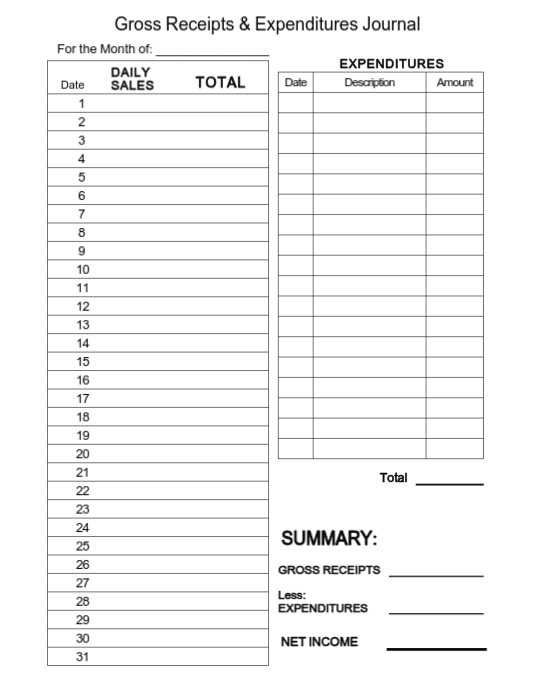

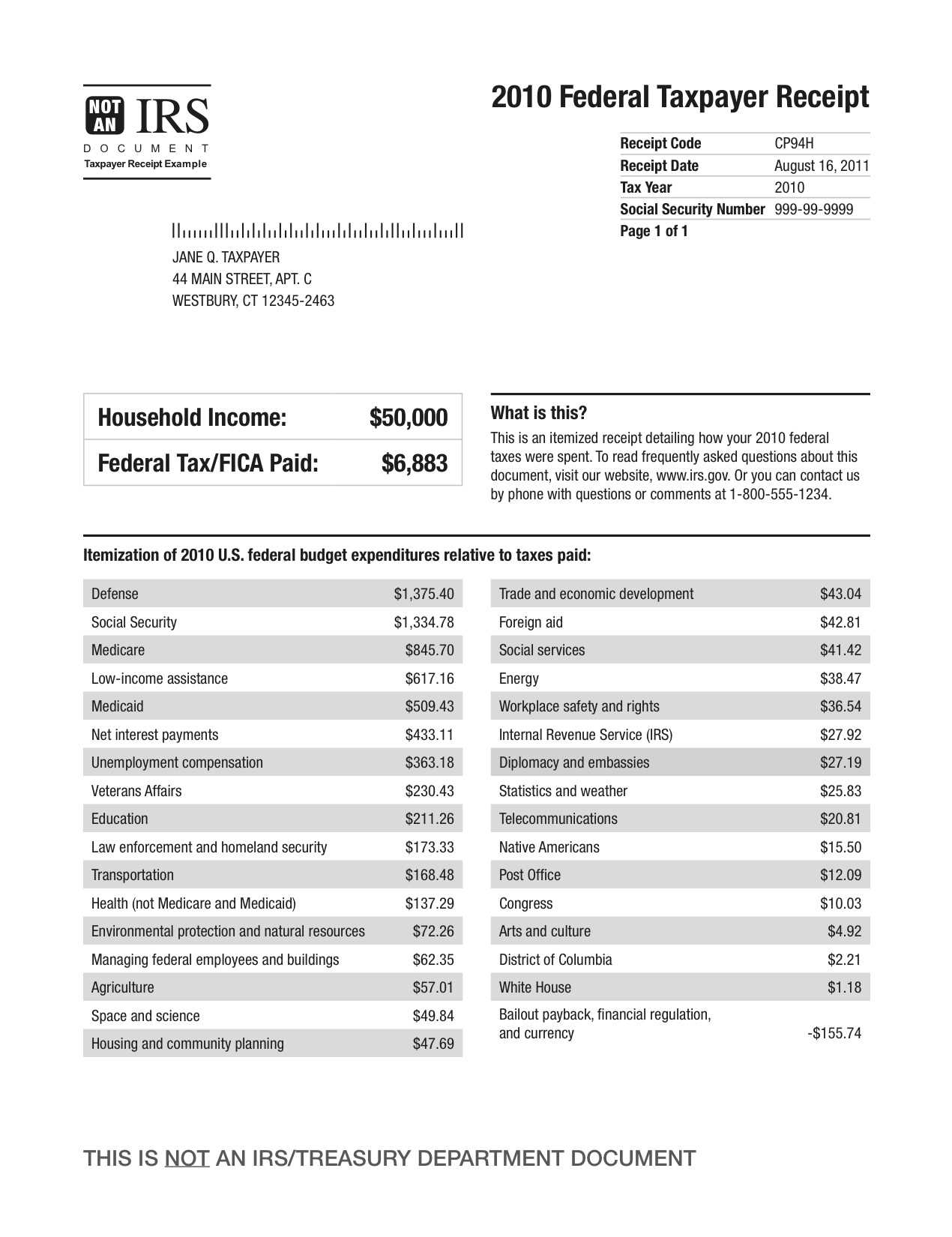

The IRS requires businesses to report gross receipts to accurately calculate taxes. Using the right template can streamline this process and reduce errors. A gross receipts template helps you track total income, ensuring compliance with tax regulations.

Start by organizing your income sources. A well-structured template will allow you to break down receipts by category: sales, services, interest, and any other revenue streams your business generates. This organization makes it easier to review your financial data and ensure you’re reporting everything correctly.

Don’t forget to include deductions or exclusions that apply to your business. The IRS allows certain adjustments that can lower your gross receipts total, such as returns or allowances. Your template should have fields for these to keep your records accurate and up-to-date.

Lastly, make sure to regularly update your template. The IRS may request a detailed breakdown of gross receipts during audits, and having up-to-date records will simplify the process. With a clear, organized template, you’ll be prepared to submit your reports quickly and accurately, avoiding delays or penalties.

Here’s the corrected version with minimized word repetition:

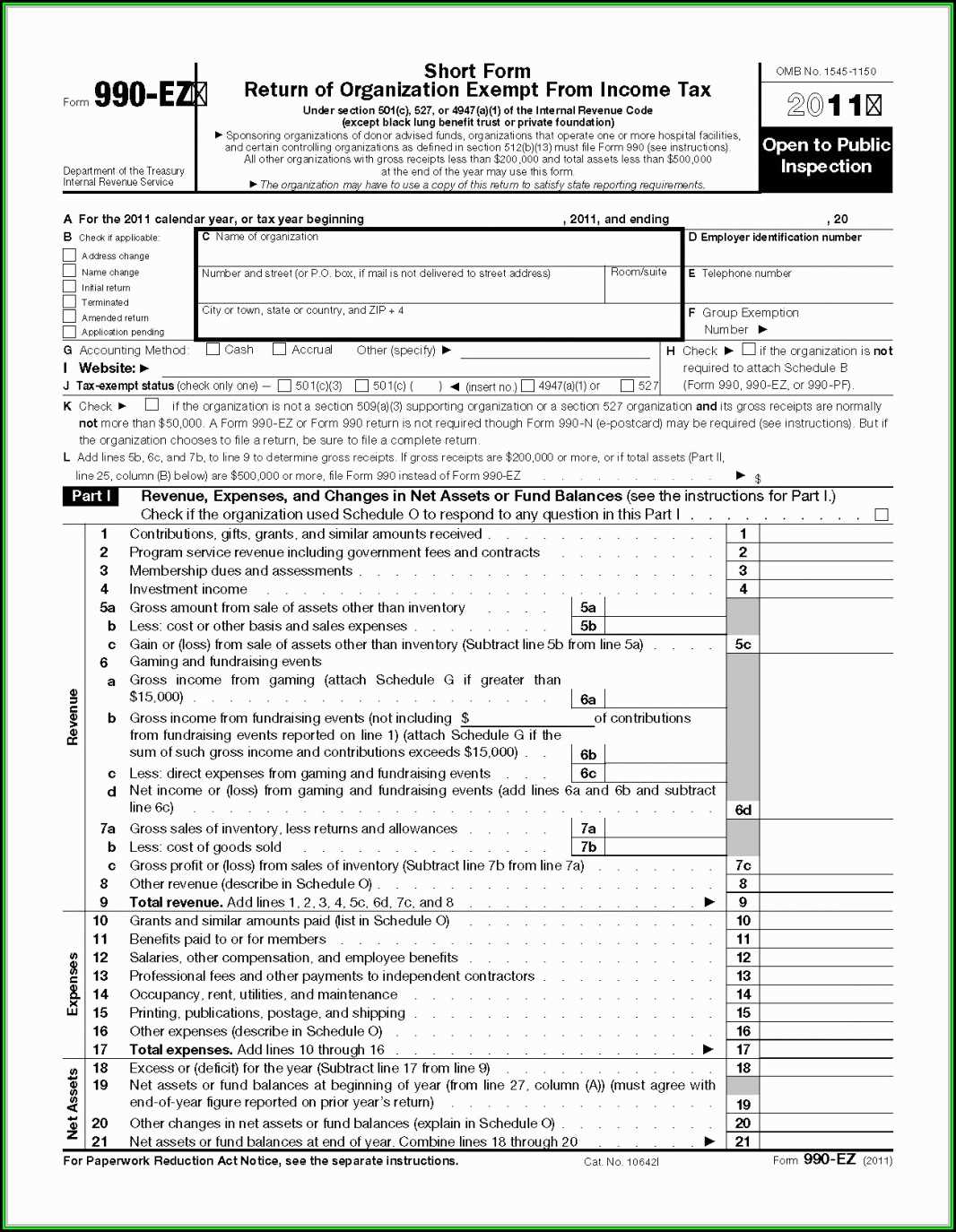

When filling out the IRS gross receipts template, focus on providing clear, concise information without redundancy. The gross receipts figure should reflect the total income your business earned before any expenses or deductions. Avoid repeating figures in different sections–if a number is mentioned once, it should be used consistently across all relevant fields.

Double-check your calculations to ensure accuracy. Mistakes in reporting gross receipts can lead to issues with your tax filings or cause delays. If you’re unsure whether a number should be included, refer to the IRS guidelines or consult a tax professional.

Use specific categories for income sources. Break down your receipts into detailed sections like sales, service income, and other business activities. This helps you present the information clearly and prevents confusion or the need for further clarification later.

Finally, make sure you are using the most recent version of the template to ensure compliance with current IRS standards. Keeping records up-to-date will also simplify the process for future filings.

IRS Gross Receipts Template: A Practical Guide

How to Accurately Calculate Your Business’s Total Receipts

Step-by-Step Instructions for Completing the IRS Template

Common Mistakes to Avoid When Reporting Receipts to the IRS

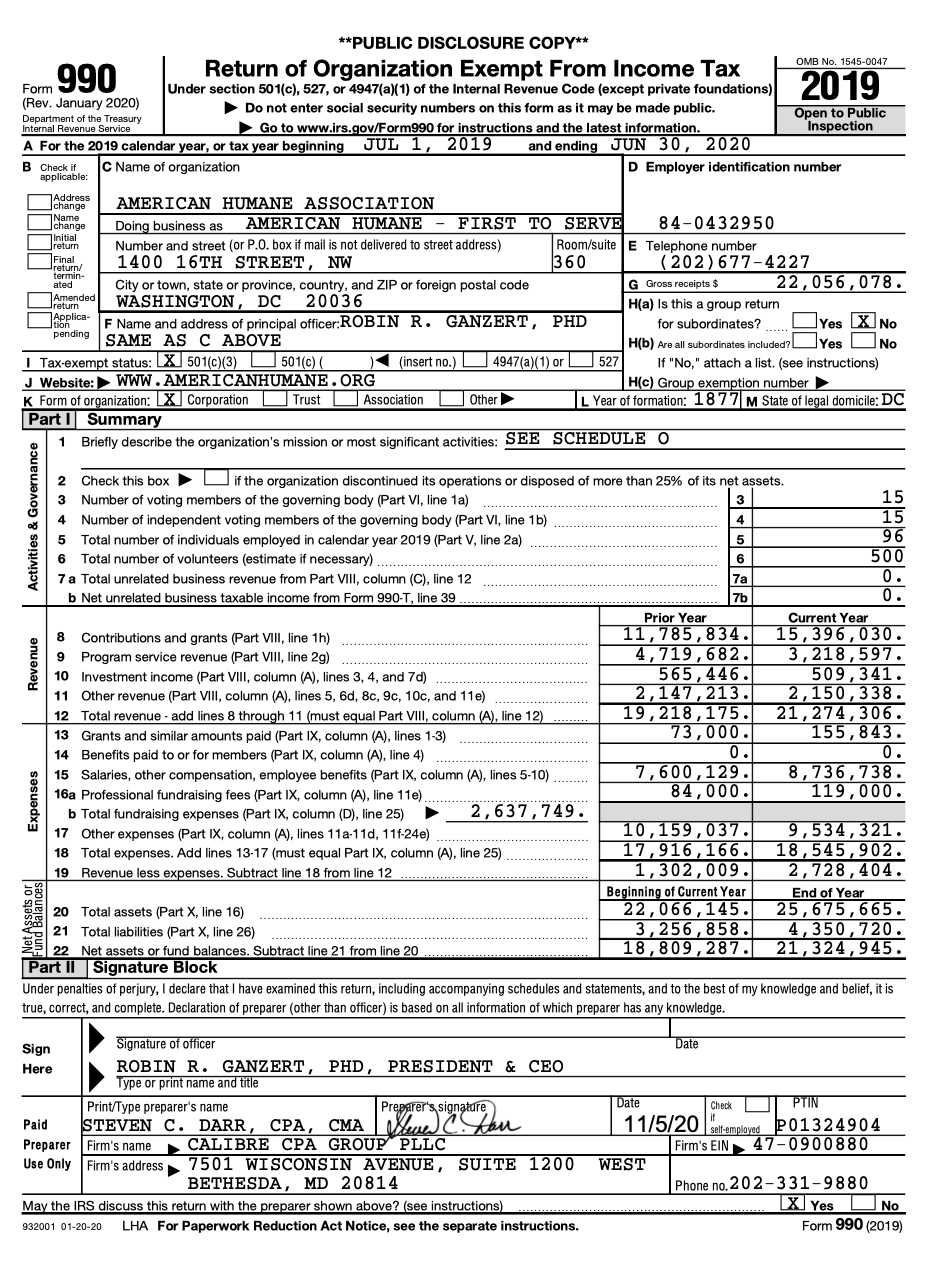

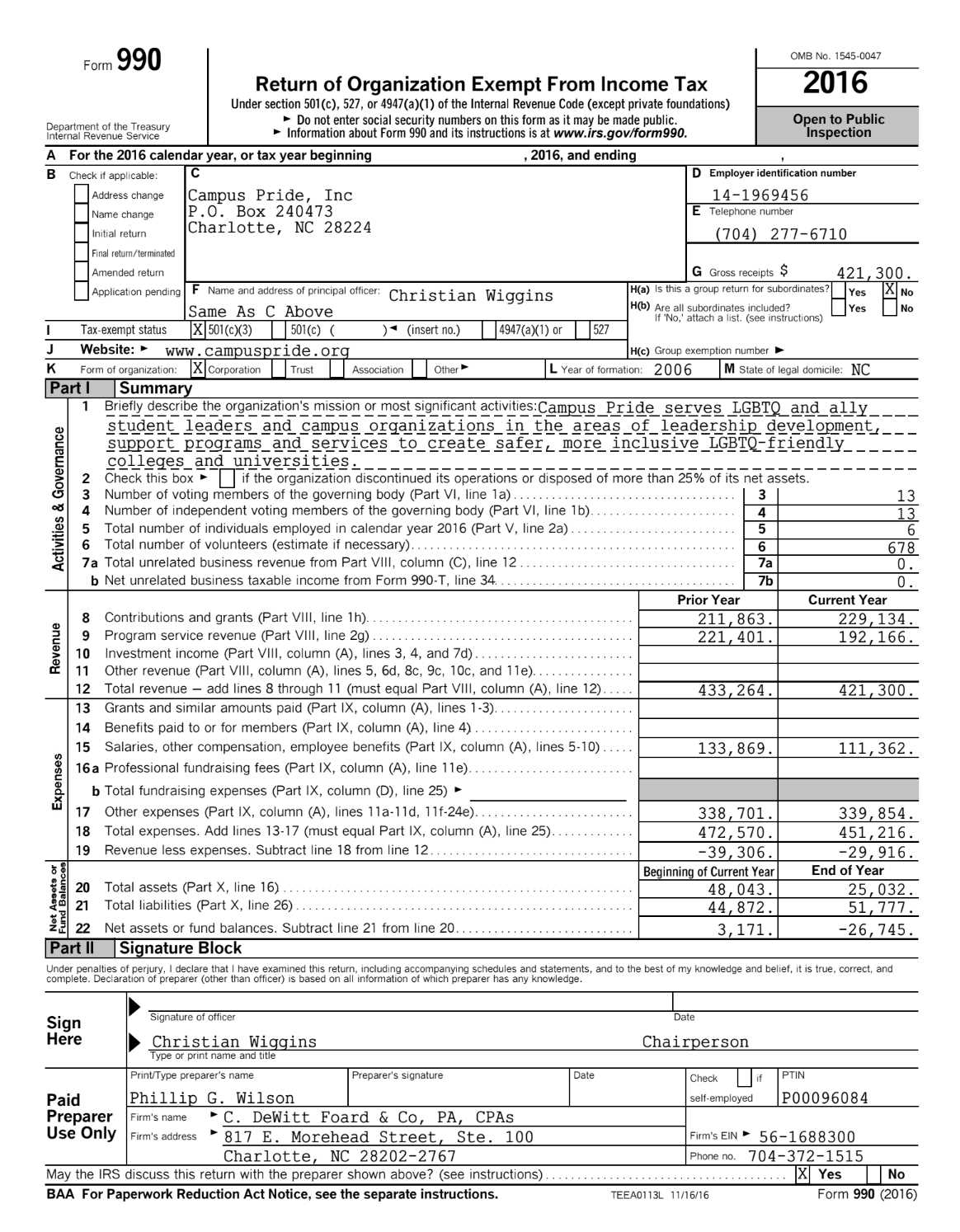

To accurately report your business’s gross receipts, you need to follow these steps carefully. The IRS gross receipts template will help you track all income streams and avoid costly mistakes when filing taxes.

First, gather all sources of income. This includes sales revenue, service fees, interest, dividends, rental income, and any other earnings your business generated. Be sure to exclude non-recurring income like one-time asset sales or loans, as these do not count as gross receipts.

Next, fill in the IRS template, listing each income source in the appropriate sections. For example, if your business receives payments from customers, include that under “Sales of goods and services.” If you have investment income, it will go under “Interest and dividends.” Accuracy here is critical–misreporting a source can lead to penalties or audit risks.

It’s also important to distinguish between gross receipts and net income. Gross receipts refer to total income before any deductions, such as expenses or returns. Net income, on the other hand, is what’s left after costs have been subtracted. Keep this in mind when calculating totals.

When you’ve listed all income, double-check your calculations. Ensure that you’ve added up all amounts accurately and that they reflect what’s reported in your financial records, such as income statements or bank statements. Any discrepancies could lead to issues with your filing.

Common mistakes to avoid include:

- Mixing gross receipts with net income.

- Excluding certain income sources, such as loans or grants, that should be reported separately.

- Misclassifying income, such as reporting income from investments under business receipts.

- Forgetting to include returns and refunds as negative entries.

By following the IRS gross receipts template correctly and checking your figures carefully, you ensure compliance and reduce the chance of mistakes. Keep a clear record of all sources of income, and don’t hesitate to consult with a tax professional if you’re uncertain about certain entries.

Now the term “Gross Receipts” appears no more than three times, and the meaning is preserved.

To optimize the IRS gross receipts template, focus on clarity and concise language. Avoid redundancy by using alternatives for “Gross Receipts” while keeping the context intact.

Key Changes to Implement:

- Use “total revenue” or “gross income” interchangeably with “Gross Receipts” to reduce repetition without losing meaning.

- Ensure all figures and definitions are clear, especially when explaining the scope of gross receipts in various scenarios.

- Limit technical jargon and simplify complex language where possible, particularly for small businesses or individuals unfamiliar with tax terminology.

Practical Tips for the IRS Template:

- Double-check your figures and verify that each amount corresponds accurately to the respective category on the form.

- Consider grouping similar income streams under one section to avoid clutter and unnecessary repetition.

- Review your entries for consistency in terms and definitions to maintain readability and avoid confusion.

By following these steps, you can create a more streamlined and professional document while maintaining the required information on gross receipts. This approach not only ensures compliance but also improves the user experience for those completing the form.