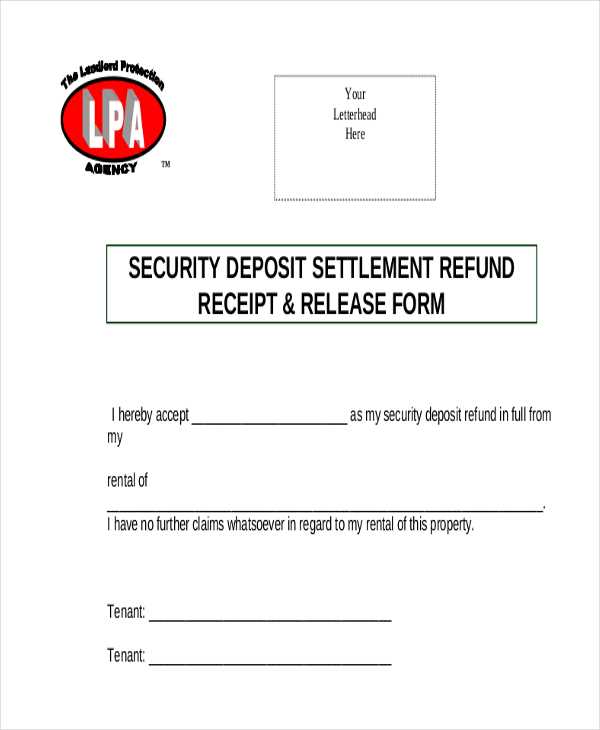

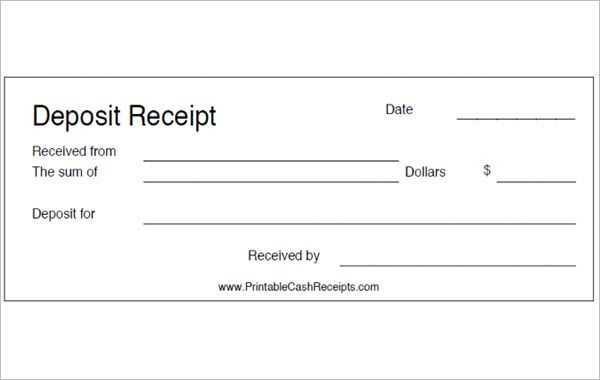

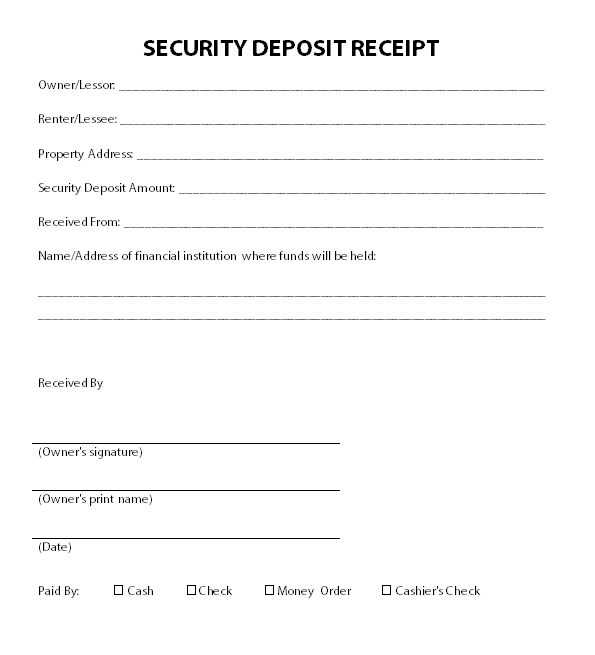

To create a security deposit receipt, make sure it includes the necessary details: tenant’s name, rental property address, the deposit amount, and the payment date. This receipt acts as proof of payment and helps avoid future disputes about the deposit amount or its return.

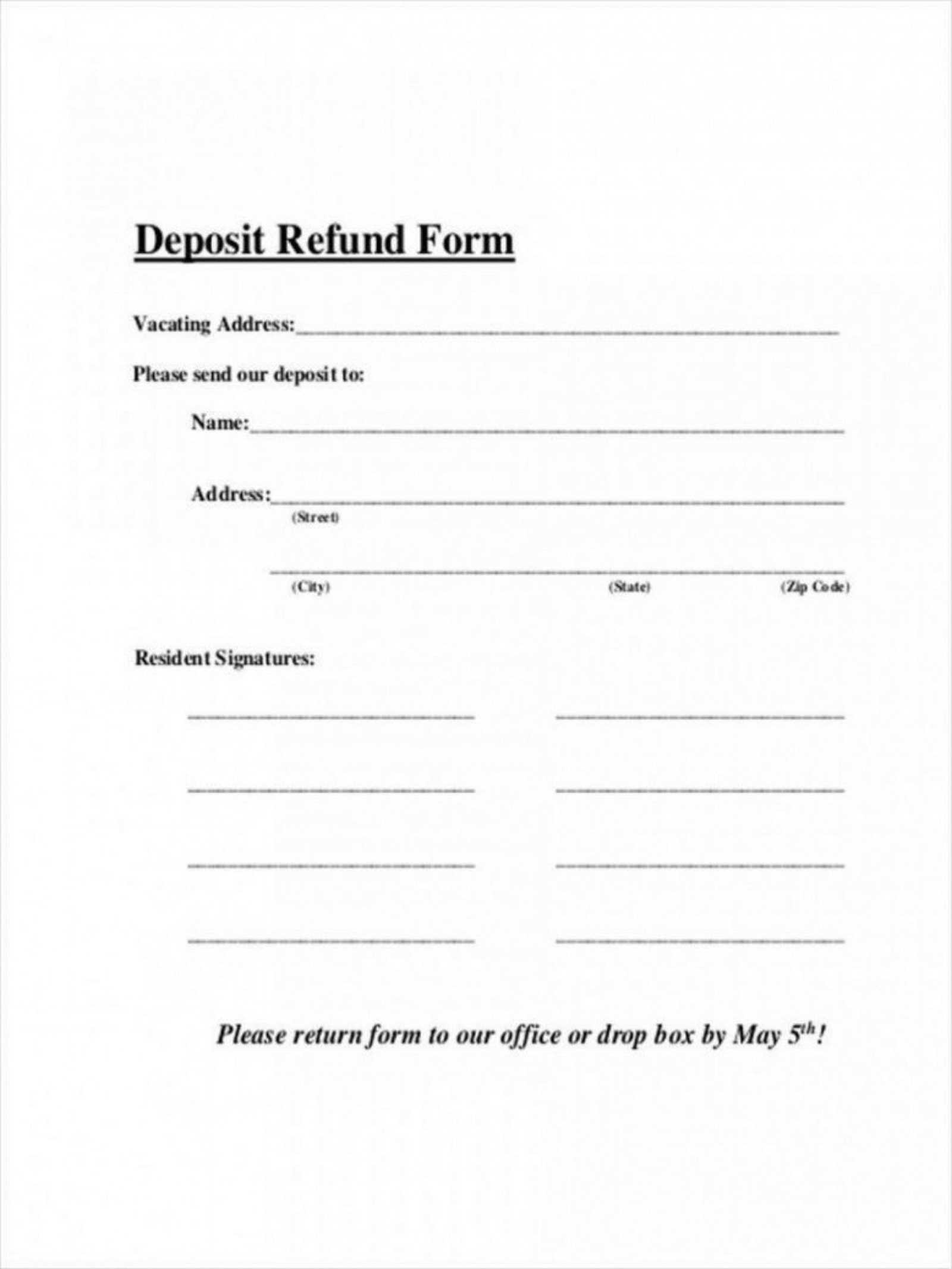

Use a clear and simple format. Include a section specifying whether the deposit is refundable and outline the conditions for its return. Mention the timeframe in which the landlord intends to return the deposit, as well as any deductions for damages or unpaid rent, if applicable.

By using a security deposit receipt template, both landlords and tenants maintain transparency and can refer back to the document when needed. Having this documentation in place ensures smooth communication and legal protection for both parties involved.

Here’s how to rephrase sentences, keeping the meaning intact while avoiding repetition:

To reduce redundancy, replace similar phrases with synonyms or restructure sentences. For example, instead of saying “the full amount of the deposit,” use “the total deposit.” Change passive voice to active voice for clarity and directness. “A receipt was issued” can become “We issued the receipt.” Also, avoid repeating the same words in adjacent sentences. Use variations like “security deposit” and “payment” to convey the same idea without sounding repetitive. Break up longer phrases into simpler ones. For instance, “The security deposit has been fully refunded as per the terms” can be shortened to “The deposit was refunded according to the terms.” This makes the text easier to follow and keeps the reader engaged.

Use context to eliminate unnecessary words. If a receipt is already understood as confirming payment, phrases like “this receipt serves as proof of payment” become redundant and can be shortened to “this receipt confirms payment.” Also, replace “issued a receipt for the deposit” with “provided a receipt for the deposit.” This eliminates repetition without losing meaning.

Another technique is combining ideas. Instead of saying “the security deposit has been paid,” followed by “we acknowledge the receipt of the payment,” combine them into “we acknowledge the payment of the security deposit.” This maintains clarity while reducing the length of the text.

Got it! Are you looking for something specific related to the Can-Am Maverick parts diagram or do you need assistance with the ACLS practice tests? Let me know how I can help!

Designing a custom security deposit receipt requires a few key components to ensure clarity and legal protection. Focus on including all the necessary information, such as the amount of the deposit, the purpose, and any terms related to its return.

1. Include Basic Information

The receipt should start with identifying details: the names and addresses of both parties (tenant and landlord), as well as the date of the transaction. Make sure to clearly state the security deposit amount and the property address for reference.

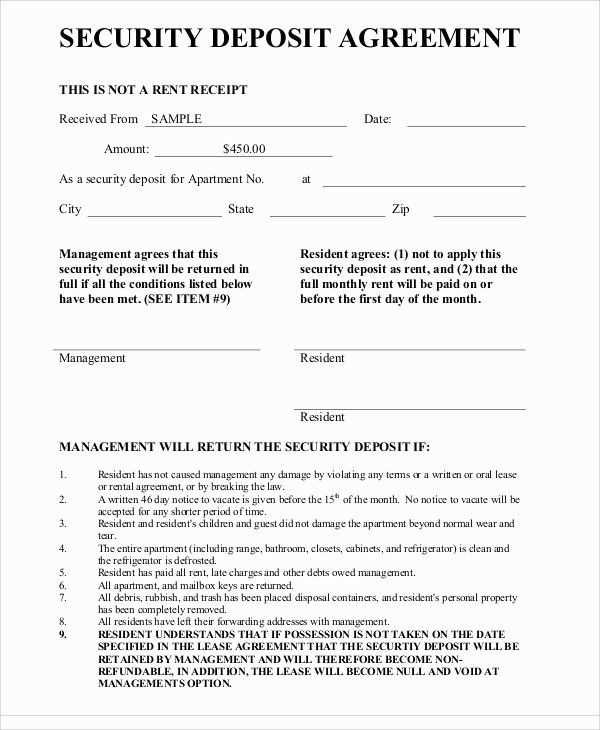

2. Detail the Terms of the Deposit

Outline the specific conditions for the return of the deposit. Mention any potential deductions for damages, unpaid rent, or cleaning fees. This ensures both parties understand what circumstances could affect the refund.

3. Add Signature Lines

Provide space for both the landlord and tenant to sign the document. This confirms mutual agreement to the terms set out in the receipt. Consider adding a date next to each signature to track when the receipt was signed.

Once these elements are in place, you will have a clear, legally sound receipt that can serve as proof of the deposit transaction.

Clearly specify the full names and contact details of both the landlord and the tenant. This helps to establish a legal connection between the parties involved and ensures clear identification in case of disputes. Include the address of the rental property to avoid any confusion about which property the deposit is associated with.

Amount and Purpose of the Deposit

State the exact amount of the security deposit paid. Be sure to specify whether the deposit is for damages, cleaning, or other purposes, as this can influence how it is returned or withheld at the end of the lease.

Deposit Payment Details

Note the date on which the deposit was received, along with the payment method used (e.g., cash, check, bank transfer). This record helps to confirm that the payment was made and provides a clear paper trail in case of future disputes.

Finally, include any relevant state or local laws governing security deposits. Different areas may have specific rules about how deposits should be handled, returned, and any interest that may accrue. Mentioning these laws ensures both parties are aware of their rights and obligations.

Always double-check the amount of the security deposit recorded on the receipt. A simple typo can cause confusion and lead to disputes. Ensure that the total matches the amount agreed upon by both parties in the contract.

Failing to Include Date and Transaction Details

Never omit the date the security deposit was received. Without it, tracking the payment becomes difficult, especially if any issues arise in the future. Similarly, include the transaction method (e.g., cash, check, or credit card) for clarity.

Not Providing Enough Identification Information

Don’t forget to include full details of the involved parties, such as names and addresses. These details protect both the landlord and tenant, ensuring clear identification in case of disputes.

Security Deposit Receipt Template: Key Points

When drafting a security deposit receipt, focus on clarity and the inclusion of crucial details. Ensure the document reflects the amount paid, the property it relates to, and the terms under which it was received. These elements help avoid confusion or disputes down the line.

- Amount and Payment Date: Clearly state the total amount received and the date of the transaction.

- Parties Involved: List the names of the landlord (or agent) and tenant, specifying their roles.

- Property Description: Include a brief but precise description of the property covered by the deposit.

- Purpose of Deposit: Indicate the purpose of the deposit, typically to cover potential damages, unpaid rent, or other liabilities.

- Refund Conditions: Outline the conditions under which the deposit will be refunded, such as after a property inspection.

- Signatures: Both parties should sign and date the receipt to confirm their understanding and agreement.

By keeping these points in mind, the receipt will serve as an effective document for tracking deposits and protecting both parties in the transaction. A well-structured receipt reduces potential misunderstandings, ensuring a smooth rental experience.