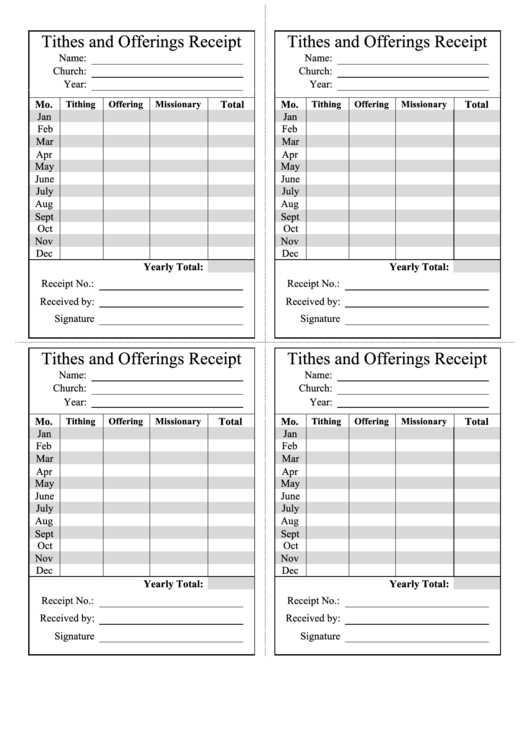

Make sure your church’s financial record-keeping is organized with a straightforward expense receipt template. This template can help track every church-related purchase, from supplies to services, ensuring accountability and transparency in all transactions. Include key details such as the date, description, total amount, payment method, and purpose of the expense to avoid confusion later.

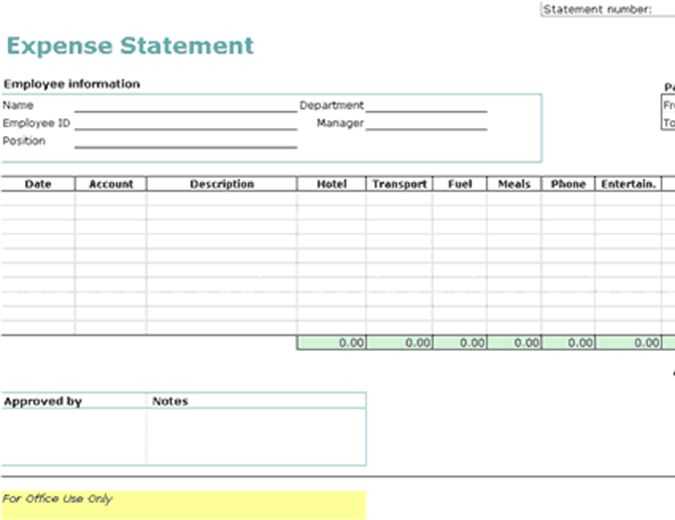

Break down expenses clearly by categorizing them. This can help simplify budgeting and reporting, especially when preparing for audits or financial reviews. Group expenses under headings like “Supplies,” “Maintenance,” and “Donations,” or according to the church’s specific needs.

Make your template easy to use for volunteers and staff by adding predefined fields for each category, making data entry straightforward. With accurate records, you ensure that no expense is overlooked, and you can keep track of your church’s spending at a glance.

Here’s the revised version of your lines:

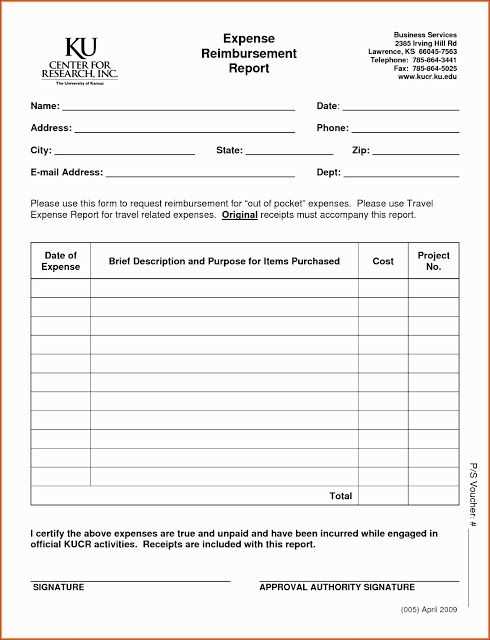

To ensure smooth processing of church expenses, an expense receipt template should be clear and concise. The layout must accommodate all necessary details, including the date, amount, vendor information, and description of the expense. This will help maintain transparency and simplify record-keeping for future audits.

Key Elements of the Template

The receipt template should include the following sections:

| Field | Description |

|---|---|

| Date | Indicates when the expense was incurred. |

| Amount | Shows the total cost of the expense. |

| Vendor | Name of the vendor providing the service or product. |

| Expense Category | Categorizes the type of expense (e.g., office supplies, utilities). |

| Description | Brief explanation of the purpose of the expense. |

Customization for Church Needs

Consider adding a field for the specific ministry or event the expense relates to. This can help with budget tracking and provide a clearer view of how funds are allocated. Additionally, ensure there’s a spot for signatures to confirm approval from authorized personnel.

- Expense Receipt Template for Churches

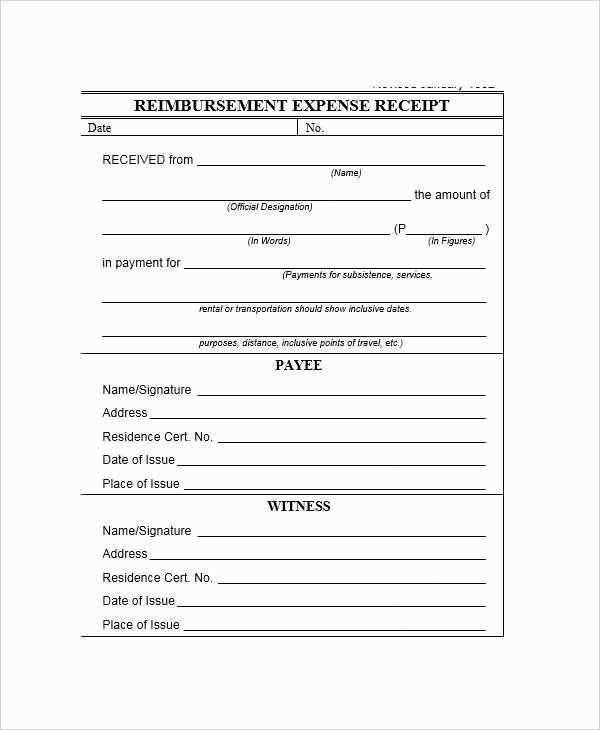

For churches managing their finances, using a clear and organized expense receipt template is key. Make sure your template includes the following elements: receipt number, date of purchase, detailed item description, vendor name, payment method, total amount spent, and the purpose of the expense (e.g., church event, operational costs). Ensure space for both the church’s details and the person responsible for the expense to sign and date the receipt.

Key Elements to Include

Include the following fields in your expense receipt template to keep records transparent and manageable:

- Receipt Number: For unique identification of each transaction.

- Date of Purchase: Always track when the expense occurred.

- Description of Item(s): A clear breakdown of what was purchased.

- Vendor Information: Name of the company or person providing the goods or services.

- Amount Paid: The exact cost of the purchase, including taxes if applicable.

- Purpose: Specify if it was for a church event, ministry, or general expenses.

- Signature: Both the recipient of the funds and the person authorizing the expense should sign the receipt.

Best Practices

Ensure receipts are clear, legible, and free of errors to prevent confusion during financial audits. Using consistent formatting for all receipts helps when tracking and organizing finances for future reference. Additionally, store receipts digitally alongside physical copies for quick access and secure storage.

Designing a simple expense receipt template for churches starts with clear structure. Include fields for key information: date, vendor name, description of goods or services, total amount, and payment method. Use a clean layout that is easy to read and fills out. Ensure that each receipt has a unique reference number for tracking purposes.

Key Elements to Include

Start with the header displaying the church’s name, address, and contact details. Underneath, provide a space for the date of the expense and the receipt number for easy reference. The vendor’s name and description of the service or product should follow, along with the total cost and payment method. Finally, add a section for the signature or authorization, especially if required by the church’s internal processes.

Design Tips

Keep the design minimalist to avoid clutter. Use a basic font and clear sectioning to ensure readability. Incorporating a logo or church emblem can add a professional touch, but ensure it doesn’t distract from the necessary information. Adjust the size of the text to fit the document well, ensuring it’s legible when printed or viewed on a screen.

Include the date of the transaction. This helps keep the records organized by time and is vital for audits and budget planning. Clearly list the amount spent and categorize it under the appropriate expense type, such as office supplies, utilities, or event costs.

Provide a description of the purchase. This could be a brief note about the item or service bought, making it easier to identify the nature of the expense later. Attach the name of the vendor or supplier to ensure transparency and clarity regarding where the funds went.

Include the payment method used, whether it was cash, check, or a credit card. This detail is essential for reconciling expenses and understanding the source of the church’s cash flow. If applicable, add an invoice or receipt number for easy tracking.

For tax purposes, include the church’s tax-exempt status number, if the purchase qualifies for tax exemption. This ensures that the transaction is properly documented for financial reporting and possible tax filings.

Label each receipt with a clear description of the expense and the date it was incurred. This simple step saves time during later audits or financial reviews.

Use categorized folders or digital folders to separate receipts by type, such as “Office Supplies,” “Event Expenses,” or “Utility Bills.” This minimizes confusion when reviewing finances.

For physical receipts, store them in a fireproof filing cabinet to ensure their safety from accidental damage. For digital receipts, back them up in the cloud or on an external drive to protect against data loss.

Scan and digitize all receipts. Optical character recognition (OCR) software can make this process quicker, allowing you to search receipts by keyword or amount later.

Implement a regular schedule for reviewing and updating your expense records. Assign a staff member or volunteer to ensure that all receipts are stored in the correct folder and that everything is up-to-date.

Consider using financial software or spreadsheets that integrate with your church’s accounting system. Many software options allow you to upload receipts directly, making tracking even easier.

Ensure all receipts are kept for the legally required retention period. In the U.S., for example, the IRS recommends keeping receipts for at least three years.

This keeps the meaning intact while avoiding repetition.

Ensure your church expense receipts have clear and accurate records. Include the date, description, and amount for each item. It’s also helpful to add the purpose or event associated with the expense. Categorizing expenses helps keep the records organized and easy to reference later.

- Include a section for the person or department responsible for the expense.

- Include any payment method details (e.g., cash, check, card). This provides transparency.

- For larger purchases, attach supporting documentation, such as invoices or quotes.

Be consistent with your format to make it easier for future audits or reviews. Refrain from cluttering the template with unnecessary details; keep the focus on the essential data. Using templates that are customizable for your specific needs will make the process smoother for everyone involved.