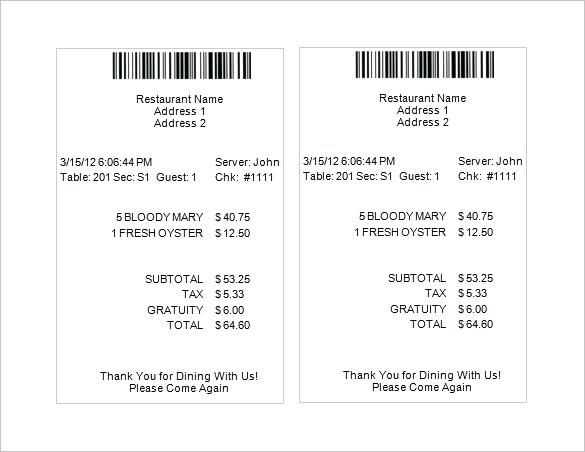

To create a realistic and believable fake itemized restaurant receipt, focus on detail and accuracy. Start by choosing a typical restaurant format: clearly structured sections, such as restaurant name, date, time, and list of items ordered. Each item should include a description, quantity, price, and subtotal. Avoid making it look too polished; small imperfections make the receipt feel more authentic.

Menu Items should resemble those commonly found in restaurant menus, such as appetizers, mains, drinks, and desserts. Keep the pricing in line with average restaurant prices, and don’t forget to include taxes and tips, if applicable. Be mindful of the item descriptions–keep them simple but accurate to avoid suspicion.

Formatting is key. Use fonts that mimic standard receipt printing, such as Courier or Consolas. Align everything properly and avoid overly fancy typography. Ensure that the total, tax, and tip amounts are clear, and don’t forget to include a small, generic footer with the restaurant’s contact information.

Fake Itemized Restaurant Receipt Template

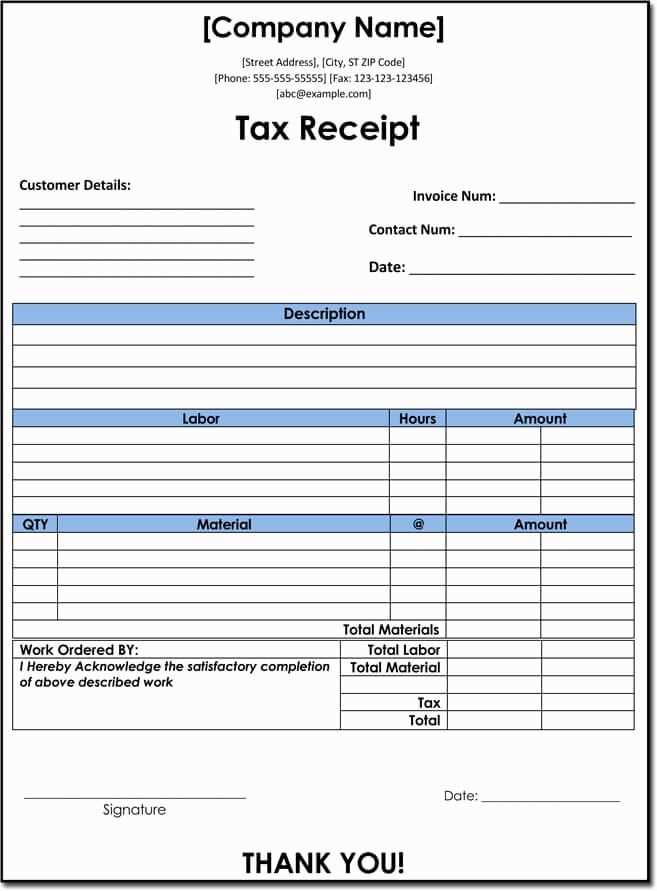

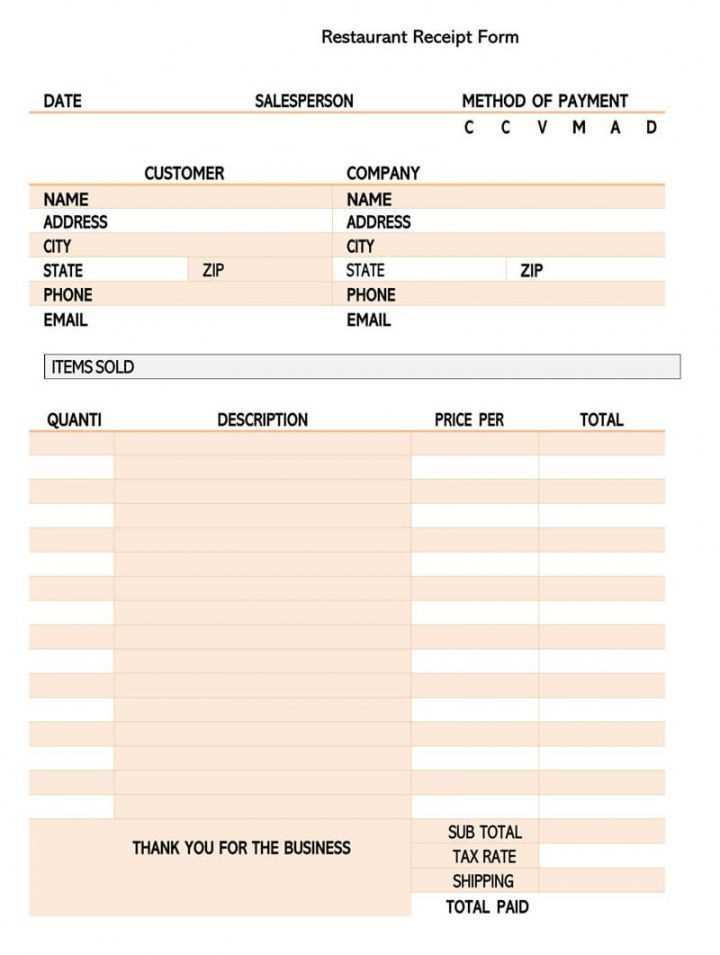

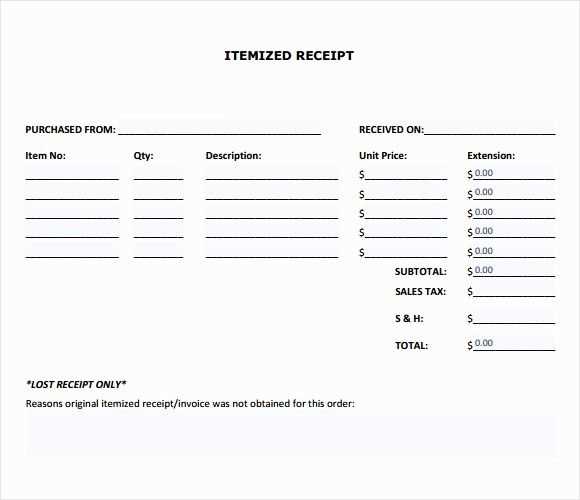

Creating a fake itemized restaurant receipt requires attention to detail. Begin by selecting a template that mirrors real receipts, focusing on accurate date, time, and restaurant information. Ensure that the items listed align with typical restaurant offerings, such as appetizers, main courses, drinks, and desserts. Use realistic prices that fit the establishment’s menu range. Adjust the subtotal and tax calculations to reflect a plausible total amount.

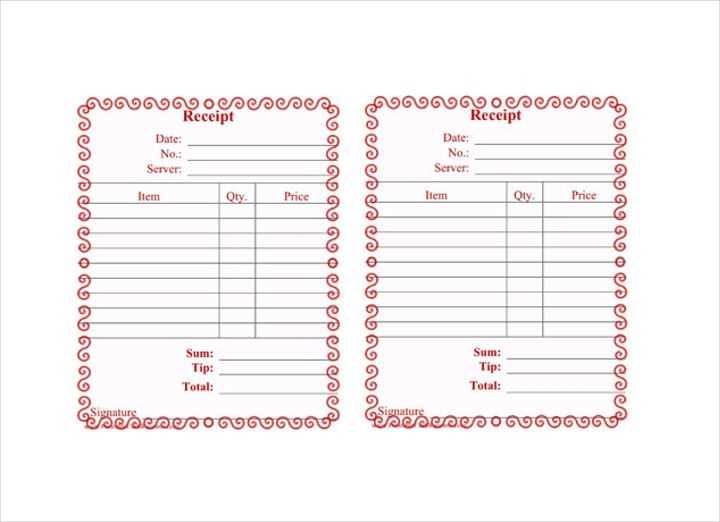

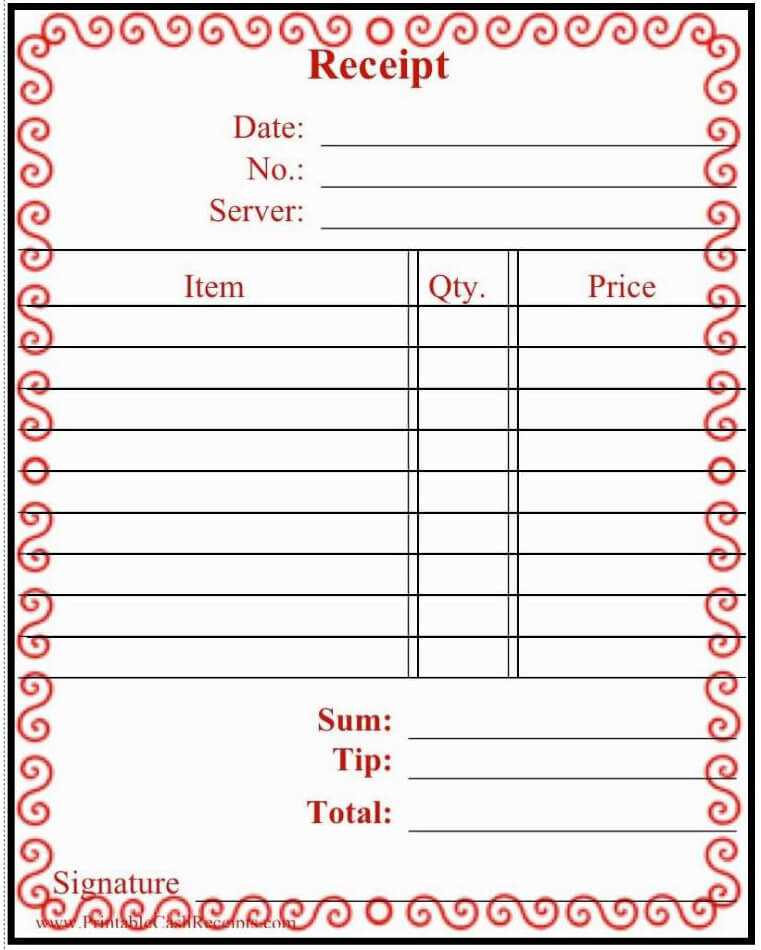

For authenticity, include customer service fees or tips if applicable. If your template includes a tip, make sure it falls within the typical percentage range of 10% to 20%. Double-check the formatting of the receipt, especially the alignment of text, spacing, and column widths, to ensure it appears professional. A credible receipt should include a payment method, such as credit card, cash, or mobile payment, and a corresponding transaction number or reference code.

When adjusting your template, make sure the text is clear and easy to read. Avoid cluttering the receipt with unnecessary items or information. The goal is to make the receipt look like it was printed at an actual restaurant, so keep the details simple and relevant. Consider using a realistic font and spacing similar to those found in printed receipts to complete the effect.

How to Create a Realistic Restaurant Receipt Template

Choose a clear, readable font for the main text. Common options like Arial or Times New Roman work well, as they mimic the fonts used in real restaurant receipts. Set the font size appropriately for different sections: larger for the restaurant name, medium for items, and small for totals and footer notes.

Include Key Elements

Ensure your receipt template includes the following components: restaurant name, address, phone number, and a unique transaction number. List ordered items with accurate prices and taxes. Add a subtotal, tax amount, and the total sum, and clearly distinguish between each element.

Use Proper Formatting

Align the text correctly. The restaurant name should be centered at the top, while item names, prices, and totals should be left-aligned for a clean, organized appearance. Adding borders or lines between sections can enhance readability and simulate a professional receipt layout.

Legal Considerations When Using Fake Restaurant Receipts

Creating or using fake restaurant receipts can lead to serious legal consequences. Engaging in this activity might result in criminal charges or civil liabilities. Understanding the risks is crucial to avoid unintended legal trouble.

Fraudulent Activity and Legal Risks

Submitting fake receipts for reimbursement or claiming tax deductions based on fabricated expenses is considered fraud. The consequences include:

- Criminal prosecution for fraud, which can lead to fines or imprisonment.

- Civil lawsuits for damages, especially if the fake receipt affects a third party, such as an employer or tax authority.

- Possible charges of conspiracy if others are involved in the act.

Tax Evasion Concerns

Using fake receipts to manipulate financial records can be seen as tax evasion. The Internal Revenue Service (IRS) and other authorities take such violations seriously, with penalties that include:

- Heavy fines that may exceed the amount of the tax owed.

- Increased scrutiny of your financial records and audits.

- Possibility of criminal charges, depending on the severity of the case.

It is crucial to adhere to legal and ethical standards when handling receipts, even if it may seem like a harmless action. The potential consequences far outweigh any short-term benefit.