If you’re looking for a straightforward, professional receipt template for Arco 60.00, this guide is for you. Whether you’re running a small business or need it for personal use, having a well-organized receipt template can save time and avoid confusion. The Arco 60.00 receipt template should capture all key transaction details without unnecessary elements, ensuring clarity and ease of use.

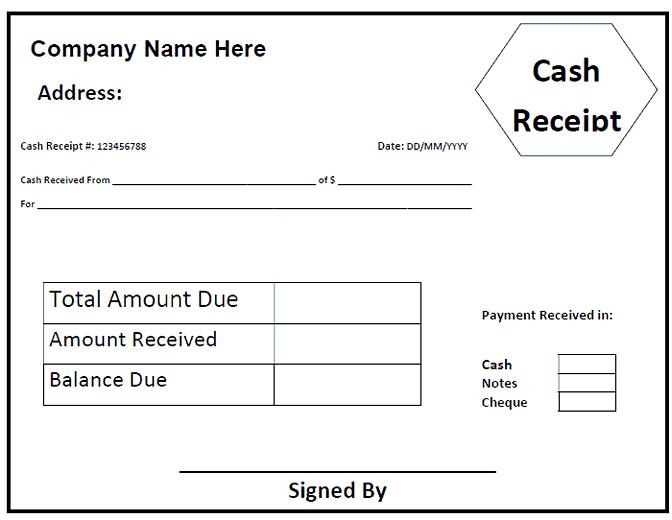

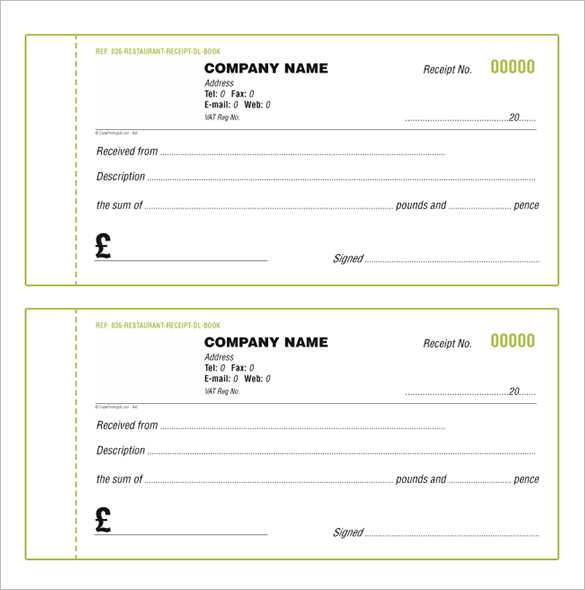

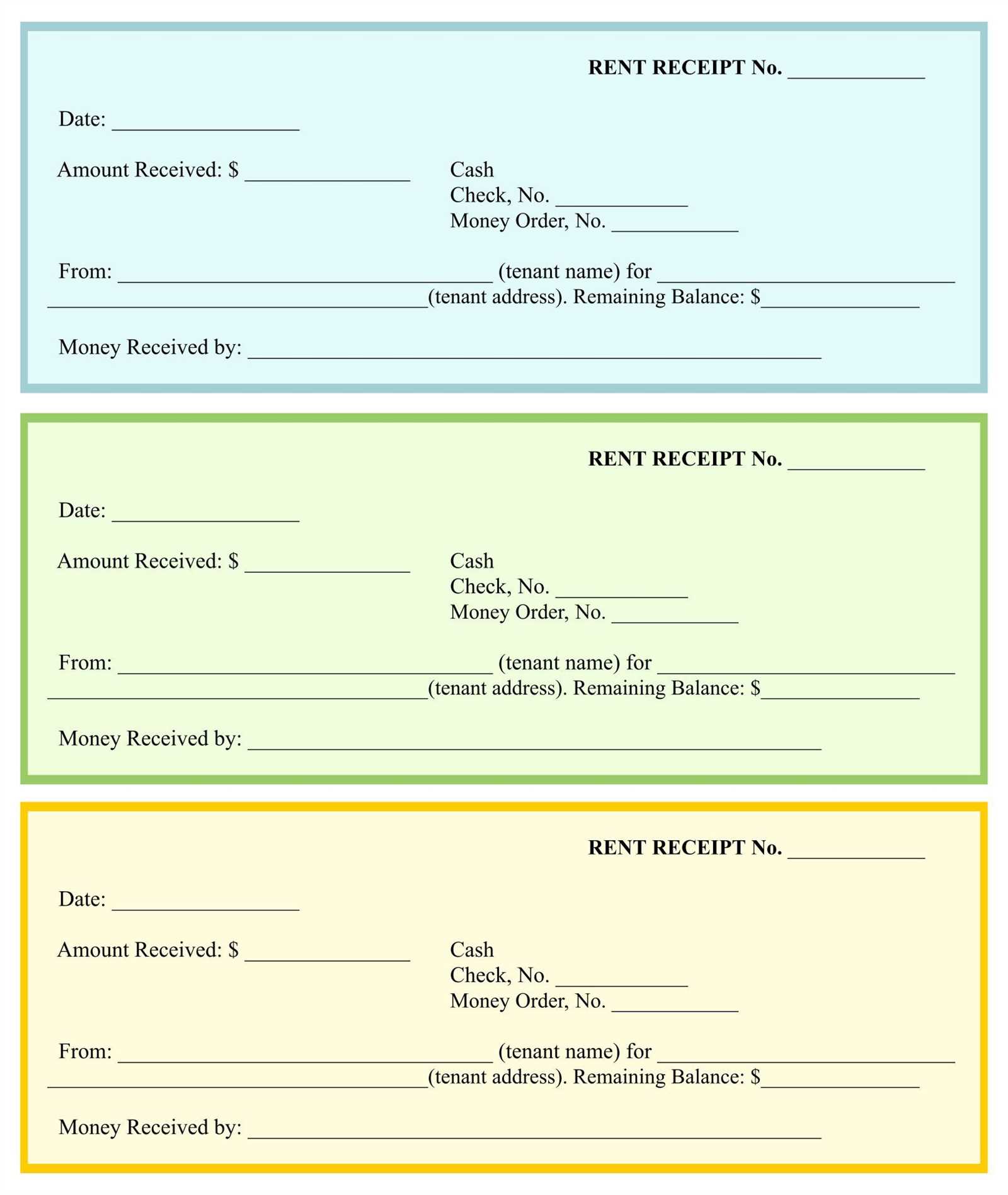

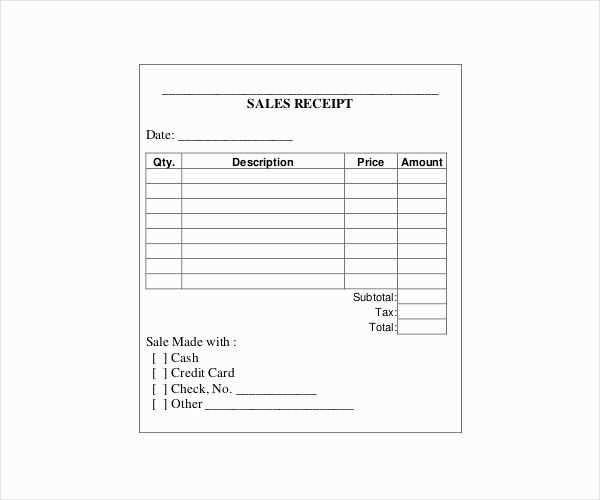

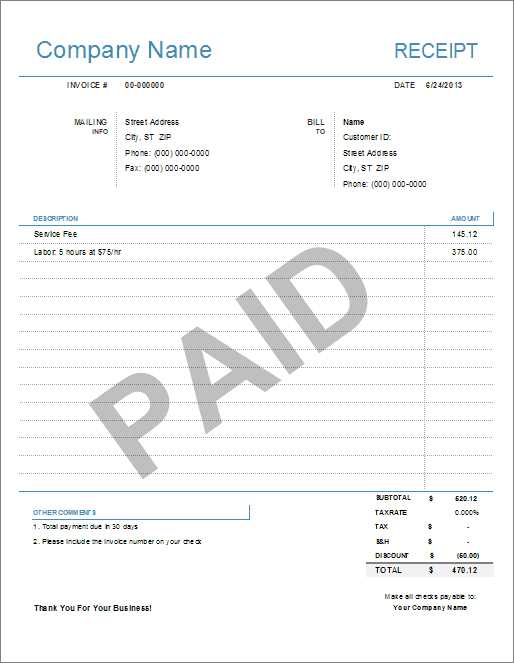

Start by ensuring that the template includes all necessary fields: transaction date, transaction ID, items or services purchased, total cost, and payment method. Make sure the template has space for both itemized details and the total price, along with a clear breakdown of taxes or additional fees, if applicable. This ensures the customer can quickly verify what they’ve paid for and how much they’ve been charged.

For consistency, ensure that your template matches the format typically expected for Arco 60.00 transactions. Use clear labels and a logical flow for ease of reading. Keeping the design simple yet functional will help maintain a professional image for your business, whether you’re sending receipts digitally or printing them out for customers.

Here’s the corrected text:

Use a consistent layout when creating the Arco 60.00 receipt template. Begin with a clear header that includes the store name, address, and contact details. Ensure the font is readable and appropriately sized, so customers can easily find key information.

Section Breakdown

The receipt should include a breakdown of the purchase. List each item with its description, quantity, unit price, and total price. Include any applicable taxes or discounts to ensure clarity.

Payment Details

Provide clear payment information at the bottom. This should include the total amount paid, the method of payment (e.g., cash, card), and a confirmation or transaction number if applicable.

Lastly, include a footer with any legal disclaimers or return policies. Keep the footer concise to avoid cluttering the template.

Arco 60.00 Receipt Template: A Practical Guide

How to Customize the Arco 60.00 Template for Your Business

Step-by-Step Instructions to Complete the Arco 60.00 Receipt

Common Mistakes to Avoid When Using the Arco 60.00 Template

The Arco 60.00 receipt template can be quickly adjusted to suit your business needs. Start by replacing the default company details with your own. Include your company name, address, contact information, and logo in the appropriate fields. Ensure your company’s tax ID number is visible, especially if you deal with business-to-business transactions.

Step-by-Step Instructions to Complete the Arco 60.00 Receipt

First, verify that the template is compatible with your software. Open the file in a word processor or spreadsheet program that supports template formatting. Then, fill in the fields for transaction details: the date of purchase, receipt number, and customer information. Each section should automatically adjust to fit the inputted data. Double-check the line items–product names, quantities, prices, and tax rates–and update as necessary.

Finally, ensure the total amount and any applicable discounts are correctly calculated. The template typically includes a field for adding additional charges like shipping or handling fees. Once you’ve reviewed the information for accuracy, save the file in your preferred format (PDF or Excel are common choices) and issue it to the customer.

Common Mistakes to Avoid When Using the Arco 60.00 Template

One frequent mistake is leaving out the company’s tax details, which can result in complications during audits or customer disputes. Also, don’t forget to include all required fields; missing items like the customer’s contact information can lead to confusion. Be careful with the date format–ensure consistency across receipts to avoid any confusion with your accounting records.

Another issue is neglecting to review the calculations on each receipt. Arco 60.00 templates often include automatic tax and total fields, but errors in the initial data can lead to incorrect final amounts. Double-check the tax rates and discount entries before finalizing the receipt.