If you’re running a business in Australia, creating accurate and professional receipts is key for record-keeping and legal compliance. A business receipt template ensures consistency, saves time, and helps maintain a clear financial overview. A well-designed template can simplify your accounting and tax filing process, reducing the risk of errors or misunderstandings.

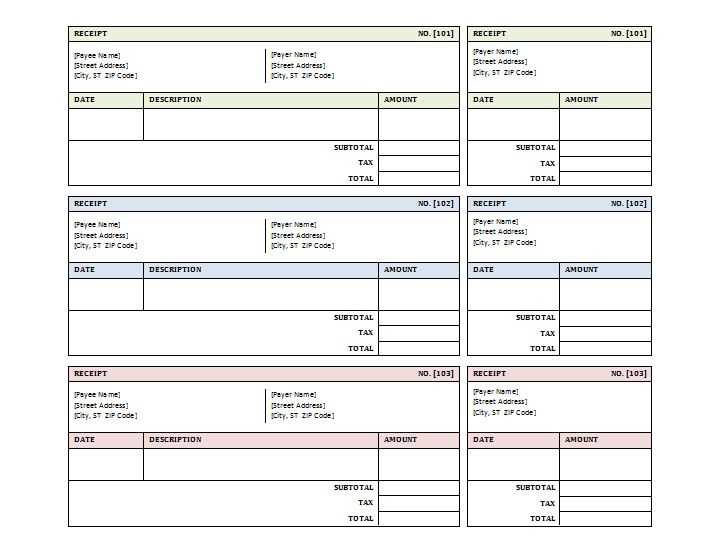

Start by including the necessary details: the date of the transaction, the business name and contact information, and the description of the product or service provided. Make sure to list the total amount paid along with any applicable taxes. If your business is registered for GST, you must indicate the GST amount separately. Including a unique receipt number can further enhance your record-keeping practices and make transactions traceable.

Consider using a clean, easy-to-read format that avoids clutter. A template will streamline the process and ensure your receipts meet legal standards, especially when dealing with tax authorities or clients requesting refunds. Customizing a template to match your brand’s identity adds a professional touch without sacrificing efficiency.

Here’s the updated version where repetitions are minimized while maintaining the meaning:

To create a business receipt template in Australia, include the following details: business name, ABN (Australian Business Number), address, date of transaction, description of the goods or services, and the amount paid. You can also add a receipt number for tracking purposes. Ensure that the total amount is clear and specify whether GST (Goods and Services Tax) is included or not.

Receipt Number and ABN

Each receipt should have a unique identification number for easy reference. The ABN must be displayed if the business is registered for GST. This helps confirm the legitimacy of your business and is important for tax purposes.

Clear Breakdown of the Transaction

Clearly outline the products or services sold, including any applicable taxes. If GST is included, indicate the amount on the receipt. Keep the format simple and easy to read, with all necessary details laid out in a straightforward manner.

- Business Receipt Template in Australia: A Practical Guide

In Australia, a business receipt is a key document for both businesses and customers. It serves as proof of a transaction and must include specific details to be legally valid. When creating a receipt template, ensure it includes the following elements:

Key Elements to Include

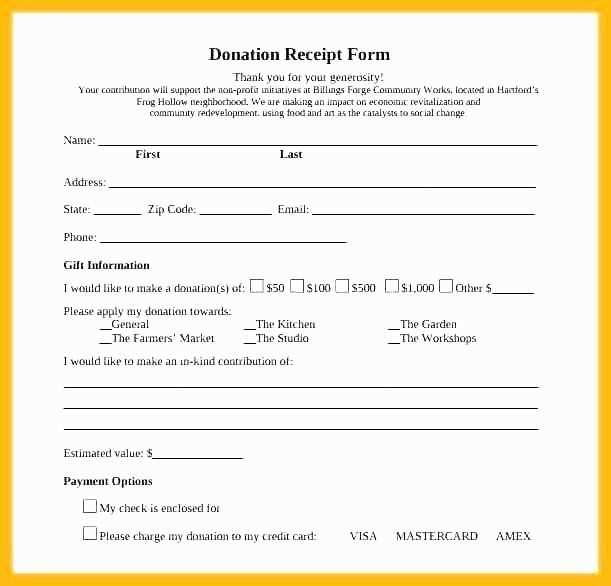

Each receipt should display the business’s legal name, Australian Business Number (ABN), and contact details. Additionally, the receipt must include the transaction date, a brief description of the goods or services provided, and the total amount paid. Don’t forget to list any taxes, such as GST (Goods and Services Tax), if applicable. This information is necessary for both record-keeping and tax purposes.

Customising Your Template

For ease of use, customise your receipt template to suit your business needs. If you offer services, include a description of the service rendered and the duration. For product sales, provide a breakdown of the items sold, including quantity and price. A well-structured template will save time and help you stay organised.

Use simple language and ensure your template is clear. You can opt for digital tools or software to create and manage your receipts efficiently. A consistent, clear format helps maintain transparency and trust with your customers.

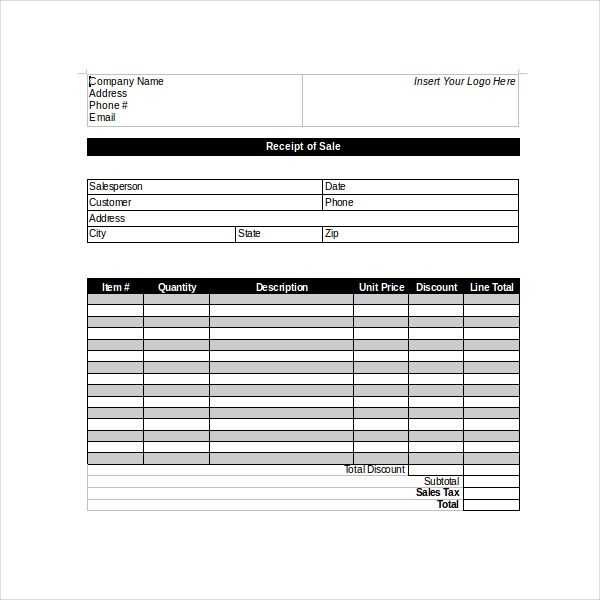

Creating a receipt template that meets Australian tax laws requires including specific details mandated by the Australian Taxation Office (ATO). A well-structured receipt helps ensure that your business complies with tax regulations and makes it easier for customers to keep track of their expenses for tax purposes.

Key Elements to Include in Your Receipt Template

Your receipt template must contain the following key elements to comply with Australian tax laws:

| Element | Description |

|---|---|

| Business Name and ABN | Include your business name and Australian Business Number (ABN) to verify your identity as a registered business. |

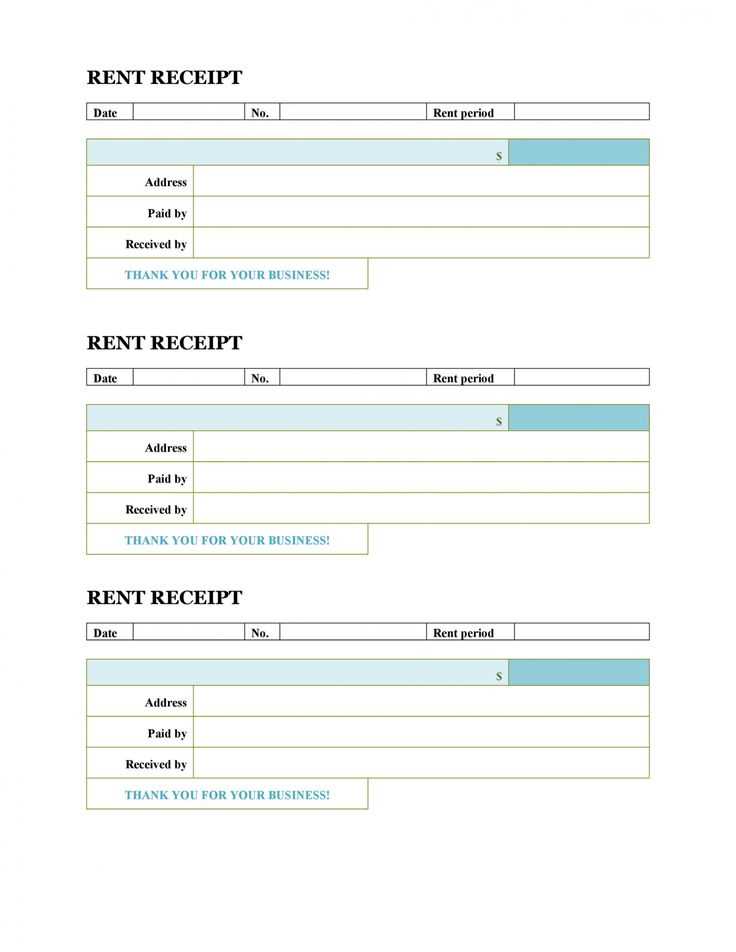

| Receipt Number | Each receipt must have a unique identifier for record-keeping and tracking purposes. |

| Date of Transaction | List the date the transaction occurred, which is essential for both business and customer record-keeping. |

| Description of Goods or Services | Provide a clear description of what was purchased, including quantity and unit price, for transparency. |

| Amount Paid | Include the total amount paid, which should match the value of the goods or services plus any applicable taxes. |

| GST Amount | If your business is registered for GST, clearly show the GST amount charged. It should be shown as a separate line item. |

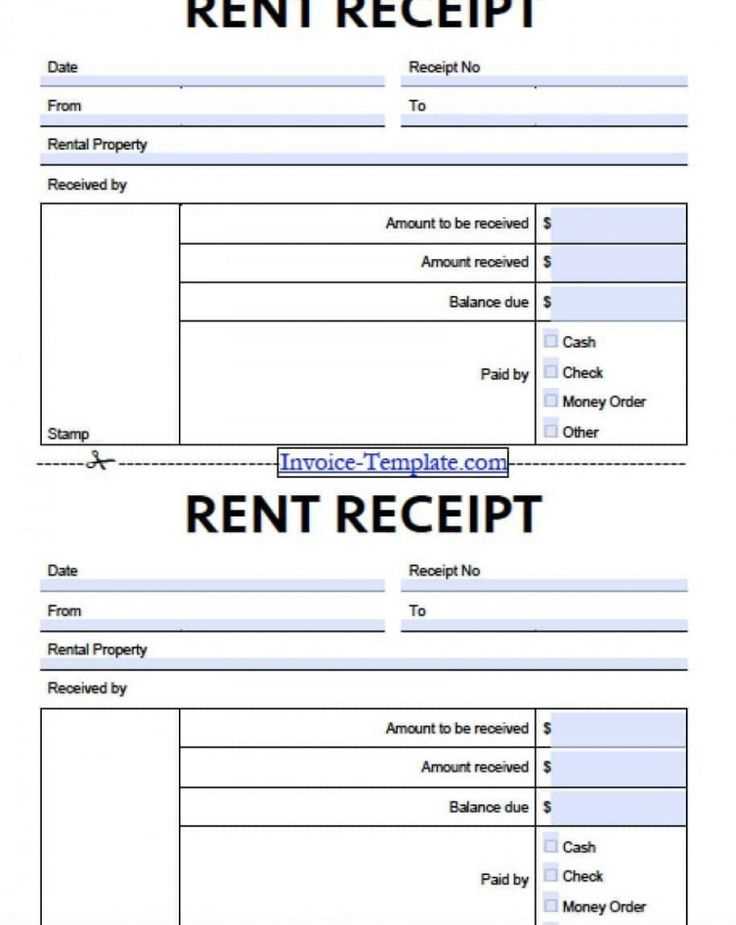

| Payment Method | Specify the method of payment, such as cash, credit card, or bank transfer, to ensure full transparency. |

| Tax Invoice (if applicable) | If the sale exceeds $82.50 (including GST), you must provide a tax invoice, not just a receipt. |

Additional Considerations

For full compliance with Australian tax laws, ensure that your receipt template is easily understandable and clear. Use consistent formatting and avoid any ambiguity regarding the transaction. Keep your records for at least five years, as required by the ATO, for audit purposes.

By following these steps and including the required elements, you’ll create a receipt template that satisfies Australian tax regulations and helps maintain transparency with your customers.

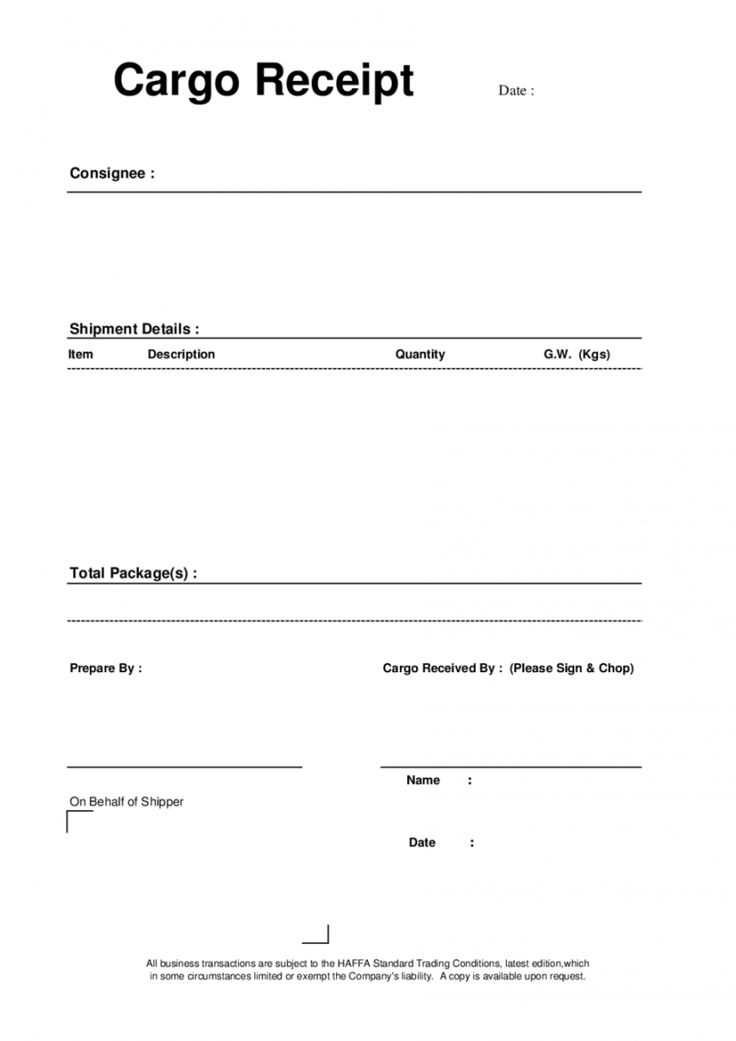

Tailoring your business receipt template according to the type of business is key to making sure it meets legal requirements and works for your operational needs. Here’s how you can adapt your template based on the business type:

Retail Businesses

- Include product descriptions and quantities clearly to avoid confusion in case of returns or exchanges.

- Ensure the total price is broken down, showing individual item prices, discounts, and taxes.

- Integrate GST (Goods and Services Tax) if applicable, and show it separately from the total amount.

Service-Based Businesses

- Highlight the service type, duration, and hourly rate if applicable. This ensures transparency.

- Clearly state whether the service is subject to GST, especially for higher-priced services.

- Include a section for payment terms and due dates, especially for ongoing contracts or subscriptions.

Freelancers and Contractors

- Customise the template to include an itemised list of services provided, including the hourly rate or project cost.

- Clearly display your ABN (Australian Business Number) for tax purposes.

- Include payment methods and terms to avoid misunderstandings around payments.

Wholesale Businesses

- Include details about bulk pricing, discounts, and terms of sale.

- Clearly separate GST from the total cost, as wholesale businesses typically deal with larger amounts.

- Make sure the payment terms are visible, especially for credit sales or delayed payments.

Adjust your template to suit these specifics, ensuring it aligns with both your business type and Australian tax regulations.

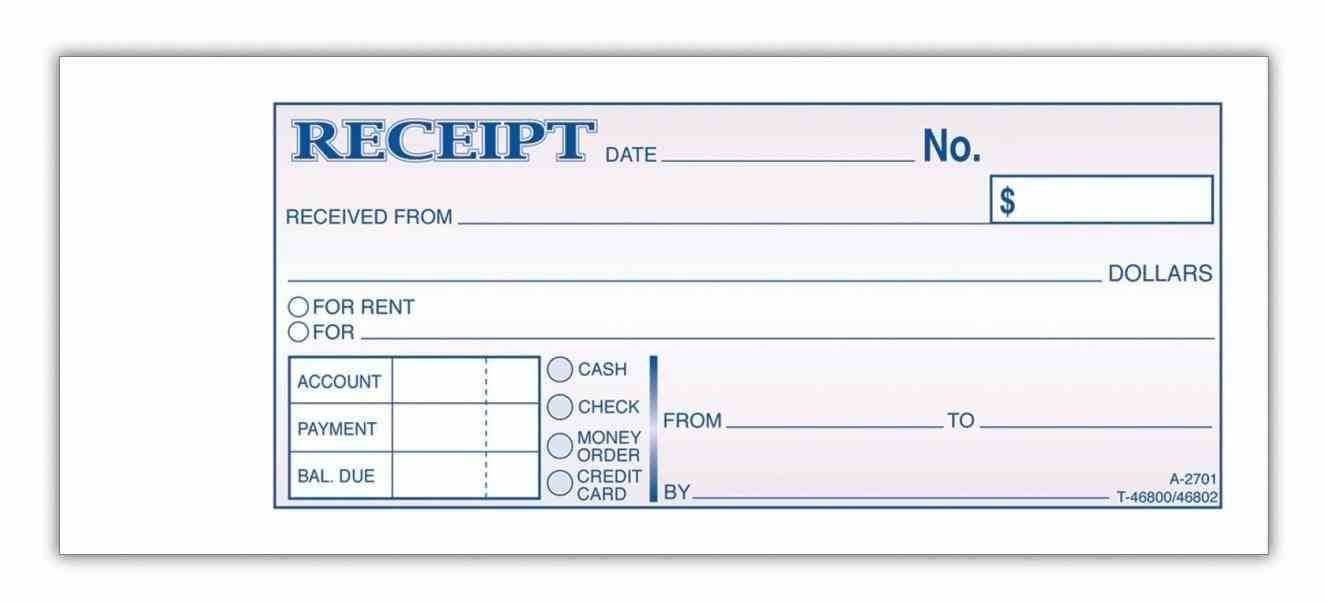

Make sure to include the following elements in your Australian receipt template to ensure clarity and compliance with local regulations.

1. Business Details: Include the name, address, and contact information of your business. This lets the customer identify your company and reach out if necessary. If your business has an Australian Business Number (ABN), include it as well.

2. Date of the Transaction: Clearly state the date when the transaction occurred. This helps the customer with their record-keeping and can be crucial for tax purposes.

3. Itemized List of Products or Services: Each product or service purchased should be listed individually, including quantity, price per unit, and any applicable discounts. This ensures transparency and helps both parties verify the transaction details.

4. Total Amount Paid: Show the total amount paid after taxes, discounts, and other adjustments. This amount must be easily distinguishable from the individual item prices.

5. Tax Details: Australian receipts must specify the Goods and Services Tax (GST) if applicable. State the GST amount and indicate if the price is inclusive or exclusive of GST.

6. Payment Method: Indicate how the payment was made (e.g., cash, credit card, bank transfer). This can help clarify any discrepancies and streamline financial record-keeping.

7. Receipt Number: Provide a unique receipt number for each transaction. This is useful for tracking purposes and for resolving any future queries regarding the transaction.

8. Terms and Conditions: If applicable, include a brief mention of your return and refund policies. It’s good practice to inform customers of their rights directly on the receipt.

Ensure Clarity in Your Business Receipt Template

Keep your receipt text clear and concise by limiting the repetition of any single word. For a professional business receipt template, aim for a variety of language to avoid redundancy. Here’s how to maintain clarity:

- Use synonyms: If you must refer to an item or service multiple times, use different words that convey the same meaning.

- Rephrase sentences: Avoid repeating the same phrase or structure. Try to change how the information is presented.

- Keep descriptions short: Ensure that each description on the receipt is direct and does not overuse certain terms.

- Incorporate numbers: Instead of repeating “amount” or “total,” simply use the numbers or symbols to keep it clean.

- Review for word choice: Before finalizing, review the text to spot any unnecessary repetitions and replace them with alternatives.

This will make your receipt easy to read, ensuring that clients quickly understand the charges and details. With these adjustments, the document maintains a professional tone while being user-friendly.