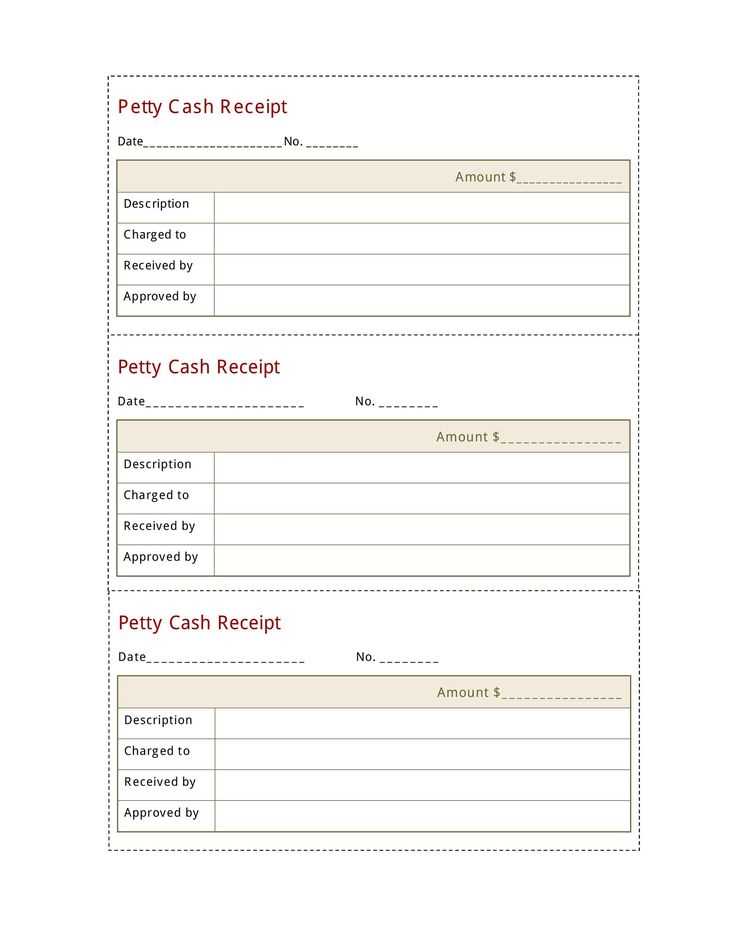

Use this petty cash sales receipt template to streamline your daily financial transactions. It simplifies record-keeping and ensures every cash transaction is documented clearly and accurately. By including essential details like the date, amount, and purpose of the sale, this template provides a quick reference for both business owners and accountants.

This template is designed to capture all the necessary information in a structured format. It includes sections for the seller’s name, buyer’s information, the payment method, and a breakdown of the items sold. The clear, organized design minimizes errors and reduces the time spent on administrative tasks.

Make sure to personalize the template with your company’s logo and contact information for a professional touch. It’s a great way to keep all your cash-based sales organized and in one place, helping you stay on top of your financial reporting.

Here are the corrected lines:

Use clear, consistent headers for each section of your petty cash receipt template. Label the “Amount” and “Description” fields in bold to highlight important information. Avoid cluttering the template with unnecessary fields–focus only on what is required for proper record-keeping.

Details to Include

Each transaction entry should have the following details: the date, description of the expense, the amount, and the person responsible. Ensure there is space for both the payer’s and receiver’s signatures to confirm the transaction.

Formatting Tips

Keep the font size uniform throughout the template to maintain clarity. Use bullet points or numbered lists for itemizing multiple expenses under one receipt. Make sure there’s enough space between each section for easy readability.

- Petty Cash Sales Receipt Template

A petty cash sales receipt should include all the necessary details for accurate documentation. A well-structured template helps businesses track their petty cash transactions effectively. Ensure the receipt includes the following key components:

| Field | Description |

|---|---|

| Receipt Number | Assign a unique identifier to each receipt for easy tracking. |

| Date | Record the date of the transaction to maintain an accurate financial history. |

| Payee | Include the name of the person or business receiving the cash. |

| Amount | Specify the exact amount of cash dispensed, ensuring it’s accurate. |

| Purpose | Clearly state the reason for the petty cash transaction, whether it’s for office supplies, transportation, or other expenses. |

| Authorized By | Include the name of the person who authorized the cash release. |

| Signature | Have the recipient sign to confirm receipt of the funds. |

By including these elements, businesses can keep a precise record of petty cash transactions. You can easily modify this template to fit the specific needs of your organization.

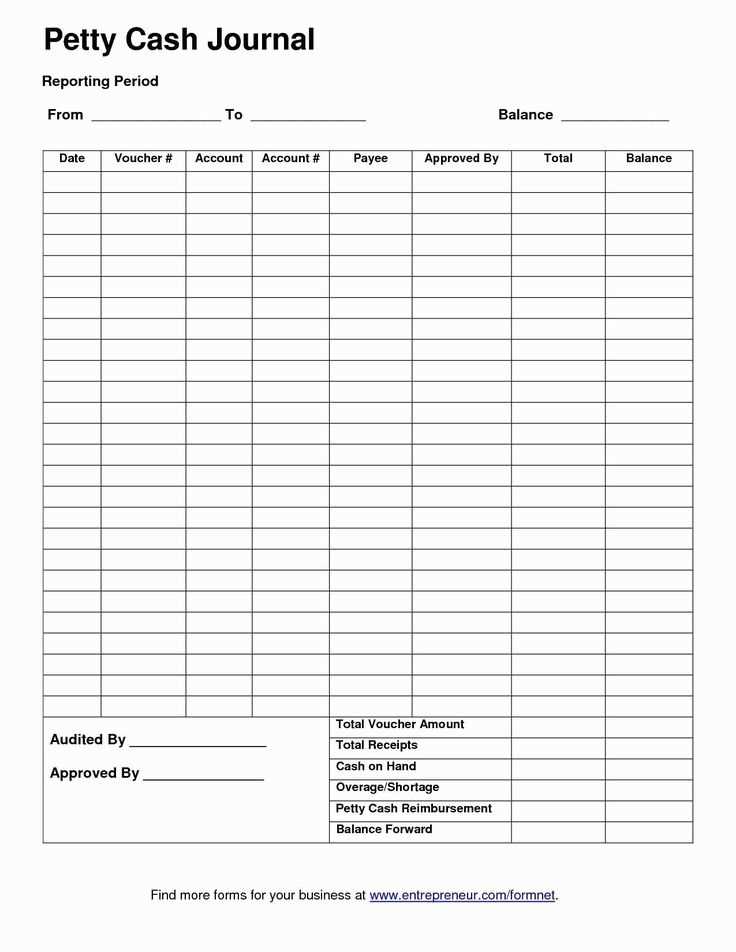

To create a simple sales receipt template in Excel, start by setting up the necessary columns: Date, Receipt Number, Customer Name, Item Description, Quantity, Price per Unit, Total, and Payment Method. Each column should be clearly labeled for easy reference.

Step-by-Step Setup

Begin with the first row. In the Date column, use Excel’s date format for consistency. For the Receipt Number, you can use a numbering system that increments automatically as you copy the formula down the column.

In the Item Description column, provide space for a brief title or code for the product. Follow with Quantity and Price per Unit columns, formatted for numbers. The Total column should use a simple formula (Quantity * Price per Unit) to calculate the price for each item automatically.

Final Touches

To wrap up the template, add a row for the overall total, summing up all item totals. You can also include a section for the payment method, whether it’s cash, credit card, or another option.

Save your template as a master version, so you can easily reuse it for future transactions by adjusting the details as needed. Excel allows for quick customizations, making this template an efficient tool for keeping track of sales in a clean and organized format.

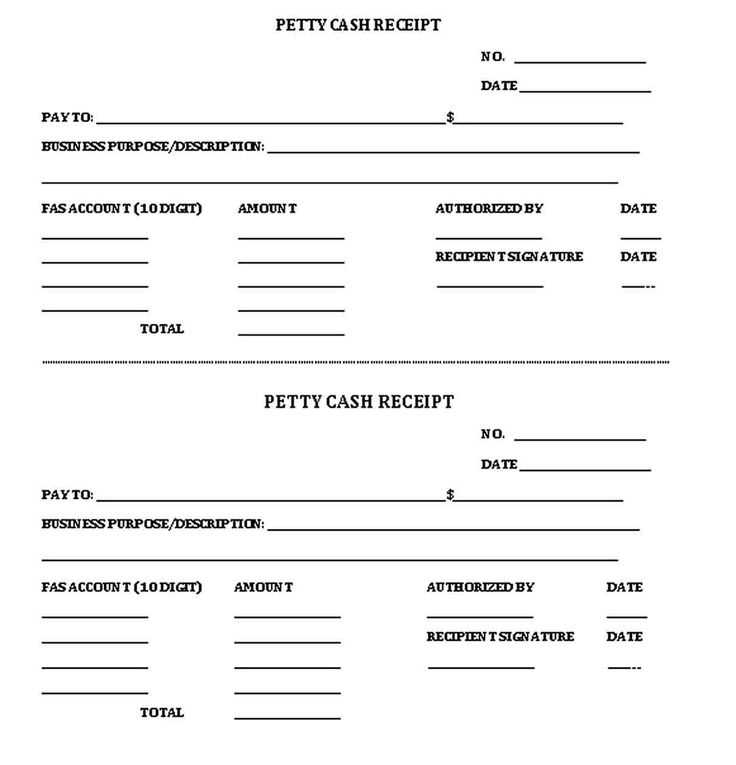

A petty cash receipt should contain key details that ensure transparency and accountability. Begin with the date of the transaction. This helps identify the specific day the funds were disbursed.

Transaction Description

Include a brief description of the purpose for which the petty cash was used. This helps track expenditures and clarifies the reason for the cash outflow.

Amount Disbursed

Clearly state the amount of money that was given out. This should be in both numerical and written format to avoid confusion or errors.

Ensure the recipient’s name is noted. This confirms who received the petty cash and is crucial for tracking who has used the funds. If necessary, include the department or project the money was intended for.

For verification purposes, a signature of both the person disbursing the money and the recipient can be helpful. This adds an extra layer of security in case of any disputes.

Lastly, a receipt number or reference code makes it easier to track and reference this transaction later. This can be part of a larger system for organizing petty cash records.

Tailoring your sales receipt template to suit specific business requirements can enhance clarity and professionalism. Here’s how to adjust key elements for your needs:

- Include Relevant Business Information: Make sure your business name, logo, and contact details are prominently displayed. Adjust the placement depending on your brand’s visual identity. If you run a store, include location details; for online businesses, focus on website and customer support contacts.

- Customizable Item Descriptions: Depending on your product or service, tailor the description field. For physical products, provide details like model number, size, or color. For services, be specific about what was rendered–this helps in tracking and customer satisfaction.

- Flexible Tax Calculation: Businesses in different regions may have varying tax rates. Modify your template to reflect the local tax laws, adding separate tax lines or providing a breakdown of applicable taxes.

- Payment Methods: Adjust the payment methods section. If you accept digital payments like PayPal, credit cards, or mobile wallets, include those options. For cash-based businesses, ensure cash amounts are clearly noted.

- Discounts and Promotions: If your business regularly runs promotions, include a space for discount percentages or coupon codes. This ensures transparency in how prices are reduced.

- Return and Refund Policy: Make the return policy easy to read and accessible. If your policy changes based on product type or purchase amount, create fields that allow this to be clearly communicated on the receipt.

- Multiple Language Options: For businesses catering to diverse customers, provide a bilingual or multilingual option. Customize text and layout to fit additional languages without cluttering the document.

- Custom Fields for Business Type: Depending on your sector, you might need additional fields. For example, restaurants could add a tip section, while freelancers may include project numbers or invoice references for tracking purposes.

Customizing your sales receipt template ensures that it serves both functional and branding purposes. Adapt it to your business, and you’ll provide customers with a clear, personalized experience each time they make a purchase.

Petty Cash Sales Receipt Template

Use a simple petty cash sales receipt template to track small transactions and maintain accurate records. Ensure the template includes the following key elements:

- Transaction Date: Clearly mark the date of the transaction for future reference.

- Receipt Number: Assign a unique number to each receipt to ensure proper tracking.

- Seller Information: Include the name, address, and contact details of the business or individual receiving payment.

- Customer Information: Record the customer’s name and contact information for reference.

- Description of Goods or Services: Provide a detailed description of the items or services sold.

- Total Amount: State the total cost clearly, including any applicable taxes or discounts.

- Payment Method: Indicate whether the payment was made by cash, card, or another method.

- Signatures: Add space for signatures from both the seller and the customer to validate the transaction.

Tips for Creating a Petty Cash Sales Receipt

- Use a consistent format to ensure that all receipts look professional and are easy to read.

- Keep receipts in a dedicated folder for easy retrieval when needed.

- Always verify the details before issuing a receipt to avoid errors.

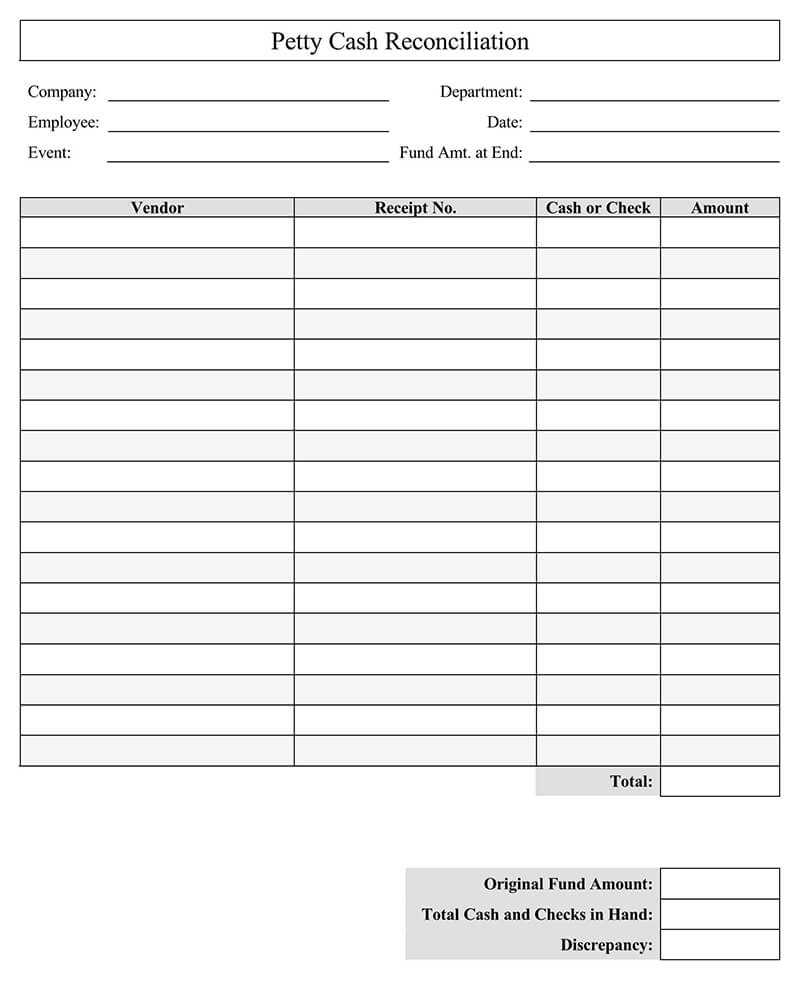

Benefits of a Petty Cash Sales Receipt Template

- Helps keep an accurate record of all petty cash transactions.

- Reduces errors and confusion when reconciling accounts.

- Provides clear documentation for auditing purposes.