For tax purposes, having a clear and professional rent receipt is key. A rent receipt not only confirms payments but also serves as proof of deductible expenses for renters and landlords alike. A simple template can ensure both parties are on the same page when it comes to tax reporting.

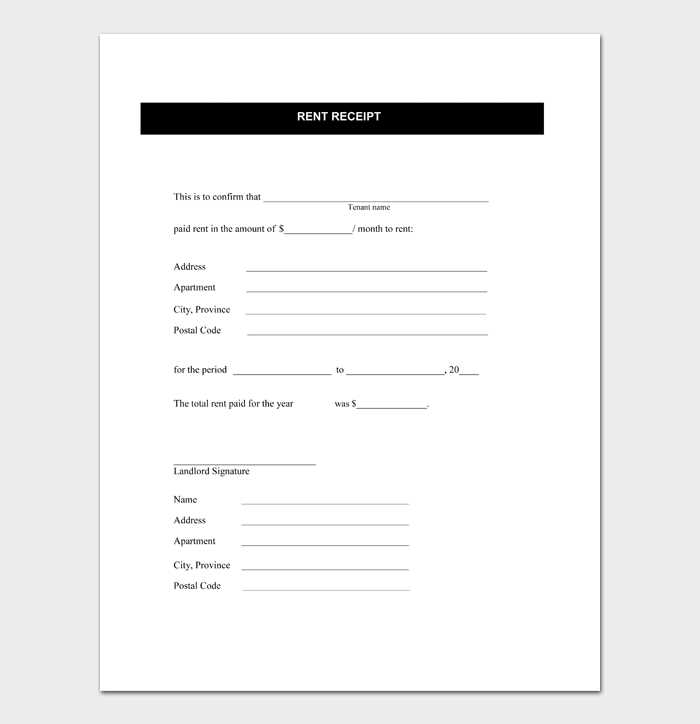

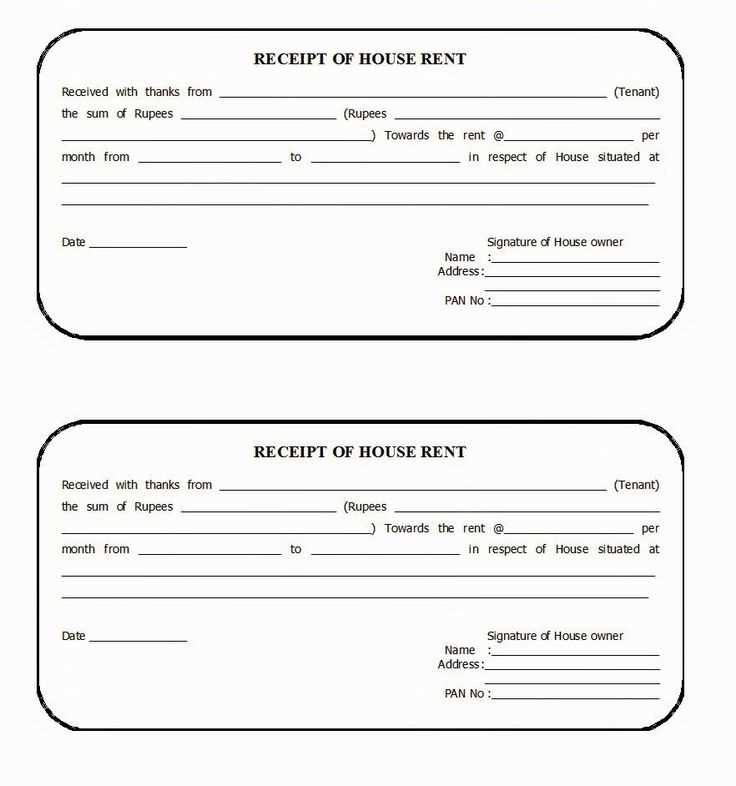

A well-designed rent receipt should include the tenant’s name, the address of the rental property, the amount paid, the date of the payment, and the rental period covered. Don’t forget to include the landlord’s signature or an official statement confirming the payment was received. This creates an official record that can be referenced during tax season.

Using a rent receipt template for taxes helps maintain accuracy and avoid disputes. The receipt should be easy to read and standardized across all transactions, making it easier for both parties to manage their tax filings. If you’re a landlord, having a template ready will save time and ensure consistency in your records.

Here’s the corrected version:

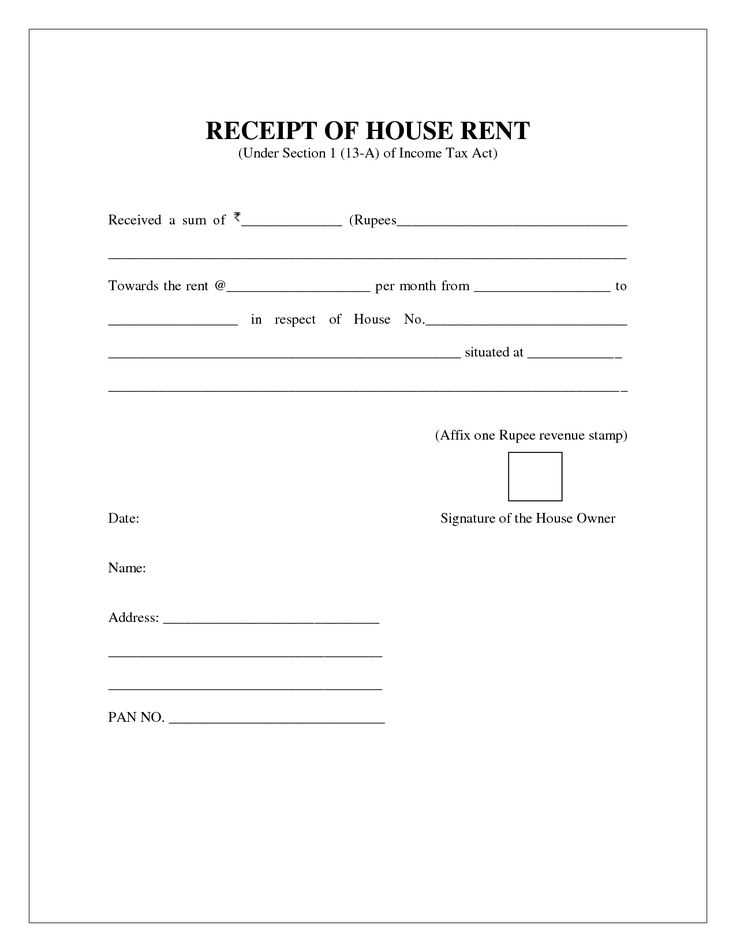

Ensure that your rent receipt includes specific details to meet tax requirements. Begin with the landlord’s name and contact details, followed by the tenant’s name. Include the property address to clarify the rental location. Specify the rent amount paid, the payment method, and the payment date. If the payment covers multiple months, indicate this clearly. Lastly, include a signature or an authorized representative’s name for verification. This structure will help you stay organized and ensure that all necessary information is included for tax purposes.

For additional clarity, note whether the rent includes utilities or other services. If so, list them separately on the receipt to avoid confusion later. This can also affect tax deductions, so documenting everything in detail is critical. Be sure to issue a receipt for each transaction to keep clear records.

Rent Receipt Template for Taxes

A rent receipt template for taxes should include specific details to ensure clarity and meet IRS requirements. The template should have the following sections:

- Landlord’s Information: Name, address, and contact information of the landlord.

- Tenant’s Information: Name and address of the tenant paying the rent.

- Rental Property Details: Address of the rental property and unit number if applicable.

- Payment Details: The amount of rent paid, the payment date, and the period the payment covers (e.g., monthly, weekly).

- Signature: The landlord’s signature to verify the transaction.

Make sure to use a clear and professional format, and keep a copy for your records. This template is helpful for tenants to claim tax deductions for home office expenses or other rental-related tax benefits. For landlords, it serves as a record of rent received for tax purposes.

Include specific rent details in your receipt to ensure it is tax-ready. Start with the exact amount of rent paid for the period, clearly stating the amount in both numerical and written form. This helps avoid any confusion during tax filing.

Details to Include

Clearly list the address of the rental property, including the unit number, street, city, and postal code. This identifies the rental location. Add the exact rental period (e.g., from January 1st to January 31st) and the payment date. If the rent includes any additional fees (such as utilities or parking), itemize these separately.

Additional Tips

Provide your contact information and that of the landlord or property manager. Include their name, address, and phone number for verification purposes. It’s also helpful to include the payment method (e.g., check, cash, bank transfer) to ensure a complete record.

To ensure the legal validity of a rent receipt, include the tenant’s full name, address of the rental property, and rental period. The payment amount must be clearly stated, alongside the payment date and the method of payment (e.g., cash, cheque, bank transfer). A signature from the landlord confirms the authenticity of the receipt, and this step should never be overlooked.

Rental Amount and Payment Details

The receipt must include the exact rent amount paid and any additional charges (such as utilities or maintenance fees) to avoid confusion. Clearly mention if the payment covers a part of the rent or if it’s for the full term. The landlord’s acknowledgment of payment is critical for both parties in case of future disputes.

Rental Agreement Reference

Referencing the rental agreement or contract within the receipt adds another layer of clarity and establishes a direct link between the payments and the terms set out. This can be crucial for both tax reporting and legal purposes, especially if the tenancy details change over time.

Make sure the date is correct. Many people overlook this simple detail, but an incorrect or missing date can lead to complications when filing taxes.

Incomplete or Vague Descriptions

Always provide clear descriptions of the rent or service. Avoid using vague terms like “payment” or “deposit” without specifics. Include the rental period, address, and the nature of the payment. This helps provide context to the transaction and can prevent confusion with tax authorities.

Omitting Landlord or Tenant Information

Include full names, addresses, and contact details for both the landlord and tenant. Missing this information makes the receipt incomplete, which can raise questions during tax filing or audits.

| Common Mistakes | How to Avoid |

|---|---|

| Incorrect Date | Double-check the date before printing. |

| Vague Descriptions | Provide specific details about the rental and payment. |

| Missing Contact Information | Ensure all relevant contact details are included. |

Lastly, ensure the receipt has a clear breakdown of amounts paid. Tax authorities may require detailed information, especially if you claim deductions for rental income. A poorly structured or ambiguous receipt can delay the process or even cause issues with deductions.

Rent Receipt Template for Taxes

A rent receipt for taxes should clearly outline key details to ensure proper documentation. Here’s what to include:

- Tenant’s Name: Always list the full name of the tenant paying rent.

- Landlord’s Name: Include your full name or business name as the landlord.

- Rental Property Address: Provide the complete address of the rental property.

- Amount Paid: State the exact amount of rent paid by the tenant.

- Date Paid: Note the specific date the rent payment was made.

- Payment Method: Specify how the payment was made, e.g., check, cash, or bank transfer.

- Rental Period: Indicate the period the payment covers, such as the start and end dates of the rental month.

- Signature: Your signature confirms the transaction was completed.

Ensure the format is clear, concise, and easy to read. It’s recommended to use a template for consistency and accuracy, particularly when handling multiple tenants.