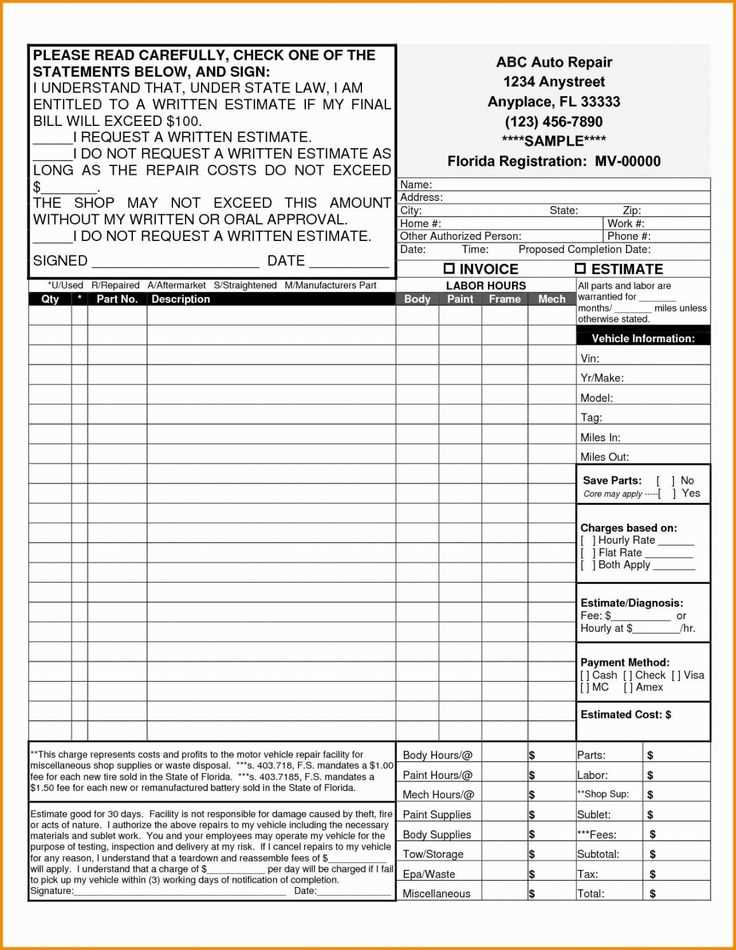

A well-organized receipt template is a key tool for any car mechanic. It helps ensure accurate documentation of the services provided, fostering trust with clients and making future reference easy. The template should include clear sections for job details, parts used, labor hours, and costs associated with each service. This transparency not only simplifies billing but also aids in inventory management and tracking repairs.

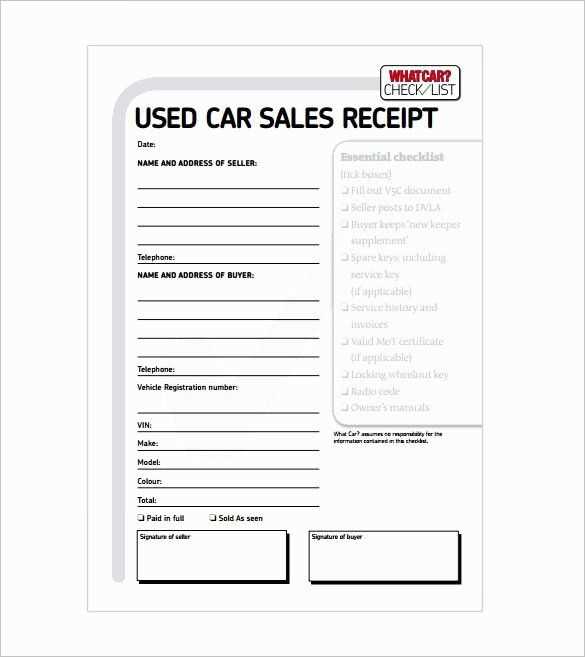

Make sure the receipt features fields for the vehicle’s make and model, as well as the VIN (Vehicle Identification Number). Including these details guarantees proper records of each transaction. Provide itemized listings of parts and services, with prices next to each, to avoid confusion and ensure clients understand what they’re paying for.

Finally, ensure your template has space for both your business name and the customer’s details. This professional touch, along with clear payment instructions and space for signatures, can go a long way in enhancing the credibility of your business. Keep it simple and straightforward, focusing on what’s important for both you and the customer.

Car Mechanic Receipt Template

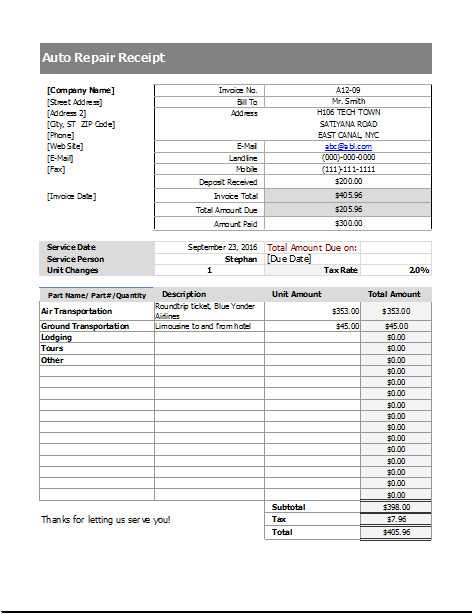

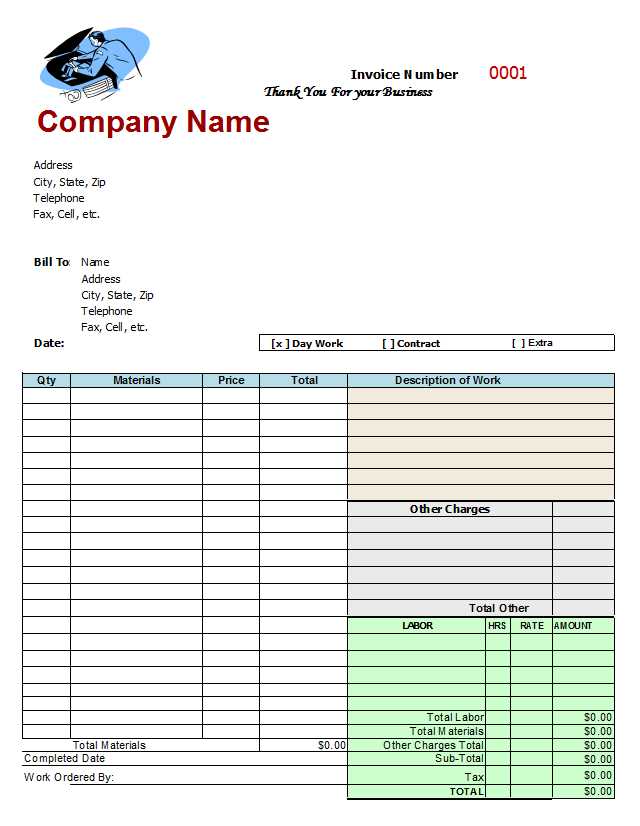

A well-designed receipt template can help streamline your record-keeping process. It should capture all necessary details about the service provided, including labor costs, parts used, and any warranties or guarantees. Below is a simple layout for a car mechanic receipt template:

Receipt Layout

Ensure your template includes the following key sections:

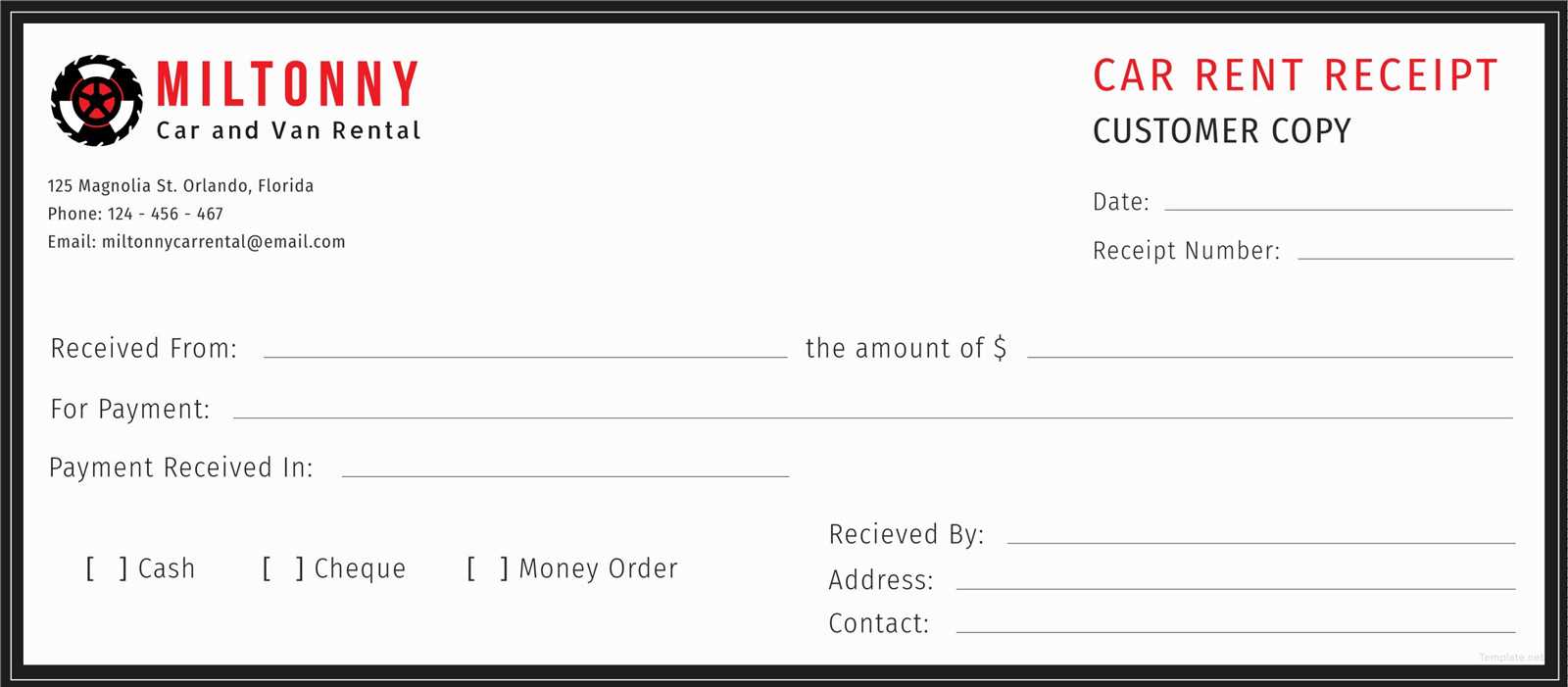

- Business Information: Include your business name, address, phone number, and email at the top for easy reference.

- Customer Information: Capture the customer’s name, contact details, and vehicle information, including the make, model, and year.

- Date of Service: Clearly list the date when the service was provided.

- Description of Services: Provide a detailed list of tasks performed, such as engine repairs, oil changes, or tire rotations.

- Parts and Labor: Separate sections for parts and labor help customers understand the costs. List each part with its price, and break down labor charges by hours worked and hourly rate.

- Total Cost: Clearly indicate the total amount due, including tax and any discounts applied.

- Payment Method: Document the payment method used (e.g., cash, credit card, check).

- Terms and Conditions: Include any relevant terms, such as warranty information or payment due dates.

Best Practices

Keep the layout simple and readable. Avoid clutter by using clear headings, bullet points, and sections that separate different types of information. Ensure all amounts are easily visible, and make sure the customer receives a copy for their records.

With these elements in place, your receipt will serve both as proof of payment and a clear record of services rendered, helping you maintain transparent and professional interactions with your clients.

Customizing the Template for Specific Services and Repairs

Tailor your receipt template by adding dedicated sections for the services provided, ensuring clients can clearly see what was done. For example, if you perform brake repairs, include fields for brake pads, rotors, and labor hours. This makes the receipt more transparent and professional.

Incorporate itemized pricing for each part and service. Listing the cost of labor separately helps clients understand where their money is going. This detail is especially valuable for more complex repairs, like engine diagnostics or transmission work, where costs can vary based on the work involved.

Adjust the layout to reflect service-specific categories, such as electrical, suspension, or exhaust system repairs. Adding a checkbox for services like oil changes or tire rotations can also speed up your process when dealing with common repairs.

For repairs requiring parts replacements, include a section to list each part’s serial number and manufacturer. This offers clarity in case clients need to track or warranty their purchased parts.

Ensure your template is flexible enough to add additional fields or sections as new types of services are introduced, allowing you to stay organized and relevant to your customers’ needs.

Including Legal and Compliance Information in the Receipt

Ensure your receipt includes all necessary legal and compliance details to meet regulations and protect both your business and customers. Clearly list your business’s registered name, address, and tax identification number (TIN). This is particularly important for tax reporting and audits.

Tax and Warranty Details

Include applicable tax information, such as VAT or sales tax, and ensure the amount is clearly separated from the total cost. This helps in complying with local tax laws and provides transparency. Additionally, if any warranties or return policies apply, clearly outline them to avoid misunderstandings later.

Consumer Rights and Dispute Resolution

It’s helpful to note consumer rights, such as the right to cancel or return services, within the receipt. Mention the process for addressing complaints or disputes, providing contact information for your service center or support team. This shows your commitment to fairness and adherence to consumer protection laws.

Integrating Payment Methods and Invoice Tracking

Set up a seamless connection between payment methods and invoice tracking by incorporating integrated software or applications that allow real-time synchronization of transactions. This enables faster updates and prevents errors when processing payments.

Payment Gateway Integration

Choose a payment gateway that supports various methods such as credit cards, digital wallets, and bank transfers. Ensure it can easily link with your invoicing system for automatic updates. This minimizes manual data entry, reducing the chances of discrepancies.

Invoice Tracking Features

Utilize invoice tracking features that automatically update the payment status of each invoice. Look for software that can flag overdue invoices, send reminders to clients, and generate reports for financial tracking. This reduces administrative overhead and enhances transparency.

- Enable automatic invoice generation upon payment confirmation.

- Set up recurring invoicing for regular clients, with payment reminders.

- Integrate with accounting software for streamlined financial management.