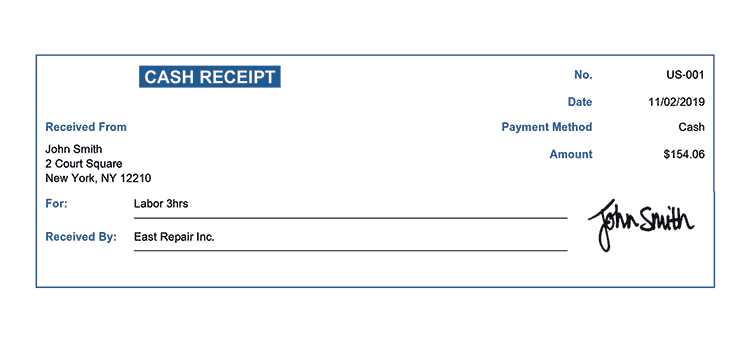

To maintain clear financial records, use a structured receipt template. This document ensures both the buyer and seller have accurate proof of the transaction. The template should capture all relevant details, including the date of the transaction, the names of the buyer and seller, item descriptions, prices, and payment method.

Begin by including the transaction date to ensure proper record-keeping. The receipt should clearly state the name of both parties, along with any contact details if necessary. Next, list the items or services purchased, including their individual costs and any applicable taxes.

Do not forget to mention the payment method. This could include cash, credit card, or electronic transfer. Adding this information helps to confirm the transaction details and can assist in resolving any disputes or questions later on.

The format of your template should be straightforward, easy to read, and allow space for any additional notes or terms. This will make it easy to verify information when needed. Lastly, ensure the template is flexible enough to accommodate various transaction types and amounts.

Here’s an improved version with reduced repetitions:

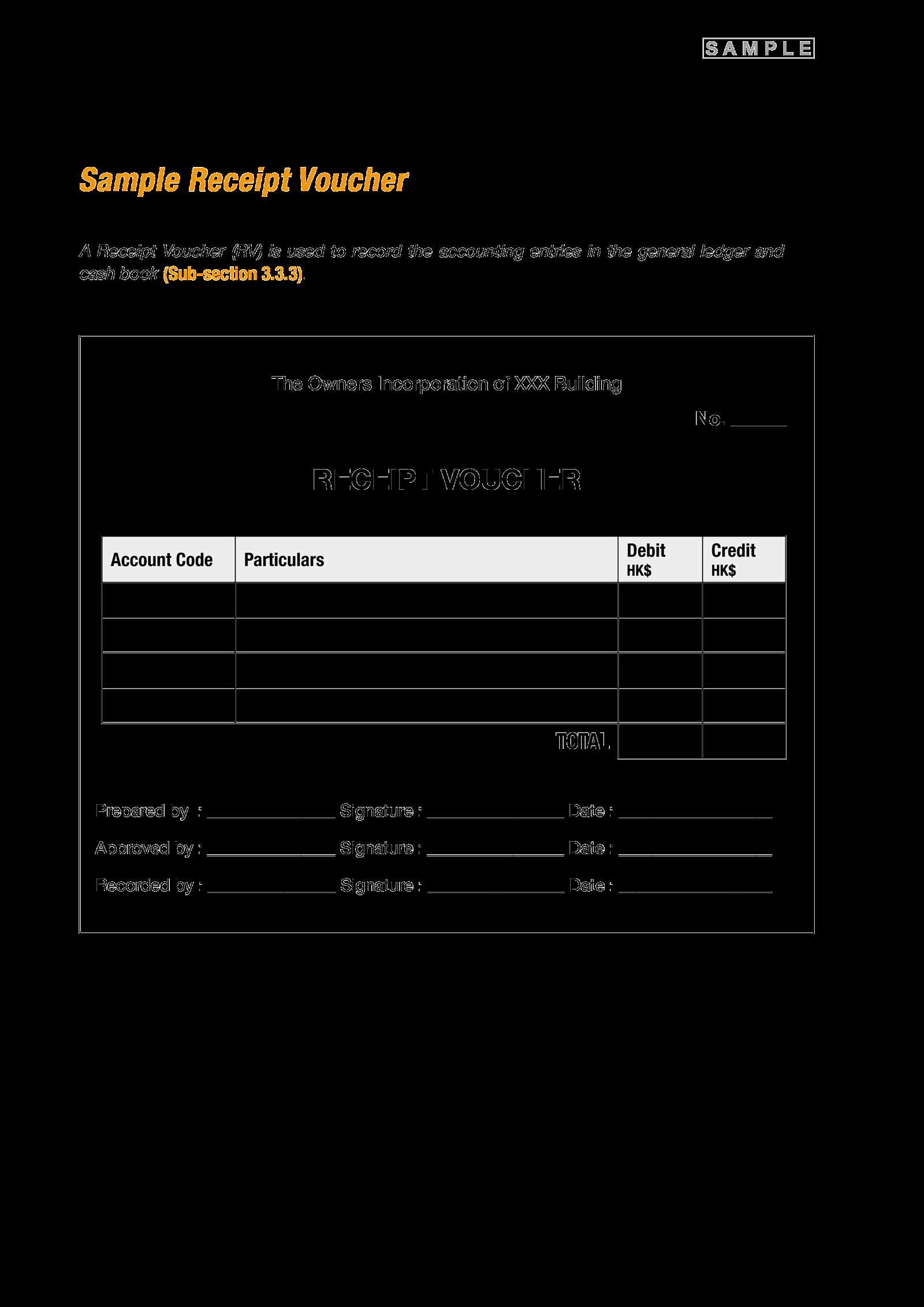

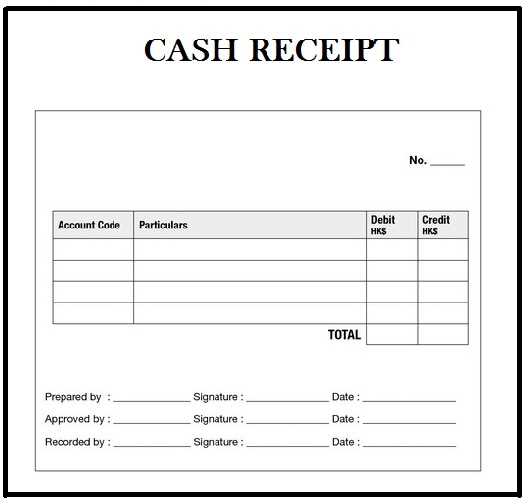

Use a clear structure for your receipt record template. Begin with the seller’s name and contact details, followed by the buyer’s information. Include a detailed list of items or services purchased, their quantities, and corresponding prices. Provide the total amount paid, including taxes and any applicable fees. Include the payment method and transaction reference number. Finally, include the date of the transaction and a space for signatures if needed. Make sure to leave room for additional notes or terms and conditions at the bottom.

This format ensures clarity while minimizing redundant sections. Focus on precise data points, avoiding unnecessary repetition in each section. Make it easy to reference key details without overcrowding the document.

- Receipt Record Template

Use a receipt record template to track payment transactions clearly and accurately. Begin by creating fields for the date, name of the payer, amount paid, payment method, and any associated reference numbers or transaction IDs. These elements provide a straightforward structure for both buyers and sellers to record relevant details.

Key Elements

Include the following components in your receipt record template:

- Date: Record the exact date of the transaction.

- Transaction ID: Include any unique reference number tied to the payment.

- Amount Paid: Clearly state the total payment amount.

- Payment Method: Indicate whether the payment was made via cash, credit card, bank transfer, or other methods.

- Payer’s Details: Collect the payer’s name, address, and contact information if necessary.

- Description: Provide details about the item or service paid for, if applicable.

Formatting Tips

Ensure the receipt record template is clear and easy to understand. Use bold for headings and important fields to make them stand out. Group related information together in logical sections, and leave space for additional notes or comments. This will make it easier to review or reference in the future.

By following these guidelines, your receipt records will remain organized, and both parties can refer back to them with confidence.

Begin with the header, including your name or business name, address, and contact details. This creates a clear starting point for the receipt. Below the header, place the date and receipt number for easy reference.

Receipt Details

List the items or services provided, with descriptions and their corresponding amounts. Make sure to break down the costs to avoid confusion. Add any relevant taxes or fees, specifying the rate and total amount charged.

Payment Information

Clearly indicate the payment method, whether it’s cash, card, or another form of payment. If the payment is partial, note the remaining balance and due date. Conclude with a thank-you note or any additional details like return policies or warranties.

Include these key elements when creating a business record:

- Date of transaction: Clearly state the date of each business activity to establish a timeline.

- Transaction details: Describe what the transaction involved, including product or service, quantity, and terms.

- Parties involved: List the names and contact details of all entities or individuals involved in the transaction.

- Amount and payment method: Specify the agreed-upon amount and how the payment was made (e.g., bank transfer, cash).

- Invoice number or reference: Include a unique identifier for easy tracking and reference.

- Signatures or approval: Ensure both parties sign or provide necessary approval to confirm the transaction.

- Tax details: Include any applicable taxes, such as VAT or sales tax, to comply with regulations.

These components create clear and complete records that can be used for reporting, audits, and future reference.

Modify your receipt template by tailoring it for different types of transactions, ensuring it fits the specific details of each case. Different transactions require unique information fields, which can affect the layout and content of the template. For instance, sales, refunds, and exchanges each have distinct characteristics that should be reflected in the receipt format.

Sales Transaction Template

For a standard sale, include the product name, price, quantity, total amount, and taxes. Also, make sure to specify the payment method, whether cash, card, or other means, and include the transaction date. If the sale involves discounts, indicate the percentage or amount saved. This transparency helps customers keep track of their purchases.

Refunds and Exchanges Template

Refund receipts should display the original purchase details, the amount refunded, and the reason for the refund. For exchanges, mention the item being returned, the replacement item, and any additional payments or adjustments made. It’s crucial to clearly distinguish these types of transactions from regular sales for clarity and proper documentation.

| Field | Sales Transaction | Refund Transaction | Exchange Transaction |

|---|---|---|---|

| Product Name | ✔ | ✔ | ✔ |

| Price | ✔ | ✔ | ✔ |

| Discount | ✔ | ✘ | ✔ |

| Payment Method | ✔ | ✔ | ✔ |

| Refund Amount | ✘ | ✔ | ✔ |

Ensure that each transaction type maintains clarity, consistency, and provides the necessary data for tracking, taxation, and returns.

Receipt Record Template

Use a straightforward structure to record a receipt. Start with the date of the transaction. This helps track the purchase and ensures clarity in the future. Include the seller’s name, business name, and address for easy reference. Clearly state the item or service purchased with its price. Add any taxes or additional fees, and list the total amount paid.

Key Information to Include

Make sure to record payment details, such as method of payment (cash, credit card, etc.). If applicable, note any discounts or promotional offers. Always include a receipt number for better tracking and organization. This ensures you can easily retrieve the record when needed.

Why Keep Track of Receipts

Receipts serve as proof of transaction and are important for returns, exchanges, or warranty claims. They also help with personal budgeting or business accounting, ensuring transparency in financial records. Store receipts in an organized manner for easy retrieval whenever required.