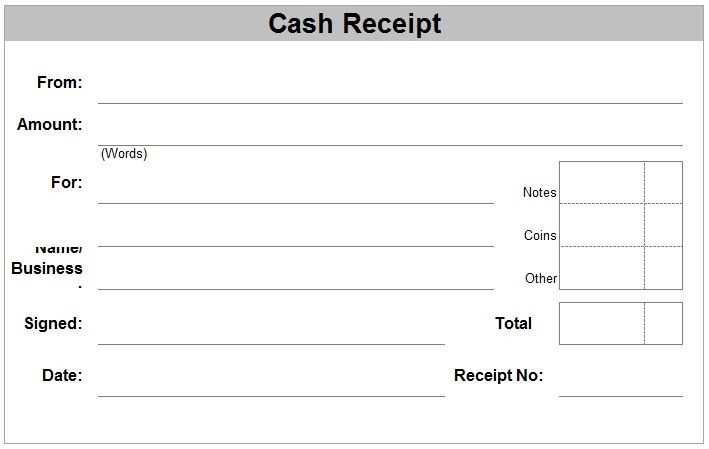

To create a clear and accurate Spanish cash receipt, focus on including all relevant transaction details. Begin with the date of the transaction and the full name of the seller and buyer. This ensures both parties are properly identified. The amount received should be clearly written in both numerical and written form to avoid any confusion. The payment method (cash, card, etc.) must also be specified to document how the transaction was completed.

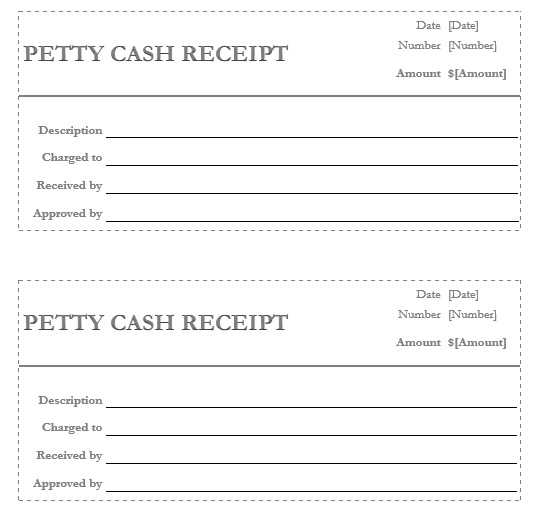

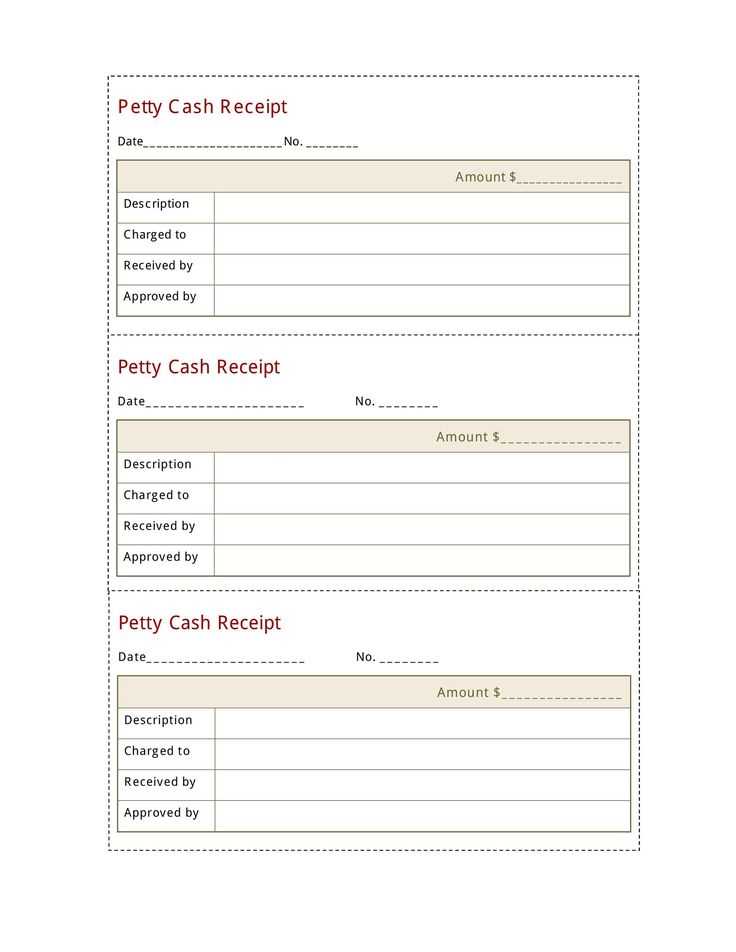

Make sure to add a unique receipt number for reference, helping in future verification or tracking. This number should follow a simple, sequential pattern for easy organization. Additionally, indicate any product or service being purchased with a brief description and the corresponding price. This provides clarity on what the receipt pertains to.

Lastly, include a signature section for both parties, confirming the transaction. This adds a layer of authenticity to the document and ensures both parties are in agreement. If applicable, you can also add a space for any remarks or additional information that may be relevant to the transaction.

Key Components of a Spanish Cash Receipt Template

A Spanish cash receipt template includes specific details that make it legally valid and clear. The key components you should include are:

1. Receipt Number – A unique identifier for the transaction. It should follow a sequential order to maintain clarity in record-keeping.

2. Date of Transaction – The exact date when the payment was made. This ensures proper documentation for both parties.

3. Seller’s Information – Include the name, address, and tax identification number (NIF) of the seller. This helps identify the business or individual issuing the receipt.

4. Buyer’s Information – Add the buyer’s name and, if applicable, their NIF or other identification details. This makes the receipt traceable to the purchaser.

5. Payment Details – Specify the amount paid, including the currency and payment method (e.g., cash, credit card). If applicable, mention any VAT or taxes applied.

6. Description of Goods or Services – A brief description of what the payment is for, whether goods or services, helps clarify the purpose of the transaction.

7. Signature – A space for the seller’s signature, confirming the receipt of payment. It also provides an additional layer of authenticity.

8. Terms and Conditions (optional) – Some receipts may include brief terms regarding returns, warranties, or payment conditions.

Including these components ensures the receipt serves as clear proof of transaction while meeting legal requirements in Spain.

How to Customize a Spanish Cash Receipt Template for Your Business

Adjust the layout of your Spanish cash receipt template to align with your brand’s identity. Choose colors, fonts, and logos that match your business’s design guidelines. Ensure that the template includes your company’s name, address, and contact details in a clear, prominent location.

Modify Payment Details

Include fields for the payment method, whether it’s cash, credit card, or other options. Customize the description section to clearly list the products or services provided, along with their prices. You may also want to add tax information and any relevant discounts applied to the transaction.

Legal Compliance and Customization

Verify that your receipt complies with Spanish fiscal requirements, such as including the seller’s tax identification number (NIF) and the buyer’s information if necessary. Adjust the template to meet the required fields for Spanish law, like invoice numbers and specific wording for VAT (IVA) details.

Common Mistakes to Avoid When Using a Spanish Cash Receipt Template

Double-check the accuracy of all data entered on the receipt. Failing to include the correct details, such as the date, item descriptions, or amounts, can lead to confusion and errors. Always cross-reference the information with the original transaction to ensure consistency.

Incorrect Use of Spanish Terms

Ensure the terms used are accurate for the region. Spanish can differ across countries, and using regional terms incorrectly might confuse the recipient. Stick to commonly understood phrases or use neutral terms that are widely recognized across Spanish-speaking areas.

Omitting Legal Requirements

Spanish receipts may have legal requirements depending on the country. Missing fields, such as the tax identification number (NIF) or tax rates, could make the receipt invalid for official purposes. Always research and comply with the specific requirements for your region.