If you’re handling donations, it’s important to provide proper receipts. A donation receipt not only serves as a record for the donor, but also as proof for tax purposes. Fortunately, you can save time and effort by using free receipt templates that are easy to customize and use for any type of donation.

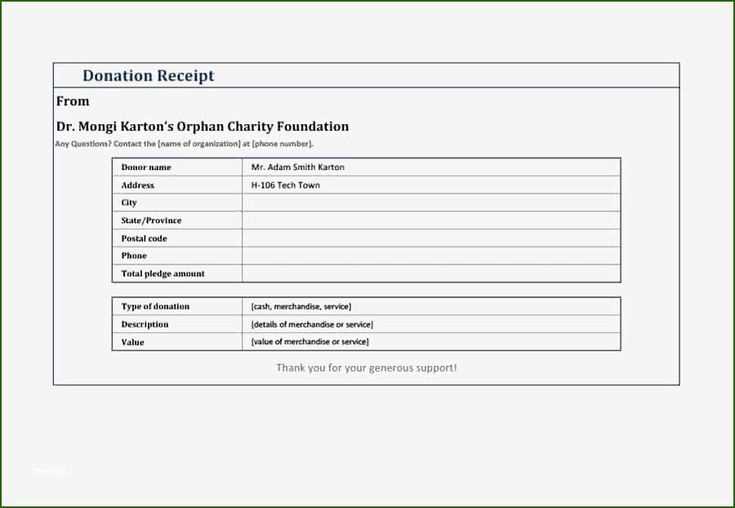

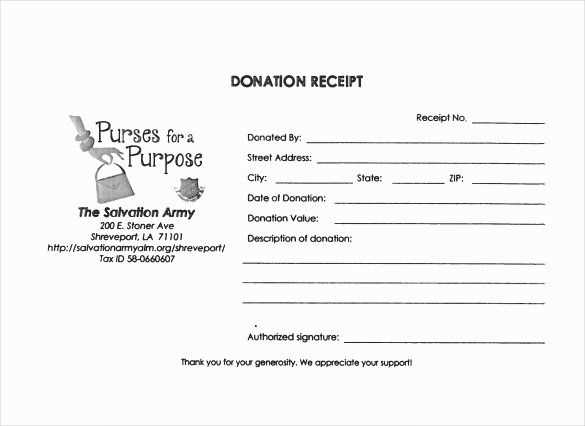

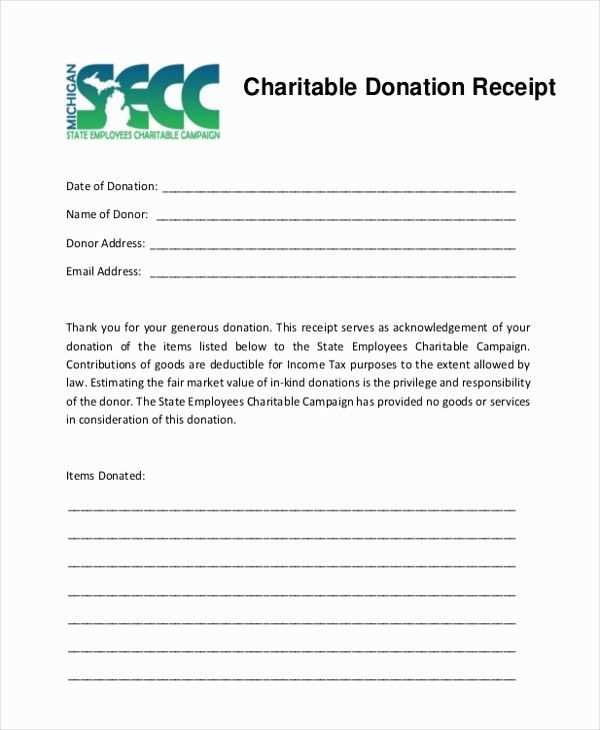

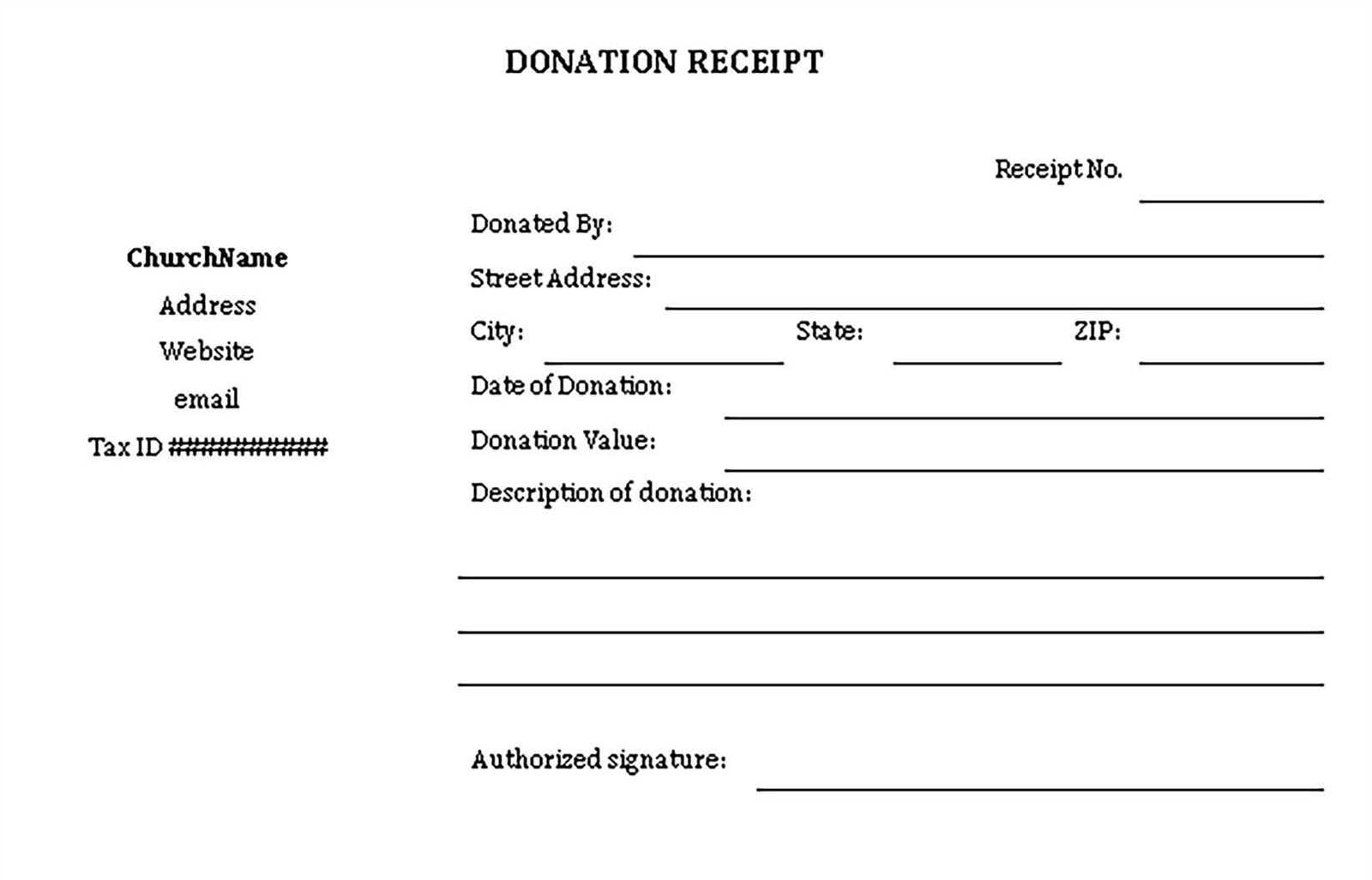

Start with a simple donation receipt template that includes the donor’s name, the date of the donation, and a description of the donated item or amount. Make sure to add your organization’s details, such as the name, address, and tax-exempt status, if applicable. This makes the receipt more official and provides necessary documentation for tax deductions.

Use free online tools or editable templates to streamline the process. Many websites offer templates in Word, PDF, or Excel formats that you can quickly fill in. You can also download templates that already have pre-set fields for donations like cash, goods, or services, saving you from retyping the same information over and over.

Remember to double-check that the value of non-cash donations is clearly listed. If you’re not sure how to assess the value, include a disclaimer that the donor is responsible for determining the value of their item. Additionally, keep records of all issued receipts, as they are important for auditing purposes and donor transparency.

Here’s the corrected version:

For a clean and clear receipt template for donations, make sure it includes all the necessary details without overloading the donor with unnecessary information. The key elements to include are the donor’s name, the donation amount, the date, and a brief description of the donation. This should be clear and concise, ensuring the donor knows exactly what their contribution was for.

What to include in your receipt template:

1. Donor’s Information: Include the name of the donor. If the donation was made by a business, include the company name.

2. Donation Details: Specify the amount donated, along with the date of the transaction. It’s also helpful to include the method of donation (e.g., cash, check, online transfer) for reference.

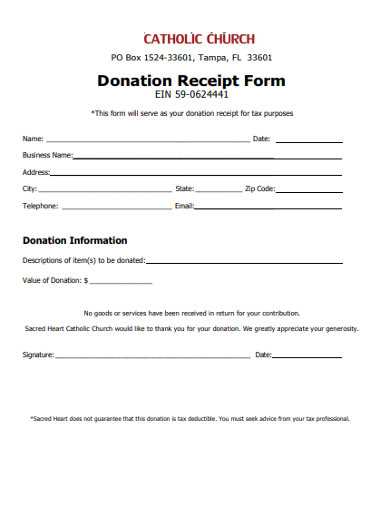

3. Acknowledgment Statement: Clearly state that the donation is tax-deductible (if applicable) and include any legal language necessary to comply with tax laws. A typical statement might read: “No goods or services were provided in exchange for this donation.”

Why keep it simple:

Overloading receipts with unnecessary details can confuse or overwhelm the donor. Focus on the basics–this keeps your receipts user-friendly and easy to store for tax purposes. Keep your template adaptable for both small and large donations.

- Free Receipt Templates for Donations

Free receipt templates simplify donation tracking for both donors and charities. These templates include all the necessary fields to acknowledge a donation accurately, ensuring compliance with tax requirements and record-keeping practices. You can find templates in various formats, such as Word, PDF, and Excel, to suit different needs.

What to Include in a Donation Receipt

A donation receipt should list the donor’s name, donation date, amount, and a description of the donated items, if applicable. If the donation is non-monetary, specify the item(s) received along with their estimated value. For monetary donations, the receipt must include a statement confirming whether anything of value was provided in return.

Where to Find Free Templates

Many websites offer free donation receipt templates, often designed for easy customization. You can access these templates through online resources like Google Docs or Microsoft Office, and some platforms also provide ready-to-use templates for different causes, such as non-profits or religious organizations. Just be sure to verify that they comply with local laws and tax regulations before use.

Select a template that matches your organization’s style and communication needs. The design should align with your brand’s identity, ensuring a professional and trustworthy appearance. A clean, easy-to-read format is essential for clarity and transparency, especially when donors need to keep these receipts for tax purposes.

Key Features to Look For

First, ensure that the template includes all necessary legal and financial information. This typically includes your organization’s name, address, tax identification number, and the donor’s details. Specify the donation amount and date, and include a statement that no goods or services were provided in exchange for the donation if applicable. If it’s a non-monetary donation, clearly describe the item(s) donated.

Flexibility and Customization

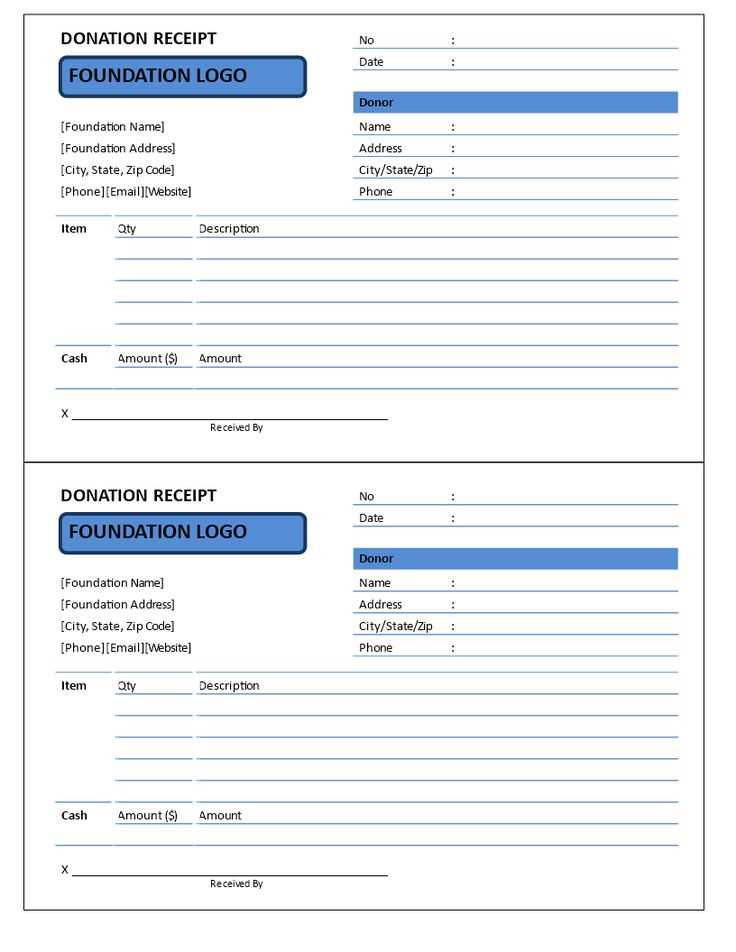

Choose a template that allows for easy customization. Being able to add your logo, change font styles, or adjust sections to suit different types of donations will save time and keep your receipts consistent. Look for templates that offer both print and digital options, enabling you to cater to both in-person and online donations.

Modify your receipt templates to reflect your organization’s unique identity by incorporating your logo, colors, and font choices. Customization ensures that the receipt aligns with your overall brand presentation and creates a professional impression.

Adjusting Visual Elements

Start by adding your logo at the top of the template, making it visible and prominent. Choose brand colors for headings, borders, or background areas, ensuring they match your organization’s style guide. Select fonts that align with your brand’s personality while maintaining legibility, especially for important details like donation amounts and recipient names.

Tailoring Information Layout

Arrange the layout to emphasize key elements, such as the donor’s name, donation amount, and date. Consider placing your organization’s contact details and website link in a footer section for easy access. This design approach adds clarity and reinforces your branding at every step of the transaction.

Each state in the U.S. has specific legal requirements for receipts related to charitable donations. These guidelines can vary, and organizations must be aware of the differences to ensure compliance with both state and federal regulations.

State-Specific Rules

For example, some states require that a charitable receipt must include the donor’s name, donation amount, and the nonprofit’s tax-exempt status. Other states may add extra stipulations like a description of the goods donated or the date the donation was received. Here’s an overview:

- California: Requires receipts for donations over $250. These must include the amount donated, a description of goods, and the nonprofit’s tax-exempt status.

- New York: Requires written acknowledgment for donations of $75 or more, including a description of the goods or services provided in return.

- Texas: Charitable organizations must issue a receipt for any donation of $25 or more, with the receipt specifying the donor’s information and the amount of the donation.

- Florida: Nonprofits must provide written acknowledgment for donations of $250 or more, and they must describe any goods or services given in exchange.

Required Information for Compliance

To comply with regulations, receipts should contain at least the following:

- The donor’s name and address

- The date of the donation

- The amount of the donation, or a description of the goods or services donated

- The nonprofit’s name and tax-exempt status

Failure to provide the necessary documentation can result in penalties for the organization, so it’s critical to stay informed about state-specific guidelines.

Include the tax-exempt status on receipts by clearly stating the organization’s tax-exempt number or a reference to it. This helps recipients verify their donation’s eligibility for tax deductions. Display the tax-exempt status near the total donation amount or at the bottom of the receipt. Additionally, specify that no goods or services were provided in exchange for the donation if applicable, as this will impact the donor’s tax deduction. Make sure the language is concise, for example: “Tax-Exempt Organization: [Organization Name], Tax ID: [Number]. No goods or services were provided for this donation.” This ensures transparency and compliance with tax regulations.

Start with clear headings for each section of the receipt template. This helps users identify required information quickly and reduces confusion. Use short and precise labels for fields like “Donor Name,” “Donation Amount,” and “Date,” ensuring users understand what to input without ambiguity.

1. Simple Layout

A clean, simple layout with enough space between sections makes the template easier to follow. Avoid cluttered designs or overly complex formats that might confuse the user. Clearly define areas for input, ensuring that each section is visually separated for easy navigation.

2. Instructions and Examples

Provide brief, helpful instructions directly on the template. For example, include a placeholder text like “Enter the donor’s full name” to guide users in the right direction. Offering a sample receipt at the top or bottom of the template can also help users understand how to complete the form correctly.

3. Consistent Formatting

Use consistent font sizes, styles, and spacing throughout the template. This consistency helps users distinguish between headings, fields, and sections at a glance. Stick to one or two font styles to maintain readability and professionalism.

4. Easy Customization

Allow users to easily modify sections, such as adding or removing lines, to tailor the template to specific needs. Ensure that customizable fields are clearly marked so users can modify them without altering the overall structure of the template.

| Template Element | Recommendation |

|---|---|

| Headings | Clear and descriptive titles for each section |

| Layout | Simple, uncluttered format with sufficient space between sections |

| Instructions | Inline instructions with examples to guide users |

| Customization | Editable fields that do not interfere with template structure |

By focusing on clarity and ease of use, donation receipt templates can become more accessible and effective for users, ensuring that they can quickly generate accurate receipts with minimal effort.

Organizing donation receipts starts with a clear and simple system. Store receipts in a way that allows easy access and quick retrieval, especially during tax season. Consider creating a dedicated folder or digital file for receipts, and make sure it is easily searchable.

1. Keep Receipts Organized by Date and Amount

- Label receipts by date and donation amount for straightforward tracking.

- Use a chronological order to prevent confusion and avoid duplicates.

- Group receipts by donor name or organization for larger donation pools.

2. Use Software for Tracking

- Utilize donation tracking software to record donations and generate receipts automatically.

- Ensure the software allows for exporting reports in a tax-friendly format (such as CSV or PDF).

- Choose a solution that includes features for attaching scanned receipts and notes for each donation.

By organizing receipts based on dates and amounts, and using tracking software to streamline the process, your record-keeping system will be more manageable and effective during audits or tax filing. Regularly back up all records to avoid data loss.

To create a donation receipt, make sure to include key details such as the donor’s name, donation date, amount, and a brief description of the donated item(s). This ensures clarity and helps donors track their contributions for tax purposes.

Key Information for a Receipt

- Donor’s Name: Include the full name of the person or organization making the donation.

- Donation Date: Record the date when the donation was made, whether it’s a monetary or item-based donation.

- Amount or Description: Specify the exact monetary value or provide a description of the items donated.

- Non-profit Organization’s Details: Add your organization’s name, address, and contact information to ensure authenticity.

Using Templates

Make it easy for your team to issue receipts by using pre-made templates. You can download free templates from various websites that are ready to be customized with the necessary details. Templates save time and ensure consistency in your records.

Always double-check the information before sending the receipt to the donor. A quick review prevents mistakes and maintains professionalism in all transactions.