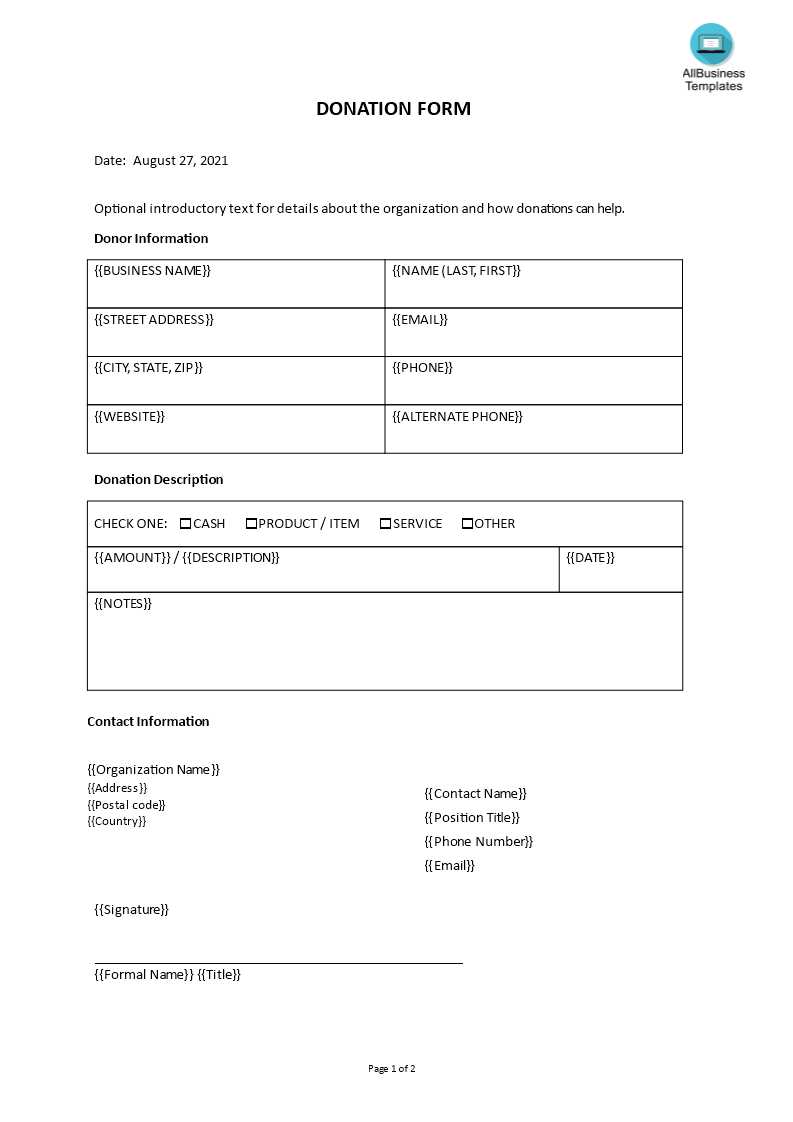

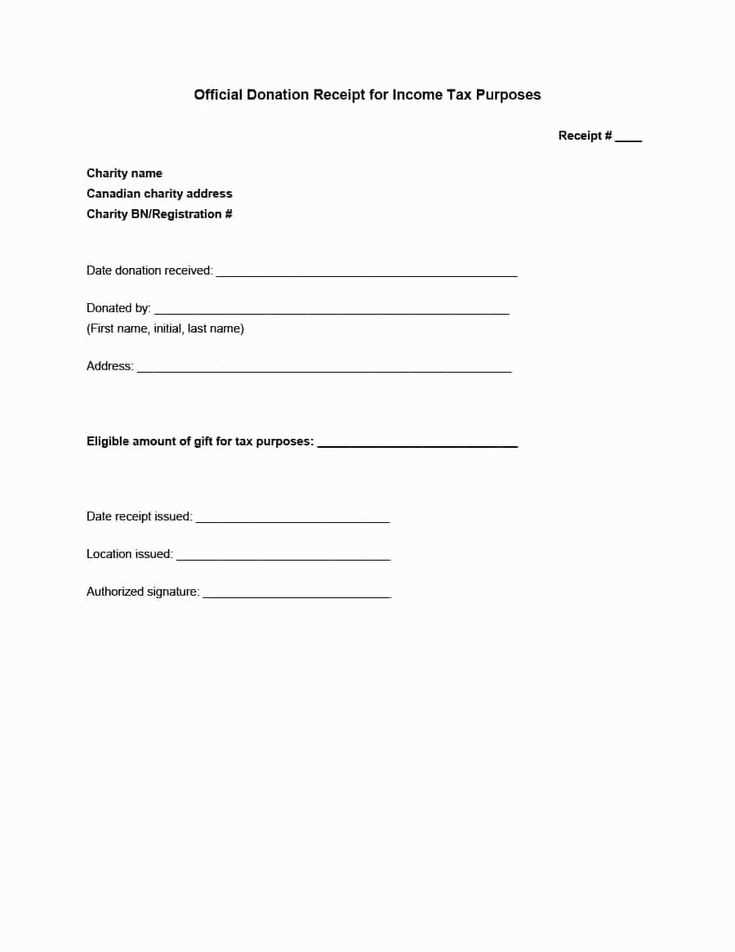

To create a simple and clear good will receipt, make sure to include key details that both parties can easily understand. Start with the donor’s name and contact information, followed by a description of the donated items, their condition, and approximate value. This not only provides transparency but also helps in case the donation is used for tax purposes.

Specify the date of the donation and include a statement confirming that no goods or services were provided in exchange for the donation, as this ensures the donor’s contribution is tax-deductible. Make sure the receipt is signed by an authorized representative of the receiving organization to give it legal validity.

It’s also useful to include a brief thank-you message that acknowledges the donor’s generosity. This small gesture goes a long way in maintaining good relations and encouraging future donations.

How to Create a Simple Good Will Receipt

Begin by clearly stating the donor’s name and the recipient’s name at the top of the receipt. Include the donation date and a description of the items or services given. If it’s a monetary donation, list the amount along with a note confirming that the donor received no goods or services in exchange for the contribution.

Itemizing Donations

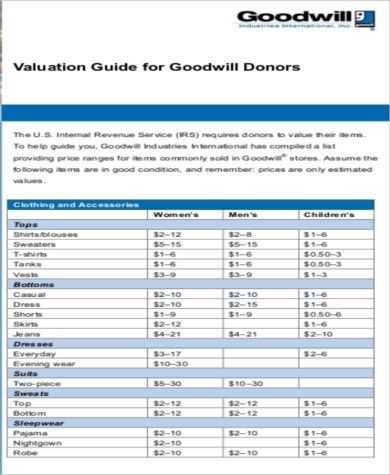

If the donation involves multiple items, list each item separately, providing a brief description and estimated value. Avoid overvaluing donated goods; use fair market value for each item. If the donation is not itemized, include a general statement, such as “various household items” or “clothing donation.”

Receipt Confirmation

Conclude with a statement confirming the receipt of the donation. Include a signature line for the recipient’s representative to sign and date the document. Always provide a copy of the receipt to the donor for their records.

Key Elements to Include in Your Receipt

Include the date of the transaction. This helps both parties track the exchange and serves as a reference for future follow-ups.

Clearly state the name and contact details of the giver or organization. This provides legitimacy and allows the recipient to reach out if needed.

Detailed Description of the Donation

Be specific about the items or services donated. For physical goods, list the quantity, type, and condition. For services, describe the type of service provided and any associated value if relevant.

Value of the Donation

Include a fair estimate of the donation’s value. If it’s a cash donation, list the exact amount. If it’s in-kind, provide an approximate value based on market standards or appraisals.

State the purpose of the donation. Clarifying the intended use helps confirm that the donation was made for charitable or goodwill purposes.

Common Mistakes to Avoid When Writing a Good Will Receipt

Do not forget to include specific details about the gift. Clearly state the item or amount received, including any relevant identifiers such as serial numbers or descriptions. This helps avoid confusion and ensures both parties are on the same page.

Avoid vague language. Use precise wording when describing the gift. Phrases like “various items” or “some money” leave too much room for misinterpretation. Always be specific about what has been given and received.

Do not omit the date. Always include the date the gift was received. Without this, it’s harder to track the transaction, which may cause future issues when verifying records.

Don’t forget to include the full names of the giver and recipient. Ensure both parties are clearly identified with their full legal names. This provides clarity and prevents disputes over the authenticity of the receipt.

Be mindful of signatures. Both the giver and the recipient should sign the document. Lack of signatures can undermine the validity of the receipt, leaving it open to questions of authenticity.

Do not overlook the context of the gift. If there are any conditions attached to the gift, such as the giver wanting the item returned, this must be mentioned. Leaving out important conditions can lead to misunderstandings.

Don’t ignore the format. Ensure the receipt is clear and easy to read. Disorganized receipts can lead to errors, especially when the document needs to be referenced in the future. Keep the layout simple and the text legible.

Refrain from adding unnecessary details. Stick to the basics. Including extraneous information that doesn’t directly relate to the gift can confuse or complicate the receipt, which defeats its purpose.