Creating a charitable donation receipt form is a straightforward yet critical task for nonprofit organizations. A well-structured receipt ensures transparency and keeps donors informed about their contributions. It also serves as an official record that donors can use for tax purposes. Having a template ready will save time and help standardize the process, making it easy to issue receipts consistently.

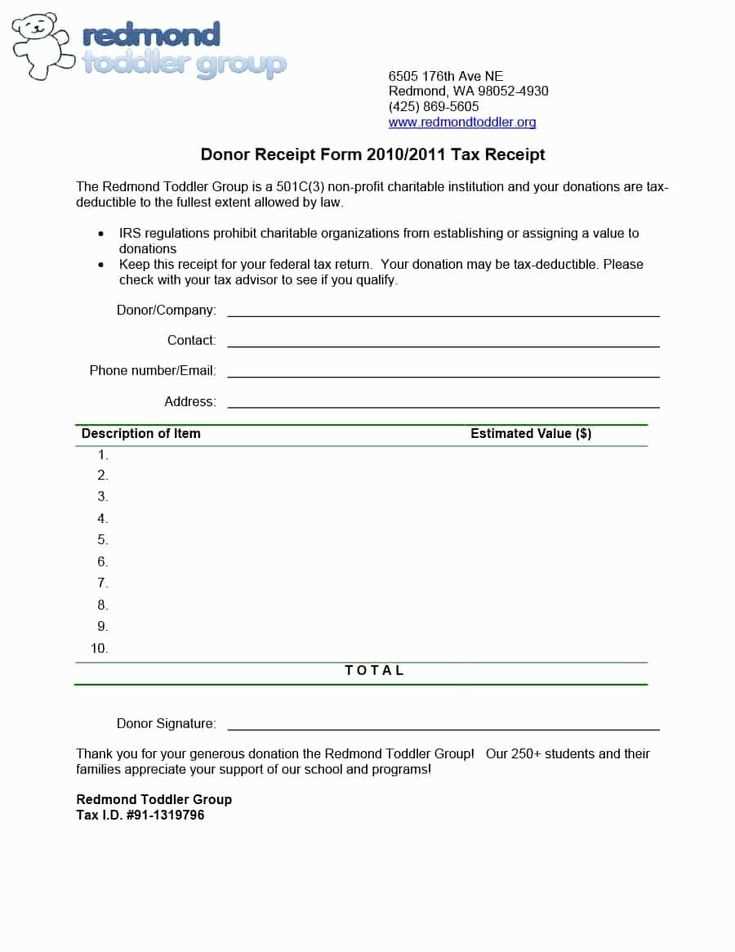

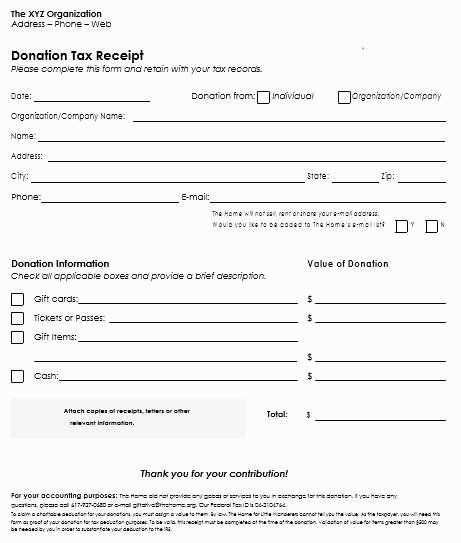

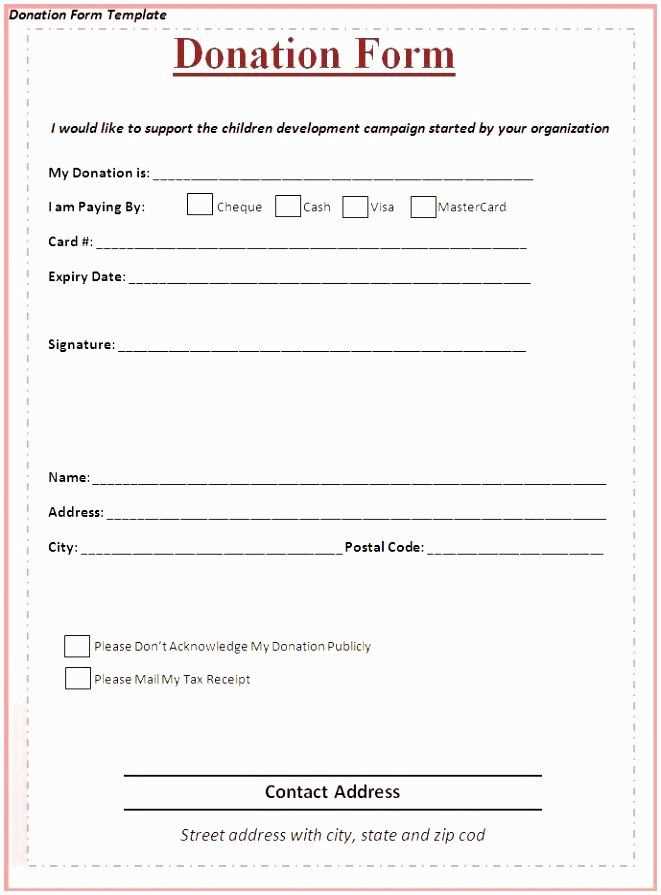

Begin by including essential details such as the donor’s name, donation date, and amount. Make sure to clearly specify whether the donation was in cash, check, or another form. It’s also a good idea to include the nonprofit organization’s name, address, and tax identification number for accuracy. This helps the donor ensure they meet all requirements when filing taxes.

Use clear formatting and simple language throughout the form to make it easy to read. Including a thank-you note or brief acknowledgment will add a personal touch, showing your gratitude for their support. This simple addition can go a long way in building donor relationships.

Here are the corrected lines:

Ensure that the donor’s full name and address are included in the receipt. A complete and accurate donor name is critical for tax purposes.

Clearly state the date of the donation. This is necessary for both donor records and for verifying the timing of the contribution.

Specify the donation amount or description of items. If it’s a cash donation, list the exact amount. If it’s an item donation, provide a detailed description and fair market value.

State that no goods or services were provided in exchange for the donation. This is important to maintain the tax-deductible status of the contribution.

Include your organization’s name, address, and tax-exempt status, as required by the IRS for charitable donations. Ensure this information is easily readable and accessible.

Provide a unique receipt number. This helps both the donor and organization keep track of donations for future reference and audits.

Sign and date the receipt. A signature adds authenticity and is a requirement for official records.

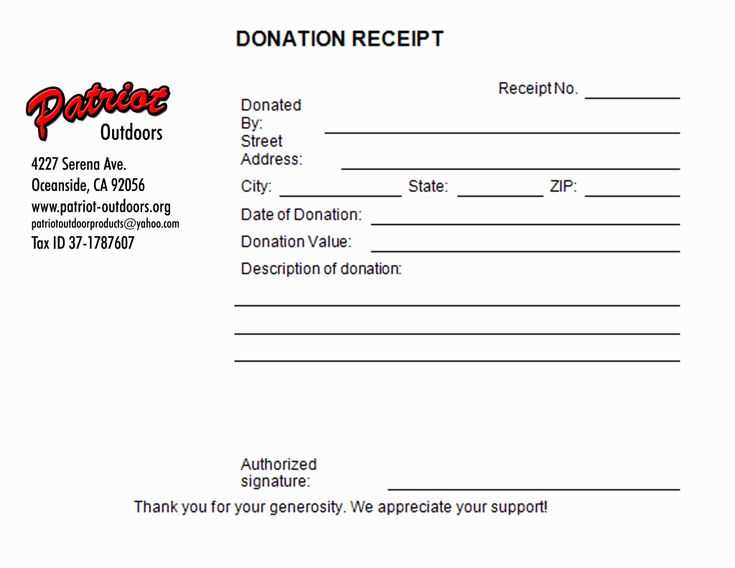

Charitable Donation Receipt Form Template

To create an accurate charitable donation receipt, include these key details:

- Donor Information: Full name, address, and contact details of the donor.

- Organization Details: Name, address, and tax-exempt status of the charity or nonprofit.

- Donation Information: The date of the donation, a description of the donation, and its estimated value (if applicable).

- Statement of Tax-Exempt Status: A clear statement that the organization is a qualified tax-exempt charity under IRS rules.

- No Goods or Services Provided: Confirm whether any goods or services were provided in exchange for the donation. If so, specify the value.

- Signature: The signature of an authorized representative of the charity.

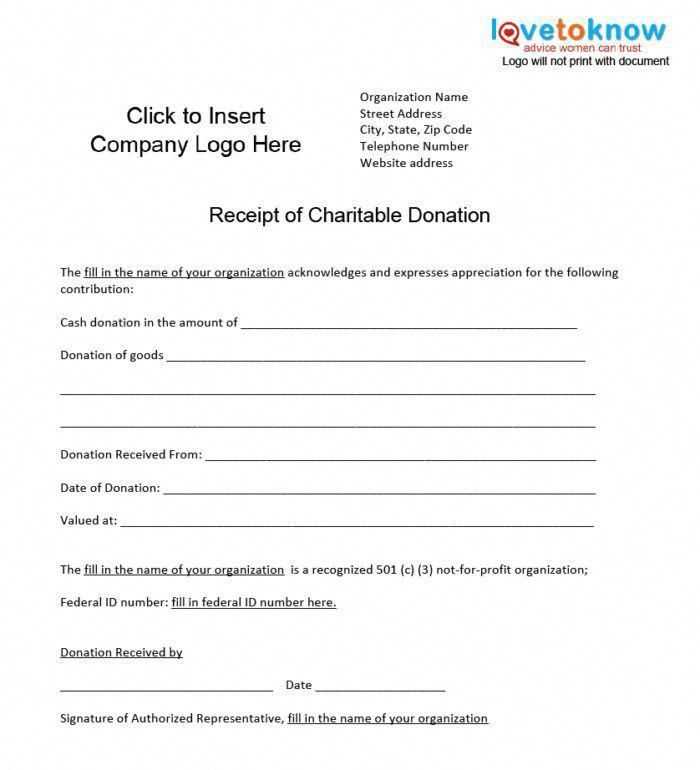

Here’s a simplified template for your charitable donation receipt:

Sample Template:

Donor Name: [Donor’s Full Name]

Donor Address: [Donor’s Address]

Organization Name: [Charity Name]

Organization Address: [Charity Address]

Donation Date: [Date of Donation]

Donation Description: [Description of the Donation]

Estimated Value: [Estimated Value of Donation]

Tax-Exempt Status: [Organization’s Tax-Exempt Number]

Goods or Services Provided: [Details, if applicable]

Signature: [Authorized Representative’s Signature]

This simple template ensures transparency and provides a clear record of the donation for both the donor and the charity.

Include specific details in your donation receipt template to ensure it meets tax requirements. Start with the name of the nonprofit organization, its address, and the tax-exempt status or IRS tax identification number. This information verifies the nonprofit’s legitimacy and tax-exempt status.

Clearly state the donor’s name, address, and donation date. For a single donation, indicate the amount of money given. If the donation is in-kind (non-monetary), describe the items donated along with an estimate of their fair market value. This allows the donor to claim the appropriate deduction.

If applicable, mention any goods or services provided to the donor in exchange for the donation. The receipt must show the value of these items, as the donor can only deduct the difference between the donation and the value of the goods or services received.

For donations above a certain amount, it’s necessary to include a statement confirming that the nonprofit did not provide any goods or services in return, or that the value of such goods or services was nominal. This statement helps clarify the full deductible amount for tax purposes.

Ensure the template includes a clear statement that the receipt is provided for tax purposes, and that it complies with IRS regulations. This can help donors feel confident that their donation is recorded accurately for their tax filings.

A donation receipt should contain specific details to ensure accuracy and compliance. These key elements make the receipt valid for both the donor and the organization.

1. Donor Information

Include the donor’s full name, address, and contact information. This helps both the donor and your organization stay organized and confirms the details for tax reporting purposes.

2. Donation Details

Clearly specify the date of the donation and the amount. For non-cash donations, describe the item(s) donated, including the fair market value if possible. Be transparent about any services or goods received in return, as these may affect the donation’s tax deductibility.

| Donation Type | Details to Include |

|---|---|

| Monetary | Amount and date of donation |

| Non-Cash | Description of items, fair market value, and date |

| Goods or Services | Value of the goods/services, and date |

3. Acknowledgement of No Goods or Services Received

If no goods or services were provided in exchange for the donation, include a statement to this effect. This clarifies the donation’s eligibility for tax deductions.

4. Organization Information

The receipt should clearly list the name, address, and contact information of your organization. Include the tax-exempt status or identification number for added verification.

5. Statement of Deductibility

State that the donation is tax-deductible, and include any relevant IRS language regarding the donation. Be clear about what portion of the donation is deductible, especially if goods or services were provided in exchange.

Include your nonprofit’s official name, address, and tax-exempt ID number at the top of the form. This ensures your receipt is valid for tax deductions and clearly identifies your organization.

Provide Donation Details

Clearly state the donation amount or the value of the goods or services donated. If applicable, include a description of non-cash items and estimate their fair market value to help your donor with tax reporting.

Design for Clarity

Keep the form simple, with well-organized sections. Use a clear font and logical flow to highlight key information, such as the date of the donation and donor details. This will make it easy for the donor to understand and for you to maintain accurate records.

Include any additional notes relevant to the donor’s gift, such as whether the donation was tax-deductible or if it was for a specific purpose. This level of detail enhances transparency and strengthens your nonprofit’s reputation.

Make sure the charitable donation receipt form clearly includes the donor’s name, donation amount, and the date of the contribution. These details are necessary for both tax purposes and maintaining transparent records.

Include a statement of the non-profit’s tax-exempt status. This is important for donors to claim tax deductions and adds credibility to the donation process.

If the donation was in-kind, specify the donated items and their estimated value. Avoid vague descriptions to ensure the donor can properly account for the gift on their tax returns.

Clearly state whether any goods or services were provided in exchange for the donation. If there were, note their fair market value to help donors adjust their deductions accordingly.

Ensure the form is signed by an authorized representative of the organization to validate the receipt. This assures the donor that the donation was officially recognized by the non-profit.