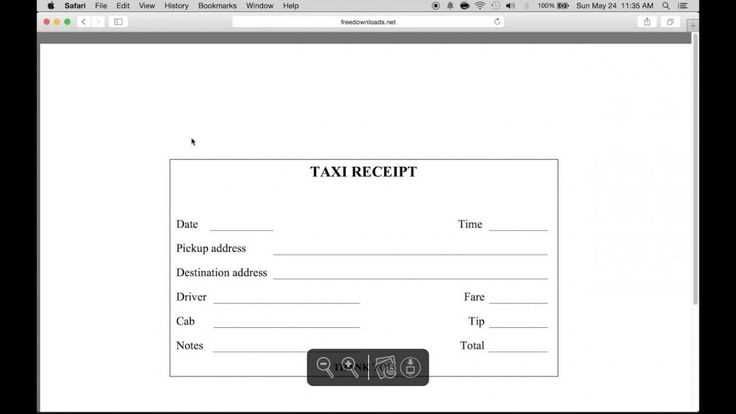

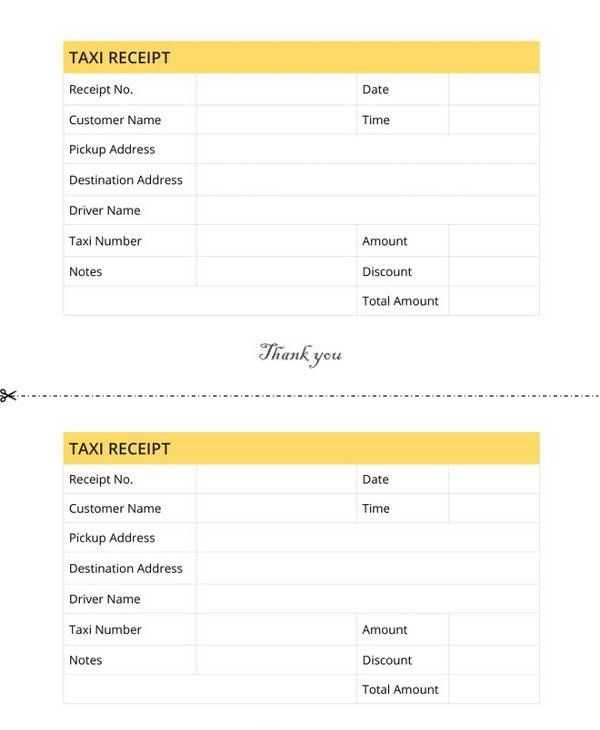

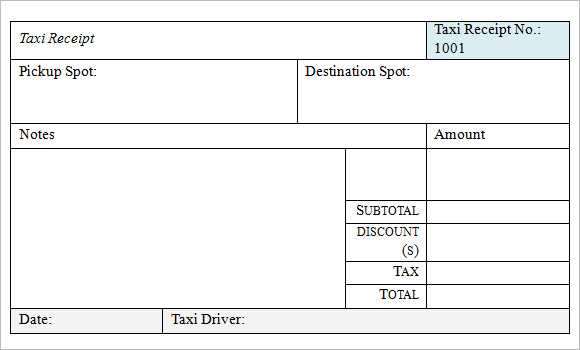

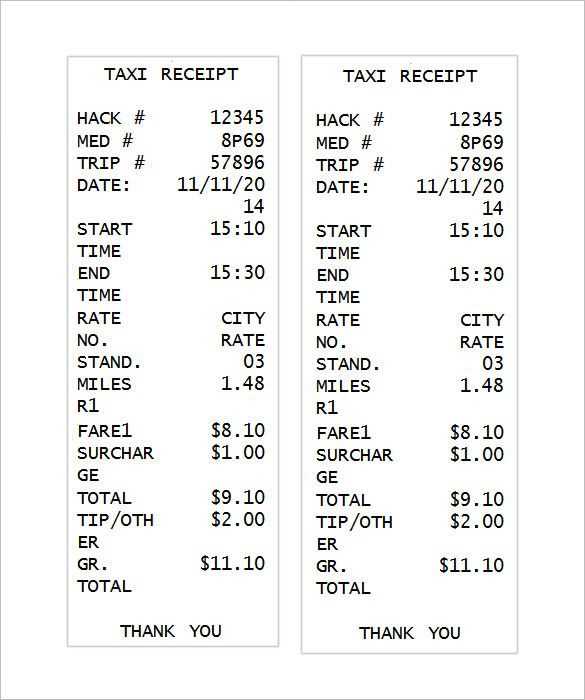

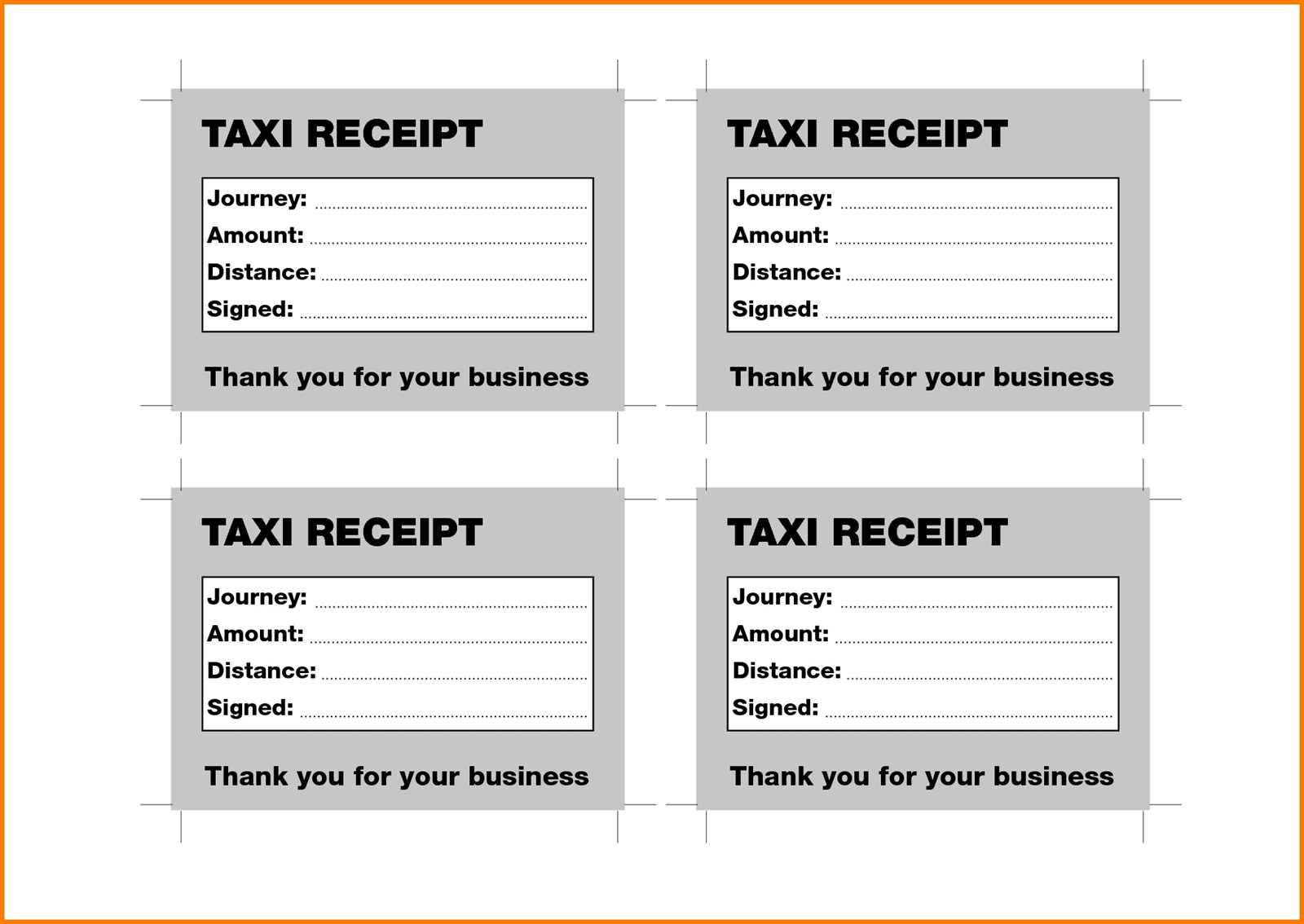

For a smooth transaction process, having a well-organized taxi receipt template is key. Ensure your template includes fields for essential details like the taxi number, pickup location, drop-off point, fare amount, and date and time of the ride. These elements provide transparency for both the driver and passenger.

A good template should also feature clear and concise sections for any additional charges, such as toll fees or waiting time, allowing for better tracking and accountability. To maintain clarity, use easily readable fonts and a layout that highlights the most important details upfront.

Incorporating a receipt number and space for both driver and passenger signatures adds another layer of legitimacy. It can help resolve any disputes or serve as proof for future reference. Always keep a digital or printed copy for your records, especially for business trips.

Here’s the corrected version:

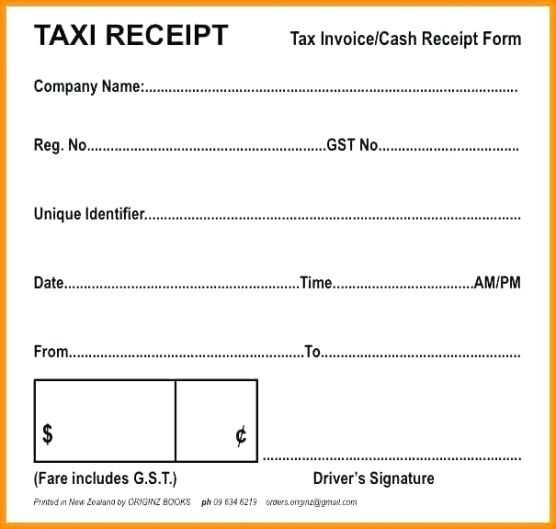

Ensure your taxi receipt includes the following details: taxi number, date, time, pick-up and drop-off locations, fare amount, and the driver’s name. This provides clear and necessary information for both the passenger and the taxicab service. Include GST details if applicable, as they are often required for reimbursement or tax records. Make sure to use clear, legible fonts to avoid confusion when the receipt is reviewed.

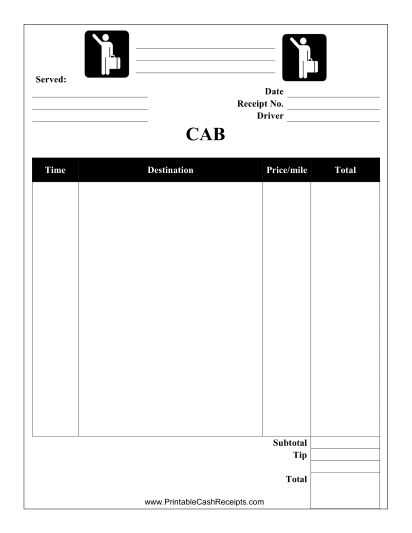

The receipt format should be simple yet informative, avoiding excessive text or confusing layouts. Incorporate distinct sections for each detail: a header for the taxi service name, a body for trip details, and a footer for payment information. This layout ensures that everything is easily accessible and understandable at a glance.

Finally, verify that the receipt is compliant with local regulations, as some states or cities may require additional information or formatting standards. Stay updated on any changes to tax laws or transportation regulations to ensure your receipts meet all legal requirements.

Taxi Receipt Template in India

How to Create a Simple Taxi Bill Template

Key Elements to Include in a Taxi Receipt

Designing an Easy-to-Read Taxi Layout

Customizing Your Taxi Bill for Tax Needs

Online Resources for Creating Taxi Templates

Ensuring Compliance with Indian Transport Laws

Start by choosing a clean and clear layout for your taxi receipt. The key components include the taxi service provider’s name, license number, fare details, date, and time of the ride. Make sure the layout is uncluttered and readable, using bold text for headings and sufficient spacing between sections.

Key Elements to Include

Your template must capture the essentials:

- Taxi Service Provider Name

- License Number

- Pick-up and drop-off locations

- Distance traveled

- Total fare, including taxes

- Payment method (cash, card, etc.)

- Date and time of the trip

- GST details (if applicable)

These elements help ensure that the receipt is both complete and compliant with Indian tax regulations.

Designing the Layout

The receipt should feature clear divisions between sections like passenger details, journey specifics, and payment summary. A bold header with the company’s name and contact details can create a professional look. Avoid using too many colors; instead, focus on readability, keeping text size consistent for easy scanning.

For customizing the bill, ensure it includes GST fields as required for tax reporting in India. This can be done by adding a GSTIN section where relevant. For businesses, including your company’s PAN number also enhances credibility and legal compliance.

There are several online platforms that offer free templates for taxi receipts. You can customize these templates by adding your business details or modifying the format to suit your branding. Some useful websites include Canva and Invoice Generator.

Lastly, verify that your taxi receipt template complies with Indian transport laws and GST regulations. You might need to consult a local expert to ensure the template is fully aligned with the latest rules.