Tax receipts play a key role in managing your finances, especially when dealing with customs or other tax-related matters. To streamline this process, free templates can be a great asset, offering a simple and reliable way to document your transactions without the hassle of manual creation.

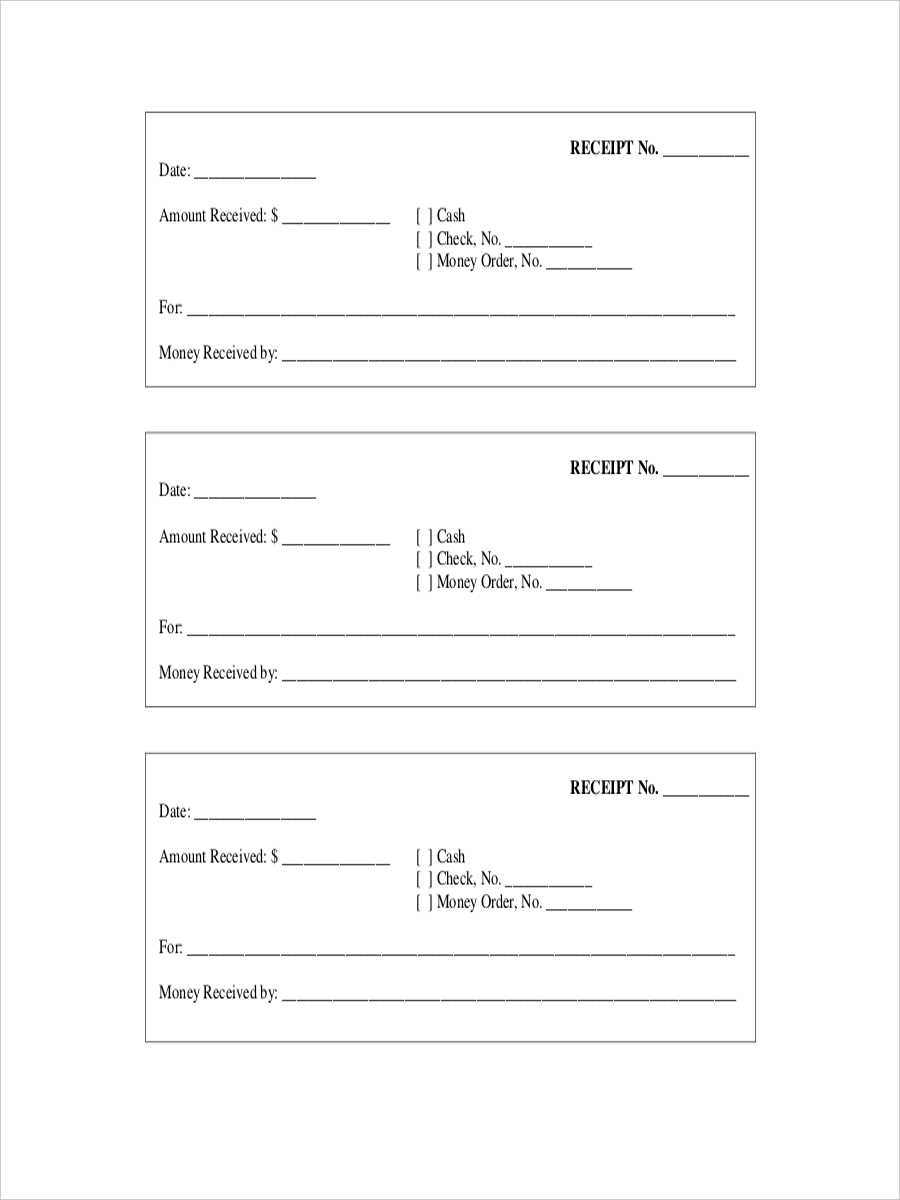

Using these templates saves time by providing a structured format, ensuring that all necessary details–such as payment amount, date, and transaction specifics–are covered. You can easily fill in the blanks, customize fields to your needs, and generate a receipt in moments.

Choosing the right template depends on your specific requirements. For example, some templates are designed with basic information, while others may include more advanced options, such as item descriptions and applicable taxes. Ensure the template fits your needs to avoid unnecessary revisions later on.

Opting for a free version doesn’t mean sacrificing quality. Many online resources offer well-designed templates that cover all the essential aspects of a duty tax receipt, making it easy for anyone to use, regardless of their level of experience with tax documentation.

Free Duty Tax Receipt Templates

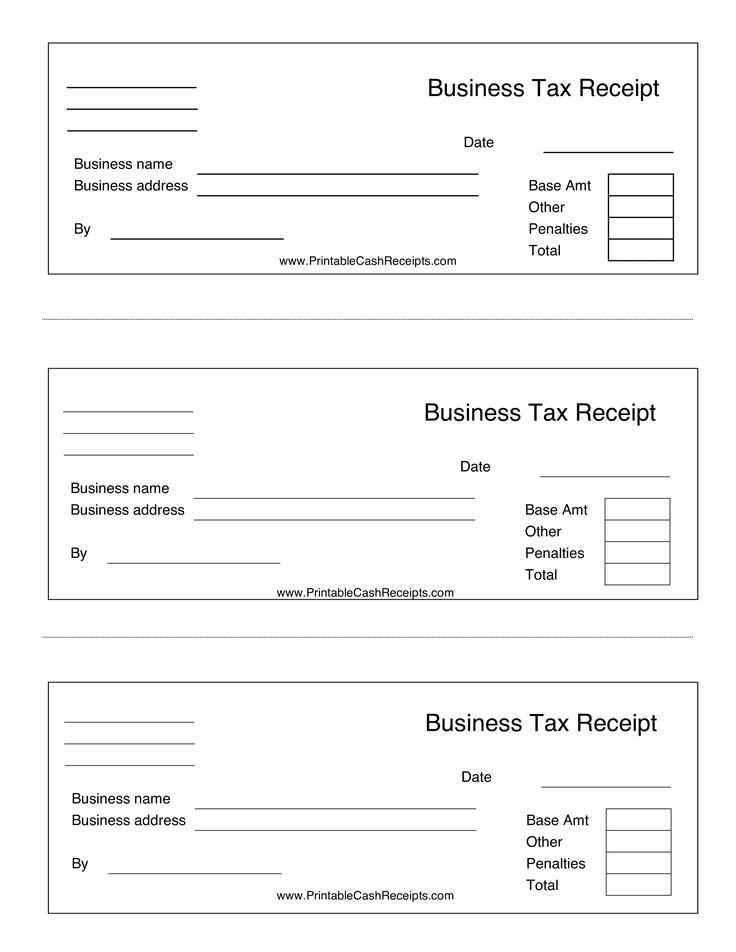

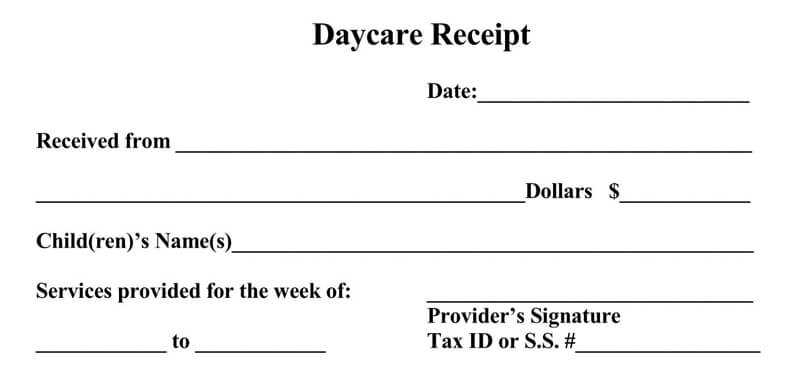

To simplify your tax documentation process, use free duty tax receipt templates that can be easily customized to suit your needs. These templates are available in various formats, including Word, PDF, and Excel, and are designed to meet legal requirements while saving time. By using pre-designed templates, you avoid the need to create receipts from scratch, ensuring accuracy and consistency in your records.

Where to Find Free Templates

Many online platforms offer free duty tax receipt templates for download. Websites like Template.net, Vertex42, and Microsoft Office’s template library provide easy access to templates designed for different business types and transactions. Check the template’s details to ensure it meets the local tax guidelines specific to your location.

How to Customize the Template

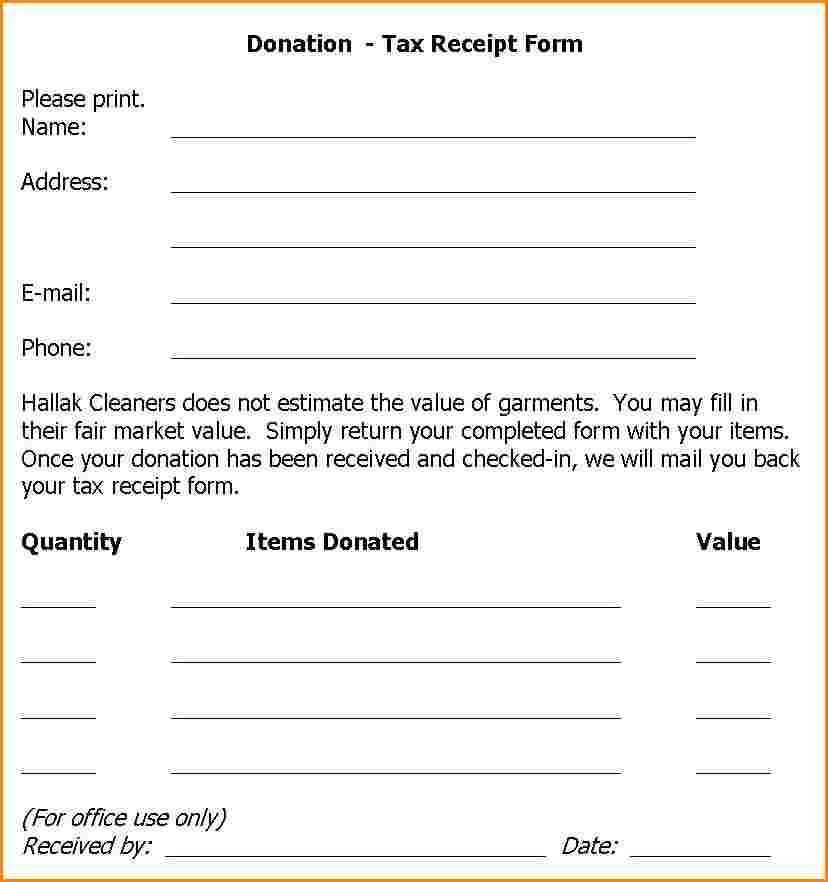

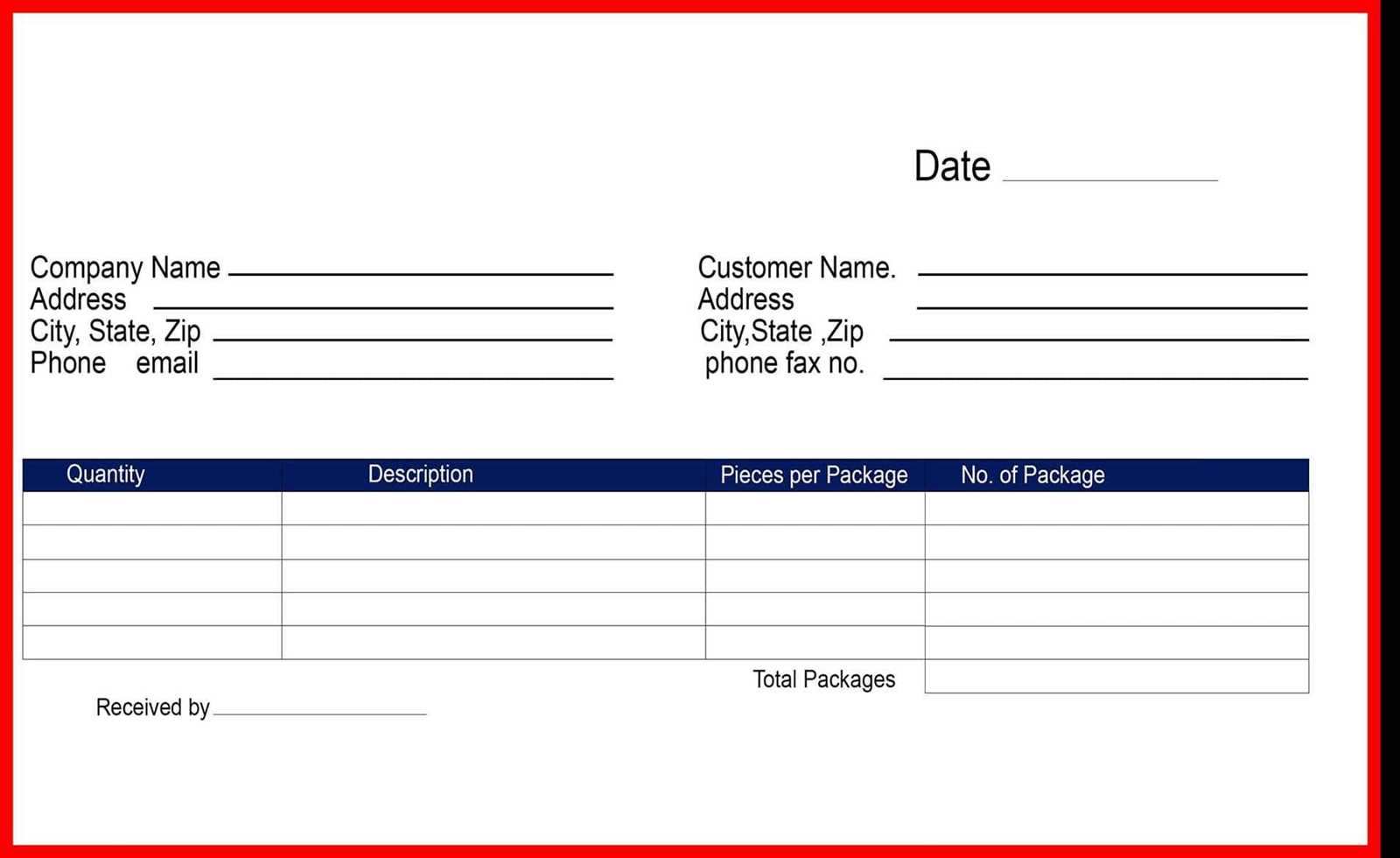

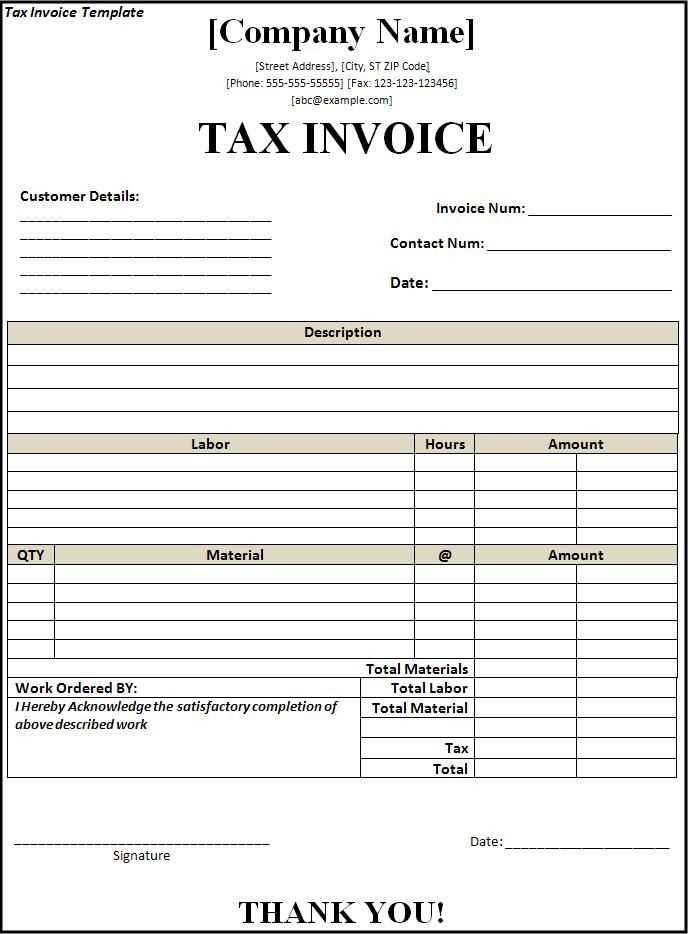

Customizing a receipt template is straightforward. Start by entering your company name, contact details, and tax identification number. Then, input the buyer’s information, transaction date, and the item description, including its value and any applicable tax rates. Make sure to check all data for accuracy before finalizing and issuing the receipt.

Choosing the Right Template for Your Business

Focus on the specific needs of your business when selecting a duty tax receipt template. Choose a design that aligns with your industry, ensuring it includes all necessary fields such as product/service description, amount, tax rate, and any relevant legal information. The template should be simple yet comprehensive, offering enough space for both client and company details.

Consider the size of your business. For small businesses, a minimal template with essential fields is ideal. Larger businesses might benefit from templates with customizable sections for various departments or products. If your business requires frequent updates or adjustments, look for templates that allow easy editing and reformatting without compromising professionalism.

Make sure the template you choose is compatible with your invoicing or accounting software to ensure seamless integration. It should also be printable in case you need physical copies. Opt for a template that maintains a clear, organized layout, as this enhances readability and ensures clients easily understand the receipt details.

How to Customize a Duty Tax Receipt Template for Different Products

Adjusting a duty tax receipt template for different products involves tailoring specific fields based on product types, pricing structures, and regulatory requirements. Here’s how to make those changes efficiently:

- Identify Product Categories: Start by categorizing products (e.g., electronics, clothing, or food). This helps determine whether different tax rates or exemptions apply.

- Customize the Tax Rate Section: For each product category, input the relevant tax rate or exemption. Some products, like essentials, may qualify for tax reductions, while others could have higher rates.

- Include Detailed Descriptions: Ensure the product description field matches each item’s specifics, such as model, size, or weight. This clarifies the taxable nature of the item for customs or accounting purposes.

- Adjust Pricing Fields: Update the pricing section according to the product. If the price varies by model or size, ensure each variation is properly reflected on the receipt.

- Add Additional Information: For products requiring special handling, such as hazardous materials, add a notes section to detail the relevant customs codes or handling requirements.

- Tax Breakdown: For high-value items, consider breaking down the tax calculation, showing item price, tax rate, and the total duty separately to avoid confusion.

By focusing on these areas, you can tailor your duty tax receipt template to suit a wide range of products, ensuring clear communication and compliance with applicable laws.

Common Mistakes to Avoid When Using Free Receipt Templates

Check for missing details. Ensure that all necessary fields like transaction date, item descriptions, amounts, and payer information are present. Skipping these sections can lead to confusion or disputes later.

Inaccurate Formatting

Inconsistent layout and spacing can make a receipt hard to read. Stick to a clean, organized format with clear labels and aligned columns. This prevents errors and ensures the document is easy to understand at a glance.

Failing to Customize Templates

Free templates are generic. Always tailor them to match your business specifics, including your logo, business name, and address. Using a template without these customizations can make your receipt look unprofessional and unreliable.

Double-check for typos. Simple spelling mistakes can damage your credibility. Always proofread before finalizing the document.

Lastly, confirm that your template complies with any legal requirements in your jurisdiction. Some areas require specific information, such as tax identification numbers or business registration details, to be included in official receipts.