If you’re a landlord or a tenant in India, creating a rent receipt can streamline your rental transactions. This document is essential for maintaining clarity and transparency for both parties. It provides a written record of payment, which can be useful for tax purposes and legal matters. Here’s a simple template to follow when preparing rent receipts.

Start by including the landlord’s name and tenant’s name clearly at the top of the receipt. This ensures that both parties are identified and their details are properly recorded. Then, list the amount paid, the date of payment, and the rental period being covered (such as from the 1st to the 30th of the month).

It’s important to include the address of the property to avoid any confusion about the location of the rental agreement. Also, make sure to specify the payment method–whether it was via bank transfer, cheque, or cash–to keep a proper financial record.

Finally, add a signature from the landlord or the authorized person, confirming the receipt. This adds authenticity and ensures that the document holds up in case of any disputes. Keep it simple and to the point, but make sure all relevant details are covered for a professional, valid record.

Here are the revised lines with reduced repetition:

For tenants and landlords in India, it’s essential to ensure clarity and accuracy when preparing a rent receipt. A well-crafted template simplifies the documentation process and helps avoid confusion. Here’s a streamlined format to follow:

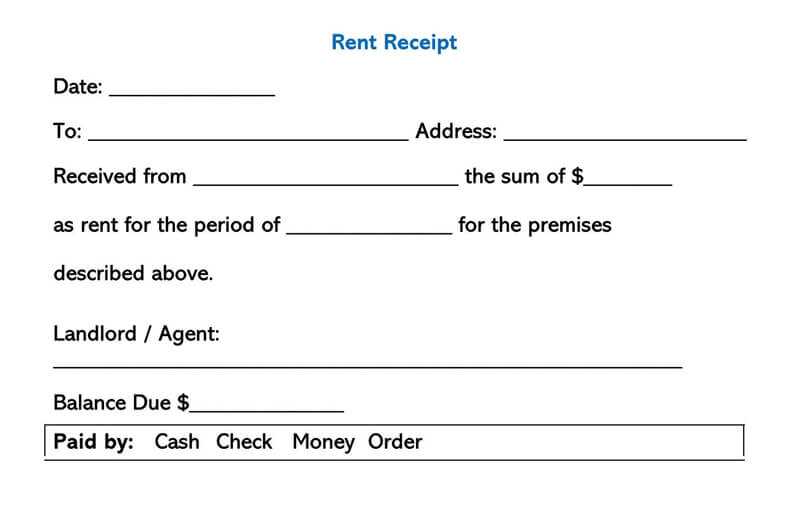

Basic Rent Receipt Template:

- Date: The receipt should clearly mention the date of payment.

- Tenant Details: Full name of the tenant.

- Landlord Details: Name and address of the landlord.

- Property Address: The location of the rented property.

- Amount Paid: The specific rent amount received, in words and figures.

- Payment Mode: Mention if paid by cheque, cash, or bank transfer.

- Signature: Both parties (tenant and landlord) should sign the receipt to confirm the transaction.

Additional Recommendations:

- Include the duration for which the rent is paid (e.g., monthly, quarterly).

- If applicable, list any advance or security deposits separately.

- For transparency, add a section for any deductions or adjustments to the rent.

- Rent Receipt Template in India

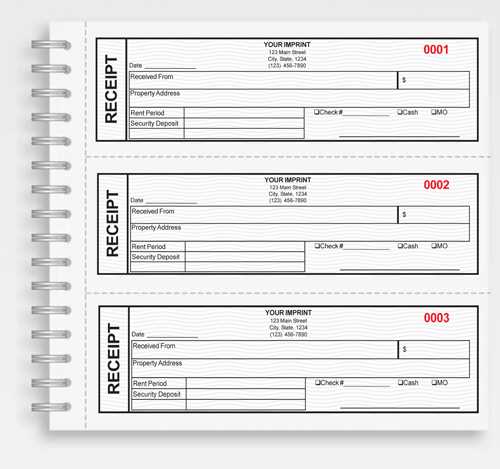

A rent receipt in India must contain certain key details for it to be valid. A basic rent receipt should include the tenant’s name, landlord’s name, rental amount, rental period, and payment mode. It is also important to mention the property address and the date of payment. For clarity, always make sure to number the receipts, especially when issuing them monthly.

Key Components

- Tenant’s Name: The person or entity who is paying rent.

- Landlord’s Name: The property owner or lessor.

- Amount Paid: The exact rent amount received.

- Rental Period: The time frame the payment covers (e.g., March 1 to March 31).

- Payment Mode: Whether the payment was made via cheque, cash, bank transfer, or any other mode.

- Property Address: The complete address of the rented property.

- Date of Payment: The specific date when the rent was received.

- Receipt Number: Sequential number for better record-keeping.

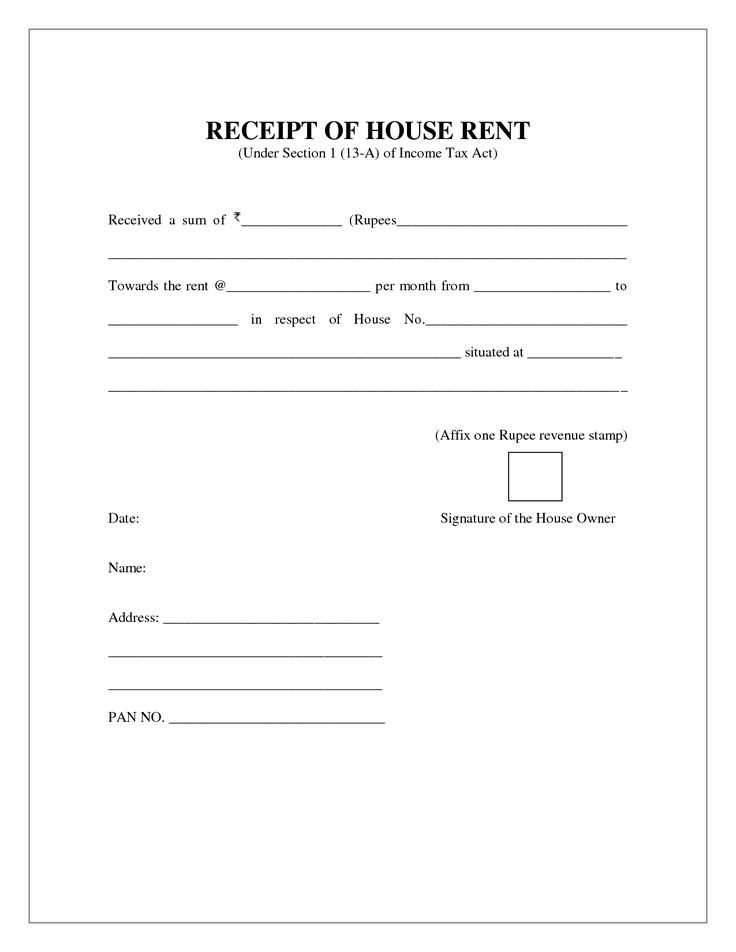

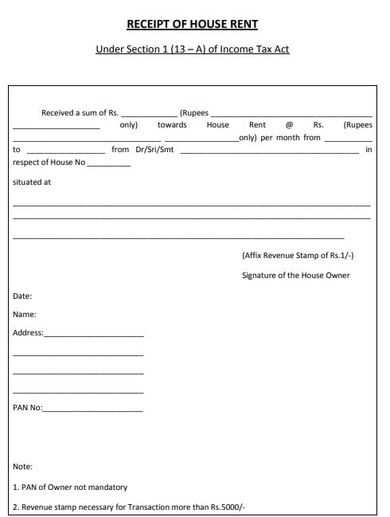

Template Example

Here’s a sample rent receipt template for use in India:

Receipt No: 001

Date: [DD/MM/YYYY]

Received From: [Tenant’s Name]

Amount: ₹[Amount]

For the period: [Start Date] to [End Date]

Property Address: [Full Address]

Payment Mode: [Cheque/Cash/Bank Transfer]

Landlord’s Name: [Landlord’s Name]

Signature of Landlord: ________________________

To create a rent payment receipt in India, follow these steps:

1. Include the Tenant and Landlord Details: Start by adding the names, addresses, and contact information of both the tenant and the landlord at the top of the receipt.

2. Specify the Property Address: Clearly mention the address of the rented property. This ensures that the receipt is tied to the correct rental agreement.

3. Detail the Rent Payment Amount: State the amount of rent paid in words and numbers, ensuring there is no ambiguity in the figure.

4. State the Payment Period: Include the start and end dates for which the rent is being paid. This makes it clear for both parties the coverage of the payment.

5. Payment Mode: Mention the mode of payment, whether it was made by cash, cheque, or bank transfer. This will help with tracking the transaction.

6. Receipt Number: Assign a unique receipt number for better record-keeping and reference in case of disputes.

7. Signatures: Both the landlord and tenant should sign the receipt. The tenant’s signature confirms the payment, while the landlord’s signature serves as acknowledgment of receiving the amount.

| Section | Details |

|---|---|

| Tenant Details | Name, Address, Contact Information |

| Landlord Details | Name, Address, Contact Information |

| Property Address | Full Address of the Rented Property |

| Amount Paid | Rent Amount in Words and Numbers |

| Payment Period | Start and End Dates |

| Payment Mode | Cash, Cheque, Bank Transfer |

| Receipt Number | Unique Identifier |

| Signatures | Landlord and Tenant Signatures |

Make sure the information is accurate and legible. A well-organized receipt not only serves as proof of payment but also ensures clarity in case of future disputes.

Make sure the document includes the full names of both the tenant and the landlord. This ensures clarity in case of future disputes. Include the address of the rented property to specify exactly what is being rented.

Specify the rental period, including start and end dates, as well as the payment due date. State the rent amount and clearly outline the payment method, whether it’s via bank transfer, cash, or another method.

If applicable, mention any additional costs, such as maintenance fees or utilities, that are part of the rent agreement. This avoids confusion regarding total monthly payments.

Include the security deposit amount and its conditions for return, including any deductions, to protect both parties. Clarify the frequency of rent payments, whether monthly, quarterly, or annually.

Ensure the document is signed by both parties with the date of signing. This formalizes the agreement and can serve as a reference point for future discussions.

Ensure that all payment receipts are clear and error-free to avoid disputes and confusion. Double-check amounts, dates, and payment methods before issuing the receipt.

1. Incorrect Amounts or Currency

Always verify the total amount paid. A common mistake is listing incorrect amounts, either due to human error or confusion between partial payments and balances. Be sure to specify the currency, especially in cases involving international transactions.

2. Missing Payment Method Information

Failure to note the payment method, such as cash, cheque, or bank transfer, can lead to misunderstandings. Always include this detail to create a clear record of how payment was made.

3. Unclear Date and Time

Ensure the payment date and receipt issuance date are clearly marked. A missing or vague date can complicate record-keeping, especially for tax purposes or future reference.

4. Missing Signatures or Authorization

If applicable, ensure both the issuer’s and the recipient’s signatures are present, or include a stamp or other form of authorization to make the receipt official.

5. Incorrect or Lack of Contact Information

Always include your business or personal contact information, such as a phone number or email address. This allows the recipient to easily follow up if needed.

To create a rent receipt template in India, follow these practical steps:

- Tenant’s Information: Include the tenant’s name, address, and contact details. This ensures both parties can easily identify each other in case of any discrepancies.

- Landlord’s Information: Mention the landlord’s name, address, and contact details. This serves to establish the receipt as an official document from the property owner.

- Property Details: Clearly state the address of the rented property. This helps in verifying the location tied to the rental agreement.

- Rental Amount: Mention the rent amount paid for the month, along with the currency (INR). Also, note any deductions or additions like maintenance fees or parking charges.

- Payment Date: Specify the date on which the rent was received. This should match the date of payment.

- Payment Method: Indicate how the payment was made, such as by cash, cheque, or bank transfer. This provides clarity on the transaction method.

- Receipt Number: Assign a unique receipt number for tracking purposes. This helps maintain organized records for both the landlord and tenant.

- Signatures: Both the landlord and tenant should sign the receipt. This confirms that both parties acknowledge the payment transaction.

Ensure the rent receipt is neatly formatted and free of errors to avoid any misunderstandings. Keep a copy for your records.