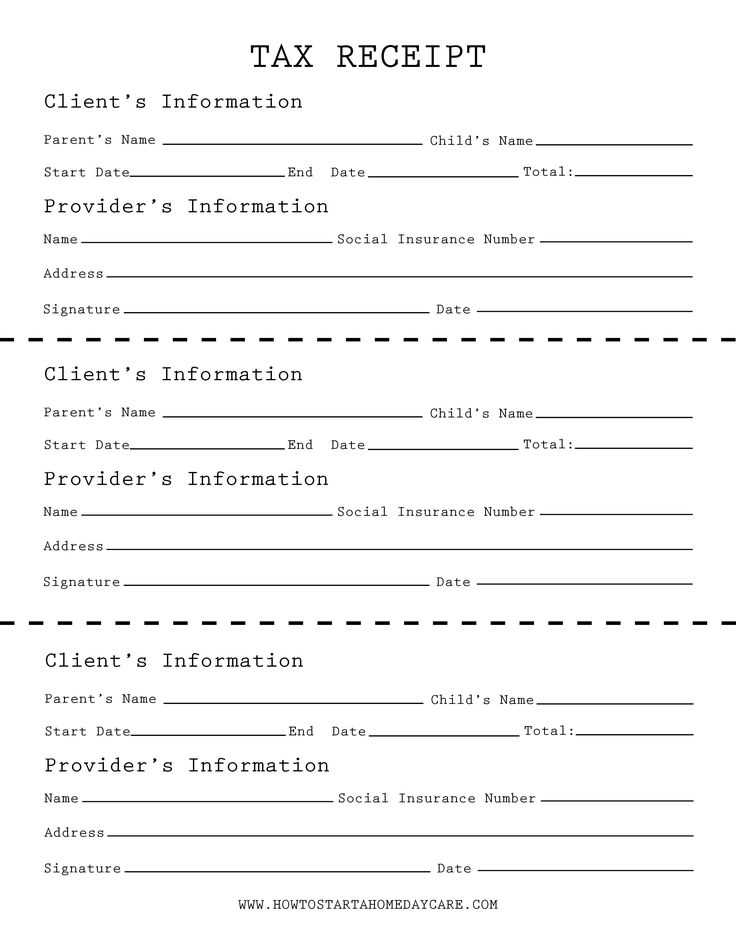

If you’re providing child care services and need to issue tax receipts, a simple template can make the process quick and straightforward. Using a clear and organized format ensures both you and the parents have all the necessary details for tax purposes. A tax receipt for child care should include key information such as the child’s name, the period of care, the total amount paid, and your contact information. With a ready-to-use template, you can save time while maintaining professional standards.

A child care tax receipt template eliminates the guesswork and ensures you’re including all the required details. Include the dates of care, the amount charged per day or month, and any applicable fees. This reduces the chance of confusion when parents are submitting their tax returns. The template should be easy to fill out and can be customized to fit your specific needs. Make sure to include a statement about the services provided and any relevant business identification numbers if applicable.

By using this template, you’ll not only stay organized but also build trust with parents. They will appreciate the clarity and transparency you provide with each receipt. It simplifies their tax filing process and reflects your professionalism. Don’t forget to keep records of all issued receipts for your own reference as well.

Here are the corrected lines:

For a child care tax receipt, make sure to include the following key details:

1. Care Provider Information

Provide the name of the care provider, their address, and contact details. This section helps confirm the legitimacy of the provider for tax purposes.

2. Date Range of Service

List the specific dates during which child care services were provided. Be sure to include both start and end dates for each period of care.

3. Total Amount Paid

Clearly state the total amount paid for child care services, broken down by the relevant date range. This is crucial for tax reporting purposes.

4. Child’s Information

Include the name of the child receiving care and their birthdate. This information will help match the services to the correct dependent for tax deductions.

Make sure each section is legible and free of errors to avoid complications during tax season.

Free Child Care Tax Receipt Template

When preparing your tax returns, a well-organized child care tax receipt can simplify the process. Here’s a template to make it easy for you to track and claim child care expenses. You can customize this template for your specific needs.

Child Care Provider Information:

Include the provider’s name, address, phone number, and Taxpayer Identification Number (TIN) or Social Security Number (SSN). Make sure this data is accurate to avoid any issues with the IRS.

Child Care Details:

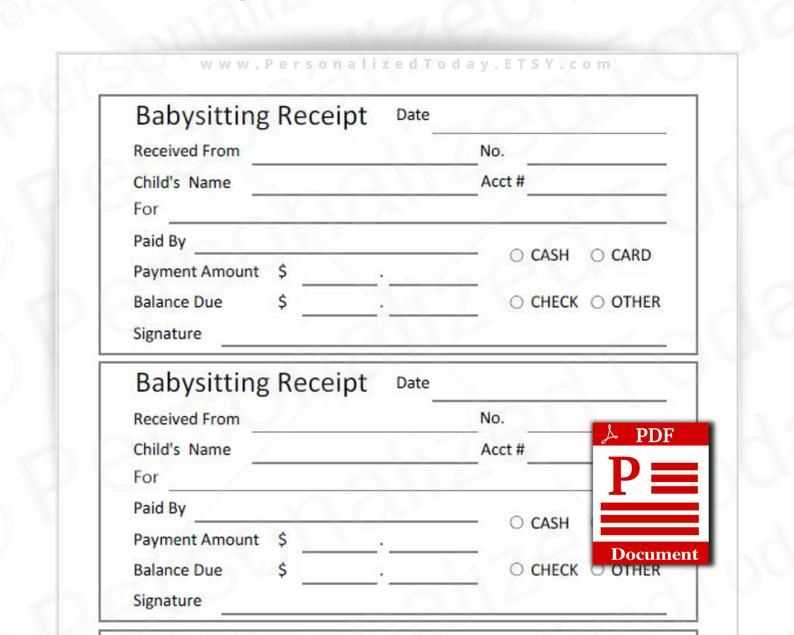

Specify the dates of care, the number of hours, and the total amount paid. Include the child’s name and age to ensure clarity. You may also need to state if the care was provided during work hours or for another eligible purpose.

Payment Breakdown:

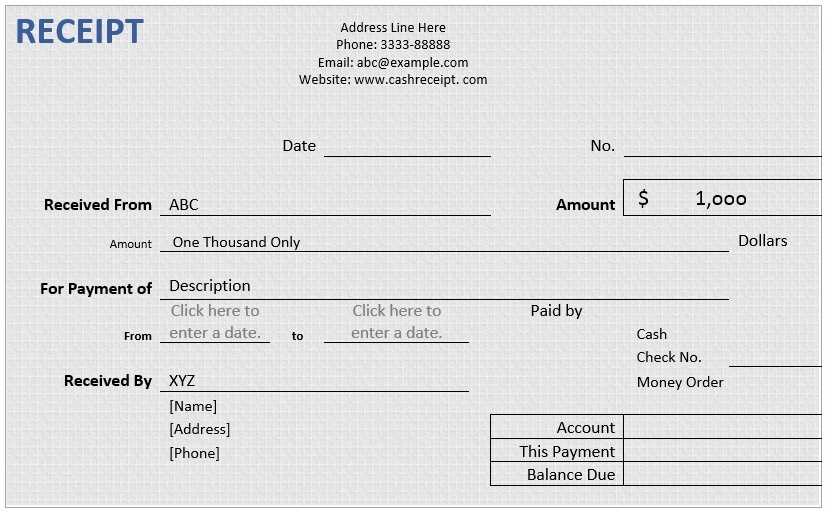

Provide a clear breakdown of the payments made, including the total amount paid, how payments were made (e.g., check, cash, or electronic transfer), and whether there were any discounts or adjustments.

Provider’s Signature:

Ask your child care provider to sign the receipt to verify the information is correct. This signature serves as proof that the child care services were provided and the payments were received.

Once completed, keep a copy for your records and submit it with your tax filings to ensure you receive any eligible credits or deductions for child care expenses.

To claim a child care tax deduction, start by ensuring your tax receipt includes all necessary details: the child care provider’s name, address, the amount paid, and the dates of service. Double-check that your receipt specifies the child’s name or age if required by your tax authority.

Check Eligibility

Verify that your child care expenses are eligible for tax deductions. Generally, expenses for children under 13 years old are deductible, but confirm the specific rules in your jurisdiction.

File with Your Tax Return

Include the receipt when filing your tax return. Depending on your location, you may either file online or submit a paper return. Attach your child care tax receipt to your tax documentation or input the necessary details if filing digitally.

By using a free child care tax receipt template, you streamline the process and ensure that you don’t miss any important information. It helps reduce errors and supports you in claiming all eligible deductions accurately.

To ensure a child care tax receipt is valid, make sure it includes the following details:

| Information | Description |

|---|---|

| Provider’s Name | Clearly state the full name of the child care provider or facility. |

| Provider’s Address | Include the complete address of the child care provider, including street address, city, and zip code. |

| Tax Identification Number (TIN) or Business Number | Ensure the provider’s TIN or business number is included to verify their legitimacy. |

| Child’s Name | The name of the child receiving care must be listed for clarity. |

| Date(s) of Service | Specify the exact dates on which child care services were provided. |

| Amount Paid | State the total amount paid for the child care services, including any taxes or additional charges. |

| Payment Method | Clarify how the payment was made (e.g., check, cash, credit card). |

| Signature | The provider should sign the receipt to confirm the information is accurate. |

Including these details guarantees that your receipt meets the requirements for tax purposes and helps ensure you claim the correct amount. Make sure to verify all data and keep records for future reference.

Many websites provide free templates for child care tax receipts. One trustworthy source is the IRS website, which offers official forms and guidance on tax receipt formats. You can use these templates to ensure accuracy in your filing. Make sure to download the correct version for your location and tax year to avoid mistakes.

Government and Non-Profit Websites

Local government websites often feature tax-related resources for residents, including free child care receipt templates. These sites prioritize accuracy, ensuring templates are compliant with tax laws. Non-profit organizations focused on family support and child care might also offer templates for parents needing assistance with tax filings.

Online Template Services

Several online platforms specialize in providing customizable tax receipt templates. Websites like TemplateLab or Vertex42 provide simple, free child care tax templates. These templates can be easily filled out and tailored to fit your specific needs. Just ensure that you download templates from reputable sites to avoid errors or outdated information.

To create a child care tax receipt, include the following key details:

- Provider’s Information: Full name, address, phone number, and business registration number if applicable.

- Child’s Information: Child’s name and age, and the period of care (e.g., specific months or weeks).

- Payment Details: Total amount paid, the payment method, and the payment dates.

- Service Description: A brief description of the services provided, such as daily or weekly care, or after-school programs.

- Tax Identification Number (TIN): Include the provider’s TIN for tax reporting purposes.

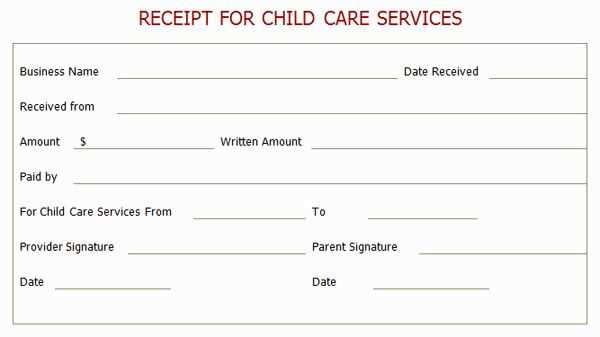

- Signatures: Both the provider’s and the payer’s signatures confirm the transaction details.

Ensure the receipt is clear, concise, and accurate to avoid any confusion during tax filing. You can also include a reference number for easier tracking.