If you’re managing a flexible spending account (FSA) and need to submit child care expenses for reimbursement, a clear and detailed receipt is required. This template helps you quickly generate a printable child care receipt that meets FSA requirements, ensuring your claim process is smooth and hassle-free.

Using this template, you can include the necessary details such as the provider’s name, services rendered, and the dates of care. Each section is designed to align with the documentation needs of most FSAs, so you won’t have to worry about missing information that could delay your reimbursement.

By filling out the required fields with accurate data, you’ll have a ready-to-print receipt that meets the standards set by your FSA administrator. This tool can save you time and help prevent mistakes, allowing you to submit your claims with confidence.

Be sure to keep a copy of the receipt for your own records. When you are ready to submit, simply print it out and include it with your FSA claim submission. This template provides a straightforward, no-fuss way to manage your child care expenses and get reimbursed as efficiently as possible.

Here are the corrected lines with repeated words removed:

To generate an accurate child care receipt for your flexible spending account, ensure all fields are clearly filled out. Include the child’s name, care provider’s details, service dates, and total amount paid. Avoid repeating any information already listed elsewhere on the receipt. Be precise with the date and amount, as these are often scrutinized by FSA administrators. If the provider offers multiple services, each should have its own line without redundancy.

Service Description: Provide a clear and concise breakdown of the care given. Use specific language to describe each service provided without unnecessary repetition of terms.

Date: List the exact dates care was provided, ensuring no overlapping date ranges are mentioned more than once.

Amount Paid: Clearly state the total amount for each service, without repeating the figure in different sections of the receipt.

Provider Information: Double-check that the provider’s contact details (name, address, phone number) are listed once at the top or bottom of the receipt.

Signature: The receipt should be signed by the provider to validate the information. Ensure this is included without unnecessary phrases.

- Printable Child Care Receipt Template for Flexible Spending Accounts

To successfully submit a child care receipt for a Flexible Spending Account (FSA), the receipt must include specific details. A printable child care receipt template ensures that all necessary information is organized and meets FSA requirements. Use the template to avoid errors and streamline the submission process.

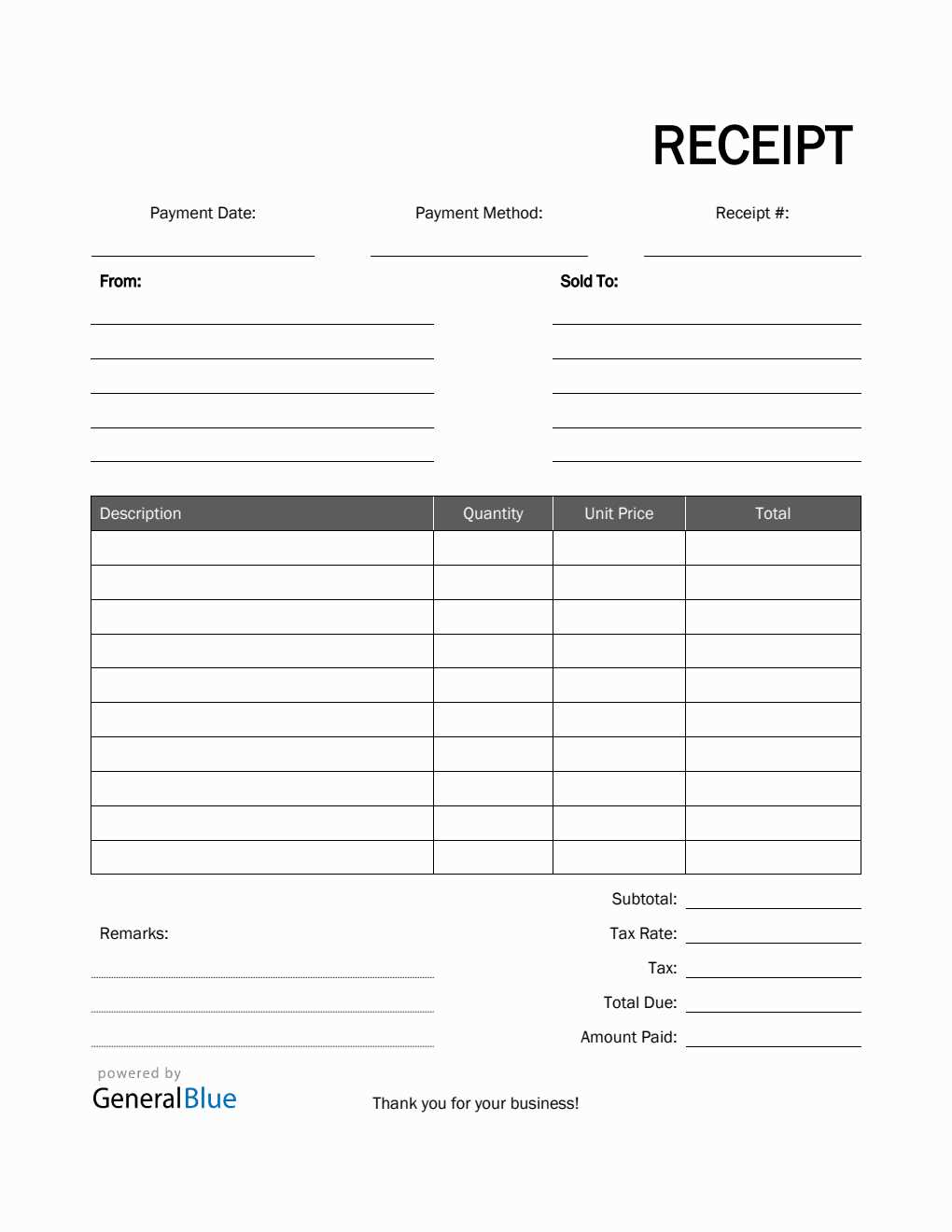

The template should feature the following fields:

| Field | Description |

|---|---|

| Provider Name | The full name of the child care provider or facility. |

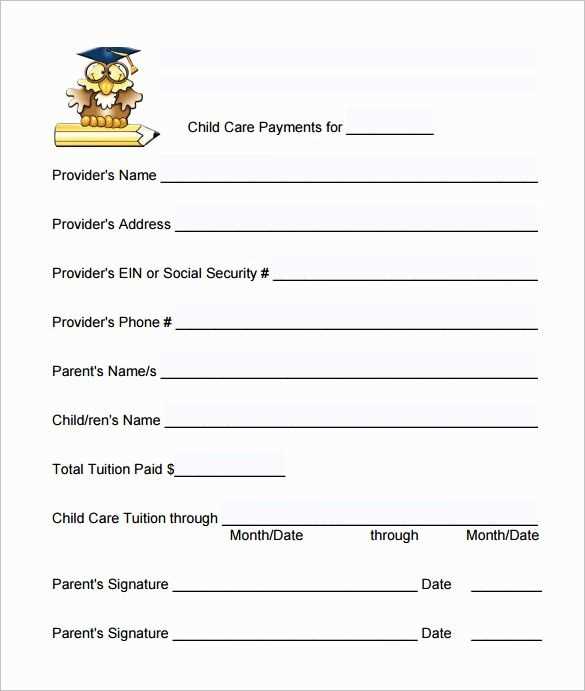

| Provider Tax ID or EIN | The provider’s tax identification number, essential for verification. |

| Child’s Name | The name of the child receiving care. |

| Care Dates | The exact start and end dates of the child care services. |

| Amount Paid | The total amount paid for services, with a breakdown if needed. |

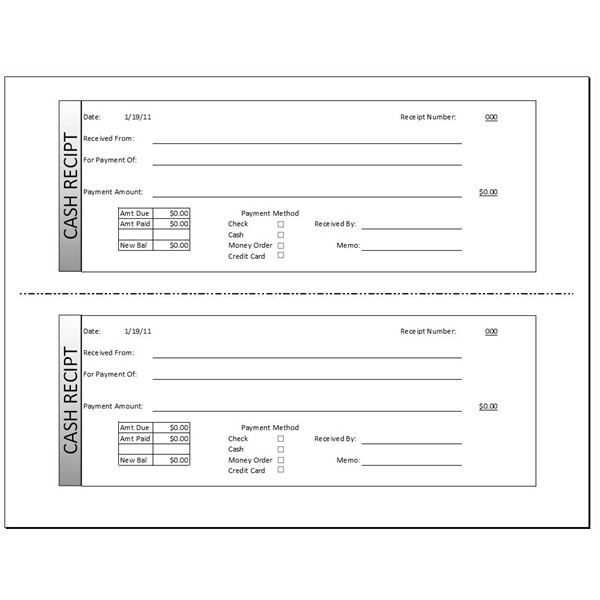

| Payment Method | How the payment was made (e.g., check, credit card, etc.). |

| Signature | A signature from the provider, confirming the services rendered and payment received. |

Ensure that the provider includes all these details to avoid delays in reimbursement. Some FSA administrators may require receipts to be submitted online, so it’s helpful to keep a digital copy of the printed receipt for quick submission.

By using a structured template, you minimize the chances of missing required information. This makes the approval process faster and hassle-free.

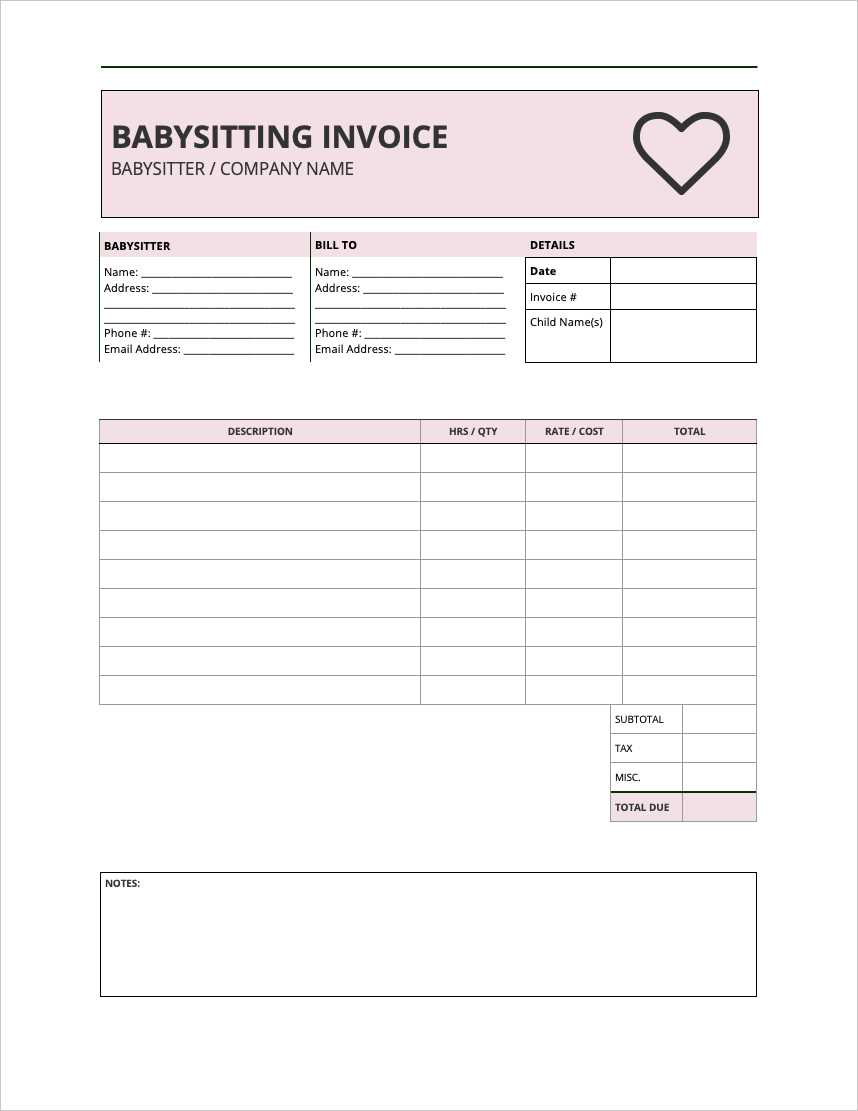

Design a receipt template that is simple and adaptable to accommodate different types of child care expenses for FSA claims. Focus on including all the required details, such as provider information, service dates, and charges, while leaving space for modifications when needed.

Essential Information for the Template

- Provider’s Information: Include the name, address, phone number, and email of the child care provider. This will help verify the legitimacy of the service.

- Dates of Service: Clearly indicate the start and end dates of the service period. This ensures the charges align with the claim period.

- Detailed Description of Service: Briefly describe the child care service provided. This is especially important if the FSA plan requires specific details about the type of care.

- Amount Charged: Include the total cost, separating any applicable taxes and fees. This allows for accurate processing of the claim.

- Payment Details: Include a receipt or transaction number, or other proof of payment. This adds an additional layer of verification.

Tips for Customizing the Template

Create a template that can be quickly edited to reflect changes in amounts or service periods. Use a table format for clarity and flexibility. Ensure each section is labeled clearly, with bold headers to make the information easy to locate.

Choose a file format that is easy to modify, such as Word or Excel. This will let you update fields without starting from scratch each time. Save the template as a PDF for submission to ensure the layout remains intact when printed or emailed.

To ensure smooth reimbursement for your child care expenses, make sure your receipt contains the following key details:

- Provider’s Name and Contact Information: The receipt should include the full name, address, and phone number of the child care provider. This confirms the legitimacy of the service and makes it easier to verify if needed.

- Child’s Name: Include the name of the child receiving care. This helps ensure that the reimbursement matches the correct dependent.

- Date(s) of Service: Clearly list the specific dates when child care was provided. If the service was for multiple days or sessions, break them down separately to avoid confusion.

- Amount Charged: Specify the exact amount you paid for child care services. If the payment covers multiple sessions, itemize the costs for each day or session.

- Service Description: Provide a clear description of the care provided, such as “Full-day child care,” “After-school care,” or “Preschool services.” This gives context to the charges and helps verify the nature of the service.

- Provider’s Tax ID or Social Security Number: Most flexible spending accounts require the provider’s tax identification number (TIN) or SSN for verification purposes. This ensures the receipt is valid for tax and reimbursement purposes.

- Signature or Stamp from the Provider: A signature or official stamp from the provider can serve as confirmation that the details on the receipt are accurate and that the service was rendered.

- Payment Method: Note how payment was made (e.g., check, cash, credit card) to match your records. This can help in case of discrepancies or future inquiries.

Why This Information Matters

Including all required details makes it easier to submit the receipt and get reimbursed without delays. Omitting information like the provider’s contact info or the dates of service can lead to rejections or requests for additional documentation. Be thorough and keep your records organized to avoid issues down the line.

Ensure that all the necessary information is clearly visible on your receipt. Missing details like the date, provider name, or amount can delay processing. Review your receipt thoroughly before submission to confirm that it includes all the required components.

1. Submitting Receipts Without Proper Itemization

Receipts for child care services must show a breakdown of individual expenses. Avoid submitting generic statements or receipts without itemized details, as FSA administrators need to verify specific charges. Include descriptions for each service or item billed to ensure quick approval.

2. Failing to Include a Detailed Provider Information

Make sure the provider’s name, address, and contact number are clearly visible. Receipts without this data could be rejected, as it is crucial for verifying the legitimacy of the expense. If this information is missing, request a new receipt from the service provider.

3. Not Double-Checking the Date

Always check that the date on your receipt aligns with the service period. FSA claims require services to have occurred within the eligibility period. If there is any discrepancy, your claim may be rejected or delayed.

4. Submitting Receipts for Ineligible Expenses

Double-check that the expenses submitted are eligible under your FSA plan. Child care services are usually covered, but expenses like late fees or charges for optional services may not be reimbursed. Review your FSA guidelines to avoid submitting ineligible receipts.

5. Missing or Incorrect Claim Form

When submitting receipts, include the correct claim form. Many FSAs require specific forms to be submitted along with receipts for reimbursement. Be sure to complete the form accurately to avoid unnecessary delays.

6. Forgetting to Keep Copies

Always make copies of receipts and claim forms before submitting them. If an issue arises or the receipt is lost, you’ll be able to provide the necessary documentation without delay. Digital copies are ideal for easy access and backup.

7. Submitting Receipts from Multiple Providers in One Claim

Submit separate claims for different providers, as mixing multiple providers in a single claim can complicate the review process. Keeping each claim specific to a single provider helps avoid confusion and reduces the risk of rejection.

8. Ignoring Submission Deadlines

Ensure that receipts are submitted within the designated time frame. Late submissions may be rejected, and you could lose the opportunity for reimbursement. Set reminders to stay on top of deadlines and submit claims promptly.

9. Overlooking Required Supporting Documentation

If your FSA requires additional documentation, like a care agreement or proof of relationship, don’t forget to include it. Failure to provide supporting documents could delay your reimbursement or cause the claim to be denied.

10. Submitting Receipts for Services Already Reimbursed

Avoid submitting receipts that have already been reimbursed. This could result in duplicate payments and require you to return funds. Check your reimbursement history before submitting any new claims.

Remove Redundant Repetition of “Child Care” and Keep the Meaning Intact

To avoid redundancy, focus on simplifying phrases by removing unnecessary repetition of “child care.” For example, instead of saying “child care services for children in child care centers,” use “child care services in centers.” This keeps the sentence concise without losing meaning.

Similarly, instead of repeating the term in phrases like “child care providers who offer child care,” simply write “child care providers.” This maintains clarity and ensures the message remains clear without being overly wordy.

By removing redundant words, you ensure that your writing is more streamlined, saving readers time while still conveying the necessary information. Make sure the context still supports the idea after shortening sentences to maintain their full meaning.