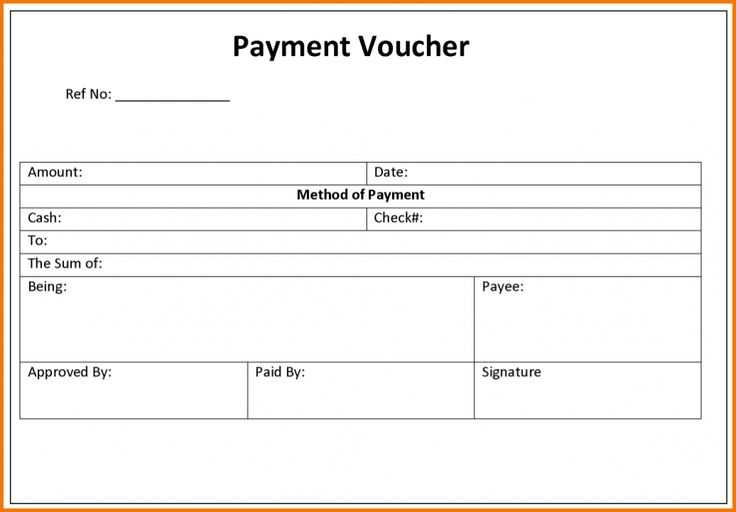

A clear and organized cash payment receipt template is crucial for both businesses and customers to track transactions. Use a simple format that includes the date of the transaction, the amount paid, and a unique receipt number. This ensures transparency and provides proof of payment for both parties.

Include fields for the payer’s name, description of goods or services rendered, and the method of payment (in this case, cash). Ensure that the amount received is clearly indicated, and leave space for any additional notes or tax details that may be relevant.

Having a template that automatically formats these details helps maintain consistency across all receipts. It also minimizes the chances of errors during manual entry, which can lead to confusion later. Use a professional font and layout, keeping it clean and easy to read for both you and your customer.

Here are the revised lines with minimized repetition:

For a clean and clear cash payment receipt, focus on structuring information efficiently. Avoid unnecessary duplication of data, which can confuse both the issuer and the recipient. Each line should serve a clear purpose, ensuring that the receipt is both concise and accurate.

Receipt Header:

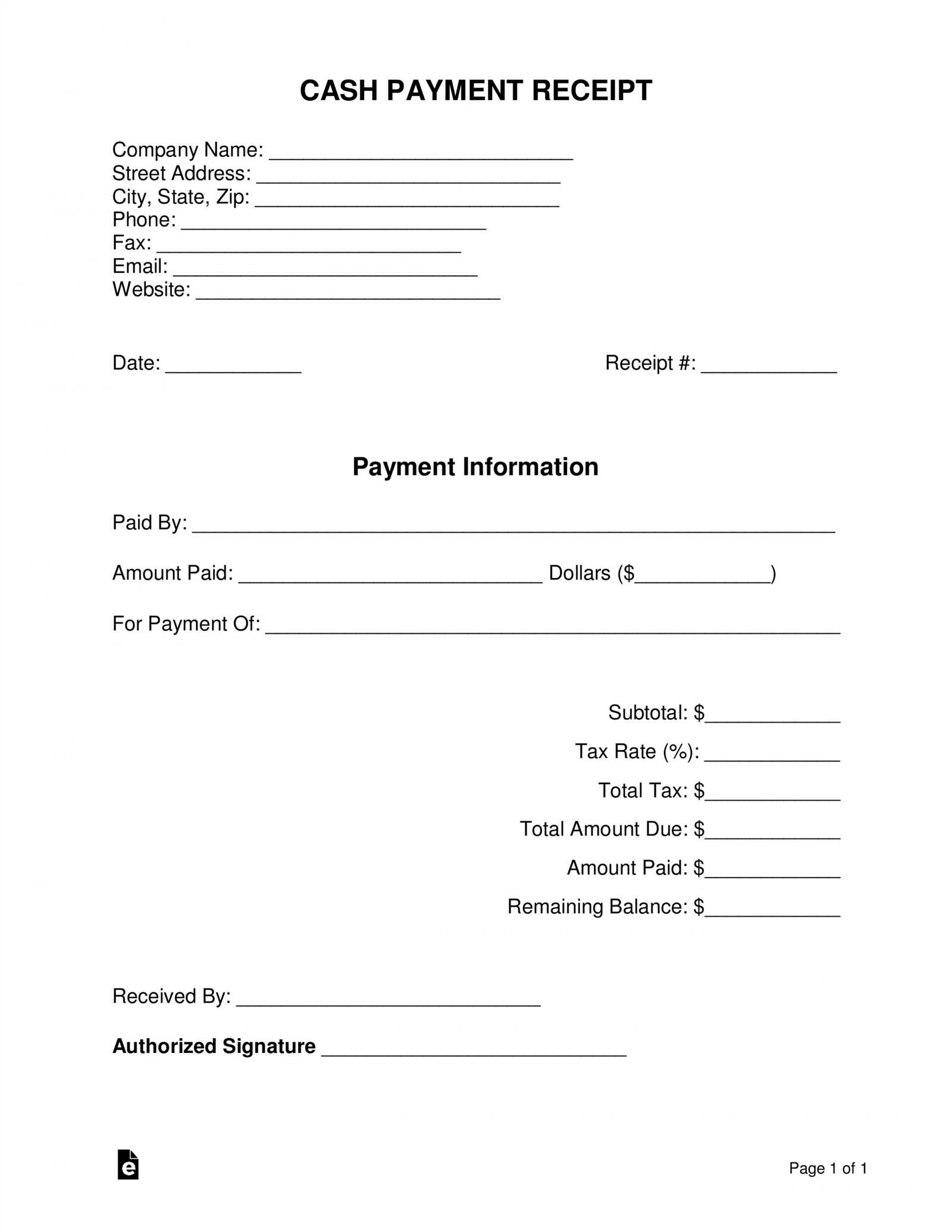

- Include only the necessary business information: name, address, and contact details.

- Place the transaction date and time in a single line rather than repeating them under separate headings.

- List the payment method in one sentence rather than rephrasing it elsewhere.

Transaction Details:

- Itemize purchased goods/services, specifying quantities and prices clearly.

- Avoid repeating “item” or “service” labels for each entry; use consistent terminology.

- Include the subtotal, taxes, and total amount once at the end to avoid redundancy.

Keep the layout simple, with each section clearly defined. By reducing repetitive phrasing, you create a more user-friendly receipt that is easy to read and understand.

- Cash Payment Receipt Template

A clear and straightforward cash payment receipt helps maintain transparency and record-keeping. It should contain specific details for both the payer and payee. Here’s a simple structure to follow when creating your own receipt:

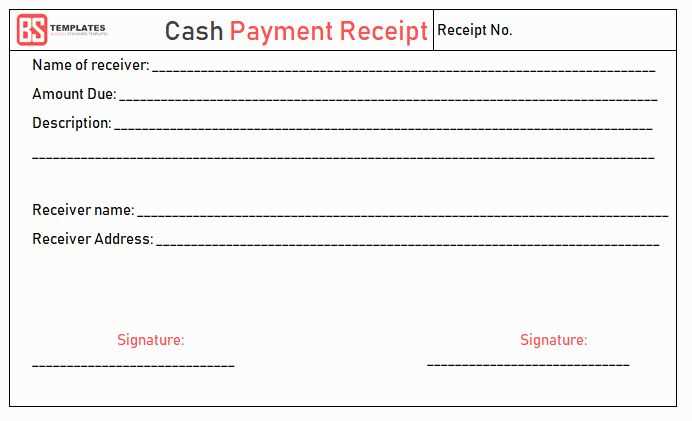

1. Receipt Header

Include a title at the top such as “Cash Payment Receipt” or “Receipt of Cash Payment” to immediately convey the purpose of the document. This should be followed by your business name, address, and contact details to confirm your legitimacy.

2. Payment Details

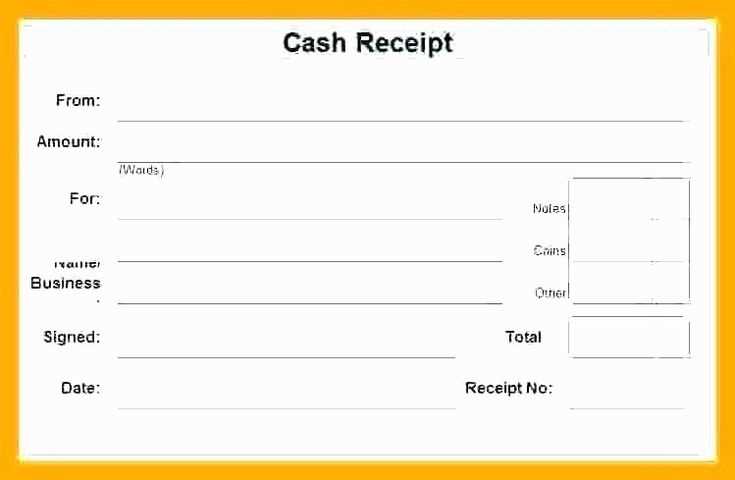

State the date of the payment and the exact amount paid in both words and figures. You should also specify the purpose or reason for the payment (e.g., purchase of goods, service fee). If applicable, include the invoice number or reference number for easy tracking.

3. Signatures

For additional validation, have both the payer and payee sign the receipt. This is particularly important if the payment is part of a business transaction or contract.

Use this template to create receipts that provide clear proof of payment and help maintain financial accuracy in your records.

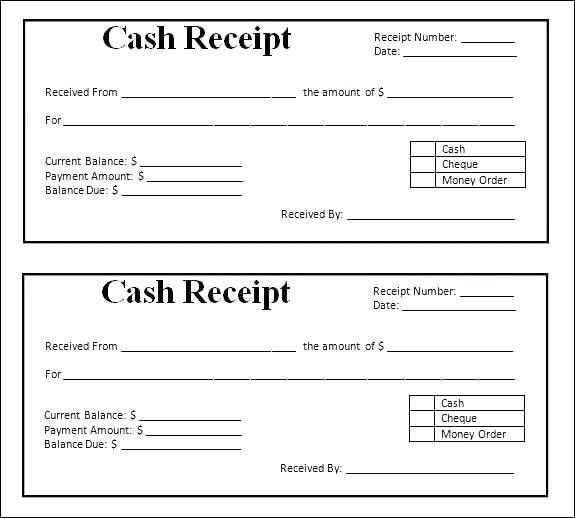

To create a simple cash receipt template, focus on including key details like the transaction date, payer’s name, amount paid, and payment method. Begin with a clear heading, such as “Cash Receipt,” at the top of your document.

For the transaction details, provide spaces for the following: date of payment, receipt number, the payer’s name, and the amount in both words and figures. Include a section for a brief description of the transaction or purpose of the payment.

Be sure to specify the payment method–whether it’s cash, credit, or another form. This adds clarity for both the payer and recipient. Additionally, leave room for the issuer’s name and signature to confirm the receipt.

Finally, consider using a table layout for organized presentation, placing labels for each section along with corresponding input fields or spaces to fill. Keep the design clean and straightforward for ease of use. Once the template is complete, save it in an editable format to use for future transactions.

For accurate transaction tracking, tailor the receipt to match the specifics of each sale. Include the item or service details, payment method, and any additional charges that may apply. For example, if there is a special promotion or discount, clearly state the discount amount and apply it to the final total. This ensures transparency for both the customer and your business.

For returns or exchanges, adjust the receipt to show the original purchase details, the refund amount, and any restocking fees, if applicable. This allows for an organized return process, avoiding confusion.

In the case of partial payments or installment-based transactions, include the total amount due, amount paid, and the outstanding balance. Providing clear due dates and payment schedules is key for future transactions.

| Item | Description | Price | Quantity | Total |

|---|---|---|---|---|

| Item 1 | Product Description | $50.00 | 1 | $50.00 |

| Item 2 | Service Description | $30.00 | 1 | $30.00 |

| Subtotal | $80.00 | |||

| Discount (5%) | -$4.00 | |||

| Sales Tax (8%) | $6.08 | |||

| Total | $82.08 | |||

For customized receipts, adding unique identifiers such as transaction numbers or dates will help in tracking specific transactions over time. This can be crucial for record-keeping and customer reference.

Start by using receipt management software that automatically generates digital receipts. These systems store transaction data, which reduces manual entry and ensures consistency. Select tools that integrate with your existing POS (Point of Sale) systems to automate receipt creation and emailing to customers. This method eliminates the need for paper receipts, which are often lost or misfiled.

Implement QR Codes for Easy Access

Integrating QR codes into your digital receipts allows customers to quickly access their payment history. QR codes can be scanned to retrieve a receipt online, minimizing storage space and physical clutter. Many POS software systems generate these codes automatically, linking to a cloud-based receipt that customers can view or download anytime.

Adopt Cloud-Based Solutions for Seamless Storage

Cloud storage options make it easy to store and manage payment receipts in one central location. These solutions offer secure backups, ensuring receipt data is protected. They also enable easy retrieval and sharing, which is valuable for accounting and auditing purposes. Set up automatic synchronization with your sales systems to eliminate manual upload processes.

Automating payment receipt generation and storage saves time, reduces errors, and improves your overall workflow. Consider integrating these tools to streamline your processes and enhance customer satisfaction.

Receipt Template for Cash Payments

When creating a cash payment receipt template, ensure it includes all relevant details such as the transaction date, payer’s information, item or service description, and the total amount paid. This ensures clarity and legality, especially for record-keeping purposes.

Key Information to Include

Include the following elements in your template:

- Receipt Number: Helps with organizing receipts in a sequential order for easy tracking.

- Date and Time: Record the exact time of the transaction to avoid confusion.

- Payer’s Details: Name, address, or contact number if applicable for identification.

- Items/Services Provided: Specify each product or service purchased with clear descriptions.

- Total Amount Paid: Clearly state the cash amount paid to avoid disputes.

Formatting Tips

Make sure the template is easy to read. Use a simple layout with enough space between each section. Bold the transaction total and highlight the receipt number for easy reference. Consistent alignment and font size also enhance readability.