If you’re handling financial transactions, using a bond receipt template can save both time and effort. A well-structured template ensures that all relevant details are recorded, providing clarity and transparency for both parties involved. This type of document acts as proof of a bond being received and can help avoid disputes later on.

The key components of an effective bond receipt template include the full names of the involved parties, the bond amount, the purpose of the bond, and the date of receipt. Including these details guarantees accuracy and can serve as a reference in future interactions. Additionally, having a clear, organized format contributes to better record-keeping practices, which can be invaluable for businesses or individuals managing multiple transactions.

To make your bond receipts more functional, ensure that the template allows space for any additional notes or specific conditions related to the bond. This flexibility can accommodate various needs, whether you’re handling a personal loan, security deposit, or contractual bond. By using a free bond receipt template, you streamline the process and keep everything professional and well-documented.

Here’s the corrected version with repetitions removed:

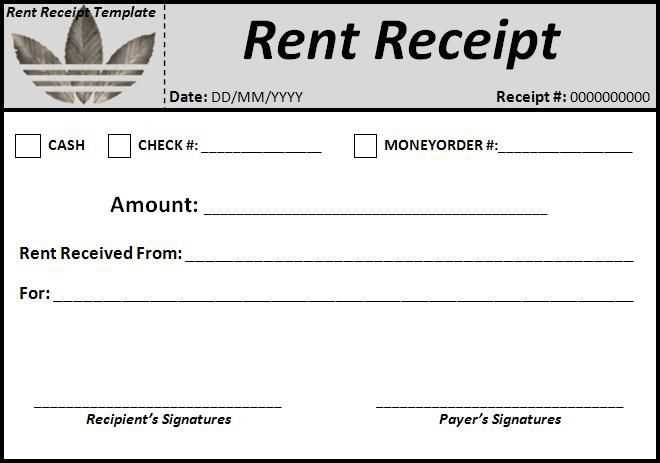

To streamline the process of creating a bond receipt, ensure the template clearly outlines the necessary details. Start with the full name of the issuer and recipient. Include the amount of the bond, along with the agreed terms of repayment. Specify the date of issue and the due date for repayment. Adding both parties’ signatures at the end can also ensure legal validity.

Key Components to Include:

- Issuer’s Full Name: Clearly identify the party issuing the bond.

- Recipient’s Full Name: Include the person or entity receiving the bond.

- Bond Amount: State the exact amount being issued.

- Terms of Repayment: Outline how and when the bond will be repaid.

- Issue Date: Indicate the date the bond is issued.

- Due Date: Specify the due date for repayment.

- Signatures: Both parties should sign the document to validate the bond.

By keeping the structure simple and clear, you ensure the bond receipt is both functional and legally sound. Avoid unnecessary jargon and focus on the key details to make it easy to understand and execute.

Free Bond Receipt Template: A Practical Guide

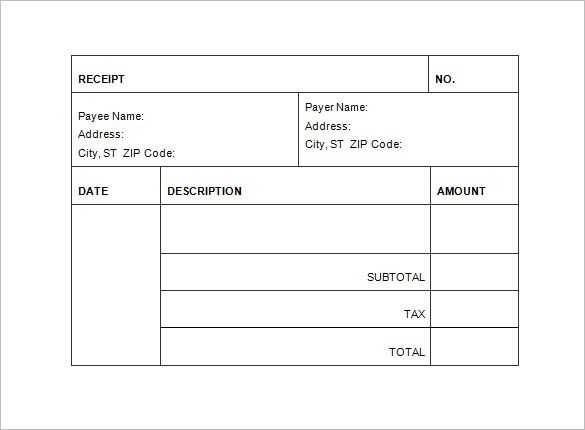

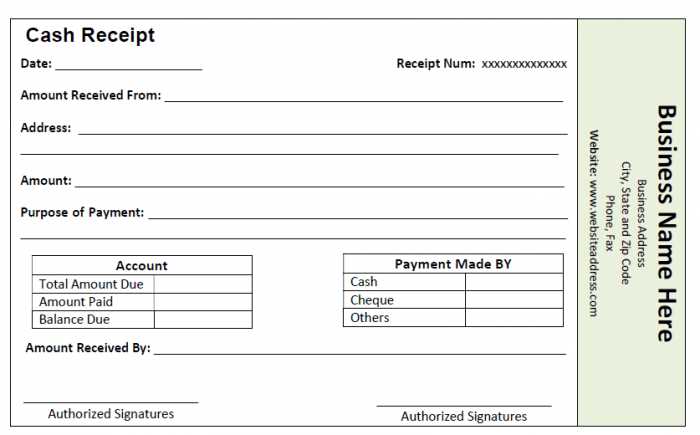

Create a straightforward bond receipt template by including key elements such as the bond number, the amount received, the date of payment, and the names of both the payer and the payee. These details ensure clarity and legal validity. Additionally, include the purpose of the bond and any specific terms or conditions related to the payment. This structure minimizes errors and makes the receipt clear for both parties.

When drafting a bond receipt, avoid common mistakes like leaving out essential details or using ambiguous terms. Ensure the bond number and amount are clearly stated to prevent confusion. Refrain from using vague language regarding the purpose of the bond–being specific helps avoid potential legal disputes. Check for any typographical errors, as these can affect the receipt’s legitimacy.

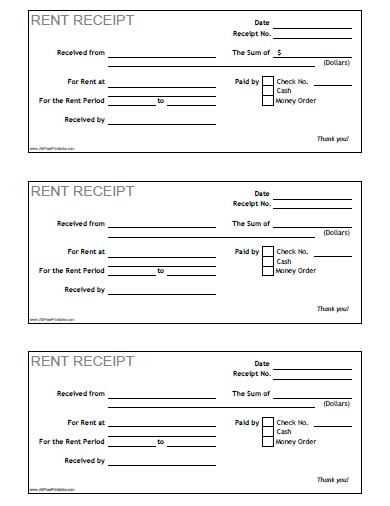

To make your template versatile, tailor it for different bond types by adjusting fields as needed. For instance, a rental bond receipt may require additional sections for rental property details or the landlord’s contact information. Similarly, a surety bond receipt might need to reference the parties involved in the guarantee. Customizing your template for various uses helps streamline the process while maintaining legal accuracy.