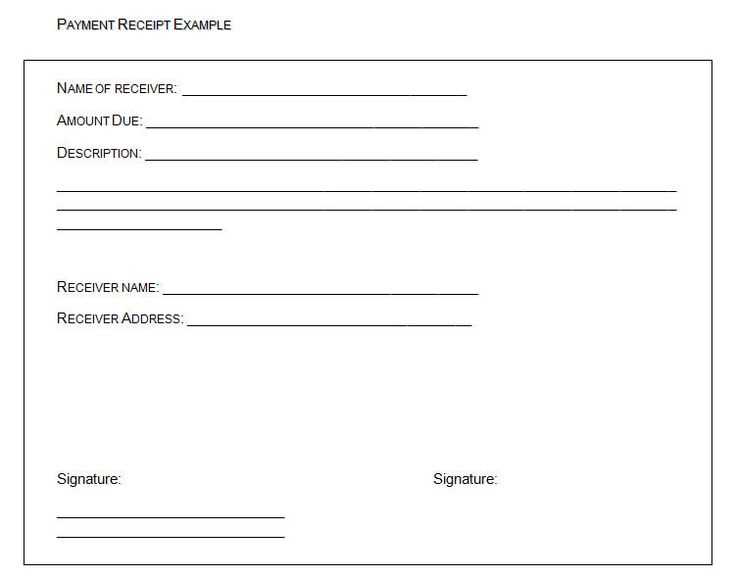

Use a “Paid to Receipt” template to simplify your payment record-keeping process. This template ensures that you capture the necessary details of any payment you receive, whether it’s cash, check, or another method. By using this format, you avoid confusion and keep accurate records for future reference or audits.

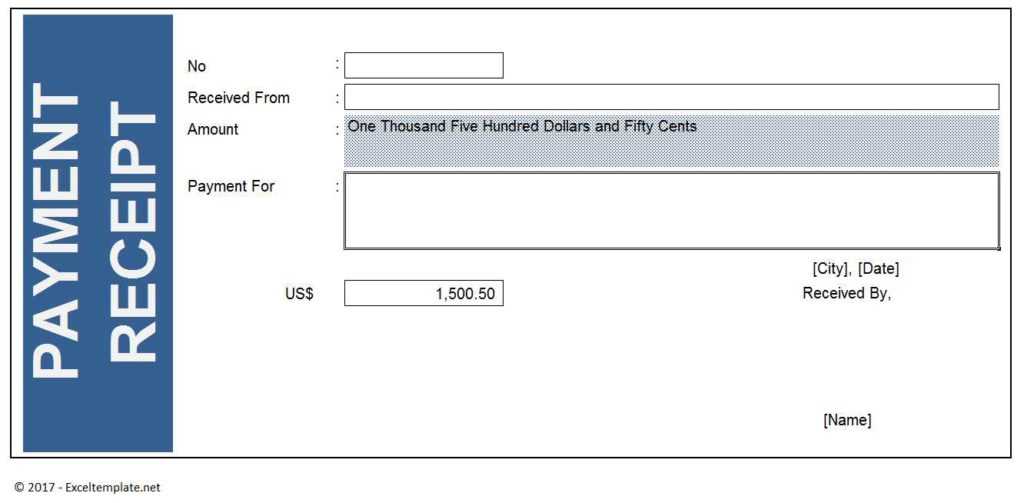

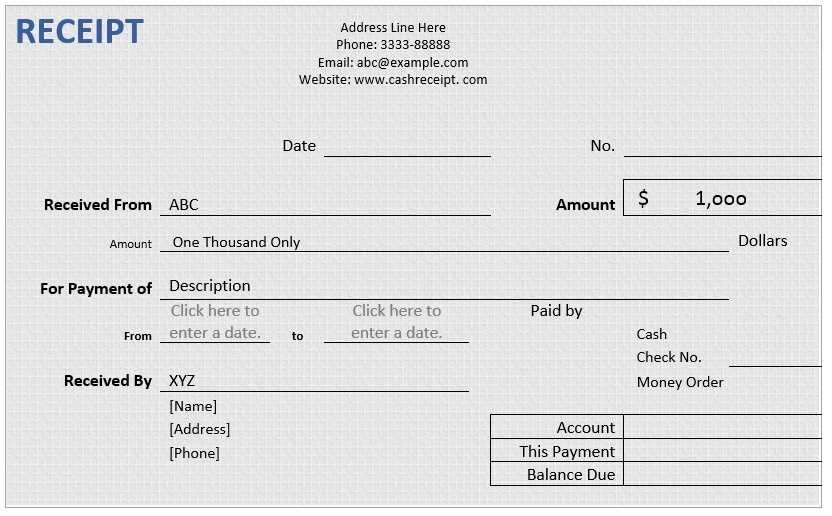

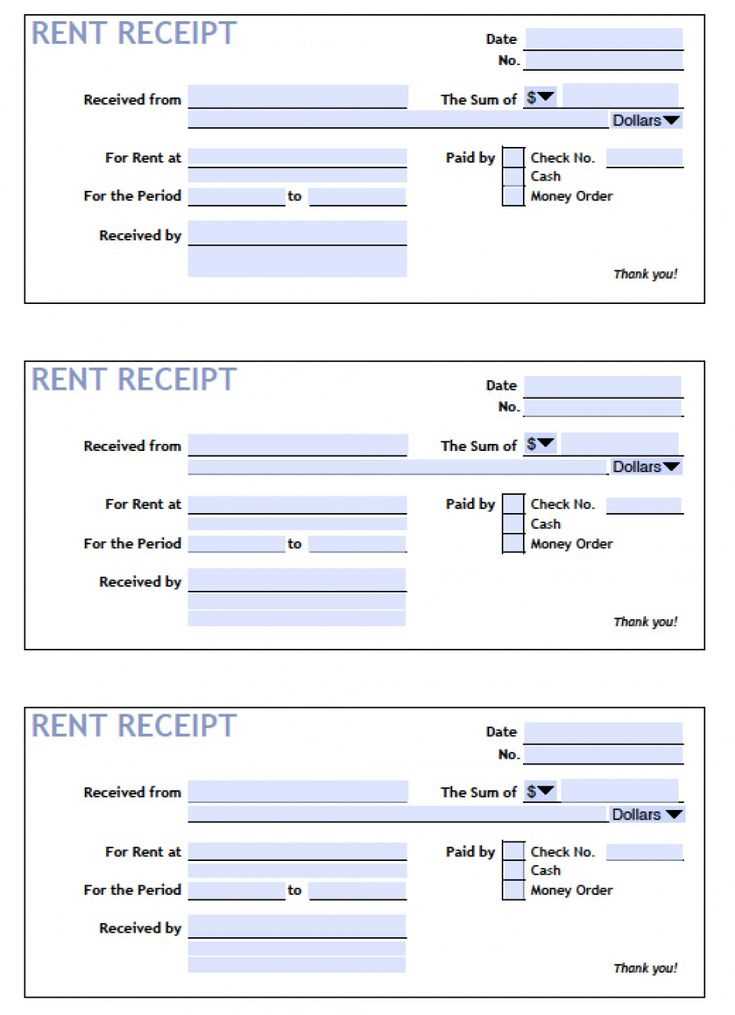

Make sure your template includes the payment amount, the date, the payer’s name, and the reason for the payment. Including a unique receipt number helps you track payments systematically. This practice helps both businesses and individuals stay organized, especially when payments are frequent or related to multiple transactions.

Additionally, ensure that the template has space for the signature of both the payer and the payee, as this adds legitimacy to the transaction. It’s also a good idea to customize your template to reflect your branding or personal preferences. A clear and professional receipt builds trust and can serve as proof of payment if needed in the future.

Here’s a detailed HTML structure for an informative article on “Paid to Receipt Template” with specific and practical headers: Paid to Receipt Template: A Practical Guide

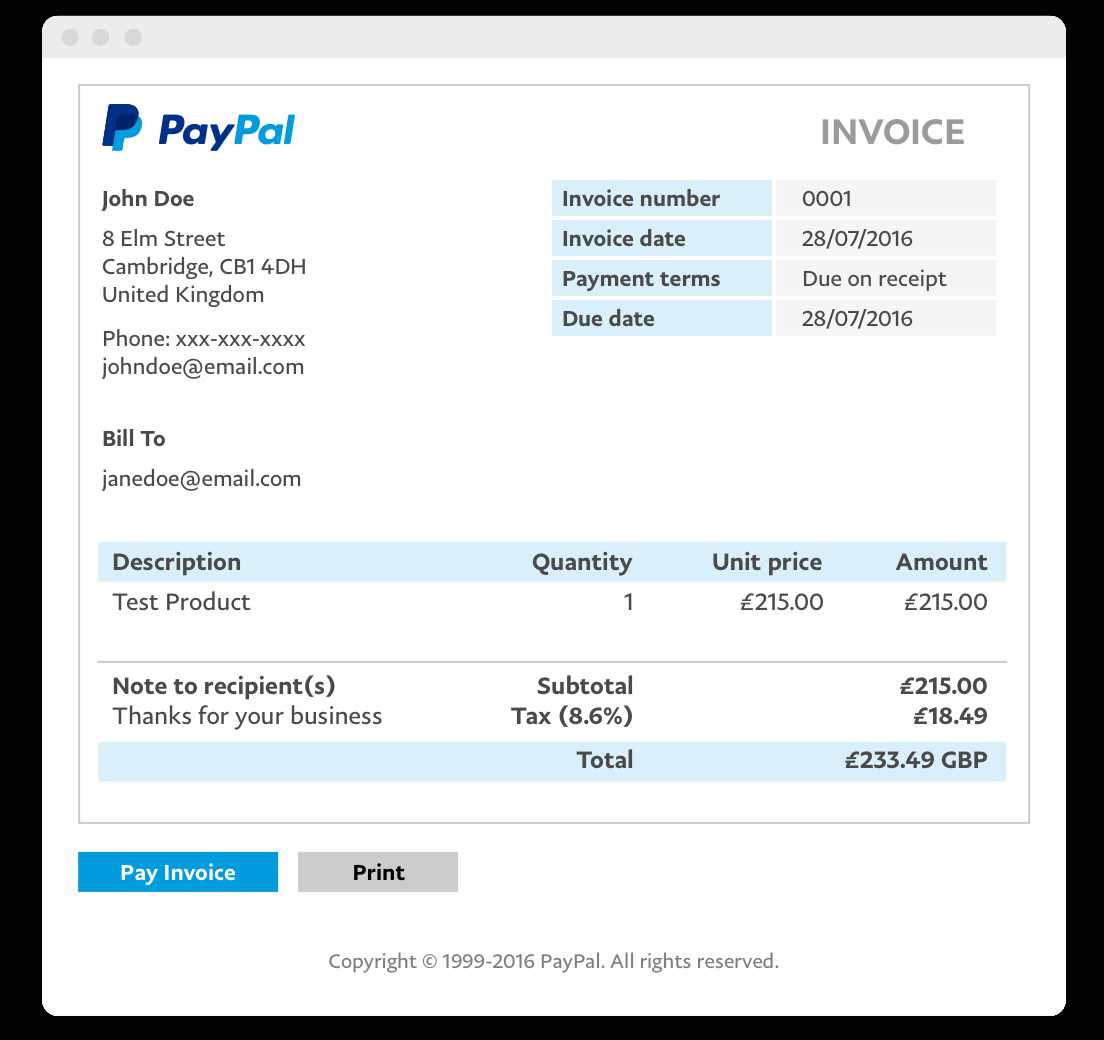

Creating a “Paid to Receipt Template” involves several key components that ensure clarity and legality. A basic structure typically includes the business name, receipt number, date of payment, payer details, amount paid, payment method, and service or product description.

The header section should begin with the business name and logo for easy identification. This is followed by the receipt title (“Paid to Receipt”) and the receipt number for tracking purposes. Clear and consistent numbering helps maintain an organized record-keeping system.

Next, include the payment date, which marks the completion of the transaction. This date serves as a reference point for both the payer and payee, confirming when the payment was received.

Incorporating the payer’s information adds transparency to the document. Include the payer’s full name, address, and contact information to confirm who made the payment. If applicable, include their business name for B2B transactions.

Clearly state the payment amount and ensure it matches the transaction agreement. It’s helpful to break down the amount if there are multiple items or services involved, making it easier for both parties to verify the payment.

Specify the method of payment–whether it’s cash, credit card, check, or another form. This is crucial for record-keeping and resolving any future discrepancies.

Conclude with a detailed description of the services or goods provided. This section ensures both parties understand what the payment is for and prevents any confusion in the future.

Including a “Paid to Receipt Template” in your business operations ensures smooth financial tracking and strengthens trust with clients or customers by providing clear, concise, and accurate documentation of transactions.

How to Customize a Paid to Receipt Template for Your Business

Adjust the layout and fields to match your business requirements. Begin by replacing the standard logo and contact details with your own branding. A clean and professional logo placement in the top-left corner ensures that your business identity stands out.

Include Relevant Business Information

Make sure the receipt clearly displays the name of your business, address, and contact information. This ensures your customer can reach you if needed. Consider adding your website and social media handles for easy online reference.

Personalize Payment Details

Update the payment section to reflect the transaction. Include fields like date of payment, payment method, and transaction ID. This information helps both you and your customer keep accurate records. If applicable, add a section for taxes or discounts.

By customizing these details, you make the receipt not only practical but also specific to your business’s needs, enhancing your brand recognition and customer satisfaction.

Common Mistakes to Avoid When Creating Paid to Receipts

Ensure all payment details are clearly stated. An unclear or incomplete receipt can create confusion and lead to disputes later. Avoid the following common mistakes:

1. Missing or Incorrect Payment Amount

Always double-check the payment amount. It’s easy to overlook, but even a small mistake can cause major issues. Verify the total amount received and ensure it matches the transaction record.

2. Not Including Proper Date and Time

Including an accurate date and time helps provide a clear record of the transaction. Failure to list these details can complicate any future inquiries or disputes related to the payment.

3. Lack of Clear Identification Information

- Include both the payer’s and payee’s names or business information.

- Provide specific transaction IDs or reference numbers.

Without these identifiers, it becomes difficult to link the receipt to a specific transaction.

4. Skipping Payment Method

Clearly state the payment method (cash, check, credit card, etc.). Omitting this information can lead to misunderstandings, especially if there’s a need to verify the transaction later.

5. Incorrect or Missing Invoice Number

If the payment relates to an invoice, include the correct invoice number. Missing or incorrect invoice numbers can complicate your accounting and cause delays in payment processing.

6. Overcomplicating the Receipt

- Keep the receipt simple and to the point.

- Avoid adding irrelevant details or excessive text.

A clear, concise receipt will be easier for both the payer and payee to understand, reducing the likelihood of errors or misunderstandings.

How to Digitally Sign and Distribute Paid to Receipts

Use a secure digital signature tool like Adobe Sign, DocuSign, or HelloSign to sign your Paid to Receipts. These tools offer encryption to ensure the authenticity of the signature. After signing, save the document in PDF format for easy sharing and retention.

To distribute the receipt, send it directly via email as an attachment or through secure file-sharing platforms like Google Drive or Dropbox. Always include a clear subject line and a brief explanation of the attachment’s contents to avoid confusion.

If you need to distribute receipts to multiple recipients, consider using an automated email system that can send personalized receipts in bulk. Ensure that the recipients have access to the necessary software or file format to open the receipt securely.

For added security, use two-factor authentication (2FA) when sharing receipts. This adds an extra layer of protection to prevent unauthorized access. Additionally, set expiration dates on links to prevent long-term access to the document after it has been distributed.

Regularly back up signed receipts in a secure location for future reference. Digital receipts offer the advantage of being easily searchable and stored without the risk of physical damage or loss.