Creating a clear and organized itemized receipt is straightforward with the right template. This type of receipt breaks down each item, allowing both the buyer and seller to have a transparent record of the transaction.

Start by listing each item separately, including its description, quantity, price per unit, and total amount. Use clear formatting to separate each part for easy readability. Be sure to include tax information if applicable, as well as any discounts or special offers that were applied.

A well-structured template ensures accuracy, providing all relevant details without cluttering the document. Make use of a table format to align the information neatly, ensuring that each column clearly represents different data such as item name, quantity, price, and total cost.

At the bottom, don’t forget to include the total amount for the entire transaction and a breakdown of any taxes or fees. This transparency is not only professional but also fosters trust with your customers.

Here are the revised lines without word repetition:

Focus on concise and clear wording when preparing an itemized receipt. Begin with the necessary details, avoiding unnecessary repetitions.

Structure of an Itemized Receipt

Each item should be listed separately, including its description, quantity, price, and total cost. Group similar items to keep the list organized, ensuring clarity for the reader.

Accuracy in Data Entry

Ensure all figures are accurate and match the total sum. Double-check the amounts for any discrepancies to prevent confusion or errors.

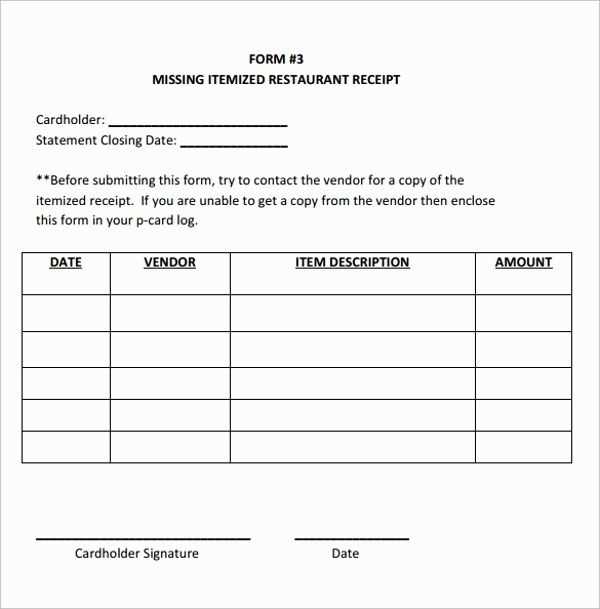

- Asu Itemized Receipt Template

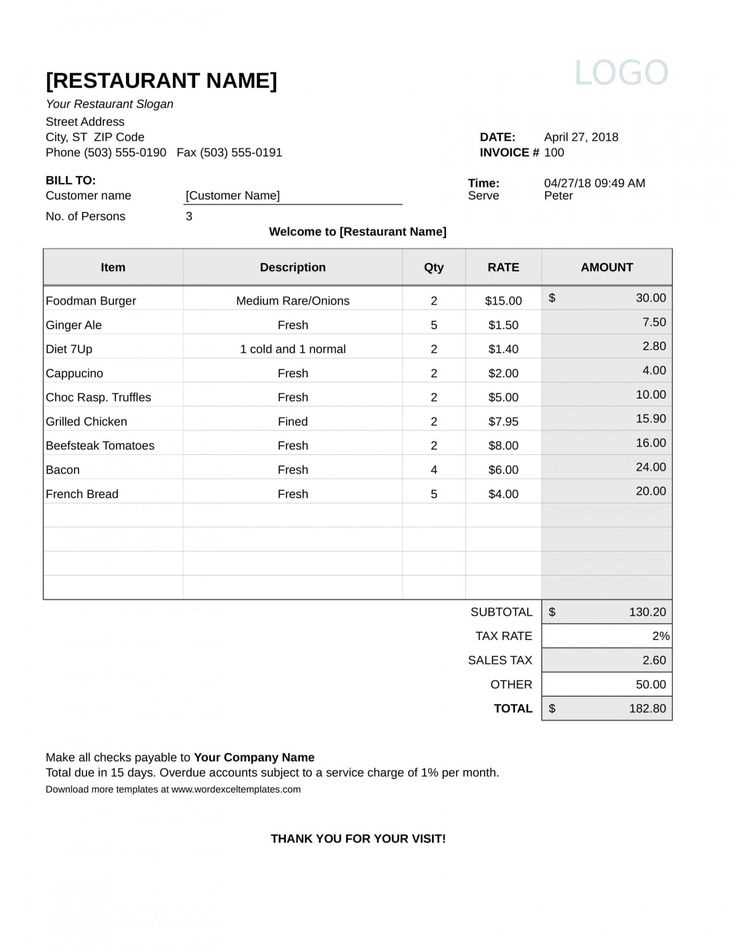

For clear and accurate financial tracking, create an itemized receipt with a template that includes all relevant details. Ensure that each product or service listed is broken down with its individual cost, quantity, and any applicable taxes or discounts. The template should follow a simple structure: a header with your business name, address, and contact info; a list of items with descriptions, prices, and quantities; and a total amount that includes tax calculations.

Key Components of the Template

- Business Information: Name, address, and phone number.

- Itemized List: Product name, quantity, unit price, total cost.

- Tax Details: Breakdown of applicable taxes or VAT.

- Discounts/Refunds: Any adjustments to the final amount.

- Total: The grand total including tax and adjustments.

Including these details in your template provides clarity for both the seller and the buyer, ensuring transparency and helping with future audits or returns. Make sure to also include space for the payment method, date of transaction, and any reference number for easy tracking. Customization is key to adapting the template to your business’s specific needs.

To create a customizable itemized receipt template, focus on flexibility and simplicity. Start by structuring the template with adaptable fields that can be adjusted for various transactions.

Step 1: Design the Basic Layout

- Header: Include a space for your business name, address, contact information, and logo. This section should be easy to update.

- Item Details: Provide fields for item name, quantity, unit price, and total price. Make sure the fields can be modified for each item in a transaction.

- Subtotal: Have a clear, editable subtotal field that aggregates the total of all items.

- Footer: Add space for a thank you note, terms of service, or return policy, depending on your business needs.

Step 2: Customize for Special Charges

- Taxes: Allow a field for customizable tax rates, where users can input different rates based on location or product type.

- Discounts: Add a flexible area for applying percentage or flat-rate discounts, either per item or to the whole receipt.

- Shipping Costs: Create a space for customizable shipping charges, which can be calculated based on weight, destination, or service method.

- Additional Fees: Leave room for optional service or handling fees that may vary per transaction.

By incorporating these customizable fields, your receipt template can adjust easily to different types of sales, making it versatile for various business needs.

Ensure that each item on the receipt is clearly listed with the correct description, quantity, and unit price. This allows both the purchaser and the seller to verify the transaction without confusion.

Include a breakdown of any applicable taxes, showing the percentage and amount for transparency. It is important to distinguish between the base price and the tax to avoid misinterpretation.

State the total amount due, including any extra charges such as shipping, handling, or fees. This helps in preventing disputes over hidden costs that may arise later.

Provide the date of the transaction to confirm the timing of the purchase. This is particularly important for returns, warranties, or any time-sensitive matters.

Include both the seller’s and buyer’s details, such as names, addresses, and contact information. This helps in identifying the transaction and resolving any potential issues effectively.

Make sure to display a unique receipt number for easy reference. This number can be used for tracking and addressing future inquiries or complaints.

Lastly, specify the method of payment, whether it is cash, credit card, or any other form. This adds a layer of security and clarity to the transaction record.

Keep the layout clean and intuitive. Begin by organizing information in a logical flow. Group related data together, such as item details, quantities, and prices. This helps avoid confusion and improves readability. Use clear headings for each section to make the document easy to scan.

Use Consistent and Readable Fonts

Choose a simple, legible font. Avoid overly decorative styles that might make the text harder to read. Stick to standard font sizes for the body and headings to maintain clarity. Ensure that the font size is not too small for comfortable reading.

Use Columns and Tables for Organization

Incorporate tables to neatly display itemized lists. Align data in columns, such as item names, descriptions, unit prices, and totals. This structure makes it easy for recipients to compare and track details without unnecessary scrolling or searching.

Provide enough space between sections to prevent the document from feeling cluttered. Use borders or shading sparingly to highlight key areas, like totals or important notes. Avoid overusing colors or design elements that could distract from the main content.

To create a detailed and clear itemized receipt template, focus on organizing information logically and ensuring each element is easy to read. Start by listing the items or services provided, ensuring that each one includes a brief description and the corresponding price. Make use of bullet points to separate each line, helping with readability.

Ensure your template has a section for the total amount at the bottom. This should reflect any taxes, discounts, or additional fees clearly. A breakdown of the final amount allows recipients to easily understand how the total was calculated.

Consider adding:

- Item or service name

- Description of the item or service

- Unit price

- Quantity

- Total cost per item/service

- Any applicable taxes or fees

By keeping the layout clean and the text straightforward, your template will be easy to follow for both you and your clients.